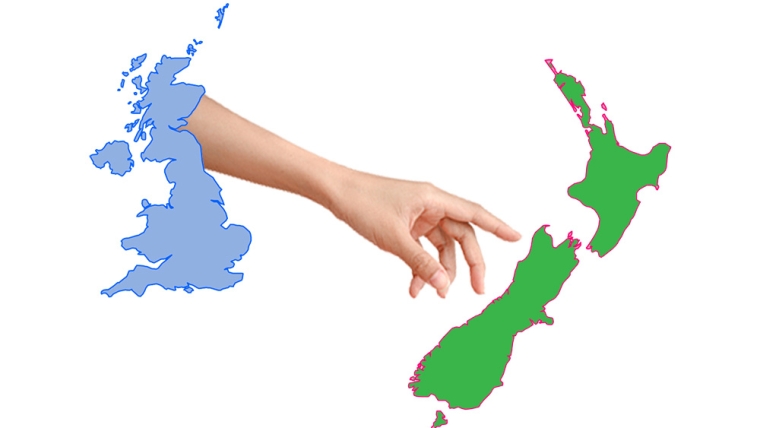

GST for all its complexities, is the best example of the Broad Base Low-Rate tax principle, a single rate of 15% applied broadly. However, one of the ongoing controversies with GST is around its application to food and other basic necessities. New Zealand's approach is at odds with many other countries, such as Australia or the UK, where food is not subject to GST (or VAT, as the UK calls it).

Frequently we see commentary that it would be a good move to help lower income earners by removing GST on food. This has been suggested as a response to the current cost of living crisis. I am opposed to such moves and many GST specialists are also in the same camp. Firstly, I don't think this move is effective as proponents believe, and secondly, if the issue being addressed is low income, then it is better, in my view, to give more income to that target group rather than using a tax measure which would benefit more people, including some who we probably think don't need assistance.

A report released yesterday in the UK regarding the impact of the withdrawal of the so-called tampon tax bears out these concerns of myself and other GST specialists about introducing GST exemptions. In the UK, VAT of 5% used to apply to tampons and other menstrual products until January 2021, when it was abolished. Prior to its abolition, VAT specialists predicted that the full benefit of abolition would not be reflected in lower prices. And a report by Tax Policy Associates bears this fear out. According to the report, at least 80% of the savings from the tax savings was retained by retailers. In fact the report questions whether any of the benefit of the removal of VAT ever passed through to lower prices.

Professor Rita de la Feria the chair of tax law at the University of Leeds was one of those who warned beforehand of this likely outcome. Commenting on the report she noted this was not only predictable but predicted. In her view “we have to stop confusing policy aim with policy instrument and we also need to stop using tax policy instruments to signal we care about the policy aim.”

Those are wise words and should be kept in mind next time you hear calls for tax changes for ostensibly very sensible reasons. In tax, even with well-meaning policy, there are always unintended consequences and tax is not always the most appropriate mechanism. Sometimes direct action, such as giving payments to those affected, or supplying tampons for free is the best approach.

How UK tax law applies to NZ residents

Staying in the UK, next week, the latest Chancellor of the Exchequer, Jeremy Hunt, Grant Robertson’s equivalent, will be presenting the Autumn Statement. He is expected to introduce a number of tax changes and tax increases in an effort to try and restore the UK's finances. Hunt, incidentally, is the fourth chancellor this year, whereas Grant Robertson is only the fourth New Zealand finance minister this century. So that gives you a measure of just how much upheaval has been going on up there.

I regularly advise New Zealanders and migrants from the UK about UK tax matters. Frequently there are ongoing issues for them and inevitably complexities creep in.

Based on my experience, there are probably thousands of New Zealanders and family trusts who may unwittingly have UK tax obligations. There are also former residents from the UK who are now living here who misunderstand the relationship between the UK and New Zealand tax treatments of investments. So here's a quick summary of those people who may be affected by UK tax and the differing tax rules between New Zealand and the UK.

Firstly, if you have property in the UK, then UK capital gains tax will apply to any disposals. There are strict timelines about reporting those disposals which are unrealistic in my view, but they still apply. CGT will apply even though the disposal might not be taxable for New Zealand purposes. By the way, the bright line test does apply to overseas property.

If you were renting a property out in the UK then you must report that income both in the UK and in New Zealand. However, for New Zealand purposes, any UK tax paid will be given as a credit against your New Zealand tax payable.

The UK has a number of tax-exempt regimes for investors, probably the best known one is what they call Individual Savings Accounts or ISAs. Those are tax exempt for UK purposes, but if you're resident here, they are probably subject to the New Zealand Foreign Investment Fund regime.

