The residential property market shook off the lockdown blues and bounced back with considerable vigour in October, according to the latest figures from property website Realestate.co.nz.

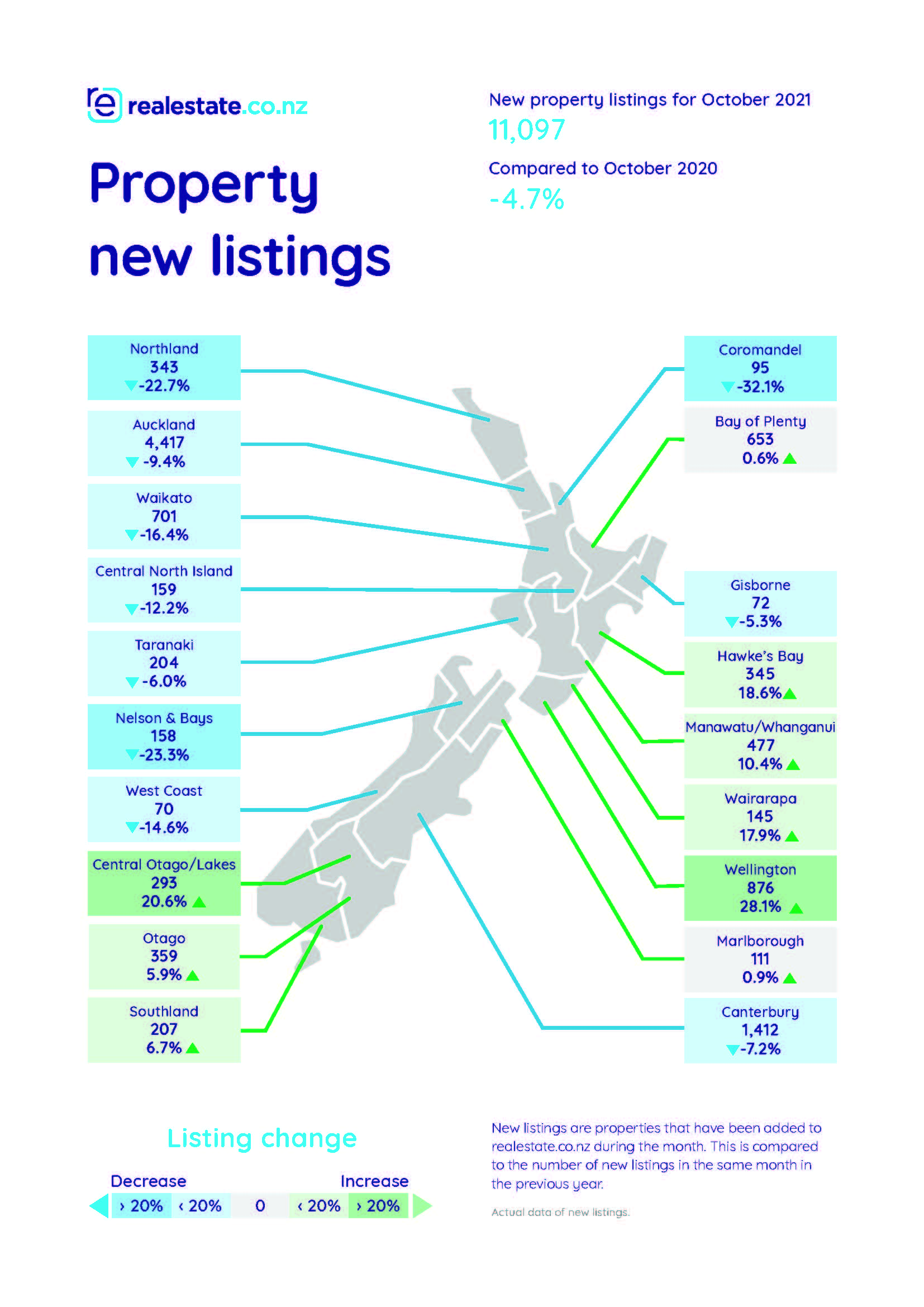

The website received 11,097 new residential listings in October, which was almost as many as the 11,649 new listings it received in October last year.

That was in spite of the fact that Auckland, which is the country's largest regional market by far, remained in Level 3 lockdown for the month.

Even in Auckland, the 4417 new listings received in October were almost back to the level of October last year when Realestate.co.nz received 4877 new listings.

