Top 10 NZ Super holdings listed; Minimum Credit payments crunched; Many clueless in KiwiSaver; Amanda's tax rage; Jean Luc Godard's Greek debt solution

1) Savings and spending

I attended an interesting debate this week on whether New Zealand ought to introduce compulsory savings outside of the New Zealand Super, which is funded through taxes paid on income. (Watch the debate here).

It is a matter of debate itself whether the New Zealand Super will be sufficiently funded to support those in the workforce who will be retiring in 20 to 30 years time given the impending drain by Baby Boomers whose life expectancy continues to increase.

I asked the folks who manage the NZ Super fund to address the question of the public pension scheme's long-term sustainability and was told it was a "policy issue" best directed at Finance Minister Bill English.

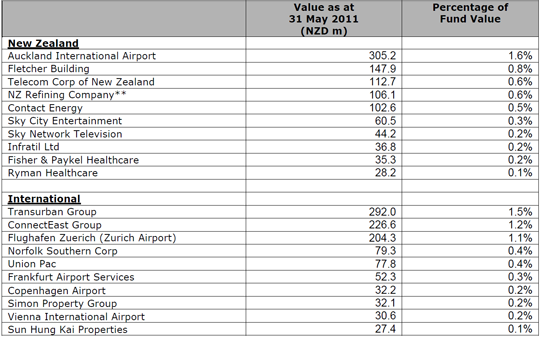

Instead, I was directed to their website, which is turns out is pretty interesting.

2) Credit and Debt

Drip-feeding debt is a bad idea, most of all credit card debt because it tends to have the highest interest rate. The trouble is banks and other lenders encourage it. How? By directing you to pay the minimum amount payable in order to maximise their profits.

However slowly, the tides are turning with respect to credit card disclosures, billing requirements and regulation. Several countries have introduced legislation requiring lenders to spell out how much consumers will cost themselves by going the minimum repayment route. Will New Zealand follow suit? Let's hope so. The first bank brave enough to make the change might just get my business.

3) KiwiSaver

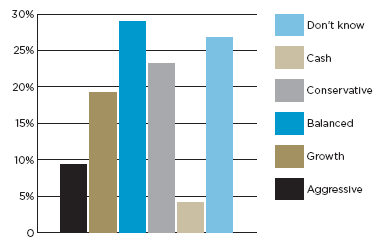

Do you know what fund you're invested in? According to a survey released this week by the Institute of Financial Advisors, more than 25% KiwiSavers don't have a clue about what kind of fund they are in. A high proportion also don't know how much money they have in their fund.

It's probably the same 25% that are invested in default funds, which are the most conservative of all funds on offer. That hasn't been a bad thing over the past few years because these uninformed investors were ironically spared some of the worst carnage that took place on sharemarkets during the global financial crisis.

Fund managers will tell you this is dumb luck and that these same investors are going to lose out over the long-term without more equities in their fund. Others, that is those with more bearish view of what's happening with the global economy suggest conservative funds, however low yielding, will be a safe haven.

Regardless of who you believe, it is important to know what fund you're in, what it is invested in and whose managing it. It's your retirement savings afterall. Check out our KiwiSaver section to find out more about your fund.

Also, to calculate what you could end up with at age 65, check out our retirement calculator here.

4) Death and Taxes

Tax rage. I'm feeling this in two countries. One lost my taxes for over a year, and now I have to pay interest for their error on top of mine for a late filing. Closer to home, my taxes also got waylaid for several months. Apparently got jumbled in with a number of other tax returns that had errors of some nature in them. Problem is solved now but for those hoping may be the tax fairy had turned red to black or made it all go away, better to pick up the phone and save yourself the added insult of even more interest owed for the time your IR3 spent in purgatory. Sigh.

5) Books and film

Franco Swiss filmmaker Jean Luc Godard in a recent interview suggested a quick way to help Greece get out of debt and prevent the Greeks from having to sell the Parthenon to the Germans.

His proposal was this: that every European who uttered the word "therefore" pay 10 euros to dig the beleaguered nation out of debt. He reckoned it was the least eurozone could do for a country who gave the world 'logic.' Just imagine how much money the Greeks would make if the phrase 'going forward' was added to the list.

The New Wave existential filmmaker may not find a big audience for the idea, nor for that matter his latest cinematic offering Film Socialisme, a story less string of evocative pictures.

In keeping with his Marxist leanings, Godard released the film for all to enjoy on You-Tube. The full length version appears to have been taken down but fragments of it are viewable in installments. Here's a taste of it. (Crack out the French-English dictionary).

Alternatively, fans of Nouvelle Vague might enjoy the music video below it. Slightly less obscure.