As should be well-known transfers of, or withdrawals from UK pension schemes are subject to New Zealand income tax. I don’t agree with that policy but it’s the law. In addition, if you are receiving a pension from the UK then the UK pension scheme should not be deducting any PAYE. You will need to apply to H.M. Revenue and Customs through Inland Revenue to get any refund of any such tax deducted. By the way, Inland Revenue will not give you a credit for any tax deducted, it wants the tax paid here. That's the procedure under the double tax treaty and you'll have to go and get the PAYE back off HMRC, which can be a very frustrating experience, believe me.

But potentially the most significant tax that will apply, which is also the least known, is Inheritance Tax. Inheritance Tax applies firstly to any assets situated in the UK. So, if a New Zealander who worked over in London, bought an investment property there before moving back here, that property is in the UK Inheritance Tax net.

Secondly Inheritance Tax also applies on a global basis to all assets wherever they're situated if you are “domiciled” or deemed to be domiciled in the UK. Domicile is a complicated concept which I am not going to get into now. But basically, pretty much anyone born in the UK who's migrated here in the last ten years or so probably still is domiciled for UK tax purposes. If you were a Kiwi and you spent more than 15 years in the UK, you may also be deemed to be domiciled in the UK. If so, Inheritance Tax applies at a rate of 40% on all assets over the first £325,000. (The price of New Zealand property means that this threshold is comfortably exceeded).

In my experience, many migrants and returning Kiwis are completely unaware of the potential impact of Inheritance Tax. For example, UK Inheritance Tax law does not recognise de facto relationships (apparently much to the relief of several politicians a partner in a London law firm once told me). I once dealt with a scenario where the New Zealand resident survivor of an unmarried couple had to pay over £50,000 of Inheritance Tax on her share of a jointly owned New Zealand property after her Scottish partner’s death.

Finally, the UK has a trust register which arrived in the wake of anti-money laundering legislation and its use has been greatly expanded. Any trust which has property in the UK must register. Furthermore, any trust which has a UK source of income such as bank interest must register if it has beneficiaries, including discretionary beneficiaries who are resident in the UK. This is a common scenario I've seen. It appears this registration requirement applies even if no distributions have ever been made to the UK situated beneficiaries. There's some controversy about that particular provision because it appears New Zealand trusts may even have to file UK tax returns even if all the UK income is being distributed to New Zealand beneficiaries.

So that’s a quick summary of some of the UK tax issues which I commonly encounter. I'll look to update this summary next week if there are any developments from the Chancellor's Autumn Statement. Now is maybe time to have a look at your position to see if, in fact, you might potentially have a UK tax issue. And also keep in mind that Inland Revenue is currently running an initiative where it is checking on people's potential tax obligations from their overseas investments.

"We want to remain tax-free"

Finally, this week and back to GST, Airbnb made a submission to Parliament's Financial Expenditure Select Committee complaining about the proposal for it to charge GST on all accommodation bookings made through its platform.

In its submission, it warned this would stifle the country's economic recovery and cost the economy up to $500 million a year.

Now this measure was introduced in the Taxation (Annual Rates for 2022-23, Platform Economy, and Remedial Matters) Bill (No 2). Airbnb along with Uber, also affected by the new proposals, unsurprisingly, think the law changes are unfair. On the other hand, the Hospitality Association was amongst those submitting in favour of the change. Chief executive Julie White said a third of its membership consists of commercial accommodation providers adding “and a consistent frustration of theirs is a lack of level playing field when it comes to services like Airbnb”.

The comments from Uber and Airbnb are unsurprising to me. But what I did find of interest about the bill was there have been quite a considerable number of submissions made 820 so far, and quite a few from individuals who would be affected. To quote one, “this law change will result in fewer bookings to me and significantly impact my retirement plans. This will have the additional impact of higher costs of vacations for New Zealand families who are largely for larger families and cannot afford to stay in a hotel.”

Another submitter thought “This action will have a huge negative impact on a new form of tourism at a very personal, localised level.” I'm personally not sure that the impact will be quite as dramatic as those submitters suggest, but it is interesting to see the reaction to what might be seen as a relatively straightforward GST proposal.

As is often the case, many other submitters took the opportunity to push for other changes, such as several suggesting for the removal of FBT on the provision e-bikes to employees.

There was also criticism of the complexity of the interest,limitation and bright-line test rules. One submitter noted that the commentary to the bill had more than 28 pages devoted to remedial provisions for this legislation, and he concluded correctly, in my view, “it is simply not appropriate to expect most landlords to be able to apply the detail of tax law of this complexity.”