Several regions recorded new listings that were above the level of a year ago, most notably Wellington, where they were up 28.1% on October last year, followed by Central Otago/Lakes +20.6%, Hawke's Bay +18.6%, Wairarapa +17.9% and Manawatu/Whanganui +10.4% (see the chart below for the full regional listing figures).

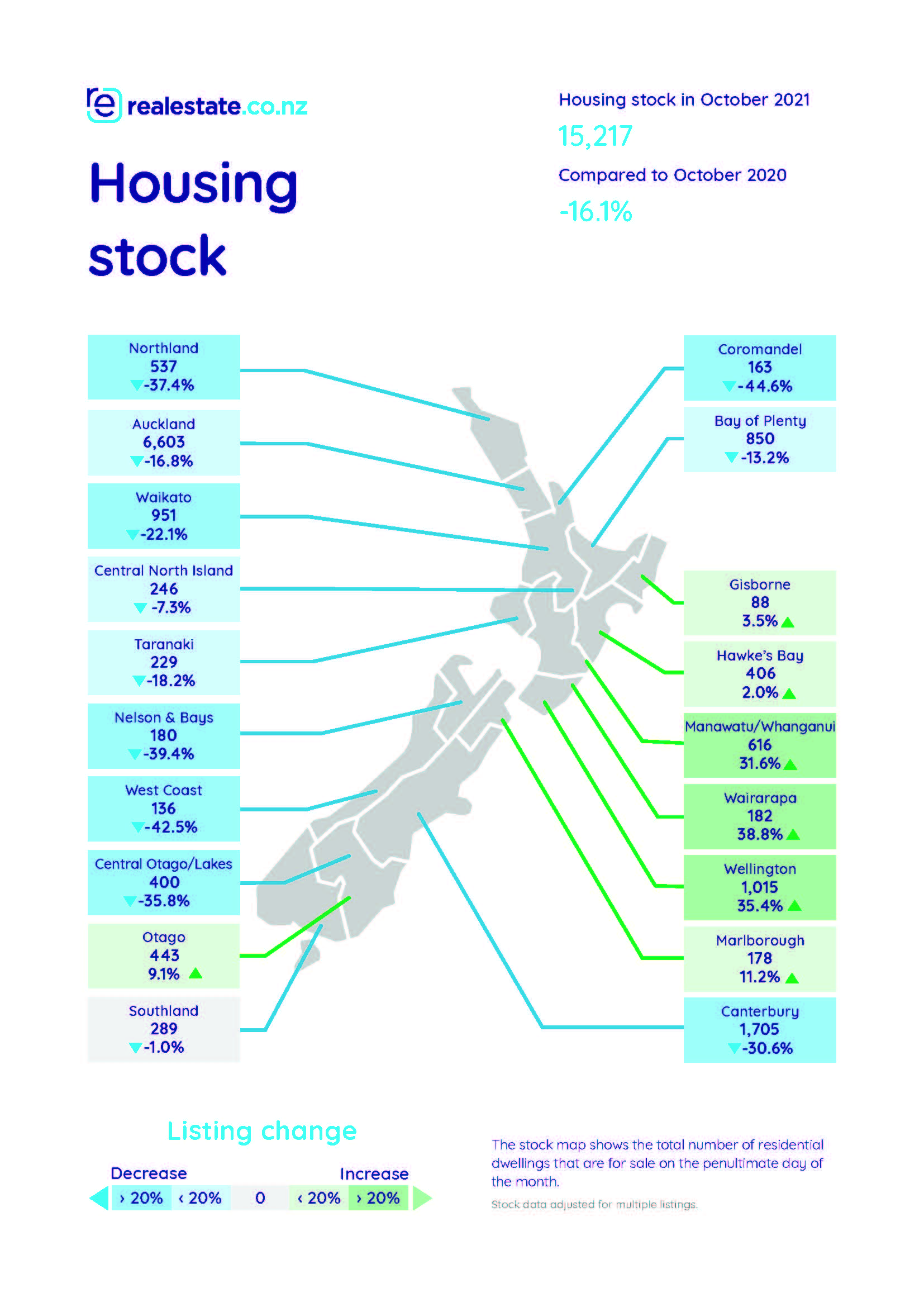

However while the number of new listings received bounced up, the total number of residential properties available for sale on Realestate.co.nz remains at a low level for the time of year, suggesting supply remains constricted as the market heads in to summer.

At the end of October the website had a total of 15,217 properties available for sale, down16.1% compared to October last year and down by 31.8% compared to October 2019 (see the second chart below for the full regional stock figures).

