Here's my Top 10 items from around the Internet over the last week or so. As always, we welcome your additions in the comments below or via email to bernard.hickey@interest.co.nz.

See all previous Top 10s here.

My must read is #5 on how bad science becomes public policy by looking at the debate about sugar vs fat.

1. Uber for lawyers - I'm fascinated by the potential for new technology to transform expensive service industries such as medicine and education and law.

I'm not a doctor or lawyer or professor so I'm hoping it dramatically cuts their costs. There's an element of schadenfreude, I'll admit, but it could also meet a whole lot of un-met need and strip out some of the super-profits currently built into these industries.

Here's the FT looking at the prospects for 'Uber-ising' the legal profession.

The top law firms in the UK and US — the most advanced and competitive legal markets — have sharply increased what they charge. In the mid-1980s, partners at top London firms charged between £150 and £175 an hour, according to a report by the Centre for Policy Studies, a think-tank. By 2015, this had reached £775-£850 an hour, with this year’s range expected to exceed £1,000.\

In the US in 2014, 74 firms enjoyed profits per partner of more than $1m, with Wachtell, Lipton, Rosen & Katz, the highest earners, turning in profits per partner of $5.5m, according to the journal American Lawyer.

While many see the mismatch between what top lawyers earn and what most can afford to pay as a problem, others see it as an opportunity. The legal profession, they say, is ripe for disruption. Cab drivers in London are, like lawyers, highly trained; mastering “The Knowledge”, the layout of the city’s streets, takes several years. But the cabbies’ high-quality, high-price service has been upended by Uber, the app-based taxi hailing system that has brought a flood of lower-cost drivers, using satellite navigation, on to the roads.

2. Turning Japanese - With all the dramas in Europe and China in recent months, it's easy to forget that Japan is still a very large economy with very big problems -- including a falling population, falling prices, falling wages and a fast-rising Government debt.

Yet it always seems to manage.

Here's Ambrose Evans Pritchard with a typically blood-curdling piece on Japan's looming issues. He cites the former head of the IMF for good measure. The phrase non-linear is used for extra curdling of the blood. I'm not sure I buy the story. It's amazing how long you can service stonking debts with negative interest rates, which Japan has, and seems likely to have for some time.

“To our surprise, Japanese retirees have been willing to hold government debt at zero rates, but the marginal investor will soon not be a Japanese retiree,” he said.

Prof Blanchard said the Japanese treasury will have to tap foreign funds to plug the gap and this will prove far more costly, threatening to bring the long-feared funding crisis to a head.

“If and when US hedge funds become the marginal Japanese debt, they are going to ask for a substantial spread,” he told the Telegraph, speaking at the Ambrosetti forum of world policy-makers on Lake Como.

Analysts say this would transform the country’s debt dynamics and kill the illusion of solvency, possibly in a sudden, non-linear fashion.

3. Just forgive the debt - This section in Ambrose's report was particularly interesting and begs the question: what happens once your central bank has hoovered up all your Government bonds.

I would have thought a self-directed debt jubilee would do the trick.

The central bank owned 34.5pc of the Japanese government bond market as of February, and this is expected to reach 50pc by 2017. Japanese officials admit privately that a key purpose of ‘Abenomics’ is to soak up the debt and avert a funding crisis as the big pension funds and life insurers retreat from the market. The other unstated goal is to raise nominal GDP growth to 5pc in order to ‘bend down’ the trajectory of the debt ratio, a task easier said than done.

Prof Blanchard did not elaborate on the implications of Japan’s woes for the global financial system, but they would surely be dramatic and there are growing fears that this could happen within five years. Japan is still the world’s third largest economy by far. It is also the global laboratory for an ageing crisis that the rest of us will face to varying degrees.

4. Ever been hunted by a drone? - This piece by Malik Jalal in The Independent explains what it's like.

I have been warned that Americans and their allies had me and others from the Peace Committee on their Kill List. I cannot name my sources, as they would find themselves targeted for trying to save my life. But it leaves me in no doubt that I am one of the hunted.

