How much do you owe on your credit cards? How much for other personal loans (that is, not for housing)?

All up, we owe banks and other financial lenders $16.7 bln for these types of high-interest loans.

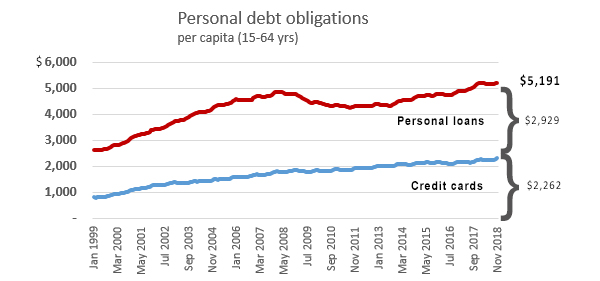

And given there are only 3.2 mln adults between the ages of 15 and 64, this works out at an average per person of $5,191. For those that have this type of debt it will be a lot more of course, because many people won't have any.

Of that $16.7 bln, the four big Australian-owned banks are owed $9 bln, and probably the bulk of this is because they are the big credit card issuers.

But they aren't the only ones. Other big issuers like Latitude (Gem) and Flexi Card (Q) are active as well. Incidentally, they are also Australian.

But you might be surprised to learn that some of our smaller Kiwi-owned banks have heavy positions in personal lending too.

Here is where all those obligations flow back to:

| RBNZ reference | H1 | F1 | H2+H3 | H5 | H6 | H7 | ||

| Total loans |

share of all loans |

Total non-perform |

Non-perform ratio |

Individual provisions |

Collective provisions |

|||

| September 2018 | ||||||||

| $ mln | % | $ mln | % | $ mln | $ mln | |||

| ANZ | 3,573.9 | 2.8% | 34.4 | 1.0% | 6.0 | 63.5 | ||

| ASB | 2,004.7 | 2.4% | 12.6 | 0.6% | - | 80.3 | ||

| BNZ | 1,417.4 | 1.7% | 11.3 | 0.8% | 0.4 | 27.3 | ||

| Kiwibank | 403.9 | 2.1% | 0.5 | 0.1% | 0.1 | 8.6 | ||

| Westpac | 2,043.6 | 2.5% | 12.9 | 0.6% | - | 79.9 | ||

| -------- | -------- | -------- | -------- | -------- | -------- | |||

| All main banks | $9,443.5 | 2.4% | 71.7 | 0.8% | 6.5 | 259.6 | ||

| Cooperative Bank | 183.9 | 7.7% | 0.3 | 0.1% | - | 3.4 | ||

| Heartland Bank | 984.1 | 24.1% | 25.2 | 2.6% | 2.0 | 27.2 | ||

| Rabobank | 10.9 | 0.1% | - | 0.0% | - | - | ||

| SBS Bank | 504.9 | 13.1% | 2.1 | 0.4% | - | 16.6 | ||

| TSB | 82.0 | 1.5% | 1.5 | 1.8% | - | 6.9 | ||

| -------- | -------- | -------- | -------- | -------- | -------- | |||

| Challenger banks | 1,765.8 | 6.7% | 29.1 | 1.6% | 2.0 | 54.1 | ||

| -------- | -------- | -------- | -------- | -------- | -------- | |||

| All retail banks | $11,209 | 2.7% | 100.8 | 0.9% | 8.5 | 313.7 | ||

| All other banks | 7.7 | … | ||||||

| All non-banks | 5,437 | 43.3% | ||||||

| ====== | ----- | |||||||

| Total (C5) | $16,654 | 3.7% | ||||||

| Credit cards (C12) | 7,257 | 1.6% | ||||||

| Personal lending | 9,397 | 2.1% |

All this data is sourced from the RBNZ, mainly the Dashboard series, also C5, C12, and Stats NZ

Heartland Bank's Marac division, and SBS Bank's Finance Now division are both significant within each of those institutions. Both have larger personal loan ledgers than Kiwibank.

Most banks have significant provisions booked for the likelihood some of this high-risk debt goes bad. The main banks have provisions in place exceeding three times the current level of non-performing loans. For the Cooperative Bank and SBS bank, this cover is more like ten times. But the Heartland Bank provisioning stands out in these comparatives as low.

Financial institutions are attracted to this type of lending because the margins are high. High interest rates charged are bolstered by high fee levels. Fees are ubiquitous here and considered 'normal' even though for most other types of lending (housing, business, rural) large chunks of their operating costs in those sectors are covered by the interest earned. But not for personal lending, where even the CCCFA and regulators accept that fees can cover 'reasonable costs'. This gives these lenders considerable latitude (pun not intended) to bulk up their net margins in a way that they just don't do elsewhere. It also attracts a wide range of non-bank lenders into the field.

