The return of the bond vigilantes?

Analysis by the World Gold Council.

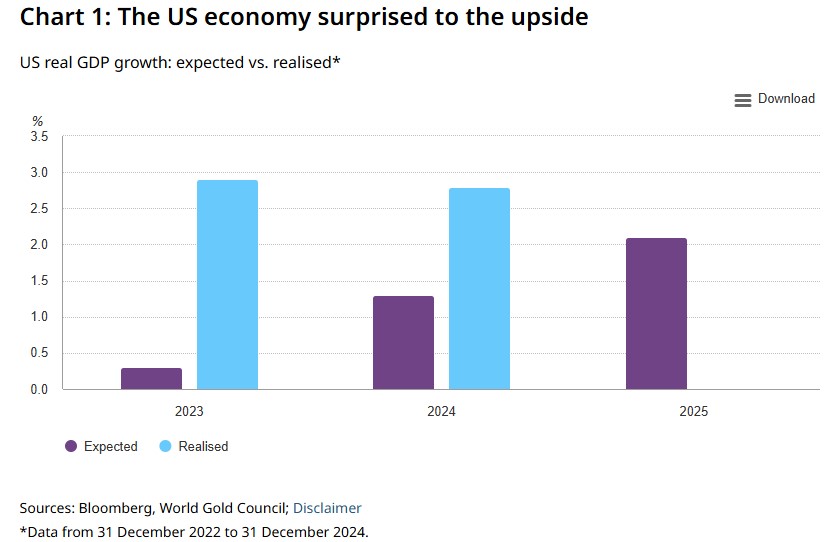

As we entered 2025, expectations for the US economy were at their highest compared to the previous two years (Chart 1) and there was widespread belief that strong growth and significant asset-price increases would continue in 2025. The Trump administration’s planned economic and policy reforms, including slashing red tape and cutting taxes, added to this optimism, suggesting that American exceptionalism would persist.

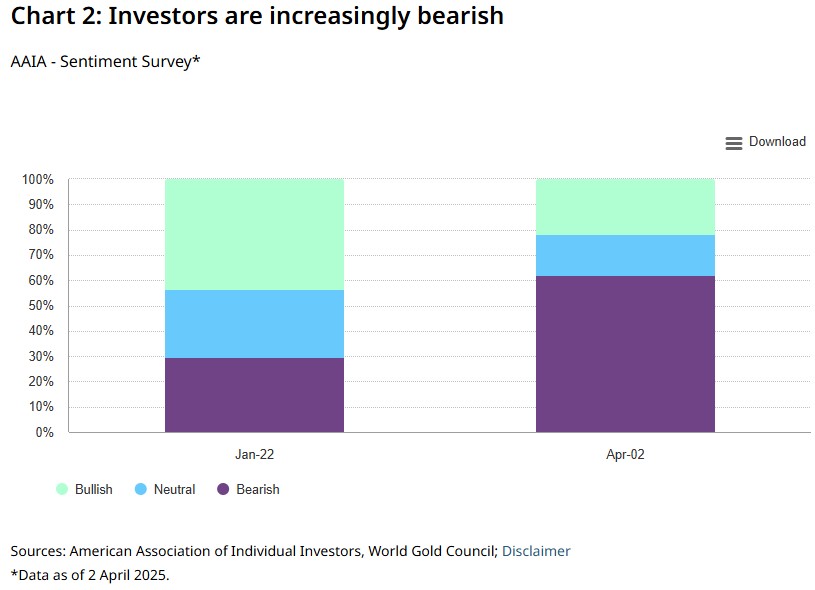

But setting expectations to such high levels always had the potential to lead to negative surprises. The American Association of Individual Investors (AAII) Investor Sentiment Survey from 2 April revealed that over 60% of respondents are now bearish about the stock market in the next six months, a significant increase from 22 January after Trump’s inauguration (Chart 2).