I soon began to park any vehicle far from my destination, to avoid making it a target. My friends began to decline my invitations, afraid that dinner might be interrupted by a missile.

I took to the habit of sleeping under the trees, well above my home, to avoid acting as a magnet of death for my whole family

5. 'Pure, white and Deadly' - It turns out the warnings about the heavy use of sugar are not new, according to this excellent analysis in The Guardian.

A British professor of nutrition, John Yukin, sounded a similar warning in a book in 1972, but was then attacked by the food industry and his warning was largely forgotten. Robert Lustig is today's anti-sugar guy.

This piece takes a hard look at how some science becomes accepted wisdom, and others doesn't.

“If only a small fraction of what we know about the effects of sugar were to be revealed in relation to any other material used as a food additive,” wrote Yudkin, “that material would promptly be banned.” The book did well, but Yudkin paid a high price for it. Prominent nutritionists combined with the food industry to destroy his reputation, and his career never recovered. He died, in 1995, a disappointed, largely forgotten man.

For at least the last three decades, the dietary arch-villain has been saturated fat. When Yudkin was conducting his research into the effects of sugar, in the 1960s, a new nutritional orthodoxy was in the process of asserting itself. Its central tenet was that a healthy diet is a low-fat diet. Yudkin led a diminishing band of dissenters who believed that sugar, not fat, was the more likely cause of maladies such as obesity, heart disease and diabetes. But by the time he wrote his book, the commanding heights of the field had been seized by proponents of the fat hypothesis. Yudkin found himself fighting a rearguard action, and he was defeated.

6. How long can central banks keep making mistakes? - This piece by Oxford economist Simon Wren Lewis on central banks making mistakes and the eventual consequences for central bank independence is particularly topical for New Zealand -- the original pioneer of central bank independence in partnership with inflation targeting.

He points out central banks didn't forecast the GFC, then were too tame in their reaction, and now they are hiking too early. Will there be three strikes and they're out?

What central banks should be doing in these circumstances is allowing their economies to run hot for a time, even though this might produce some increase in inflation above target. If when that is done both price and wage inflation appear to be continuing to rise above target, while ‘supply’ shows no sign of increasing with demand, then pessimism will have been proved right and the central bank can easily pull things back. The costs of this experiment will not have been great, and is dwarfed by the costs of a mistake in the other direction.It does not appear that the Bank of England or Fed are prepared to do that. If we subsequently find out that their supply side pessimism was incorrect (perhaps because inflation continues to spend more time below than above target, or more optimistically growth in some countries exceed current estimates of supply without generating ever rising inflation), this could spell the end of central bank independence. Three counts and you are definitely out?I gain no pleasure in writing this. I think a set-up like the MPC (Bank of England's Monetary Policy Committee) is a good basic framework for taking interest rates decisions. But I find it increasingly difficult to persuade non-economists of this. The Great Moderation is becoming a distant memory clouded by more recent failures. The intellectual case that central bank independence has restricted our means of fighting recessions is strong, even though I believe it is also flawed. Mainstream economics remains pretty committed to central bank independence. But as we have seen with austerity, at the end of the day what mainstream economics thinks is not decisive when it comes to political decisions on economic matters. Those of us who support independence will have to hope it is more like a cat than a criminal.

7. Disposable people - This New York Times piece on the culture in many US tech companies now is an eye-opener. People seem much more disposable than they used to be. There is a particularly nasty and sociopathic libertarianism being spread out of San Francisco these days.

AT HubSpot, the software company where I worked for almost two years, when you got fired, it was called “graduation.” We all would get a cheery email from the boss saying, “Team, just letting you know that X has graduated and we’re all excited to see how she uses her superpowers in her next big adventure.” One day this happened to a friend of mine. She was 35, had been with the company for four years, and was told without explanation by her 28-year-old manager that she had two weeks to get out. On her last day, that manager organized a farewell party for her.

It was surreal, and cruel, but everyone at HubSpot acted as if this were perfectly normal. We were told we were “rock stars” who were “inspiring people” and “changing the world,” but in truth we were disposable.

