Financial yogis; 7 tips to save; 10 things you're better off buying used; Sudden Wealth; Iceland's crush on Canada

By Amanda Morrall (email)

1) Money man rich, yogi wise

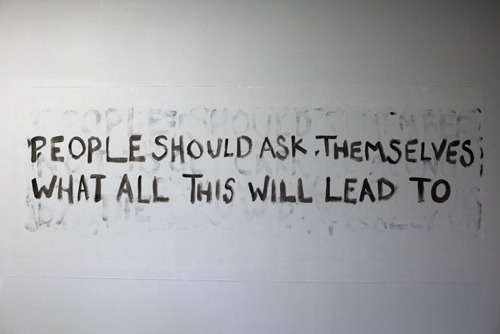

Darn it, someone beat me to the yogic money mat. It was bound to happen. Since spreading to the West, yoga has bent in all manner of directions. It was only a matter of time before the financial planner fused with the yogi. In the yogic spirit of sharing, here's Brent Kessel's musings (via the Yoga Journal) on money, saving and the deception that is perception.

2) Sudden Wealth

What would you do tomorrow if you won the lottery or a big fat inheritance? According to this article via the Globe and Mail, one of the first things you ought to do is get a financial planner. You might expect a financial planner to say that the evidence shows lottery winners don't have a great track record on keeping their riches. A high percentage blow it all within the first few years. Last year, I spoke to three Kiwi money experts to get their top tips for managing a lotto win. Here it is again.

3) Seven tips to save

Wellington's Liz Koh, an authorised financial advisor with Moneymax offers seven tips to spending less.

Seven Top Tips for Spending Less

There are only two ways you can save more: you can increase your income, or cut back on your spending. Here are seven great ways to save by spending less:

· Buy and sell second hand goods on trading websites. Have a rule that before you buy anything new, you have to get rid of something first. That way, you avoid accumulating clutter.

· If you have to buy new, use price comparison sites on the Internet to find the cheapest deal. However, stay away from one-day deal sites to avoid impulse buying.

· Wait before you buy. If you have spotted a must-have pair of shoes in your lunch hour, wait until the next day or the next week before you think about buying. You might find they are not such a compelling purchase the next time you see them.

· Negotiate the price you pay. This is a lot easier to do if you pay cash. Negotiating can work well on a high value purchase such as a car, or something that has no value past a certain time, such as a last minute stay at a motel.

· Choose lower cost alternatives. Take your partner out for a romantic picnic instead of a swept-up dinner at a restaurant. Give hand-made or home grown gifts. It’s the thought that counts!

· Don’t pay extra for designer labels, expensive brands or the latest model gadget. Whether it is groceries, appliances, clothing, cars, haircuts, or mobile phones, let others brag about having the most expensive version while you bank your money.

· Try to make or fix things yourself. Better still, barter with your friends. Do you have skills, tools, or garden produce that are useful to someone else in exchange for something they can do for you?

4) Second-hand savings

For the self-restrained savings opportunities abound. MSN Money produced a list of 10 items you're better off buying used. It includes textbooks, baby clothes, jewellery, furniture, bicycles, toys and pets. I ticked all the boxes except my darn dog. Naughty but worth it. Not many of her kind on the seconds market either.

5) Iceland's crush on Canada

After a report last week published in the Globe and Mail on Iceland's interest in adopting the Canadian currency (and Canada's receptivity to this idea) politicians from both countries were trying to cover up their tracks. The story, in its original form, looks to have been scrubbed with revisions explaining the short-lived romance. Tres bizarre.

To read other Take Fives by Amanda Morrall click here. You can also follow Amanda on Twitter@amandamorrall

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.