Because 'everyone does it' there is no market pressure available to borrowers to make shopping around effective. Fees are often only disclosed formally at the point where you know you want to buy the goods involved, or at least, borrowers seem to ignore the online disclosures elsewhere. Disclosure isn't very effective.

Lenders do have the option to use positive credit reporting to offer sharper, competitive interest rates to borrowers with exemplary credit histories. But again, there is no real evidence any institution is doing that - and even if they did, the fees are still likely to apply. There may be as few as 200 banks and finance companies offering personal loans to customers nationwide. But there are probably more than 1 mln people who use these services (credit cards and personal loans). Because loan balances are relatively small (~$10,000 or so) no one customer has any negotiating leverage to remedy the imbalance in what is offered. That is up to the regulators and even now there is no official energy trying to square up the power ledger here.

47 Comments

Personal loans at 16 - 24% interest are often an oppression on people that can’t really afford to participate in the economy e.g. need a car for work so borrow 12000 for a reliable car for work I.e. they are always on the back foot.

The cheapest personal loans are balance transfers on credit cards from 1.9% to 5.95% - the problem is that borrowers need to have setup at least 2 credit cards from different banks with a decent limit on them, say, 10k +.

Then all that consumer needs to do is buy the car on credit card 1, and then balance transfer to credit card2. Pay it down as much as possible for 1 year, then transfer back to CC2. Of course this needs discipline to repay fully compared to the compulsory personal loan.

You obviously missed the 1980s sunshine

23% mortgage rates

Man that's all you ever do, look for an opportunity to bring up 23% Mortgage Interest Rates in the 1980s. We get it, people who had a mortgage in the 1980s should be given a Knighthood for their bravery.

And the huge pay rises that came with that inflation is never mentioned...

Oh they'll bring up the 18 month wage freeze by Muldoon as another challenge that they had to deal with. But they won't tell you it was an attempt to reign in the huuuge inflation of the 1980s which was a great way of reducing the debt burden.

or the fact that houses were 3x income...

Well, the mortgage was at least

No, didn’t miss that era: mortgage at 21% in 1987.

Now I see it as a positive: there was only one way interest rates could go and that was down!

Also the high mortgage interest rates constrained how much you could borrow - about 3 times my salary but 1.5 times household income.

Also wages moved up reasonably well annually.

One other positive practice in this era: sections were reasonably cheap, & the bank commissioned their own internal Valuer to value the new house under construction and so authorised the progress payments.

Also with Interest Rates being so high anyone looking to buy had 2 things going for them:

Mortgage Rates keeping a lid on house prices, and bank deposit rates giving them a much better return on their savings for the down payment.

Personal loans at 16 - 24% interest are often an oppression on people that can’t really afford to participate in the economy e.g. need a car for work so borrow 12000 for a reliable car for work I.e. they are always on the back foot.

It does not cost you $12,000 for a reliable car.

And if you're poor, get a bus, or ride a bike. I never had the delusions that I should be getting around in a car - let alone a $12,000 one - when I was unemployed or doing intermittent minimum wage work.

Nor was I ever stupid enough to get a loan at 16-24% interest. I'm sorry but you're borderline retarded if you do that. If you want to legislate against it, create a license that people need to access high interest loans, that asks basic questions. And go a step further - if they fail that test, prevent them for voting, driving a motor vehicle, operating heavy machinery, and sterilise them.

Anyway since that isn't going to happen, I feel like I should get into this business somehow. This mouth breathers have to be useful for something, and I'm likely raising their kids with my tax dollars anyway.

Buying a car is just one example.

The point is that many people who take a personal loan are already at a disadvantage in terms of their position in the economy.

Yes, you can blame them for poor life choices but maybe a zero interest loan may get them on their feet.

Certainly there's no question that it's often very expensive to be poor.

Yep. I know someone on a $45K salary with loans from four different non-bank lenders: Oxford Finance, Q Card, East Bay Finance and UDC - and a student loan balance. Not at all unusual if you talk to anyone working in budgeting assistance.

How much of all that is course fees and how much is NON course fees

All course fees + a computer (course costs I think they call it).

I would agree. $12,000 on a car is madness - even without a loan. I have substantial income and wealth (top 1 percent, multiple properties) and have a car that would be worth $1,000 at most - even that is an extravagance. The reality is most of these loans are used to buy frivolous things that simply aren't needed - like the newest iphone for a cost of $2,000 (again, my $10 nokia has served me quite well for the last ten years). Expensive cars are a great way of examining how poor people become even poorer.

