By Amanda Morrall

1) Savings and spending

I feel duped. Last week I wrote about how to save $100 by switching power companies. Sure, $100 is not a lot but it's better than nothing. But could it and should it be better? Hell yeah.

Geoff Bertram, a senior associate at the Institute of Policy Studies at Victoria University, in an interview this week on National Radio explains why he thinks the "What's Your Number" campaign is basically a farce. According to Bertram, New Zealanders may catch a wee break on their bill but until real competition is opened up, savings will only ever be trifling.

Hearing the interview made my day. Bertram was on fire. Here's a taster:

Q) "Well, if thousands of people are leaving their current companies to get a better deal elsewhere doesn't that show there is competition?

A) "No it shows, it shows that there is a lot of fat in the electricity industry, that prices are far higher than they need to be....You are not looking at a competitive environment where generators produce power and there is a liquid market where anybody who wants to do retailing can get in there buy power and supply it onto the customers. You are looking at a market that has been locked up by a tightly defined set of rules written by the dominant five companies to protect their position and keep competition out.

Within that little playground, yes there is a playground squabble going on at the moment and the government has stirred the pot a little bit, largely I think for political ends to pretend they are doing something about the competitive state of the industry but without changing the basic structure -- and it’s the basic structure that delivers what has been a very fat and lazy and monopolistic industry since it was formed.''

Bertram says until government takes away the barriers to entry by independent retailers and generators, not much will change.

First tax rage, now electricity rage. What's next?

By the way, here's Bernard interviewing Geoff Bertram on the currency, foreign borrowing and banks a few weeks ago.

2) Credit and debt

I attended a conference this week which looked at some of the challenges related to boosting private savings in New Zealand. There's no end of them apparently.

The CEO of the NZ Federation of Family Budgeting Services, one of the speakers at the meeting, said that saving was increasingly a luxury many New Zealanders can not afford. Raewyn Fox said the organisation has been overrun with demand. It expects to see a 20% increase in numbers this year over last.

Fox said the extra demand is coming from a segment of the population budget advisors were not used to seeing; mainly middle income earners with mortgages and seniors.

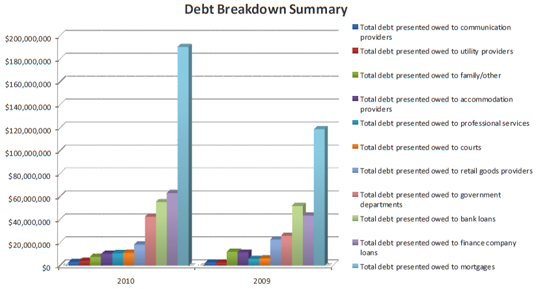

The Federation charts the type of debt that their clientele carry and the numbers show an interesting picture. Mortgage debt on their books has doubled. It's not the level of debt that has exploded by the number of people who have mortgages who are finding they can't cope the pressures. Also, where non-mortgage bank debt used to be the second highest level of debt, that has been replaced by finance companies.

Finance companies, as you know, tend to loan money out at a much higher rate.

The debt noose tightens.

3) KiwiSaver

KiwiSaver enrollment levels (1.77 million) are still going up, but in July saw their biggest relative slide since the national savings programme was rolled out four years ago.

A few possible reasons why:

Tower Investments CEO Sam Stubbs, in his monthly KiwiSaver analysis, suggested the deceleration might be owing to changes announced by government in the May budget. The changes, you'll recall, include a halving of member tax credits, tax on employer contributions and an increase in the levels of compulsory contributions for both employees and employers in 2013 from 2% to 3%.

Stubbs also speculates recent volatility in the market might also be scaring potential new members off.

A interesting side note: automatic enrollments into KiwiSaver through employers have also been declining since March. A sign of a slowdown in the rate of employment growth? Or have Kiwis hit their saturation point of interest in the scheme?

Compulsion would obviously boost the numbers but against a backdrop of declining membership, is this what the public wants or needs?

We'll know more in a few weeks when Government releases its discussion document on the subject. Also see more here from Workplace Savings CEO David Ireland talking about KiwiSaver on TVNZ.

See our interactive chart below.

4) Death and taxes

My tax rage is unabating. I expect Christchurch doctors Ian Penny and Gary Hooper are suffering a case of their own tax rage this week following a Supreme Court decision which nailed them for tax avoidance. (Read more here). The surgeons went into business for themselves, paid themselves an artificially low salary, then channeled the profits (in the form of dividends) into family trusts taxed at a lower rate.

Tax accountants will undoubtedly be delighted by the decision. For them it represents more businesses. Thousands of New Zealand small businesses will surely be scrambling to seek clarity about their own circumstances.