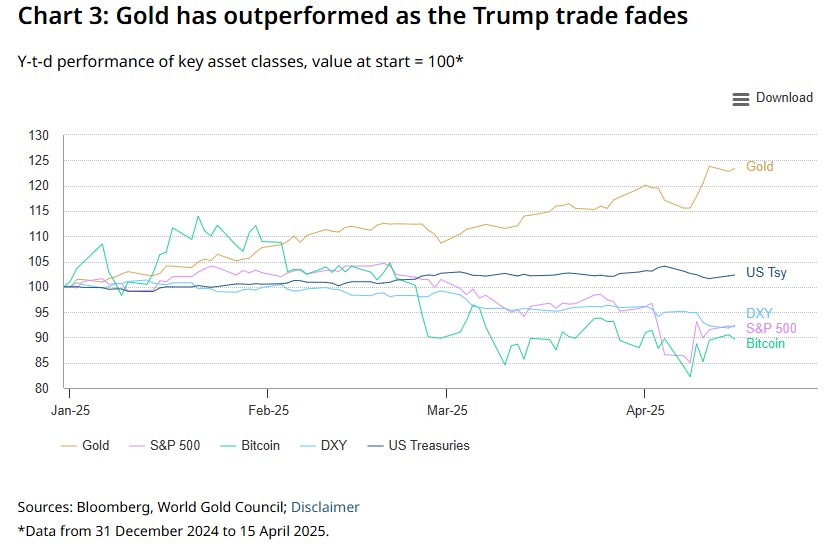

Investors are now growing increasingly concerned over the growth and inflation outlook, both at the US and global levels, from the fallout of the ongoing trade war (Chart 3).

All told, until calm is restored on the political and economic policy fronts, volatility is likely to stay elevated across financial markets – both equities and bonds – which in our view supports an allocation to gold.

Equities: a bumpy road ahead…

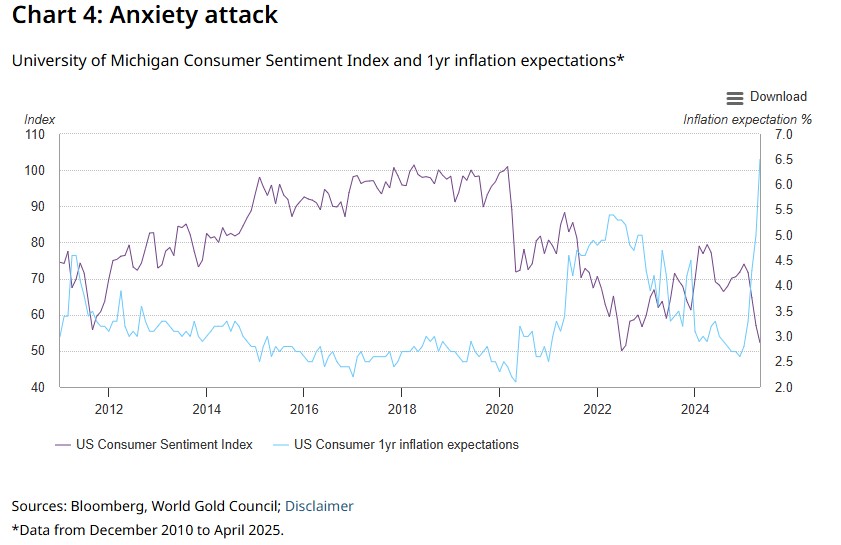

The longer the uncertainty lasts, the bigger the risks, but for a hint as to the bumpy road ahead, look no further than the collapse in the University of Michigan Consumer Sentiment Index and the surge in inflation expectations – moves that point to stagflation as consumers respond to tariff concerns (Chart 4).