Can you get work emails on your $10 Nokia you've had for ten years?

How about your camera and laptop?

I am not someone who always has the latest device (my smartphone is generations behind and years old) but for many today a phone is their primary device for email, banking, and a good many other parts of life. They may not have a laptop (unless one is provided for work) or a standalone camera at all, making a phone equivalent for many people to a number of other devices that in the past would be quite separate and paid for separately.

With the prevalence of digital assistants and Bots increasing more and more, this is only set to get more pronounced in the next few years.

How much was your car when you purchased it, out of interest? Assuming you've had it for a long time?

No I can't get work emails on my nokia, but if my work requires me to check my emails then they better damn give me a phone for free - I certainly won't be borrowing at 15% to buy the latest iphone for $2,000. For all those other things I have (three) perfectly decent computers, the cheapest which you could buy for $100 and it would do all of those online things very capably - no need for the flashest model. Pro tip - install Brave browser, block all ads and you'll find everything goes vastly faster so no need for the greatest and latest broadband plan. As for the last question, the car cost around $5,000 in 2008 I believe, so not bad depreciation over ten years and almost no repairs or maintenance needed.

Well, that's a valid point: many of the flash new phones these spendthrift whippersnappers are carrying around can be provided by their workplace too. A few of my phones have been workplace-provided.

(I don't generally see ads, unless I'm very trusting of the site.)

Rocking an expensive camera?

I'm what you'd call a whippersnapper and my workplace provides me with one of these flash new phones with a camera. They even pay for the data and calls.

Could you share with us what is the ANCAP http://www.ancap.com.au safety rating of your car ?

Not being sarcastic, just some of us has to carry other family members (young or old) and old cars have not done well in crash tests.

96 lancer. Never had an issue with it in the 8 years I've owned it, nor the 7 years before that when I had a similar model (95 eterna). By comparison, for my wife's corrola, it costs more than my entire car's value every single time she goes into a service (although I think they see her coming and charge her a fortune). I think the most important safety element is driving it safely and not hooning around at 150 km in meadowbank (like the poor fellow who killed himself this weekend).

Yea that's fine until someone crashes into you (like the people on the bus, who were also injured).

Havn't had many cars over my 40 plus years of driving because i drive them until they are no longer drivable.

Never paid over 7k for a car and the worst 2 that i purchased were from members of the elder community who were selling their low mileage cars.There a good reason they were low mileage,they were crap cars.

The best one,which i still drive was part of a family members estate sale and i got at a good price for a 2 year old car with only 6k on the clock.10 years later still going like a new car .Car was purchased new for 22k,2 years later according to an Auction company it was worth 4/5k and the yard where it was purchased from offered 11/12k.So i jumped on it after negotiations with my family.Met in the middle.

Cars are a requirement depending on where you live and the price you pay is the price you pay.Car dealers are very similar to real eatate agents,all of them spruikers.

Confidently arguing from ignorance, it seems to me like a problem that I don't know who the plural regulators are nor what exactly each one is responsible for. Maybe it's just me, but I'm glad not to depend on personal finance.

I don't know how people can work in jobs dishing out these high interest loans to people who they know are going to get themselves into financial trouble by the very nature of the loans. It's sub-prime under another name.

The same way people can have a job leading cattle to the slaughter house. You rationalise it by saying they're not that intelligent and so their capacity to suffer is limited.

The whole business of personal loans and student loans is a nightmare. They can be a good thing, but the temptation to borrow too much is overwhelming for most people.

The other scary thing is that these interest rates may actually be appropriate for this sort of risky lending. We are used to a world where interest rates are manipulated downwards in order to buy votes. Perhaps mortgage rates should be 8-12%. Houses would then be affordable again.

It seems the regulators and banks have worked together and constructed a system to ensure maximum indebtedness across society.

Student loans are exceptionally dangerous and insidious.

The 18 year old effectively signs up to 30k to 40k student loan debt over 3 or 4 years with no credit checks or warnings. The qualification may or may not be completed, and the subject area may or may not be in an area of good employability or good earning potential but the debt is the same.

Then if they go to Australia to work then it’s 5.x% interest with minimum annual repayments.

But if they stay here it's interest free, the repayments aren't proportional to the size of the debt, they are proportional to income.

But yes, lets go back to heavily restricted University entry and almost no fees and let employers cover the costs of training their own employees in anything beyond high school level.

Employers are getting a free ride certainly at the moment.

They can hire an engineering or IT graduate with work ready skills with zero cost to have those grads to that point. Companies should be paying some of the cost of the training of NZers if they wish to employ them.

