Crypto assets that can be used as instruments of payment have proliferated into more than 10,000 variants since the 2009 debut of Bitcoin, the first and still the largest. The bewildering speed with which they have developed and the pseudonymity they can provide have left tax systems playing catch up.

In a new paper, we discuss how governments can address the emerging challenges of taxing these crypto assets while its use is still limited so that they prevent a leakage in tax revenue and protect the integrity of the tax system.

Classifying crypto

Views of crypto assets are diverse and held with passion. The prospect of liberating financial transactions from oversight by governments and the involvement of financial institutions is a libertarian dream for some. El Salvador and the Central African Republic have gone so far as to adopt Bitcoin as legal tender.

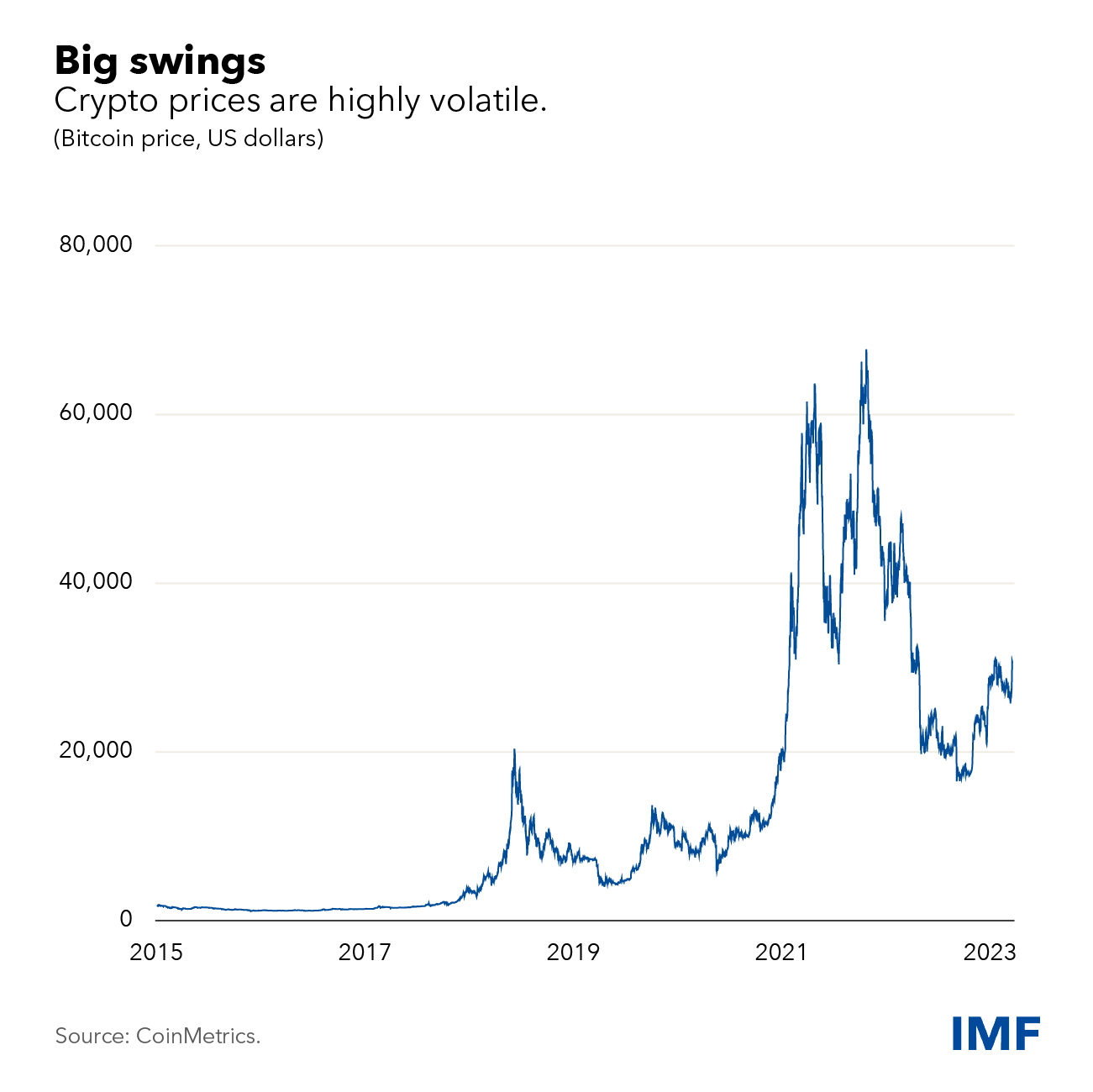

Critics, however, see crypto assets as not merely inherently worthless but a front for crime, scams, and gambling. They also point to their dizzying volatility. Bitcoin, for instance, soared from $200 a decade ago to nearly US$70,000 in 2021 before plunging to around US$30,000 today.

The collapse of FTX last year and recent US Securities and Exchange Commission lawsuits against Binance and Coinbase have fed anxiety among users while the appeal to criminal activities has been reflected in high-profile seizures of billions of dollars. These developments have triggered increasing scrutiny from policymakers and widespread calls for regulation.

But whether crypto assets ultimately boom or bust, a coherent way to tax them is needed.

A key issue is how to classify crypto assets - should they be regarded as property or currency? When crypto is sold for profit, capital gains should be taxed as they would be on other assets. And purchases made with crypto should be subject to the same sales or value-added taxes, or VAT, that would be applied for cash transactions.

So, one important task is to ensure application of these principles, which requires clarity on how to characterise crypto for tax purposes: in essence, as currencies for VAT and sales taxes and as assets for income tax purposes. While this is not easy due to the evolving nature of crypto asset transactions, it is perfectly possible. The deepest challenges are then in enforcement.

Revenue considerations

Crude estimates suggest that a 20 percent tax on capital gains from crypto would have raised about $100 billion worldwide amid soaring prices in 2021. That is about 4 percent of global corporate income tax revenues, or 0.4 percent of total tax collection.

But with total crypto market capitalisation down 63 percent from the late-2021 peak, tax revenues would then have shriveled. If these losses were fully offset against other taxes, there would be a corresponding reduction in revenue. In more normal times and with the current market size, global crypto tax revenues would probably average less than $25 billion a year. That, in the broader scheme of things, is not a huge amount.

