Today's Top 10 is a guest post from Lena Hesselgrave.

Lena is in Singapore on a Prime Minister’s Scholarship for Asia, studying Asia Strategy and Leadership at the National University of Singapore, and working in the strategy team at Xero Asia.

As always, we welcome your additions in the comments below or via email to david.chaston@interest.co.nz.

And if you're interested in contributing the occasional Top 10 yourself, contact gareth.vaughan@interest.co.nz.

See all previous Top 10s here.

1. Singapore, Thailand weigh e-payment alliance in digital push

Despite being a tech savvy nation in many ways, the uptake of digital payments in Singapore has lagged behind other advanced economies. A surprising number of local shops and restaurants only accept cash. Singaporeans can even opt to pay for their Uber rides in cash, with Singapore being the only developed country where this feature has been rolled out.

The announcement earlier this month of a potential link between Singapore and Thailand’s national digital payment systems, Singapore’s PayNow and Thailand’s PromptPay, would be the first of its kind. A higher adoption rate for both countries would allow for traceability of monetary transactions, lower costs for local businesses, and would ensure they can compete with potential challengers from abroad, including the likes of Chinese payment giants Alipay and WeChat.

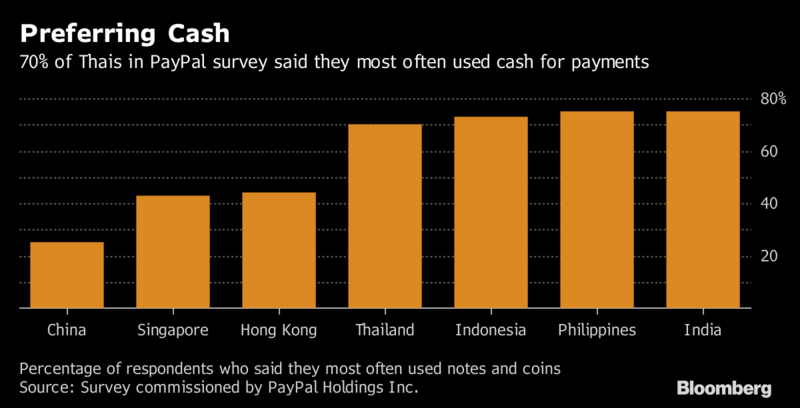

Initiatives to enable faster and more efficient cross-border financial services within Asean is a positive development for the industry, MAS encourages more of such cross-border engagements, premised on common standards, to create a seamless and inter-operable digital experience for the Asean community. For now, cash remains the dominant mode of payment in much of the region. Some 57 percent of 4,000 consumers in seven Asian markets said they rely on notes and coins, a PayPal Holdings Inc. survey shows. In contrast, digital transactions are prevalent in much of Europe.

If I could transport one thing back to New Zealand from Singapore, it would be the vibrant hawker centres and the delicious affordable food they offer. So long as you’re prepared to brave the humidity and the lines for the particularly famous stalls, it is a fun way to enjoy a meal out with friends and colleagues. It is also a great model for up-and-coming chefs as the start-up costs are low and limited menus mean there’s less wastage on ingredients.

The culture of dining out in restaurants is still the norm in most Western cities, but preferences are changing and consumers are looking for more of a ‘full package’ evening out.

The model of a night out has changed, reckons Preeya Khagram-Nasim, one of the founders of Hotbox. Young people no longer expect drinks at a bar, followed by dinner at a restaurant and dancing at a club. With drinks and music on offer alongside the food, night markets are an entire evening’s entertainment in one package. Nobody need make a reservation; people can arrive and depart as early or late as they please. Communal tables mean the chances of meeting new people rise. Even children, not always welcome in fancy restaurants, fit in: they can roam free, the sky absorbs their screeches and concrete floors resist their spills.

And as youngsters in Western countries are taking fewer drugs and drinking less, food has become more important. It is more photogenic than gin or heroin and the explosion of social media has helped such markets grow. The rosy blush of slow-cooked ribs at Hotbox, garnished with garish pickled chillies, bursts out of the squares of Instagram and a quick tag tells followers the source.

The Maxwell Hawker Centre in Singapore is a popular spot for locals to grab a bite from one of the many highly rated stalls. (Photo Lena Hesselgrave)

3. 60 years of the Singapore citizenship: From hawkers to millionaires, they all queued up

Immigration and multiculturalism are central parts of Singapore’s history and will continue to be important as the birthrate declines and population ages. The Singaporean identity was formed from the amalgamation of Malay, South Asian, East Asian and Eurasian cultures. Creating a harmonious society from so many diverse cultures is an admirable feat, although the country will need to recognise that demographics are changing and integration is a two-way street.

The Straits Times takes a look back at citizenship since the city state was founded in 1959.