They would just employ immigrants. Actually they are doing that already for graduates in commerce and business - then they flip burgers and pay their employer for the privilege of a fancy job title. Less compliant Kiwis with similar degrees and student debt are either unemployed, under-employed or working in Australia. Its crazy.

Note the term "student loan" is rarely ever shown separately as "university course fees" and "accommodation loan" the greater of the two often being the living accommodation loan

We need targetted legislation to protect vulnerable borrowers , such as that which we see in other countries .

These measures include :-

> Reckless lending rules aimed at lenders to prevent them lending to people who are unable to service the debt

> A cap on lending rates .

> A cap on "administration fees"

> A Ususry Act , which should not allow the total interest charge to exceed the Principal sum borrowed , in other words if you borrow $2,000 to total interest cost can never exceed $2,000 , even in the case of default

Wish they had had that last measure in place when I was paying ~10%pa on my mortgage.

You probably wouldn’t want that - I doubt the bank would allow you more than a 10 year loan. They not that stupid

It was 25 years with floating rate that may have averaged about 8% and went higher - but on the other hand inflation reached 20% so I paid it off in less than 10 years. I'd like to se an rather average graduate in their twenties do that with an Auckland million dollar 3-bedroom house.

Point is if I had prepaid the minimum requested by the bank the interest would have been way over the amount of loan. Adjust the point for inflation and it might make sense.

How would that work for interest free mortgages? If I pay say 5% then after 20 years is my one million debt wiped free? If so, fantastic, nobody would ever rent again@!!!

The banks wouldn't advance mortgages under those terms, so you'd have to rent until you saved the entire purchase price..

How would that work for interest free mortgages? If I pay say 5% then after 20 years is my one million debt wiped free? If so, fantastic, nobody would ever rent again@!!!

Yes, and no. For every reckless lender, there are 10 reckless borrowers that blatantly lie on an application, have serious gambling issues, mental health, or drug problems. Analyzing a credit file, or 90 days of bank statements will not necessarily pick this up. And believe you me, the number of individuals in this country on serious income, with major problems is enormous. The only way to truly protect would be for someone, such as a doctor, lawyer, or financial advisor (with the individuals authority) to have the power to flag an individuals credit file with a “no lend’ instruction. This should also extend to the court in certain cases. By doing this lending rates, and admin fees would fall dramatically. However as a society we would need to “man up” and accept that maybe as an individual we can’t make common sense decisions, and that perhaps someone else is more equipped. To keep bagging the lowly loan approval officer is not going to achieve a lot. Neither will attacking the finance sector for high rates, or fees. Admin fees represent actual cost, or in the case of interest rates cover the borrowing cost, together with a margin that is acceptable to shareholders.

Given that your website(s) tout for those with bad credit, and offer 100% no deposit finance, and have an online calculator that calculates finance at what looks to be about 8% interest rates with no option to change it to more realistic rates, even though your other website says car finance from 8.95%...

Can you really expect not to get dodgy applicants with poor credit history? If you don't want them, don't go looking for them.

PS: you really should get someone to proof read your websites.

nice of you to review our businesses pragmatist and provide some feedback.

for your information we don't advertise for business, and have not done so for many, many years. regarding "bad credit" finance there are varying degrees of what constitutes "bad credit:" We have never discriminated against individuals on that basis. Sorry to disappoint you but the same policy will apply at ANY financial institution. Have a nice day

Mainly just letting others know that you are in the business of providing finance, and as such your opinion is biased as hell. And even if your company doesn't directly advertise, the dealers that you get your end customers from most certainly will. One look at trademe ads for car dealers and one of the features they highlight heavily is of course No Deposit finance, and bad credit financing.

I assume the $16.7 bln includes people like me that buy everything on credit card but pay before interest is incurred?

96 lancer. Never had an issue with it in the 8 years I've owned it, nor the 7 years before that when I had a similar model (95 eterna). By comparison, for my wife's corrola, it costs more than my entire car's value every single time she goes into a service (although I think they see her coming and charge her a fortune)

The cost of a reliable used car in New Zealand might be in the $1500 to $3000 range all-in (e.g. I’ve got a '02 Honda with 120,000km for $2000 a couple of months ago and it’s perfect, everything works including air con and it was just serviced), yet most lending for cars is a much higher loan amounts. In fact the Australiasian banks impose a minimum cap of $3-5k for personal lending.

Are if banks are behaving ethically in enticing customers to ask for larger car loans than they need? Do those products best meet customers needs? I’d be in a pickle to explain why that was doing the right thing for a banks clients.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.