By Amanda Morrall (email)

Thank you everyone for the oh so positive and constructive feedback from yesterday's call out. It's much appreciated.

In a nutshell, most of you told me to keep the Take-Five, to look at introducing some money makeovers or case-studies of regular Kiwis, to crank up the interviews with interesting entrepreneurs, economists or people with insights about money and financial behaviour, to do more videos, delve deeper into the investment space outside of KiwiSaver and not to drift into the gloomsday territory.

I'll be taking all that good stuff on board for when I get the book project off my plate - ETA May 28th.

Your readership and feedback is much appreciated.

Without further ado, here's my links for May 10th.

1) Meat-bag investor brain

I love self-deprecating humour. This blog by the monevator.com could pass as comedy but actually he raises some sobering points about investing and how DIYs moving in and out of the market at exactly the wrong times, staying on the sidelines and allowing fear to dictate strategy can end up costing themselves big time.

According to one of the stats he cites, the average investor has under-performed the S&P 500 by 4.32% for the past 20 years on an annualised basis because of the reasons cited above. Monevator's solutions to the 'meat bag investor brain' (which he admits to having) is a system of regular contributions (dollar cost averaging) and a low-fee index tracking vehicle.

2) Active is out

In the U.K. (where monevator.com hails from), actively managed funds have fallen out of vogue. This article from the telegraph.co.uk reports on the large inflows in the first quarter of this year into index trackers.

According to figures from the Investment Management Association (IMA) sales of tracker funds were at their highest since records began, with tracker funds outselling fund of funds – previous investors' favourite by almost double. The record number of sales swelled the amount of cash in tracker funds to £43.3bn.

Jane Lowe, from the IMA, said that they had not seen such sales figures in nearly two decades.

Investors opted for lower cost investment vehicles, as sales of fund of funds, which traditionally have higher fees, fell by £1.3bn in the three months to the end of March compared to the same period in the previous year.

Here's a good primer on index trackers with a NZ focus from freelance writer Diana Clement.

And if you're interested in growing your knowledge further, check out our investment 101 series by my erstwhile colleague Kevin Mitchelson.

3) International money transfers

If you're looking to save money on an international money transfer, you probably want to avoid using your bank. Typically, they're the most expensive option. That's particularly the case for transfers coming into New Zealand from Australia where "retail swap rates" are hideously high. (See my interview with former currency sales agent Fiona Whyte here about alternatives.)

This piece (also from the Telegraph) offers some tips on how to save money making international transfers. See also our currency section here for news, analysis, FX calculators, charts and more.

4) Four hour case studies

Timothy Ferriss, the Four-Hour Work Week wonder kid, also has a blog that he somehow manages to maintain during his punishing work week. I decided to check it out. I discovered some useful case studies (he calls them the four-hour case studies) from budding entrepreneurs and upstarts who've taken a good idea/product/service on-line and made a killing. I enjoyed the story about the couple who manufactured over-sized yoga mats (big fat squares instead of skinny rectangles).

This square shaped idea now generates the happy yogis between $10,000-$25,000 a month in extra revenue. Brilliant.

5) Wallet audit

One of my guilty consumer indulgences is magazines. I seldom indulge because they're over-priced and the entertainment value lasts about as long as bubble bath. In exchange for taking in a orphaned dog (whose owner is headed to Nepal shortly on a tramp) I have been gifted a stack of glossies, and home-baked cookies and books. This dog is a saint (much like its owner) so I'm getting the better deal believe you me. (There's a thread here with my fifth link so hang in there).

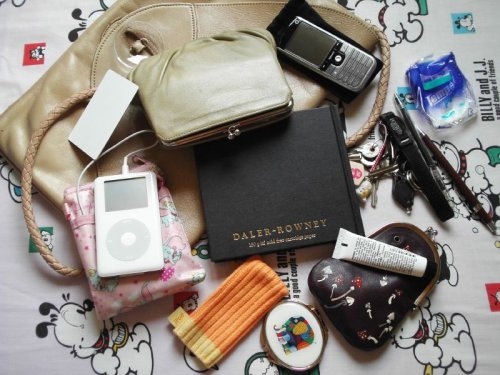

The snoop in me enjoys these glossy glamour puss mags partly for those interviews with celebs who are asked to describe the contents of their hand/bag, pet peeves, favourite authors and latest bedside reading etc.

As I alternate between three handbags, as well as schlep around my laptop, and lately a backpack with stinky running gear, my list is long and messy. I have two staples however: Pressed powder and my wallet. I actually managed to leave the latter behind on a day trip to Wellington awhile back. Total embarrassment. If you want to know how I survived you can read about my debacle here.

So the link...this one from getrichslowly.org talks about the importance of auditing the contents of that overstuffed wallet periodically, so you'll know what's in it (and potentially needs replacing) should you lose it, or in the case of the author, get mugged.

To read other Take Fives by Amanda Morrall click here. You can also follow Amanda on Twitter@amandamorrall

1 Comments

There is a behavioural economic theory called Prospect Theory which tries to answer the question how do people make trade-offs that involve risk. These are the findings of many experiments with two equal groups of diverse subjects, ages, genders etc:

First group is asked to make the following either/or choice:

(a) I give you $500 right now for sure - or -

(b) I give you $1000 if you guess the flip of the coin but nothing if you're wrong.

Second group is given the folowing choice:

(a) You give me $500 right now for sure - or -

(b) You give me $1000 if I guess the flip of the coin but nothing if I get it wrong.

In group ONE (faced with a gain) - 85% of people choose the sure bet.

In group TWO (faced with a loss) - 70% of people choose the riskier coin toss.

All things being equal, we tend to be risk-averse when it comes to gains and risk-seeking when it comes to losses.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.