In the early years after 1965, Singapore citizenship was mainly passed on by descent. There was naturalisation for some who moved here, but the numbers were small. There was also a tendency for foreigners in Singapore - including blue-collar workers - to eventually be granted permanent residency and citizenship if they sank roots. But as the Singapore economy grew rapidly, the country attracted many more prospective immigrants, and the Government could be much more selective. Today, most blue-collar workers are given work permits, with no path to citizenship. Skilled migrants can become citizens, but the criteria are fairly non-transparent. Applicants know that factors like education, income, length of stay and family ties matter, but they are not sure how they add up - unlike in countries that use a point system such as Canada and Australia.

A ceremony held for new Singapore citizens at The Pinnacle@Duxton in August.

4. How to invest in the ‘New China’

A Chinese economy based on mining, steel, utilities and property is rapidly transitioning into the new reality that is emerging; an economy based on consumer goods, healthcare, education and technology. Those new sectors are taking up about 40% of total company earnings this year, versus 25% in 2011.

Alibaba now has more customers than Amazon and Ebay put together. Investors are taking notice of this large number of tech savvy consumers, with increasing lifestyle expectations and the internet companies starting up to cater to them. With weak corporate governance and heavy handed interventions from government, they are not without risk.

FT Money examines the long-term case for investing in China, the likely risks and rewards, and the best ways into this fast-changing market.

Technology stocks are part of what Ms Cortesi sees as the unfolding consumer story in China. Since 2013, she has avoided holding manufacturing stocks in her portfolios and has focused more on what ordinary Chinese people are buying. “We look at where people spend their salaries,” she says, noting the desire to spend more on experiences. “People are eating better quality food and drinking more expensive beverages, and people are spending more on intangible things like travel and education.” Growth stocks focused on these areas are what fund managers are looking for — and what they are not finding in the manufacturing and construction sectors that used to dominate the Chinese markets.

5. Xi Jinping has more clout than Donald Trump. The world should be wary

The United States is still the world’s most powerful country in terms of the size of its economy and military power, but its leader is proving less effective abroad than any of his recent predecessors. In contrast, Xi Jinping the president of the world’s largest authoritarian state, walks with swagger abroad and promotes globalisation, free trade and the Paris accord on climate change. Mr Xi’s leadership clout will soon be on full display this week at the Communist Party Convention, a five-yearly congress held in Beijing in which he is poised to take absolute power.

The Economist focuses in on Mr Xi’s power and signals that his leadership won’t change China, or the world, for the better.

Mr Xi may think that concentrating more or less unchecked power over 1.4bn Chinese in the hands of one man is, to borrow one of his favourite terms, the “new normal” of Chinese politics. But it is not normal; it is dangerous. No one should have that much power. One-man rule is ultimately a recipe for instability in China, as it has been in the past—think of Mao and his Cultural Revolution. It is also a recipe for arbitrary behaviour abroad, which is especially worrying at a time when Mr Trump’s America is pulling back and creating a power vacuum. The world does not want an isolationist United States or a dictatorship in China. Alas, it may get both.

6. Nordic accelerator launches in Shanghai, joining wave of expat-preneurs in China

A Scandinavian company is looking to help budding entrepreneurs from the region access the growing Chinese middle class by launching a new accelerator programme, nHack, in Shanghai. The founder believes few companies succeed in China by sitting in their own country and trying to manage remotely. nHack’s goal is to bring technology from Finland, Sweden, Norway, and Denmark and connect them with Chinese investors, partners and customers. The first batch of companies participating in the programme includes hardware, virtual reality, agriculture tech and gaming companies.

The past few years have seen a slew of overseas organisations, such as Chinaccelerator, StartupEast, and Startupbootcamp, enter China in hopes of helping entrepreneurs from their respective countries succeed in Asia’s largest market. At the same time, local governments and organizations in China have been opening their doors to foreign tech talent. The Nordic region, whose combined population roughly equals Shanghai, has seen an increasing amount of cross-border activity with China.

7. Mobile payments ‘to overtake credit cards’ as preferred payment method by 2019

The United Nation’s ‘Information Economy Report 2017: Digitalisation, Trade and Development’ notes that the share of credit and debit cards in global payments is expected to drop to 46 per cent by 2019 from 51 per cent three years ago. E-payment services such as Alipay in China and Paypal in the US have led the way for the rapid growth in the digital payments sector as more transactions have moved online.

The UNCTAD report said that in developed regions, digital payments are dominated by credit and debit cards, followed by e-wallets. But in some developing countries, where credit cards are rarely the most important payment method, new online and mobile payment methods are catching on. It noted that in China, the preferred payment method for business to consumer e-commerce was Alipay, which is used by 68 per cent of all online shoppers in the country, while in Kenya, mobile money, or accessing financial services via a mobile phone, is more common than credit cards for e-commerce, although cash on delivery remains the main method.