There are also important fairness issues at stake. Though their pseudonymity makes it hard to be sure exactly who holds crypto, there are signs that ownership is heavily concentrated among the relatively wealthy - even though holding of crypto is strikingly common across people with low incomes too. Available surveys indicate that about 10,000 people hold one quarter of all Bitcoin.

There is also VAT. Crypto transactions have similarities to those in cash in their potential for being hidden from tax administrations. Today, the share of purchases made with crypto is still small. But widespread use, if tax systems were not prepared, could someday mean widespread evasion of VAT and sales taxes, leading to materially lower government revenues. This may be the biggest threat from crypto.

Addressing implementation

The most fundamental difficulty in taxing crypto assets is that they are “pseudonymous.” That is, transactions use public addresses that are extremely difficult to link with individuals or firms. This can make tax evasion easier. Implementation is thus at the heart of the matter for tax authorities.

The problem is surmountable when people transact through centralised exchanges, since these can be made subject to standard “know your customer” tracking rules, and possibly withholding taxes. Many countries are putting such rules in place with the expectation that tax compliance will improve.

However, reporting obligations could induce people to keep tax authorities ignorant by instead using centralised exchanges abroad. To address that concern, the Organisation for Economic Co-operation and Development has developed a framework for crypto-related exchange of information between countries. Implementation, however, is some way off.

A more troubling possibility is that reporting rules (and the failures of some crypto intermediaries) could induce people to transact increasingly through decentralised exchanges or directly through peer-to-peer trades where no central governing body oversees these transactions. Those are still extremely difficult for tax administrators to penetrate.

Given the complexity of the fundamental challenges posed by pseudonymity, the rapidity of innovation, the vast information gaps, and the uncertainties ahead, the tide has not yet turned in the battle to incorporate crypto properly into the wider tax system. Some of the elements needed for doing so—such as clarity in their classification for tax purposes—are clear.

But the challenges are fundamental, and the risks, particularly to the VAT and sales taxes, may be greater than people recognise. As many (though far from all) governments are beginning to realise, policymakers need to develop clear, coherent, and effective frameworks for taxing crypto.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.