Incidentally, the same submitter suggested that because the interest limitation measures had been introduced partly in response to rising house prices, now house prices were falling logically the interest limitation measures should be repealed. It's a fair point, and he wasn't the only one to make it. But somehow I can't see that happening. To leave off where we came in this is another situation where the policy aim and policy instruments have got confused.

And on that note, that's all for this week. I’m Terry Baucher and you can find this podcast on my website www.baucher.tax or wherever you get your podcasts. Thank you for listening and please send me your feedback and tell your friends and clients.

Until next time kia pai te wiki, have a great week!

*Terry Baucher is an Auckland-based tax specialist with 25 years experience. He works with individuals and entities who have complex tax issues. Prior to starting his own business, he spent six years with one of the "Big Four' accountancy firms including a period advising Australian businesses how to do business in New Zealand. You can contact him here.

23 Comments

." If you were a Kiwi and you spent more than 15 years in the UK, you may also be deemed to be domiciled in the UK. If so, Inheritance Tax applies at a rate of 40% on all assets over the first £325,000."

My only son has been in UK > 5 years and is likely to stay there, as he's paid more.

So I'll be giving 40% of my estate to the UK Govt when I pass on,if he's stayed 15 years (and Hunt may change the domiciliary definition)? .. unless I make a capital transfer to him before I die??

After some research it seems that I would have had to have been domiciled in UK for my estate to have to pay inheritance tax, so article could be misleading?

The implications of an estate settlement are not restricted to the UK.

My wife is one of 4 siblings who inherited when her father died some 5 years ago. 3 of them live in NZ and took their disbursement, but her eldest brother has lived in Australia for decades, and if refusing to take his allocation as it might "affect his Australian pension"(which unlike ours, is Means Tested)

So the funds just sit in the Auckland solicitors trust account, attracting 'services fees' and await some sort of resolution, knowing that any legal avenue to progress that will be family disruptive, expensive and time-consuming.

Wow, not only is Australia's $180k+ tax bracket a lot higher than ours, but their pension is also means tested??!?!

Means test excludes the family home. And you dont have to sell it to get aged care subsidies, you can also get 100% back on retirement village units.

Predict when you are going to die accurately - capital transfers within 7 years of your death remain taxable for inheritance tax purposes. How Inheritance Tax works: thresholds, rules and allowances: Rules on giving gifts - GOV.UK (www.gov.uk)

The introduction of GST was a tax change in itself as we didn't always have it and so it is not set in stone and can be altered. Taxing people on their daily necessities is inequitable and it is a part of the neo-liberal paradigm.

Seriously?

As Lange so deftly put it at least drug dealers now pay tax.

Hardly a reason to tax peoples food. Even Lange lost faith in Roger Douglas and the misery he caused and unfortunately we then ended up with Ruth Richardson.

Secondly Inheritance Tax also applies on a global basis to all assets wherever they're situated if you are “domiciled” or deemed to be domiciled in the UK. Domicile is a complicated concept which I am not going to get into now. But basically, pretty much anyone born in the UK who's migrated here in the last ten years or so probably still is domiciled for UK tax purposes

It's actually quite tricky to get rid of being a uk domicile (it's more than just living somewhere else for a while). Unless you happen to be a politician's wife/husbnad of course...

Funny how tax changes supposed to make the law fairer for all players always mean net positive cash flow for the Crown.

Will the Crown share this additional revenue with local councils footing the big bill for this tourism infrastructure? I guess not.

I've written code for processing GST (VAT) and NZ is sensible to leave it asis. Introduce exemptions and it is too easy for the small dishonest trader to cheat. Even for honest traders it is near impossible to clearly distinguish the categories. Remove GST from food and it is removed from the sack of potatoes and the lobster thermidor at the poshest restaurant. Try to adjust for that and you get the UK's problem with a whole chicken tax free but a half a chicken taxed (it becomes processed food).

Is it a whole chicken if the feathers, head and feet are off and the entrails removed?

Because that sounds processed to me. :)

Well it may have changed since I left. From memory the whole chicken without feathers, entrails, etc was exempt. As was a raw rump steak. If the chicken was cooked or cut in half or split into legs, thighs, wings and breasts then add GST. Add a marinade to the rump steak and it probably was 'prepared'. I can't remember if minced or cubed removed the exemption. It was messy and I'm guessing some traders would record 99% of sales as exempt and the GST taxmen had a problem proving otherwise. If the aim is to help the poor them what would the kind hearted recommend for a MacDonalds 'Happy Meal' - add the tax just to the toy?