8. How bKash is revolutionising banking for the poor

One of the most fascinating companies to watch in FinTech has been bKash, a Bangladesh based mobile financial services product with a user base of 24 million.

Founded in 2011 with backing from the Central Bank, bKash has helped many of the country’s rural unbanked population to enter the formal banking system for the first time by offering free accounts accessible entirely through mobile phones. The product has since expanded to function as a money transfer system, payroll management and mobile wallet.

The emergence of companies such as bKash are indicative of the trend of developing nations leapfrogging technologies from advanced economies, and in this case moving from a solely cash based society to one built completely on digital banking services.

9. The importance of public policy for Digital Competitiveness

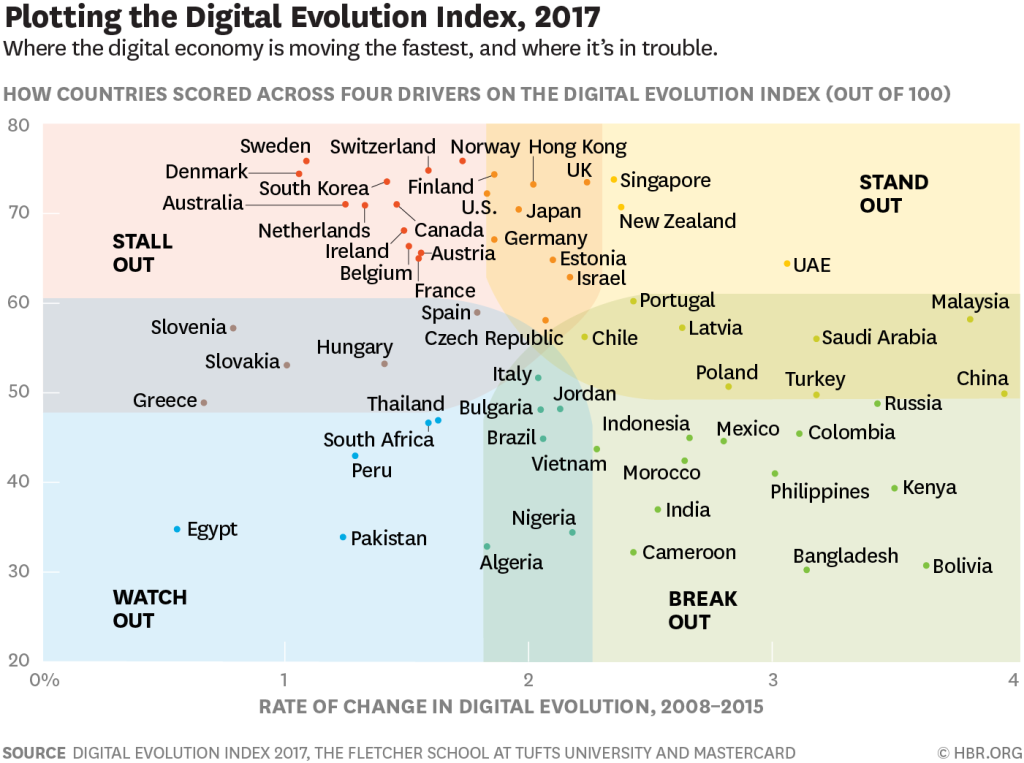

The annual Digital Evolution Index, developed by Harvard Business Review, traces the rate of change and sophistication of a country’s transition from physical interactions in all facets of life to digitally mediated ones. Singapore and New Zealand both feature in the Stand Out quadrant by scoring highly on both the current level of digital competency and the rate of further improvements.

However the most interesting are the breakout nations; countries with a low score for current abilities but a high rate of change such as China, Malaysia, Russia, Kenya and Bolivia.

The unifying factor between the Stand Out and Break Out countries is that they are benefiting from a combination of the strong rates of digitalisation and the involvement of governments in orchestrating digital economies. The converse of this is seen in the US, where there is a risk of the country falling into the Stall Out zone (high advancement with low rate of change) due to “missing political debate”.

More digital innovators should recognise that public policy is essential to the success of the digital economy. Countries with high-performing digital sectors, such as those in the EU, typically have had strong government/policy involvement in shaping the digital economies. So do high-momentum countries (such as Singapore, New Zealand, and the UAE) as well as many Break Out countries (including China, Malaysia, and Saudi Arabia). As for the U.S., it is at risk of falling into the Stall Out zone. One of us has made the point that there is a “missing political debate” in the U.S. over the digital economy, despite that fact that American digital companies and innovations are pre-dominant worldwide.

