Credit cards are a modern convenience that looks ubiquitous.

You need them for paywave transactions, and when loaded to your mobile phone wallet, they become enticingly easy to use. They, along with other cards like debit cards, have transformed how we shop, from the weekly supermarket run to on-line buying and subscriptions.

Behind all this are two vast payment networks who harvest fees in a uniquely tax-free way, the very definition of bad corporate citizens. They advertise a lot to mask the toll they take on economies and the continuous payments activities.

And yet we all know credit cards are 'bad'; especially the interest charged when you don't pay them off in the interest-free period. Interest rates can range from 9.95% to 28.99% pa. This 'bad' is on top of the interchange fees and tax avoidance that goes on behind the scenes.

Prior to 2008, when short term interest rates went up or down, credit card interest rates tended to follow (with the usual lags of course when they went down). But when interest rates dived after the GFC bit, it was very noticeable that credit card interest rates didn't fall. Yes, there were a few more 'low rate' card offers in the market after about 5 years, but they were rarely promoted aggressively except by new entrants and challenger banks.

Even when challenged by buy-now-pay-later schemes, credit cards became rivers of gold for banks as well as the network companies. The push for paywave and its benefits became the focus. Now that interest rates are rising again, it will be interesting to watch how card rates change.

But is 'knowing this' affecting behaviour? Surprisingly, it might be.

Data from Centrix clearly reveals that having multiple credit cards is declining. And the sheer number of cards is falling too, even among people who only have one card.

Data from the RBNZ also shows that the amount being charged to credit cards might be rising, but the balances we leave on these cards are falling too. We are paying them off faster.

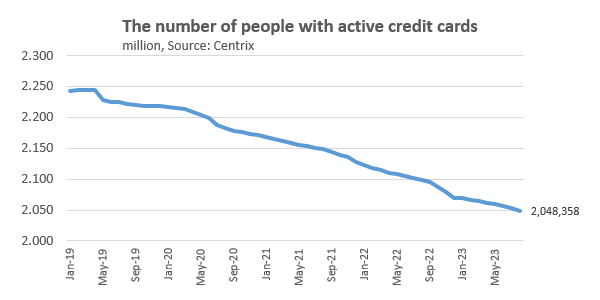

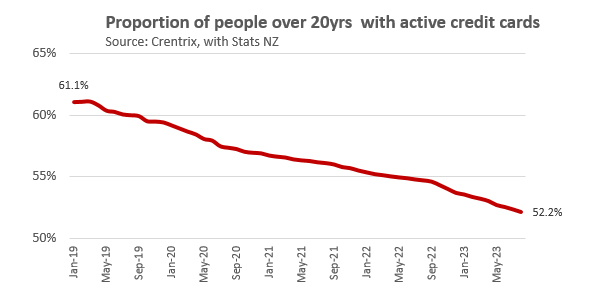

In the almost five years since the start of 2019, the number of active credit cards has fallen -8.7% to now 2.05 mln issued and active in New Zealand.

Of course, our population has risen over the period. Among the population aged 20 years and over, total card adoption has fallen more than -14%.

But that is only part of the story. The details show that the number of people with three or more active cards has dived from one in six, to only one in 13 now. The number with two active cards has also fallen from one in four to one in five over this same period. But the number of people with one card has risen and is up 14% to 1.45 mln since early 2019. But the growth has essentially disappeared since the onset of the pandemic and hasn't returned.

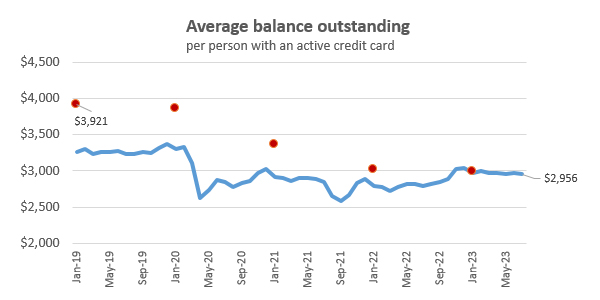

Folding in the RBNZ data that records overall balances due, we find that overall average balances are less than $3000 per person and haven't been shifting recently. So not only have the total amounts of credit card debt not been growing (C12) even if billings on them have been (C13), credit card holders have resisted the temptations and there is no overall signs of credit stress. For some, there will be, but not for most.

More than that, after accounting for inflation, which has been high in recent years, the inflation-adjusted balances have actually been falling.

The red points in the chart below are the Q2-2023 equivalent balance values adjusted for inflation using the RBNZ inflation calculator. In August 2023, the average balance owed on a credit card of $2,956 is -25% less in 2023 dollars than what was owed at the start of 2019. That is a large shift

That is confirmed by the RBNZ data that shows the proportions owed on credit cards that incur interest are now running at near all-time lows in data that goes back 23 years

We wish to thank Centrix for the access to their card number data for this analysis.

8 Comments

The government provides us with money that we can use for free and it's called NZ Dollar Currency and also referred to as government debt and it's created every time that the government spends its money into the economy.

Some of the governments money we hold as cash and some we hold as bank deposits and the banks also hold some as central bank reserves and as treasury bonds.

We can use this money until we are required to return it in taxation and at which point it is deleted again.

You could team up with PDK and make a 2 trick pony.

We fit the story. We now have only two cards, with only one being active & we pay it off each month, pronto. We are lucky enough to be empty nesters & even get invited around to their place for dinner. There's got be some upsides for being old.

Down to one card myself, the 6 month fees used to be a rip off. Always pay it off every month, its very convenient in tracking my spend and the ASB True Rewards points are great, usually a free shop every time I go into Mitre 10 on points. Don't tell Labour.

Across younger customers, almost 90% of them are using debit cards or EFTPOS, with the 10% that are using credit cards typically being personal finance saavy and using them as a way to collect airpoints or cashback.

It's actually really nice to see how the younger generation isn't falling for legal scams from the bank.

Just discussed this with my wife this morning! A credit card would be far more convenient than what we currently do - which is transfer onto debit every transaction.

But we like the control - and the fact if you set something up to debit off the card you're relying on a social, not physical, contract that they won't take more at will. Not so much an issue here, but have had issues in the past with Aussie and UK companies in particular either double charging or charging post-cancellation - and it's a real pain to deal with those post-event. Simply a non-issue with the way we manage our debit card.

Meanwhile, the money's sitting in a call account earning interest.

This 'bad' is on top of the interchange fees and tax avoidance that goes on behind the scenes.

Anyone know what is meant by the above which is 'going on behind the scenes'?

Not that I need to hear about yet another robber-bank type story. But, if there is a tax avoidance trick going on - we really ought to think of a unique way to tax banks. They've had quite enough money for nothing.

Beware of cancelling a credit card. The banks appear to not want to provide them. I had a friend of mine who took a year to get a new one (Mastercard) and its was a drawn-out process to say the least. He has $250k of income and $10m of assets (retired). Maybe it was just bad luck, but he needed an extra one for travel incase of fraud. Occasionally the bank will suspend your card whilst you are away leaving you high and dry. Also Hotels etc can place a hold on your card with amounts well in excess of the charges and take some time to release these.

Yes the fees for not paying are excessive and the greed of the banks is excessive that said they have many frauds which I expect they have to wear. The FMA has made them have better processes to avoid extending credit to people who might never be able to meet the obligations.

So a bit of a sad story !

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.