Grant Thornton accountants lay out the fact of the case really well in this this release. As they point out, it is not the business model itself that's the issue, but rather the sticky question of "fair market value" for pay.

Inland Revenue assures it won't be setting out on a witch-hunt. So who might be in their targets?

Grant Thornton suggest the lowing combination of factors would hint at high risk.

· A sole proprietor business is transferred to a new structure, such as a company.

· The profits of the business are highly dependent on the personal exertion of the proprietor.

· The working owner’s income is restricted to a salary that is significantly lower than the profits of the business.

· There are no extenuating circumstances to justify the low salary (eg capital commitments, expected poor financial performance).

· The working owner has access to the use of funds previously at their full disposal but now routed through an intermediary structure.

It’s not just orthopedic surgeons that are at risk. Any professional or trades based business is potentially at risk. At less risk are businesses that depend more on the trading of goods or a high level of capital investment for their profits.

Business owners will not only have to consider how they deal with salaries in the future, they will also need to think about how they have dealt with them in the past.

5) Books

I stopped buying books when I moved to New Zealand. I found the costs prohibitive. Instead, I started reviewing them so I got my books for free and got paid for the pleasure of reading. It was a great arrangement while it lasted. Thank you BR.

For Roger Hamilton's Wink, I am tempted to break out open my wallet.

This bestseller was first published in 2002 but somehow it's taken almost a decade to fall into my lap. I have read it twice now and will likely do so several more times. It won't be chore.

This "modernal day parable of wealth beyond words" was a joy to read and true to its purpose -- to inspire.

"Apply, rinse, repeat" I shall. With gratitude to Fiona for pulling this one off the shelf for me.

Kiwisaver membership

Select chart tabs

9 Comments

The problem with NZ, Amanda, re (4), is that 999 out of 1000 sheeple are rejoicing at the doctors' downfall, with no ability to understand that case was the final downfall of classical liberalism in NZ. All judicial activism here now in the tax field is about sanctioning the intrusion of the State against the property and life of the individual - it's morality turned on it's head.

Vis a vis your parable of wealth, I give you the parable of the piss head.

Your probably right, most people have no option but to pay the normal tax rate, and are happy when cheaters are caught. How does two doctors making megabucks, and cheating the system adavantage 999 out of a thousand NZ'ers?

Amanda, I feel sorry for you, you never get many comments on your articles.

What's wrong with people on this site?

Not entirely true YL - I made a few comments on some of Amanda's Kiwisaver pieces but was then told by the big Boppa to 'lay off Amanda'.

So now I avoid commenting on her pieces.

Oops I just did. Sorry B., won't do it again.

Bernard rarked you up for taking shots at Amanda .

... As he said , comment freely upon the information she presents , but don't shoot the messenger .

But as Amanda isn't as frivilous with her claims and extrapolations as some presenters are , she doesn't draw the attention that others do ....... isn't that so , Bernard .. heh heh !

You are correct Mr. Hero. Bernard and Gareth get to write all the items about the horrid PIs, rich people, banks, BBs etc themselves. They know the red rags to wave around.

Poor Amanda gets all the boring topics to write about.

Bernard should give her a fairer go.

And who wouldn't want to see her face more often than Bernard's on the top of articles?

PS Is the Hero title the conventional meaning of the name or the more more recent interpertation of the word?

truely stupid comment above about electricity market

Bertram says until government takes away the barriers to entry by independent retailers and generators, not much will change.

how on earth does he think anyone gets to be allowed to build any sort of power generation in New Zealand? They don't Electricity Generation in New Zealand has always been and always will be a political decision. All the sell ofgf is about is an attempt by some to lock in some private monopoly profits for themselves from a resource actually owned and paid for by all New Zealanders

John Key is an appalling politician , I really do think he must be completely dishonest, there is no other explaination for it?

Let's keep it seemly people.

cheers

Bernard

Gummy's Book Hutch : Jesse Livermore ( world's greatest stock trader ) : Richard Smitten . ( John Wiley & Sons Inc , 2001 , 319 pages ) .

... there are few books that the Gummster can't put down until they are finished .... this is one of the few . It is an fascinating biography of truely self-made man . JL lived from 1877 til 1940 , when he committed suicide . He began " share trading " in the illegal " bucket shops " of Boston , when he was just 15 .

The book follows his life , his personal history , plus his share market and commodities speculating . Much of the material was sourced from personal interviews with his surviving son Paul , and his first son's widow .

.... there is a rich vein of investing material to be mined from this book , plus an intriguingly nostalgic look at the lives of the rich-set in America during the early decades of the twentieth century .

Highly recommended !

[ Gummy's copy from Amazon.com , $US 7.95 + 12.49 postage ]

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.