The cooling housing market is giving buyers more choice, according to property website Realestate.co.nz.

The website had 25,659 properties available for sale at the end of March, up a whopping 32% compared to March 2021. And that's the highest number of properties for sale on the site in the month of March since 2019.

It was particularly significant that the total amount of stock available for sale on the site increased, even though the number of new listings it received declined.

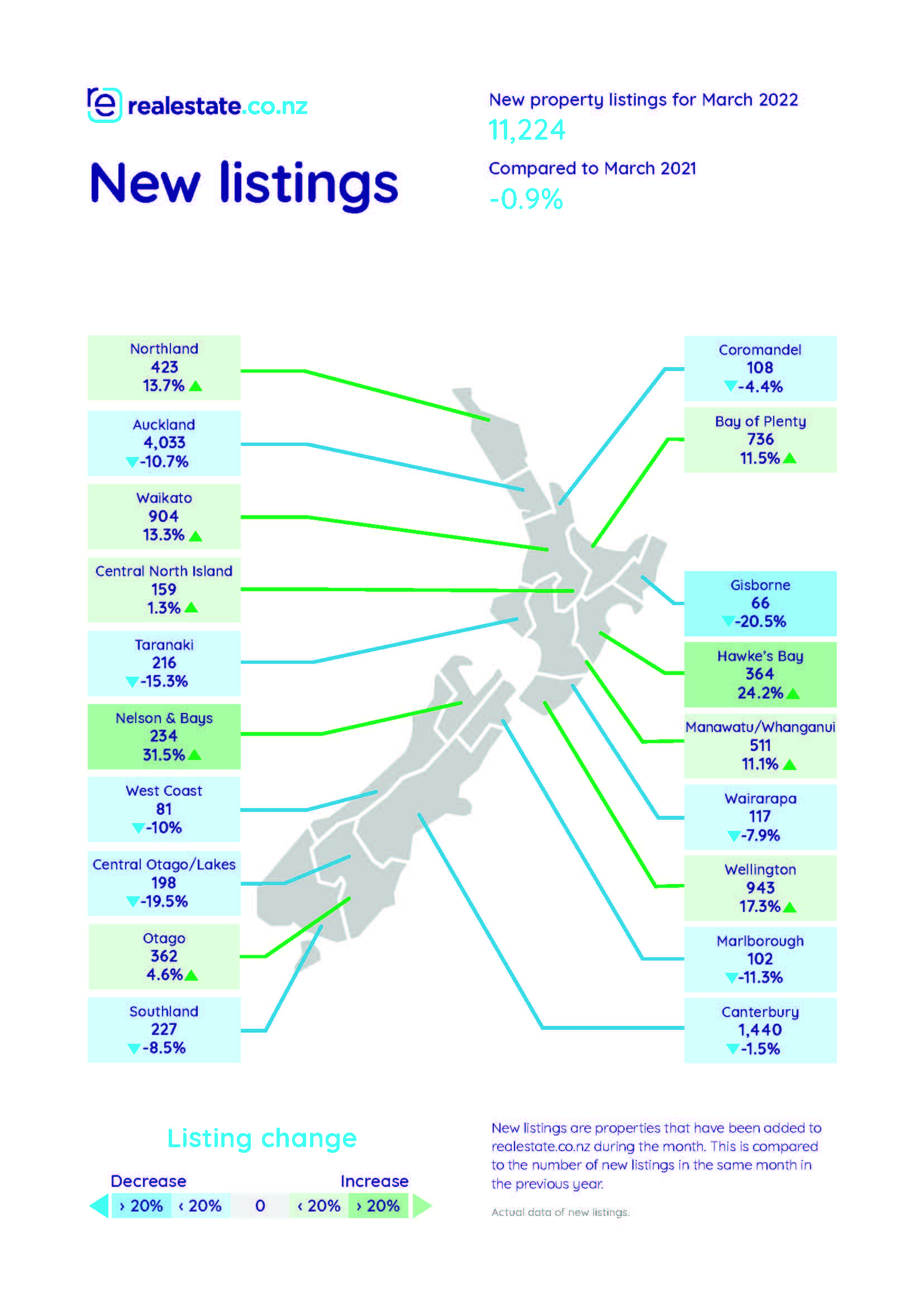

Realestate.co.nz received 11,224 new listings in March, down from 11,545 in February, and 11,322 in March last year.

On its own, the small decline in new listings was not significant, but the fact that inventory levels increased while listings declined slightly, suggests that properties are staying on the website longer because they are taking longer to sell.

Realestate.co.nz said a buyer's market had emerged in the Wellington region, with average selling time in the region stretching out to the longest it has been in the last 15 years.

Realestate.co.nz also warned that a buyer's market may also be starting to develop in Auckland, with properties also taking longer to sell there.