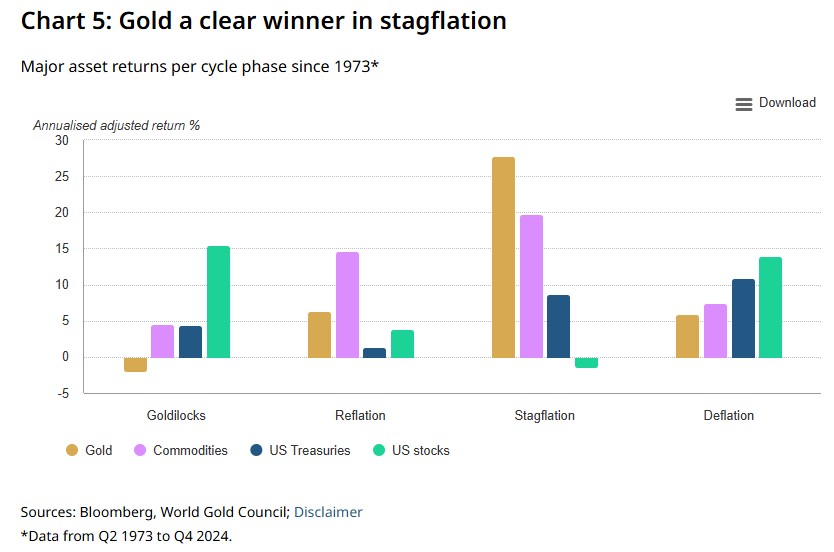

And with tariffs looking likely to produce a stagflationary impulse, the Fed faces a dilemma: should it prioritise controlling inflation, which is set to rise,1 or support growth, which is expected to decline? Unlike in 2024, the Fed is less likely to get ahead of any growth concerns. And a reactive Fed typically spells trouble for equities. More broadly, stagflation has historically been detrimental to equity returns and beneficial for gold returns (Chart 5).

Furthermore, given the recent bruising moves, investors could be forgiven for thinking that equities must now be factoring in a lot of downside risk. In fact, US stocks are barely out of the starting gate when it comes to pricing in an economic downturn as the US stock market was highly valued to begin with. With the recent relief rally, the benchmark is trading on 19 times analysts’ 2025 earnings per share forecasts. And on all common valuation metrics, the S&P 500 remains more expensive than historical averages (Table 1).

Table 1: The S&P 500 looks expensive

Common valuation metrics of the S&P 500*

| Metric | Current | Average | Min | Max | % above (below) avg |

Z-score |

| Trailing PE | 22.6 | 20.2 | 10.7 | 34.4 | 12% | 0.5 |

| Cyclically adjusted PE (CAPE) |

33.1 | 17.6 | 4.8 | 44.2 | 88% | 2.1 |

| Price / Sales | 2.7 | 1.7 | 0.7 | 3.2 | 62% | 1.8 |

| Price / Book Value | 4.5 | 3.1 | 1.6 | 5.2 | 45% | 1.6 |

| Price / Cash Flow | 18 | 12.2 | 4.9 | 28.8 | 48% | 1.5 |

Source: Bloomberg, Robert J. Shiller, World Gold Council

*Data from April 1990 to April 2025 except for CAPE, which is from January 1881.

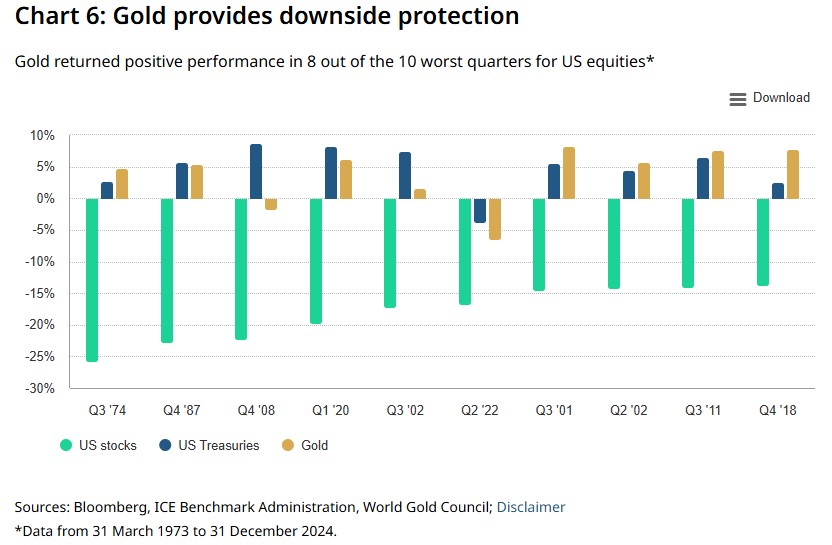

And amid the trade onslaught, the probability of a recession has risen substantially. The future trajectory will depend on key indicators such as jobless claims, consumer spending and corporate profits. But a recession would be a particularly tough scenario for equities, and investors should keep in mind that considerable downside would be yet to come for the asset class, leading to greater safe-haven demand, notably gold. In fact, with few exceptions, gold has been especially effective during these periods of systemic risk, generating positive returns in 8 out of the 10 worst quarters of performance for the MSCI USA index (Chart 6).

If one thing is true of the bond market at the moment, it is that, on the face of it, it looks attractive on a risk-adjusted basis. Current yields are well above long-term returns for many of the global fixed income sub-asset classes, which means that fixed income may be well positioned to deliver robust returns in the period ahead.

