3 Comments

The Most IMPORTANT Video You'll Ever See (part 1 of 8)

5 million views for an old codger giving a lecture about arithmetic?? What's going on? You'll just have to watch to see what's so damn amazing about what he (Albert Bartlett) has to say.

I introduce this video to my students as "Perhaps the most boring video you'll ever see, and definitely the most important." But then again, after watching it most said that if you followed along with what the presenter (a professor emeritus of Physics at Univ of Colorado-Boulder) is saying, it's quite easy to pay attention, because it is so damn compelling.

https://www.youtube.com/watch?v=F-QA2rkpBSY

Entire playlist for the lecture: http://www.youtube.com/view_play_list...

I agree. It is worth a watch. Bartlett is a cult figure now and many commenters on this site have pointed to his video over the years. I think Murray Grimwood (Powerdown Kiwi) was the first in 2011. Thanks for the reprise.

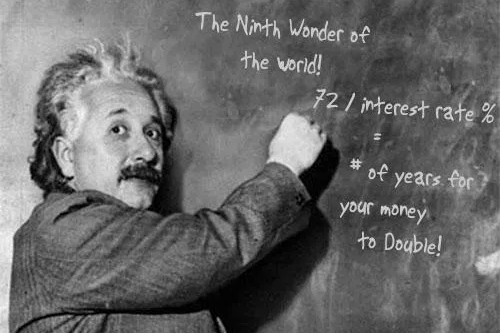

Very disturbing in part, in fact. A great part of society today does not seem to understand the difference between money earned and money borrowed, when it gets down to spending. Often wonder within the great debate about poverty traps, the homeless etc, in what percentage of that indebtedness might have played a part. And in turn does the relatively easy access to credit these days encourage that. Information such as this article should be compulsory somewhere in curriculum of every school child. Can remember, way back in my time, there were lessons “home economics” but that was cooking & domestics I believe. Perhaps bring that back with the accent now on budgeting, saving, investing etc.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.