"This could signal a future market shift led by our main centres," Realestate.co.nz spokesperson Vanessa Williams said.

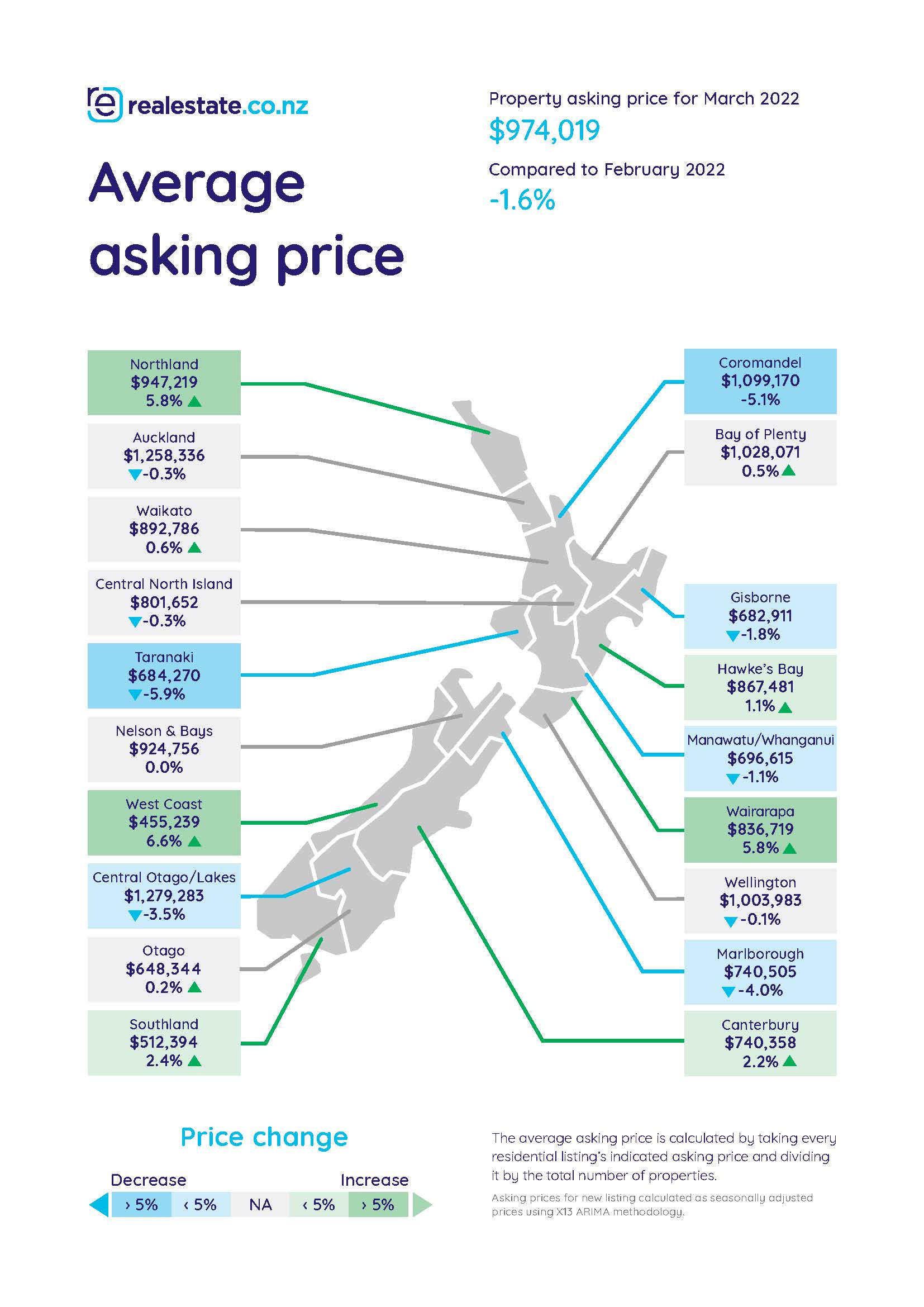

Asking prices are also softer, with the national average asking price of properties listed for sale on the website declining for the second month in a row from the record high of $995,766 in January to $974,019 in March.

That was the lowest it has been in the last five months.

The comment stream on this story is now closed.

196 Comments

Stock levels are now back to normal but asking prices really have not shifted yet. Currently looking seriously for a place in Tauranga but prices are in a holding pattern. The auction is in a few weeks time so I do not see a big shift in the market between now and then.

Too soon!

There is not enough panic yet….

Can you hold on until mid winter?

Not really. When you have the money its different it becomes more about finding the right house than the price. Yes I'm expecting a dip in the market and waiting a few months is obvious really but anything can happen at auctions. Plenty of seller are already in a panic but they have a poker face on. Auctions are about a bit of luck, how many turn up and bid and how serious the vendor really is about selling on the day.