16 Comments

"Drip-feeding debt is a bad idea" hence having a mortgage or taking out one when you only have a very low initial deposit (even 20% is way to low) is just stupid.

Doing so only reinforces bank funded global slavery which governments also encourage and then subsidize by taxing the last remaining productive people to give benefits to those who don't have a economic clue. And here we are...........look at the place, a debt ridden unproductive global economy with nowhere to go but down the tubes

Come'on Justice. Don't make me be a cheerleader for this country...it has 'heaps' of potential. Just have to harness it...

Just been to the herald to read the funnies!

"At one of the Party's conferences he ( flipflop Phil)had also called on half of caucus to resign because they'd been there too long."

http://www.nzherald.co.nz/politics/news/article.cfm?c_id=280&objectid=10746270

Fair go...you couldn't make this shite up could you.

"Spain has announced plans to try to tackle the severe problems facing its housing market.

The government will temporarily halve the sales tax on new homes to 4% to try to stimulate its construction sector.

Spain's economy was plunged into recession following the collapse of its once-buoyant property sector.

The government is also hoping that building projects will help create jobs and cut the unemployment rate, which is one of the highest in the eurozone." bbc

They will have to do more than that considering the rorts scams and utter shite within that sector across Spain...seen enough pommy programmes on property disasters to know not to go near Spain even with a property lawyer on a long pole.

Hey it's Goofy with cunny and klinger....nice picture.

http://www.stuff.co.nz/sunday-star-times/opinion/5479874/Labour-must-leave-past-behind

RE #4.

Find Ian Wishart's piece on income tax, it is a good read.

Basic proposition is that it is an illegal tax. Apparently half a million Americans are refusing to pay, and there is bugger all they can do about it because it is unconstitutional.

In NZ it is only mandatory to pay tax if you have an IRD number(not withstanding the aforementioned illegality or the tax), but it isn't mandatory to have an IRD number. Only works if you are self employed though, because your employer would have to tax you at 45% without an IRD number.

I find it hard to believe its illegal....the crown/parliment can set the law....so head scratcher for me...

regards

I will try to find it again for you Steven.

From memory it goes right back to early legislation introduced by a British King. The principle behind that law it still exists in modern law, or more to the point is one of the foundation principles.

Are you trying to start a revolt Scarfie?

Haha, no not at all. It will happen on its own accord with no help from me:-P

No one ever listens to me anyway.Lol.

Actually I find human behaviour fascinating. I would suspect there is a lot of dissatisfaction simmering away below the surface, but most people are unwilling to act on that. Fear perhaps? I don't know what it is that leads to a tipping point, perhaps where the desire for change outweighs the fear. The really interesting bit is societies that have perished because they would not change.

I identified a while ago that I don't have any leadershipt skills, nor do I want them. But I am not a follower either. I just sit on the sidelines observing, but perhaps throwing in a my two cents worth from time to time just to agitate things.

I couldn't find that Investigate Magazine with the article in.

Another question arises, that is it a revolt when it is against something unjust or unfair?

One thing that has become apparent is that economic depression is a way of correcting the imbalance in the distribution of wealth.

here you go scarfie....................

Great post Scarfie/Christov

"that even the 1688 Bill of Rights protecting MPs from being sued may have no effect"

Hope they've got indemnity insurance .... what a great test case that could be... though now I'm not sure who could prosecute it....

Yes excellent work Christov.

I can't wait to see when this rears its ugly head.

All sovereign power and authority within the territories of the United Tribes of New Zealand is hereby declared to reside entirely and exclusively in the hereditary chiefs and heads of tribes in their collective capacity, who also declare that they will not permit any legislative authority separate from themselves in their collective capacity to exist, nor any function of government to be exercised within the said territories, unless by persons appointed by them, and acting under the authority of laws regularly enacted by them in Congress assembled.

Very useful in trying to determine the ambiguous parts of the treaty me thinks.

Intransitive verb 1 : to renounce allegiance or subjection (as to a government) :rebel 2 a : to experience disgust or shockb : to turn away with disgust transitive verb : to cause to turn away or shrink with disgust or abhorrence — re·volt·er noun An armchair rebel perhaps? I'll have to ask IRD for a definitive ruling.

Haha very good. Perhaps I have always been in revolt.

A fine line between renouncing and resisting I guess. (edit) or what about simply ignorning where possible, does that count?

IRD don't have any authority anyway, if you read the link Christov has provided:) Will interest you as Canada is in the same boat.

Thank you, you have put it with the eloquence mine was missing:)

I think the Magna Carter may be what Wishart referred to, but I didn't say because I am not sure.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.