I am old enough to remember the 1980s and early ’90s, when technology executives were obsessed with retaining talent. “Our most important asset walks out the door every night,” was the cliché of the day. No longer.

Treating workers as if they are widgets to be used up and discarded is a central part of the revised relationship between employers and employees that techies proclaim is an innovation as important as chips and software. The model originated in Silicon Valley, but it’s spreading. Old-guard companies are hiring “growth hackers” and building “incubators,” too. They see Silicon Valley as a model of enlightenment and forward thinking, even though this “new” way of working is actually the oldest game in the world: the exploitation of labor by capital.

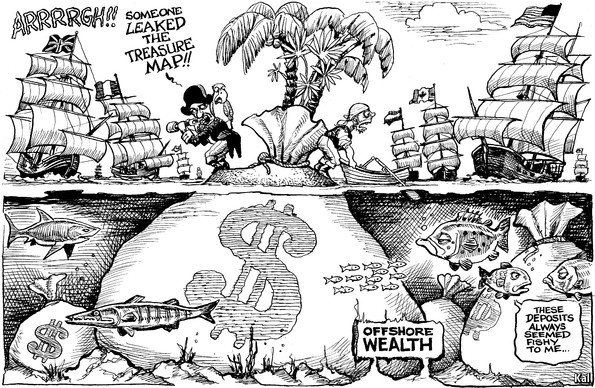

8. Totally 'Have I got news for you'. - I've just re-discovered this after a few years away from Britain. It's the model for 7 Days and is excellent on the Panama Papers.

9. Totally John Oliver on America's credit rating system. This is fascinating, particularly given New Zealand is moving towards America's 'positive' credit reporting system and the IRD will soon start sharing tax debt information with the credit rating agencies here -- Dun and Bradstreet and Veda Advantage.

10. Totally Clarke and Dawe on Australia's totally nutty (and fun) political landscape. Malcolm Turnbull must wish he lived in New Zealand.

28 Comments

I thought the pirate cartoon was about the Kermadecs... You know, giving away untold national wealth to whoever wants to steal it.

Everyone seems to get most upset about selling "prime dairy farmland" (really second rate beef country) to the dreaded foreign owners. Then the government give away the produce of a vast area of our oceans to whoever wants to fish them directly (technically naughty but no one will ever know) or harvest their produce perfectly legally by fishing the boundary. It's nuts but no one cares.

I just hope they don't decide to give the South Island away. Perhaps they are already secretly planning to give Northland away for all I know, in order to get rid of all those troublemakers and after all it has no net economic value anyway.

Aaargh.

Did I read that right? BoE to quick to raise rates? About 8 years and counting isn't it?

ECB, Riksbank, Fed and RBNZ have all had false starts. BoE has talked about hikes and stopped printing early, but didn't actually hike.

#6 QE is flawed. It hasn't helped Japan and they seem keen to burn their economy to the ground. Theories are great and all that but the Yen is remaining strong because it makes a lot of sense to borrow cheap money from Japan. That is not factored into modelling or economic hand waving.

The Fed is trying to avoid the liquidity trap that Japan is in and if some bubbles burst it's out of necessity. Failure is allowed and debts get written off. It's better than running growth into the ground.

Japan has 3.3% unemployment, a current account surplus of over 3% of GDP, and per capita income the same as New Zealand. The income figures in both countries do not factor nominal increases in asset values, or in Japan's case the massive purchasing of foreign assets with Japanese printed money. They have few natural resources and have coped superbly with the loss of their nuclear power industry due to the tsunami.

In my view they are playing the world for fools.

You'll find their pension funds are approaching depletion. There's some latency before serious trouble starts in Japan but it's going to get really bad.

They aren't really playing the world for fools they're just sweeping everything under the carpet hoping their problems will go away.

I don't think so. The Japanese Government Pension fund is the biggest investment fund in the world and has over US$1.1 trillion in assets. A good share of Japan's money printing has been channeled through their pension funds to soak up assets from whoever is willing to sell theirs.