Prices were also firm, with the national average asking price hitting a new (unadjusted) record of $980,131 in October, with record (unadjusted) average asking prices also set in 15 of Realestate.co.nz's 19 sales regions.

The comment stream on this story is now closed.

- You can have articles like this delivered directly to your inbox via our free Property Newsletter. We send it out 3-5 times a week with all of our property-related news, including auction results, interest rate movements and market commentary and analysis. To start receiving them, register (it's free) and when approved you can select any of our free email newsletters.

41 Comments

Housing market remains buoyant.

TTP

One Roof has my old Auckland place going down in value last month for the first time I can remember. Tauranga is still on the up, almost another 4% last month alone.

Only buoyant if you denominate in fiat.

Housing market continues to crash against Bitcoin if your view is long term.

Choose your denominator carefully in the next decade.

As alluded to in the article, housing stock on hand is 25 percent down from levels of one year ago as per trademe listings. Less choice for buyers to scramble over

Greg, could you please also publish the graph showing the asking prices in all regions, Realestate.co.nz hasn't published its October report yet on its website. Thanks

Bounced back? No way.

Friends just sold in West Auckland for well over 1 million. They got 150k more than they would have accepted and well over the top homes.co.nz estimate. Its a nice place, not your average 3 bedroom weatherboard house, but still, just illustrates how bonkers it still is. A million dollars for West Auckland, imaging thinking that 10 years ago!

Over a million sounds great until you go to buy the next house in Auckland. You would have to now move out of Auckland to get a much better house, which is the way to go if you can do it. There is 100Mbps or even 200Mbps Fiber to your home in Tauranga now, its all you need to work from home.

Yes, buying in the same market nets you nothing. My point was merely illustrating how ridiculous prices still are.

In fact you go backwards. The RE fees mean you now need about $100k before you even begin to buy into a better home than the one you just sold.

To hell with that!

when people finally understand - this cannot be called market anymore, it is centrally regulated price of the basic human being need. Put the OCR into the 8-12% and we will see what the real market is.

Ah, yes.

Just like our Wool Market, and the London Tin Market and the various fixed Exchange Rate and Capital Controlled markets around the World, over the last several decades. And what happened to them? 'They' couldn't control them any longer and the price, in every case, collapsed.

"What can't be sustained, won't be sustained'. It's only a matter of 'when' and how bad the fall-out is.

Your perspective shows your self interest

Its not going to go to 8%+ and everyone knows it. It will top out at 6% next year unless there is a massive worldwide meltdown.

Interest rates at 6% will hurt enough people to make a difference in house prices

And why would that be? Just because some people have really paid a lot of money to buy houses? How many of them are there if we compare it with larger population?

With so much money floating in the market and all of it is debt, if interest rates do not increase it will be carnage for everyone.

So only way to protect everyone is to let a few suffer.

They won't go that high unless there is substantial wage inflation. If there is substantial wage inflation then those large mortgages will be easier to pay, as long as you keep your job.

Mortgage rates are at near on 4%, today.

Going to 6% is now almost an inevitabilty over the course of the next couple of years.

From the start of this thread (andreas_od),

"Put the OCR into the 8-12% and we will see what the real market is"

And the Carlos67's reply,

"Its not going to go to 8%+ and everyone knows it. It will top out at 6% next year"

So they're talking about OCR not mortgage rates.

OCR of 6% is a *long* way off. I stand by my comment that we won't get there unless there is substantial wage inflation.

I assume when you say it will top out at 6% you mean the CPI?

Or do you mean retail interest rates

Carded bank mortgage rates at 6% for even short terms like 2 or 3 years. There will be another OCR rate hike this month, it could even finally be a "double tap" so up another 0.5% on the OCR. If it doesn't happen in November it sure will happen in February.

New RV's due out this month or next will just throw even more fuel on the fire. Its the last of the Summer wine and time to fix that mortgage.

Be Quick.

Or if we stay locked down this Christmas, the suffering businesses would love to see higher interest rates…….?

What do RVs have to do with mortgage interest rates or CPI inflation?

Nothing but he's making the point that the new RV's, which will be much, much higher than today's, will embed the higher prices, even if RV's are a poor valuation of houses

I wouldn't call RV's a "Poor Valuation" I would call them a "Minimum valuation" if fact as they are going to be based on prices back in like July 2021 its going to be very much a minimum valuation. Its a wonder the councils don't freeze or delay the new valuations as they are already way out of date.