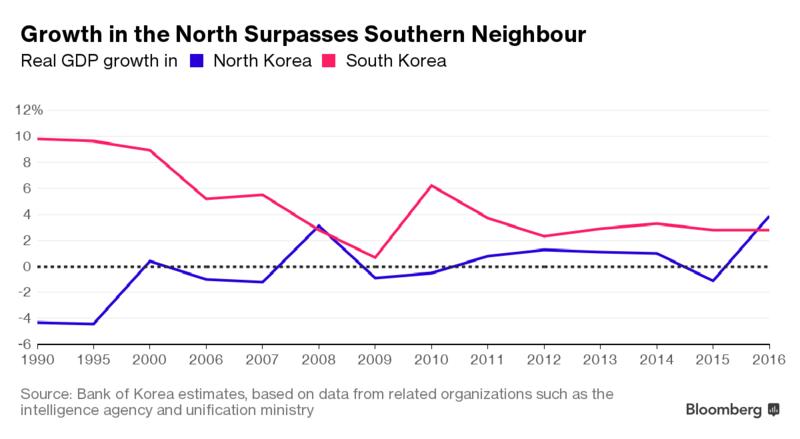

10. North Korea’s secret weapon? Economic growth

The United Nations is imposing further sanctions on North Korea for its most recent nuclear tests, but it's worth asking why such penalties have been failing for more than a decade. One reason is that the economy is improving more than is commonly understood and China remains reluctant to impose sanctions. The country is still poor, but its gross domestic product grew by an estimated 3.9 percent in 2016 and wages have risen quickly.

The results are striking. Street vendors, once rare, are now a common site in Pyongyang. Some neighborhoods have new luxury high-rises, modern supermarkets, fashionable shops, and streets busy with Mercedes-Benzes and BMWs. Although the government denies having abandoned the old socialist system, the evidence is undeniable: By some estimates, the private sector now accounts for up to half of GDP.

7 Comments

#4&5, re China. With respect, I want to question what I see as an open-mouthed awe of Chinese scale, power and influence. A state, or consortium of states such as the EU, influences others by offering something the others want, but at a cost acceptable to the others. (I'm not talking about the straight projection of military force.) Certainly, China offers access - with tightening conditions - to an immense and increasingly wealthy market. It also offers extensive productive capacity for material goods, and lavish outwards investment availability. However it has to be questioned how far it has been able to turn these features into influence. And the sticking points for others are fear of an unaccountable, ruthless state apparatus.

Thus the costs of accepting Chinese influence or even getting too close to China, for most states, are simply too great. Not one of its neighbours (North Korea is a special case) are at all keen to accept its embrace. The only states over which China has been able to gain significant influence - one way or another - are in central Africa, where there are attractive mineral deposits and other geographic resources of interest, and state leaderships - again for one reason or another - have been willing to sanction the investment and other transactions.

So economic power may not readily translate into influence, let alone respect. Today we read that all foreign companies operating in China need to add party functionaries to their teams. In time it may be - may be - that, without radical internal change in China - the costs to others in meeting China's demands will be too great to bear. The question for the West is whether it values its freedoms above its earnings. And that, of course, is an open question.

What should the US do to increase it's "clout" abroad? Follow the Chinese example?

The business of America is business and military interventions to keep its resource supply going. It derives its power from money (which makes America go around) and military hardware. China has been an outcast for far too long. It is also a silent clash of values and civilisation, in a way. Now America itself is searching for an identity in the wake or Trump. That gives more chance for China to project its power and influence. The Chinese Leadership is well aware of this. But they will move gradually, cautiously only. Every country will have to deal with China differently to keep its interests safe. There is no one size fits all.

The Singaporean identity was formed from the amalgamation of Malay, South Asian, East Asian and Eurasian cultures.

Eurasian? How come European and more specifically British culture doesn't get a mention? English is an official language. I was in a hotel in Singapore recently and a guest was trying to speak to the concierge in Mandarin and they, rather gruffly, asked them to speak in English.

...integration is a two-way street.

Why does it have to be? You would think people emigrated to Singapore to become Singaporeans.

When I was in Singapore for a few days a while ago, I was told by a long time resident that the West has a big influence and stake in Singapore remaining West friendly and many Westerners consider Singapore to be the safest place on earth, even above their own cities and towns. The Singaporean Government is supposed to heed that so it can also benefit from trade and commerce and other businesses done by Western corporates through Singapore. Since Singapore has no natural resources to exploit and sell, this is the most important way they can remain prosperous. Of course it involves some restrictions and forced discipline but they are ready to pay that price. It is a silent accommodation between several groups that keep Singapore going as it is now.

"" But as the Singapore economy grew rapidly, the country attracted many more prospective immigrants, and the Government could be much more selective."" a lesson for New Zealand?

Even now they are letting in many low level workers, maids, etc. The wealthy demand such services. The class division is very much apparent there and the government actively but behind the scenes works to keep the balance right (in their own standards) .

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.