By Geoff Cooper*

China’s slowdown has rightly drawn the attention of commentators and business leaders over the last few weeks.

It’s easy to see why.

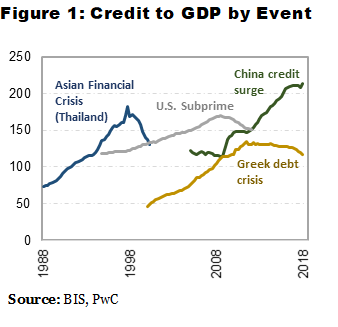

In the aftermath of the global financial crisis, China’s credit has surged (Figure 1). And while it showed signs of slowing earlier in the year, it is picking up again.

The bubble could yet burst. But China has tools to manage a downturn.

Financial conditions can be eased, falling exchange rates can support exporters and there is room for fiscal stimulus and domestic demand to pick up the slack.

Strong fundamentals, including a young population and continued urbanisation will support long term growth.

Trouble out West

However, the larger risk lies further West.

Almost a decade after the Eurocrisis emerged, pockets of Europe remain in bad shape.

The epicentre is Italy.

GDP per capita of the world’s ninth largest economy is now 9% lower than pre crisis levels. One in ten are unemployed; youth unemployment is three times that level. After much fanfare from a small economic bounce in 2017, growth slid to less than one percent in 2018. Forecasters expect the trend to continue.

There are several reasons why Italy has been in the doldrums for so long. Productivity has stalled, its legislative system is in gridlock, population growth is negative and it has long spent more than it earns.

The consequences are felt most acutely in its fragile banking sector, where various forms of balance sheet jujitsu have kept doors from closing. Italy’s banking sector remains clogged by bad loans – some NZ$360 billion in total. Under the heavy weight of such dismal asset quality, some banks haven’t made a profit in years.

Unicredit, Italy’s largest bank and a designated globally systemic important bank (GSIB), has lost over 90% of its share value since 2009; Monte Dei Paschi, Italy’s third largest bank, is now majority owned by the government.

Problems in the banking sector could easily spread to the sovereign or vice versa, with Italian banks continuing to hold large quantities of government debt. The sovereign-bank nexus that was the undoing of so many European countries just a decade ago, remains unresolved in Italy.

If global events throw Italy into a tailspin, there would be no easy way out.

Debt noose

Public debt is 132% of GDP, a tight noose on any government stimulus (by comparison New Zealand is 21%).

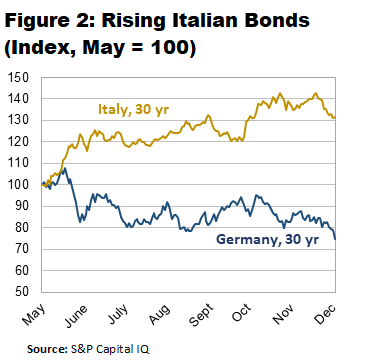

The government bond rate has doubled in recent times (Figure 2), as redenomination risk starts to dominate and foreign investors pull their cash.

Lending money to an Italian government managing a deeply troubled economy, compounded by an unprofitable banking sector, is asking a lot of private markets.

Rome can’t rely on European support either, because the Germans can’t stomach bailing out supposedly profligate Italians. And while euro advocates frequently point to internal devaluation (a pseudonym for lowering wages) as one way out, it didn’t work well in Greece, so why would Italy be any different?

The problems are further amplified by the Euro – a common currency adopted by 19 countries in 1999.

Interest rates too high

Since Italian inflation has tracked well below the Eurozone average for most of the last two years, the real interest rate (the rate adjusted for inflation) for many Italian borrowers is above 2% - much too high for a country teetering on the edge.

Faced with deteriorating economic conditions, Italy won’t be able to ease its own monetary policy or manufacture a depreciation to support trade. The euro is too strong for Italian exporters.

If Italy was to slip into recession, it could overwhelm Europe’s defences.

Backed into a corner, Europe might be tempted to impose a program of fiscal austerity, as it did for Greece. But Italy is 10 times larger and far more complex. And such a plan would carry huge risk.

Euro scepticism

The Italian electorate is already highly sceptical of Europe. Of all nationalities in the EU, Italians are least likely to think they have benefited from membership – a belief that has spurred support for the anti-euro Five Star Movement party. To a large extent, it was the Greeks that prevented Grexit; Italians might not be so forthcoming.

Problems in Italy could easily spill over with regional or global ramifications. It’s true that New Zealand weathered the last eurocrisis ok. But a slowing of Europe and China at the same time might pose a different challenge. Add to that jittery markets in the US, negative growth numbers in Germany and Japan, Brexit, and the threat of an American trade war and the south pacific could get choppy in 2019.