On Japan, Bernard you very reasonably suggest the solution: "I would have thought a self-directed debt jubilee would do the trick." The Professor Blanchard is stuck in a paradigm where central banks are not supposed to directly fund governments. Japan has 3.3% unemployment- effectively nil therefore; and still a very high standard of living. They are robotising many things such that their age demographics might end up being positive. Their infrastructure would actually be even better with 25 million less people, which is where they are headed in 25years.

The same paradigm in my view explains the central bank failures to address inflation. Most central bankers realise ZIRP or near ZIRP involves very distortionary economies with massive transfers of wealth and income to highly leveraged (indebted) people with existing assets. So they would prefer not to sustain such models longer than at all possible.

What they should have been doing is massive government spending on infrastructure. The United States famously has dilapidated and failing roads, subway systems, water and sewage systems among many other failings. They have wasted the last few years of highish unemployment where central bank funding of infrastructure would have soaked up surplus supply.

Bill English is very much stuck in the same paradigm, and it is his government's biggest failing.

Japan has 3.3% unemployment- effectively nil therefore; and still a very high standard of living.

Which is not reflected in their spending and household income patterns.

Over the past three months, dating back to November 2015, nominal household spending was -2.9%, -4.2% and for January -3.1%. In other words, the past three months were worse in overall household activity than immediately after the tax change that supposedly sent Japan into its fourth recession in the series. The only saving grace as far as Japanese citizens are concerned is that QQE failed to ignite sustainable inflation to multiply those nominal declines once more. Read more

I think the problem is taking the Japanese at their word in terms of their stated objectives. If they stated their real objectives, as evidenced by the outcomes, the rest of the world would be in uproar. On this Trump is not far off the mark.

Their real objectives, for Japan Inc:

To fund government without increasing income taxes, so keeping the citizens happy.

To keep unemployment very low.

To keep the yen low and competitive, largely to appease their large corporates, and to keep unemployment low.

To buy up as much of the world's assets as they can get away with.

Keep real incomes at least stable, and by western standards very equitable.

On all of these objectives the Japanese have been spectacularly successful, even through a period where they had to import energy supply after their nuclear issues.

I agree, Japan have been extraordinarily succesful in containing the fall out of their debt bubble. Instead of 30% unemployment like Blanchard and his pals have created.

The Japanese have reduced their government debt by 34.5% by buying 34.5% of it back. Very sensible of them.

You'd think someone with a Ph.D in Economics from MIT would actually have some understanding of economics. They must have been consuming too many drugs in their office to think that austerity was going to work.

Criminal negligence and dereliction of duty you would have thought. Plus fraud, market rigging, extortion and collusion.

And just being stuck in an "orthodox" paradigm. If Blanchard had addressed the very obvious government writing off debt to itself option, and explained the downside, then maybe you could credit him. But he didn't even broach it. The downside is that massive printing would likely keep the Yen lower in value than it otherwise would be.

But the Japanese love a lowish competitive yen. They are crying at the moment because it won't go down.

dictator, you are absolutely correct on austerity and drugs. These people who have been championing austerity hate to see Japan beat them, as it proves the nonsense of their own policies. So they paint Japan as in crisis, when it so obviously is not.

For the avoidance of doubt wasteful government spending on digging holes and filling them in again is never a good idea; nor is waste on operating expenditure. And when very low unemployment starts threatening high inflation, then also austerity is required, but in those conditions it is relatively painless. The west has not had those conditions for 8 years.

The Japanese have reduced their government debt by 34.5% by buying 34.5% of it back. Very sensible of them

It remains on the BoJ's asset ledger offset by the authorised bond dealer credit liability created to fund the purchases. Furthermore, the debt remains in receipt of coupon interest payments until the government redeems it at maturity. Hardly a windfall for the taxpayer, unless state retention of debt in receipt of taxes for citizen debt is preferable to business rehypothecating it in wholesale chains to create credit for private growth purposes. Moreover, governments are not known for their thrift when it comes to other people's money.

My assumption was that the money was already spent/wasted long ago and that the central bank owning government debt was the same as my left trouser pocket owing my right trouser pocket. Am I naively missing something? I see that there is a windfall profit for the previous bondholder.