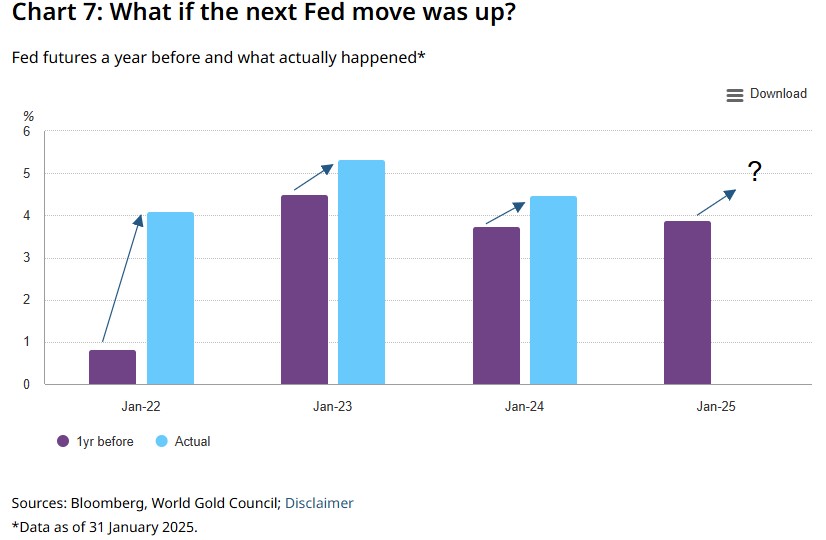

But markets have been continuously in a pre-COVID mindset of returning to ultra-low rates, hence under-pricing how hawkish the Fed would be, and we believe these dynamics could continue in the near term (Chart 7).

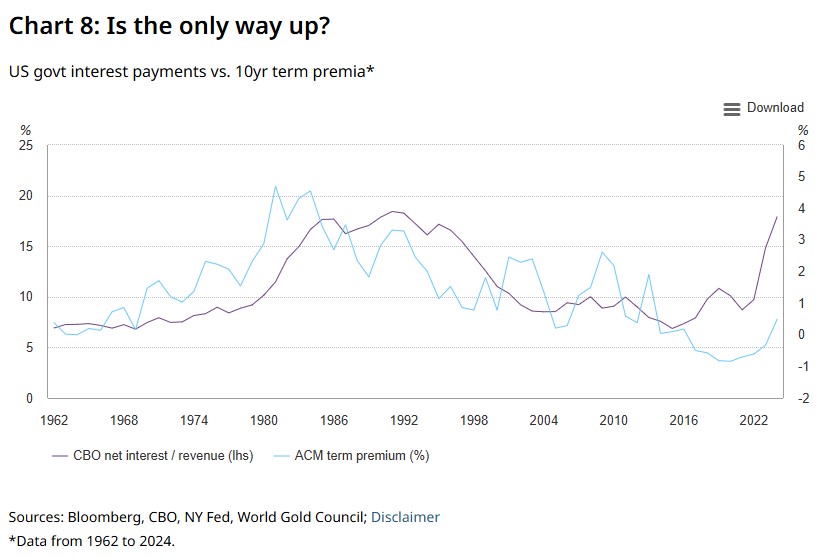

Moreover, the macro environment over the past several months (years) has been such that market pricing of central banks’ rates has been volatile. And we see plenty of reasons why yields could continue to be volatile and also come under pressure. If Trump is successful in the large-scale reshoring of US manufacturing capacity, goods deflation in the US could come under pressure, making the inflation target more difficult to achieve and bond markets will have to take note. Besides, in an increasingly antagonistic geopolitical environment, foreign central banks seem likely to continue shifting their reserve holdings away from Treasuries towards other assets such as gold. Finally, doubts about the appropriate level of term premia seem only likely to grow (Chart 8). The CBO data below look frightening enough as it is – even before including the impact of extending Trump’s Tax Cuts and Jobs Act tax cuts.