*Geoff Cooper is Chief Economist, PwC and formerly worked on the China and Europe desks at the United States Federal Reserve.

20 Comments

Ahem, you might have noticed a little uprising in France over the last few weeks, paralyzing Paris and bringing Macron to his knees?. Austerity and the Mastricht rules will be ignored now in France. Italy will rightly say why can't we ignore them too?..... The Eurozone is unsustainable. What is unsustainable, won't be sustained. Having your own floating fiat unpegged national currency is vital. Austerity, contrary to prior received wisdom, is not the friend of Capitalism. Try being a shop owner on the Champs Elysee for the last month.

Well said, capitalism is in a mess.

The French are living in a socialist country with 40-50% tax rates...what’s capitalistic about that?

That the 40-50% tax rates are being paid by the common people, while the elitist corporate and banking sectors take advantage of off shore tax havens and every other tool of capitalism that they have created to their benefit.

Read the Panama papers.

Socialism always screws the common people. A cursory study of history will tell you that. Even if the French govt confiscated all the wealth of the top 1% it would still be broke within a year. And why stop there...only 99% of the population left to impoverish. Their social welfare system costs $1.2T a year and the average worker needs to pay $250 in taxes to have $200 left to spend. But hey, the truth is kryptonite to the socialist thinker and they would rather burn the country to the ground before admitting they were wrong. How noble...

Like it or not, capitalism rests on a social contract that requires workers to see rising standards of living. Workers are many. Capitists are few. When workers get angry capital must temper its profiteering. Governments have historically mediated this conflict by fiscal measures, until austerity took hold. I agree, French workers are over taxed. The French government must deficit spend. But the eurozone says no. And therein we have the crux of the problem.

All the best countries have a high level of sensible socialism. Countries that have minimum wages and extensive public funded health, education and so on.

UK, US, Sweden, Denmark, Canada, Finland, Japan, Norway, Switzerland, Netherlands, Austria, Germany, Australia, New Zealand, Ireland, Iceland, Singapore.

The highest ranked countries consistently share a few common factors, including mandatory schooling from a young age, regular access to preschool/kindergarten, and widespread access to health coverage.

Yeah Kate, but all capitalism isn't the banks and elite corporate's. Alot of the capitalists employ a lot of people and create a lot of wealth. All small business owners are capitalists and that is a large chunk of the productive economy right there. Ginourmous, fat cat, monopolistic, old mans club, behemoths raping society and the environment are not really features of capitalism or socialism.

It is not capitalism that fails or communism that fails, people fail. They are vain and greedy and stupid and proud. But also funny and loving and brilliant and smart. We haven't found a system that gets the most out of all those characters.

Too me capitalism is simply the efficient allocation of resources and a free market is the mechanism for that.

We do not have a free market, nor are resources even remotely efficiently allocated so I don't see that we have a system that is especially free market or capitalist.

I fully support your plan to democratize access to off-shore tax havens. Let's all do our bit to level the playing field and lower taxes for the working and middle class.

There you go, Macron all of a sudden finds the capacity to put minimum wage up 100 euro per month, pension taxes lowered, businesses to be called on to make Christmas bonuses - end of petrol tax.... but it won't be enough in my opinion and the eurozone will not like it - but the populist cat is out of the bag. Ordinary people have got a whiff of the power they have to cause chaos. The last thirty years of neoliberalism's chickens are coming home to roost - you reap what you sow and the Rogernomes of this world - you've sown a populist uprising that is very angry. Hopefully the uprisings have a social democratic outcome. But that is not at all assured. I could go the other way and fascism may prevail.

Yes, there are parts of Italy in big trouble. Even some of the bigger (better) cities have large tented communities fill to over-flowing with migrants of all sorts. We (planet Earth) are in the middle of a global migration crisis that we can contain, if we're lucky, but my guess is we will be overtaken by it at some point.

I see the Yanks have set up in the Niger trying to stop the sources out of Africa which is 'feeding' Europe as you've read above. Down our way in South-East Asia there's all sorts of pushing & shoving going on as the bully boys try & buy their way in or if that doesn't work, spark up a conflict somehow. Nobody wants a fight, but with the sheer quantity of human numbers currently on planet Earth (7.5 bill & increasing) there are bound to be some casualties. I think we've got to get real here. The Great Re-Set as mentioned in articles published here by John Mauldin, may end up being that which is re-written after another great global war. And from what I have seen & heard from all sides of the conflicts that are happening right around the globe, unrest is exactly what they want. They can't do it as well as us, so they will try to over-whelm us (with migrants) or, if that fails, they will try to kill us, & if we can't get our heads around that, then we're living on Mars not Earth.