It is a mess: increasing computing and tax investigator admin costs, rewarding the dodgy trader - best to leave it alone. It is worth considering reducing the rate of GST and correspondingly increasing income tax rates.

""if the issue being addressed is low income, then it is better, in my view, to give more income to that target group rather than using a tax measure which would benefit more people, including some who we probably think don't need assistance.""

Politicians prefer targetted benefits. Obviously when the target is clear that works fine - workers pay taxes so the unemployed can get the dole. But with many benefits means tested it makes little sense to actually work. Allow for means tested WFF, accommodation benefit, children's student benefit, Income tax and it soon becomes a disincentive to actually work - I know since 15 years ago I calculated I would be losing 80% of any extra earnings (the other 20% would have gone on transport and smarter clothes).

Is making air bnb’s pay gst fair? It’s not really a simple yes or no.

** motel owners will always say yes , as they have to charge gst. Where the vast majority of air bnb owners don’t as they don’t have revenue over 60k. Even up the playing field?

** air bnb owners will say no as like absolutely every other business including owning a motel, you only start paying gst after you have revenue over 60k. Why pick on one sector?

** government will say yes as they get more tax. Surprise surprise.

** I would say this: the government has always argued against removing gst off items like fresh fruit and vegetables by saying “ if you allow a few items to be excluded, everyone then wants to be excluded”

But isn’t this the same situation in reverse? you either need to allow small business owners who earn less than 60k revenue not to pay gst. Or change the the rules so they all must pay gst.

Allowing over complicated rules that say this group does need to pay gst but not that group, will make a simple tax system into a complicated mess.

How many motels can one purchase using a residential mortgage? I assume if you want to borrow for a motel it'll be a business loan at 8 - 10%. Exempting Air BnB owners from GST, while they can borrow at much lower rates, is completely unfair to motel owners.

If Air BnB owners want to be treated like every other business, then subject them to planning permissions. Since the property is undergoing a "change of use" then building code provisions should apply. E.g. minimum number off street carparks with wheelchair access. Fire escape lighting, manual fire call points etc.

It's about market disruption not about "being fair to motel owners".

Air BnBs are not "undergoing a change of use", same residency occupancy utilization, toilets bedrooms etc.

Except arguably it's a change to Schedule 2 of Building (Specified Systems, Change the Use, and Earthquake-prone Buildings) Regulations 2005 for sleeping activities for spaces providing "transient accommodation", although Air BnB is unique in that it's usually one client per building not several (like motels/hotels).

SA

(Sleeping Accommodation) spaces providing transient accommodation, or where limited assistance or care is provided for people

Motels, hotels, hostels, boarding houses, clubs (residential), boarding schools, dormitories, halls, wharenui

SR

(Sleeping Residential) attached and multi-unit residential dwellings, including household units attached to spaces or dwellings with the same or other uses, such as caretakers’ flats, and residential accommodation above a shopmulti-unit dwellings, flats, or apartments

However, Building Code Clause C (Fire Protection) does mention under the Risk Groups that:

- SH = Buildings with sleeping (residential) and outbuilding Residential Dwellings are excluded

- SM = Sleeping Non-Institutional which covers:

Transient accommodation such as: Hotels, motels, serviced apartments, hostels,

backpackers, cabins at holiday parks. Buildings where six or more people pay for

accommodation (such as boarding houses/homestays/ bed and breakfast.

So if an Air BnB property is capable of sleeping 6 or more people, then technically they should be expected to meet the requirements under the Building Code.

I think you are assuming that the majority of air bnbs are going to be used that way full time. Remember the average yearly return for an air bnb is a bit over 4K. Most are only rented out for a few weeks.

Regarding the loan terms, I think this is a conversation with the bank who will base the interest rate on the risk it perceives.

Are Airbnb's being asked to pay gst or is air bnb it's self the target as they are the entity doing the invoices? If it was actually the individual doing the invoices and turning over less than $60k wouldn't be a problem.

Hi red cow.

The government is trying to introduce new legislation saying that individual air bnb owners have to pay gst, even if they earn less than 60k. Even though every single other business type in NZ is excluded under the 60k threshold.

It seems like they have caved under lobbying from the hotel / motel groups.

My understanding is that the individual would not be responsible for charging gst, the platform that they use would be responsible as they are the ones actually charging for the service. If the house owners wish to rent out as an individual and take responsibility for the financials and assuming they are less than $60k then no gst. Align themselves with a charging platform and GST will be required from the customer.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.