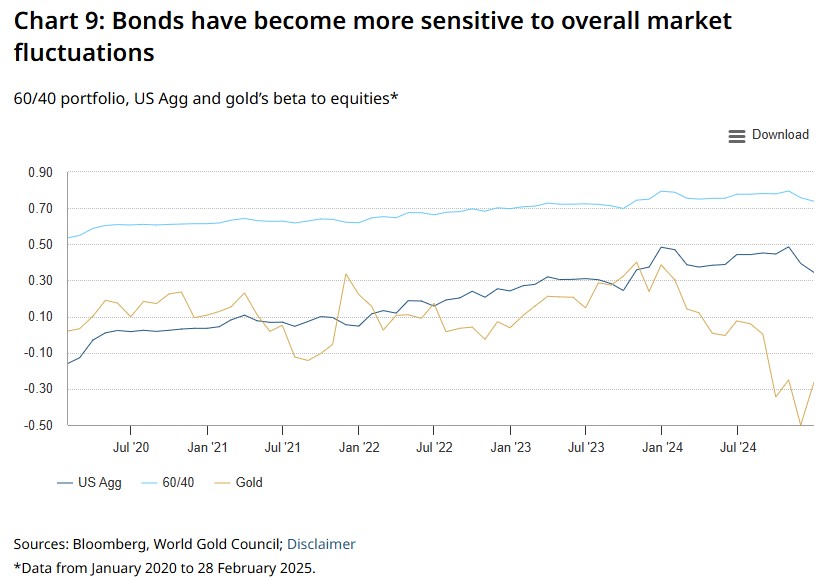

All in all, maintaining a diversified portfolio can feel like chasing a moving target in today’s rapidly evolving market environment where bonds are now providing less of a diversification benefit than in the past, but also demand a higher portion of investors’ risk budgets. Chart 9 shows that today’s 60/40 portfolio beta — its sensitivity to overall market performance — is at among the highest levels in the past five years. Meanwhile, bonds’ beta has also ratcheted higher. Therefore, bonds are now more stimulated by higher levels of overall market risk.

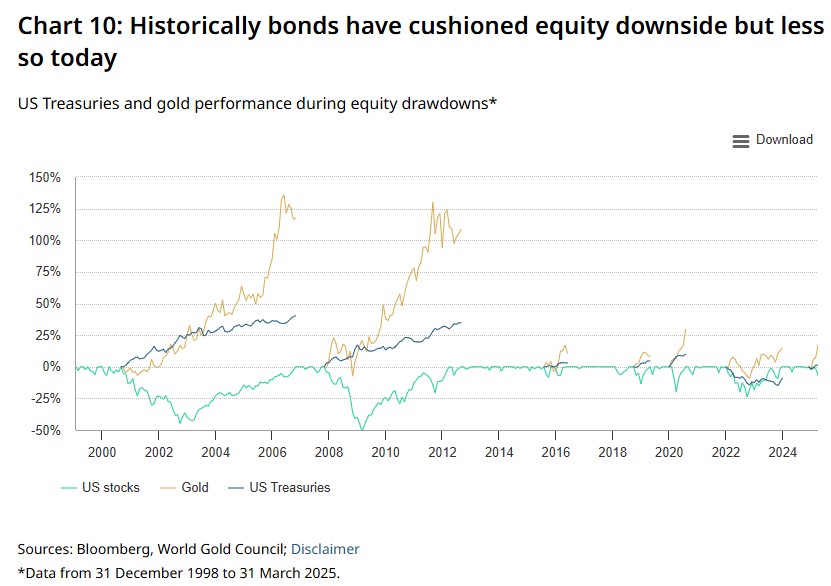

Against this backdrop, we believe investors should consider alternative and complementary assets to high-quality fixed income assets, such as gold (Chart 10).

Conclusion

The current macroeconomic landscape is characterised by significant volatility and shifting dynamics. This presents numerous challenges for investors seeking stability and diversification. In fact, maintaining a well-diversified portfolio in this evolving environment necessitates a strategic reassessment and adaptation to mitigate risks. Consequently, we believe investors should explore alternative and complementary assets such as gold.

Footnote

1. The price level from all 2025 tariffs would rise by 2.3% in the short run according to the Budget Lab at Yale: Where We Stand: The Fiscal, Economic, and Distributional Effects of All U.S. Tariffs Enacted in 2025 Through April 2 | The Budget Lab at Yale

This article is a re-post from here.

![]() Our free weekly precious metals email brings you weekly news of interest to precious metals investors, plus a comprehensive list of gold and silver buy and sell prices.

Our free weekly precious metals email brings you weekly news of interest to precious metals investors, plus a comprehensive list of gold and silver buy and sell prices.

To subscribe to our weekly precious metals email, enter your email address here.

Comparative pricing

You can find our independent comparative pricing for bullion and coins in both US dollars and New Zealand dollars which are updated on a daily basis here »

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.