People are waking up to the globalist elites and are taking back their sovereignty. Expect more nationalist uprising in Europe especially once this UN migration pact is signed on the 10th of December.

Interestingly some countries including Australia won’t be signing up due to the loss of sovereignty concerns so let’s see what Winston does on the 10th of December. The MSM are very quiet on the subject.

You're so right there delboy, it was the CIA and "friends" that made sure the EU was formed.

https://www.telegraph.co.uk/business/2016/04/27/the-european-union-alwa…

The European Union always was a CIA project, as Brexiteers discover

Brexiteers should have been prepared for the shattering intervention of the US. The European Union always was an American project.

It was Washington that drove European integration in the late 1940s, and funded it covertly under the Truman, Eisenhower, Kennedy, Johnson, and Nixon administrations.

Today is the 10th of December - I guess you mean that is being signed on our 11th? And yes, sure people want their sovereignty back - but how to combat globalism? The three-letter agency forces and their backers are strong - and there's no Ghandi, or Martin Luther King, or Nelson Mandela, or JFK on the horizon.

I know I've posted this before (many times!), but will do it again, because I hope that everyone who is concerned enough will find this helps them to truly understand globalism's roots and what political forces have made it the dominant political ideology of our times;

http://socialsciences.people.hawaii.edu/publications_lib/JPI%20Ideologi…

The best thing that the Brits can do is get out completely as soon as possible, otherwise they will get further sucked into the looming Eurozone crisis. In general term the Eurozone is a good thing, but the common currency and Elitist central bureaucracy are killing it. Unless it changes significantly, it will fail from it's failing economic and social model, and and the public's increasingly violent opposition to it.

Britain, get out now as cleanly as you can, even at the risk of some significant short term pain. If you do I am sure that you will find that the EU may be far more willing to do a far better deal. They are having you on. Call their bluff.

For Balance. Message to Europe. For goodness sake wake up. You are sleep walking to disaster and Putin must be rubbing his hands with glee. Your political leaders need to get together urgently and review the strengths and weaknesses of the present arrangement, the concerns of their voters and what needs to be changed to reverse the current trajectory. If this is done I suspect that you may well end up changing most if not more of the issues that Britain trying to address with you before they voted to leave. Take this as an opportunity to suggest that Britain delay Brexit pending the changes that may result. If the changes that result are close enough to what they were originally seeking, then the British parliament may be persuaded to hold a second referendum on leaving.

the big vote on the EU deal with May will happen in couple of days, if its a deal ( hopefully not), no deal Brexit,

I suspect there is a plan B, the EU has devised knowing full well the first deal will fail big time, they will try and stop the UK from fully leaving, ultimately for the UK to withdraw the article 50 before March 31st 2019, they may try to force a snap election next year

New Zealand is a great place. Time to pull up the drawbridge. Yeah yeah. I know that's not fashionable but globalism is not popular any more either.

The UK needs to implement Brexit ASAP and get out of that club. As always they will be thankful they have the channel to serve as a protective barrier to separate them from Europe. They just need to pull the pin before its too late, anyone can see the train wreck coming in Europe.That hard Brexit will look like a soft Brexit when France, Greece and Italy go down the gurgler.

Europe has been a dysfunctional disaster for some time. It's mostly a political problem.

Their choices are either to add a proper European-wide Treasury that can balance out the Euro-wide Euro monetary policy or let countries pull out of the Euro or the EU completely.

If the EU did choose a common govt tax/spend function to match its common currency then it needs proper democratic institutions to control these functions.

The days where it was ok for the leaders of France and Germany to run Europe are over. That system is not sustainable.

The Euro has avoided these hard choices -so the continent has buggered itself up.

Meanwhile the US has gone down the demagogic populist route. So the West is in a bed shape -the worst since WW2.

NZ has the opportunity to show what a functional democracy and economy can do -we can address actual problems -like the housing crisis and making a just transition away from an old carbon economy to a new electron and hydrogen economy.

In the short term I know of several very bright individuals who have come to NZ because they cannot stomach Trump or the dysfunctions of Europe.

But the danger is instability globally will bugger up NZ too.....

The really big Elephant in the Evil Union is Deutsche Bank whose share price was E92 in 2000 and is now below E7 a reduction of 92% so the market is essentially saying the Bank is probably worthless maybe insolvent but the Merkel proposes a merger with Commerzbank so 2 possibly insolvent Banks make a solvent one or more likely too big to fail so the German Taxpayers gets to fix the problem. In addition Deutsche has loans to Italy as does France so Geoff is right Italy is the real problem and should Italian fireworks coincide with Brexits bonfire and possibly the Don turns his expressed dislike for France and Germany into retaliation the EU will likely implode like a super nova.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.