Governments are not responsible to the taxpayer. The taxpayer is just one group amongst many, and not necessarily very powerful most of the time. Voters are not all taxpayers and anyway they are divided. Other more powerful lobbies may be discreet and evade the public eye. The military, industry, banking interests, the hereditary wealthy property owning families and the secret service and mafia may be more pertinent power groups than the poor media befuddled and easily led taxpayer.

Ask yourself if an American President could be elected without Goldman Sachs' backing, or could a UK Prime Minister be elected without Rupert Murdoch behing them. Possible but unlikely. Vested interests matter.

I read Machiavelli's "The Prince" a couple of years ago. It seems to have rubbed off on me.

I see that there is a windfall profit for the previous bondholder.

That remains inert, lodged at the central bank offering security to daily inter-bank clearing operations, but not much else.

The Fed H3 ledger supports the case. Primary dealer bond sale proceeds sit it out earning 50 bps and remain ungeared under the 10% retention level fractional reserve banking system. The banks have no incentive to gear in this 1950s manner of money creation while the returns on collateral chain shadow banking remain more lucrative.

#1. Uber for Lawyers. LOL. I have always had whip smart lawyers and they are always from smaller firms. If you use big firm services what you get is junior staff, under huge pressure to lift the number of 6 minute chargeout units. These guys want to take a Law Society generic lease for example and then review and then renegotiate each and every clause. Useless work and vastly expensive.

Plus you have to explain what each clause means to them.

Those contracts are just written by administrators. They are full of contractual mistakes and spelling errors in critical wording. When corporate lawyers get involved I've sent back dozens of mistakes to be corrected, they are useless.

Other corporate lawyers try to rewrite my contracts with clauses that look like they were written by an idiot. I just tell them I will never sign any contract that they write. That ends the time wasting nonsense. I do get the impression that a lot of them won their degree in a lucky dip.

Shouldn't laugh, machine learning will commoditise lawyer function, just a matter of time

Some aspects of law certainly will. I would be more concerned if I was accountant though.

BH: in happier times.

http://www.dailymotion.com/video/xsvaeo_hignfy-s43e07-william-shatner-c…

Central banks, especially RBNZ, are under the mistaken belief that anytime soon their economies will return to old normal and they can get back to their familiar role of inflation fighting - because that's what they do best.

Great articles and comments. I believe that central banks will soon run out of bullets. There is only so much QE that can be done to be effective. They can do more QE but I believe governments will need to ask for businesses to start spending to stimulate industrial economies. Stagnation is a possibility particularly if inflation picks up due to a rise in oil prices later this year or next year. Moving on from this and on a different subject New Zealand needs to crack down on dangerous breeds of dogs. We don't need these dogs in society. Any dogs with locking jaws should be newtted or culled and slowly removed from New Zealand society. There maybe owners that think there dog is wonderful but the breed is dangerous and can snap or change or be over protective of its owner. The risks are far to great. Any dog with locking jaws such a pitbull, Staffordshire cross etc that are still in circulation the owners should be tracked down and advised that this is the last one they can have and the license to keep the dog must go up to $1500 per year or hand it over and be monitored by councils on 6 monthly visits. In the UK certain breeds have been banned. You can fine owners that there dogs bite someone but these people don't really care about that or the fine they have been given, so best to remove dogs from society. This is very similar to having a gun law in the USA and people get shot every day. In NZ someone gets bitten every day by dogs. If we cannot fix this then we risk becoming a banana republic. We need to do the right thing, we just don't need these dogs. Generally the people that pick pitball dogs or dangerous types dogs have is because they have a small willy. Someone with a spaniel or Jack Russell would be tougher and have a bigger willy. If you go for a run in a park or run on a trail path that says keep dogs on lead at all times and 50% of the dogs are not on lead this can sometime be frustrating when a dangerous dog is on the loose. If we don't ban these dogs then do we carry knives strapped to our arms to defend ourselves against dogs when out jogging. There will always be owners that don't care so do the right thing and bans breeds of locking jaw dogs pitballs etc. Governments, Council time to act now! save millions in hospital admissions.

Agree with you on dogs.

It's pitbull not pitball

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.