According to the Financial Markets Authority (FMA), New Zealanders made around 500,000 individual changes to their KiwiSaver investments last financial year. While changing your KiwiSaver investment approach is theoretically free, the snail pace at which it happens can result in some significant costs to investors.

There are two main ways people make changes to their KiwiSaver investments:

- Switches: Moving from one KiwiSaver investment fund into another fund, all while staying in the same scheme (e.g. going from a Conservative Fund to a Balanced Fund)

- Transfers: Moving from one KiwiSaver investment fund into another fund offered by a different scheme (e.g. going from the Milford Conservative Fund to the Fisher Funds Growth Fund)

There were around 130,000 transfers and almost 370,000 switches in the last financial year, including over 40,000 that switched KiwiSaver investments multiple times in the same year.

This suggests that a sizable number of Kiwis may not appreciate the real cost of flip-flopping on their investment decision making.

The out of market cost

When you transfer from one KiwiSaver scheme to another, it takes up to 10 business days to take effect. In that time, your money is effectively out of the market, which has a cost in terms of missing out on any market movements. Switching funds is faster - around 3 days - but that can still be significant, especially for those making multiple switches within a year.

According to the FMA, nearly 6,000 investors switched their KiwiSaver investment funds five times or more last year. Assuming it takes three days minimum to process each switch, this could mean they were out of market for at least 15 business days.

The exact out-of-market cost of this break will depend on what those investors were invested in, and the market performance on those days.

However, if we take the S&P 500 as an example, we can see that someone that was fully invested throughout all of 2023 would’ve enjoyed a roughly 24% gain on their investment.

If a person was out of the market for just ten of the S&P 500’s best market-performing days of 2023, that annual return goes from 24% to less than 4% – a nearly 90% drop-off in returns for just 10 days – the same amount of time it can take to transfer from one KiwiSaver Scheme to another.

Missing 15 of the S&P 500’s best market performing days in the year would result in your 2023 return being negative – “returning” almost -4% for the year. For those that made multiple changes to their KiwiSaver investments during the year, 15 days out of the market wasn’t hard to achieve.

Applying these return figures to the average KiwiSaver portfolio value of around $30,000, the investor that was out of the market for just those 10 best days would have had a measly $1,000 gain over 2023. If they’d remained invested for the whole year, they would have generated a $7,000 gain.

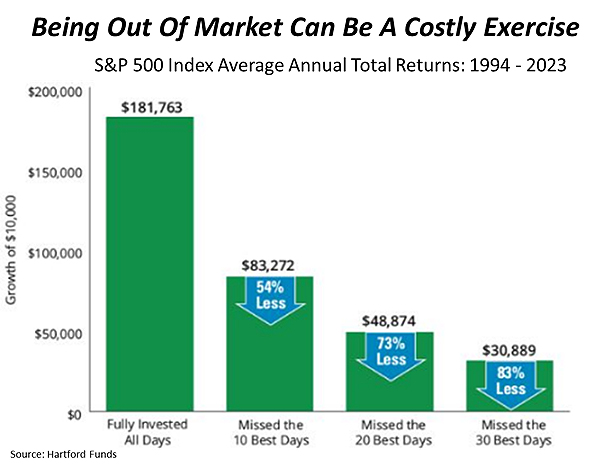

These sizable out-of-market costs aren’t an isolated event either just because 2023 was a gangbuster year for markets. In fact, the substantial cost of missing key market days can also be seen when we look back further in time, and is even more pronounced over longer-term horizons.

For example, looking at the S&P 500’s performance across the past 30 years, missing out on just the best 10 days would lead to a 54% lower investment portfolio, while missing out on just 20 days would result in a 73% lower balance.

When should you change your KiwiSaver investments?

To avoid the out-of-market costs, ideally there should be little need to make changes to your KiwiSaver investments.

The numbers suggest Kiwis understand this. The FMA highlighted that over the 2023 reporting period, there were 19.1% fewer switches compared to 2022, while the number of people transferring between KiwiSaver providers was down 16.8% year-on-year.

Your KiwiSaver portfolio should align with your investment objectives and risk preferences, which shouldn’t change drastically from one year to the next.

But you do need to understand what those objectives are when you first join KiwiSaver. If investors don’t do this first, then they may want to change at some point in the future when they do give it some thought.

There are other good reasons why someone may want to change their KiwiSaver investments.

Changing investment needs (i.e. buying a house, having kids or retiring), issues with the value and service from your current provider, as well as fees and performance could all be valid reasons for a change.

However, because typical KiwiSaver schemes limit your investment choices to just the ones offered by a single manager (typically the promoter of the scheme), changing investment managers will typically also require a transfer from one KiwiSaver scheme to another - and a potentially expensive 10 days out of the market.

It may well be that a change can lead to greater future returns, but that should also be weighed up against the cost of that change.

Anthony Edmonds heads the Apex Group in New Zealand, which administers over $150 billion for New Zealand clients. Apex purchased Implemented Investment Solutions and InvestNow in 2022.

7 Comments

Good info I am about to change providers.

"According to the FMA, nearly 6,000 investors switched their KiwiSaver investment funds five times or more last year."

Why!?

It works both ways. You could avoid the 10 worst days as well. KiwiSaver is long term and should be viewed as such.

I don't see the point of this article. Is it just waving the flag that Apex exists?

And it does have that thing used by 'advisors' where they tell you some factoid to make you think they are wise. But it's not actually wise.

As for the analysis. "missing the ten best days in the market". I am sure the calculation is correct.

But but but. What about the calculation of missing the "ten worst days" in the market". That would show a great results. Bingo result indeed.

But he does not mention that.

Do we see "advisors" chipping away at Kiwisaver confidence. Yes I think so.

And finally, while I see KS providers tout for business, I haven't heard of churn being a feature.

Outside of KiwiSaver providers of course churn is a well recognised problem in the financial industry. And individuals I directly know have done it.

Maybe an analysis of switching in non KS providers would have enlightened the article.

Yep, the "ten best days" analysis trotted out incessantly is one of the most inane in financial markets.

The fact is there are massive clustering effects with the highest returning days (and lowest). Historically, the biggest up days have actually occurred during bear markets, either during recovery or coincident with massive selloffs (dead cat bounces). Bear markets still have a large % of up days which is counterintuitive to some, but the common factor is that volatility is higher on both upside and downside, and the down days average bigger than the up days.

Very few of the best days in markets happen when markets are making new highs.

Good article, however it makes the assumation that those transferring their balances are doing on their entire balance. I am on of those that made a transfer last year from growth to balance fund as I am in my mid 50's and gearing down my investment, however I am only doing this in small chucks each year (10%). In that case I am only missing out on 10% of my fund losing any value as per this article.

Analysis based on "average" performing days, rather than "best" performing days, would probably provide a more reasonable assessment of likely potential impact.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.