Buyers with a pre-approval in hand may need to act fast, banks will renew expired pre-approvals with a lower number dashing hope.

Make up your mind and be quick.

Unless they building then they safe, off the plans is a good way to go for FHB,

You reckon? There’s been stories of people buying off the plans at a “fixed” price only to find that the price has increased $40k two months later. You reckon banks are going to lend the extra amount when there’s no limit to these inflationary forces on building supplies?

Interesting to see Wellington's numbers up so much. It still feels like slim pickings out there. Though maybe it's going from very low to just low stock. It's easy to imagine why one would want to leave Wellington right now.

I think Wellington always feels like slim pickings as the quality of housing is so poor. By the time you discount those, there are very little left. I can see why the mad rush to Christchurch has begun

One should have left wellington 5 years ago. So leave now before it's get too late.

Wellington is only to be a place for bureaucracy and highly tax paid government bureaucrats.

A lowly tax paying citizen has no reason to live there. You will not be able to afford and you will be looked down upon as a poor pathetic individual. So get a better life somewhere else or even on some other country.

This is not a place where you will be considered human.

100% agree, unless living with family.. university students choosing to study in Wellington really can't be considered 'the best and brightest'

Choosing to live-in/leave Wellington is fast becoming an economic-intelligence-test.

Wellington is still slim pickings - but notice a lot now listing with a price and not a "deadline or Tender sale" always an indication the market has well peaked.

Lower Hutt on the other hand has the most listings on the market since 2016 - as of this morning 323 on Trade Me (3/4 of Wellington City's stock) - admittedly 95 are off the plan properties - but none of the "traditional" rental listings are selling at the moment - which must mean investors are being attracted to the off the plan properties. There are some bargains to be had for FHO - saw one property which took 75K off the listing price last week to try to sell it - was listed at $730 and now at $655

Wellington and Auckland remain excellent choices for property investors.

But don’t dismiss the provincial cities - especially progressive centres such as Palmerston North. Well-located sections in PN are fetching premium prices - such is their scarcity. That’s an indication that PN house prices will continue rising.

TTP

We have had a few offers on our house in Hamilton from developers who want to knock it down and build 2/3 units.

With that in mind we did a tour of Rototuna,Flagstaff etc and found not many on the market and those that were were well above what i would pay for a house.

No cricket pitch,a clothes line you can reach from a bedroom window and a supposedly double garage tht in reality is a one and a half.

Staying put NG? I am so glad I bought my land-holding mid 2020

Going nuts again. Detached homes on half sites that were selling this time last year for 850-950 in our area are now going for 1.2+.

No I don’t think it’s a good thing.

All expected when the government introduces new rules that massively increase development potential for even properties that are 300-400 square meters in area.

That along with one final FOMO driven on by fear of rising interest rates is why I see prices still rising at least another 5-7% by April.

I am selling a property in Opaheke (Papakura) at auction tomorrow. If I can still comment on this thread then I'll post CV (2017), current qv and what it sold for to help fuel / settle the debate. I don't know if this is just post peat, at peak, or pre peak as there are so many new influences on the market. I guess I'll know in 24 hours.

I would not want to be a buyer at todays prices... (Auck. population is no longer growing and interest rates are no longer falling..and increasing new supply of housing.... 3 dark clouds...in my view.) https://www.stats.govt.nz/news/aucklands-population-falls-for-the-first…

I respect the views of Chris Joye. ( Australian mkt )

https://www.livewiremarkets.com/wires/house-prices-to-fall-15-25-after-…

well in NZ those out of cycle contractions have already begun - with most fixed terms up a full 1% already. Add in the restrictions on lending and new credit requirements and you would have to say anybody paying above a property's current valuation may find themselves with a property that will be making capital losses for a number of years.

With Western govts hell bent on adding costs, regulations & restrictions everywhere you look, we have today, beginning to brew, all the key ingredients for a global slow down. Biden hasn't got a clue what he's doing & is being run behind the scenes by his progressive colleagues at enormous expense. In California, the new regs on truck drivers meant they have to be treated like employees, not contractors, so the big transport companies have sacked large parts of their operations, adding (creating?) to the global port dramas in North America big time. Europe has withdrawn their energy options to the point of being held hostage by Russian gas & Mr Xi has had second thoughts on building ghost cities & apartments that house nobody lives in but keep going up in price. How does that work? It doesn't, which is my point. Nobody works these days. We're all on the dole of one sort or another. Big (bad) tertiary has got a lot to answer for.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.