Fair dos esp if cashed up.

I have the money, and want to buy in Tauranga. Going to wait until the panic really sets in before buying.

This is the best time ever to rent. To buy now would be like throwing money away.

The ground is a long way down at this point.

If you're borrowing, doesn't waiting mean your servicing costs increase?

I'd just negotiate hard on something that hadn't sold quickly. Sometimes the bad headlines are more than the reality.

That's the catch - the longer you wait for house prices to drop, the more interest rates increase...

The more interest rates increase the more house prices drop. 🙃

The majority of mortgaged people haven't even "felt" a rate rise yet, because they are fixed short term. It takes time for all the mortgages to roll over, and for holders to start feeling pressure.

It takes time for panic to set in. It takes time for capitulation. Patience here is a virtue.

Just think about the thousands of dollars people can save each week by doing Absolutely Nothing !

The market is panicking, and that panic is increasing rapidly .

Do Nothing, Sit Tight, Watch Netflix, Eat Popcorn. You cant earn money as fast as what you are now saving by doing NOTHING.

Wait Wait Wait, and your patience will be Rewarded.

7% interest rates this year Guaranteed . -30% Crash in Home Prices a Certainty .

Nothing is guaranteed or certain anymore.

Other than the Pendulum always Swings.

Won't be 30% drop. Will be 5- 10%, maybe 15%. The problem is it can't stay down for long due to the rapidly increasing cost of building houses, and the cost of developing sections. Effectively puts a floor under it, barring a complete economic meltdown- then were all in the cart

It's the land that's overpriced. There's no floor, the great abyss awaits.

Wrong way to look at it. Your not borrowing money so much at today's rate so much as what the rates will be next 5 years, 10 years, 25 etc. Depending on length of mortgage of course.

But that initial $ value of debt doesn't change, you lock that in.

Thats the kind of thinking that will now be putting pressure on households. Those who judged thier ability to afford a level of Debt based on last year's rates, 800k / 1mil mortgages, now facing doubled interest costs.

I have money and want to buy in Auckland. Also waiting... Will keep waiting until after total available inventory stops increasing and rates stabilise.. Hopefully this year, though I'm patient..

Are you worried about intervention from Orr & Robertson to assist the market? They've done it before...

Why do I feel like '2022' is 'CWBW' who's had a melt down and gone DGM...

Had similar thoughts. Professional troll.

Yes and no.

I don't expect intervention like that. But would I be surprised? No. Noting I'm also effectively hedged either way, so even if it does go up we'd still make a move later on anyway. For now no harm in waiting.

How about this -> I think its more likely that Robertson will be out of a job next election, rather than seeing any house price gains before then...

The questions is how could they? And why did they do it last time?

My impression is that Central Banks came out of the GFC in 2009 under the belief that they didn't do enough stimulus & could have done more, so likely had it planned in that when the next crises came they'd go harder on the money supply. The main justification has always been the lack of inflation right? So that covid came and the Fed is just running from a playbook.

So we then arrive at a place where we've effectively doubled the global supply of money in the last 10 years and the only reason it's not kicked over into inflation (stopping the printing) is why? I'd suggest because most people have taken this cash and put it into equities, properties etc... but its not been flushed into consumer markets at the same rate its been created.

An interesting question then, is whether the current inflation is due the recent stimulus since 2020, or due to the massive oversupply of cash built up over the last 15 years? Ie was covid just the thing that gave inflation a bit of a nudge (supply chains whatever). And now its spilling over, with lots of older people now want that money out for retirement etc.

So all up I just don't see how we can continue the stimulus without that continued inflation, which means higher rates are here to stay. Which means our house prices to income are completely outside of sustainable & there is didly squat that little old NZ can do about it

Just a theory.

But worried? Nope.

What I am worried about is global warming & the fact that humans have cause something like a 1600x increase in the long term extinction rate over the past 100,000 or so years.

Best way to know the market has turned is when the majority of properties start to be advertised with actual asking prices, instead of auction or negotiable.

HistoryRepeats,

Interesting comment. I have a small rental in the Mount which I have had for many years. I had an agent look at it a few days ago and she talked about putting an asking price on it. I will be interested to see her suggested price range.

100% agree - deadline sales / by negotiation / auctions / (insert next delaying tactic)

Once we actually get a price normality has been restored although price subject to revision – downwards I expect

Exactly, Carlos.

House prices are "sticky-down" and that's not about to change.

A downward price correction is evident - but it won't be dramatic.

TTP

A "soft landing" perhaps?

A "soft landing" perhaps?

That's been said around here, I believe.

TTP

The real estate industry (Tony Alexander etc) is trying to spin the narrative of a soft landing.

'Prices will only fall 10% etc’ as that’s their best possible outcome. That’s what they want people to believe so they keep buying.

The foundation of that logic is what happened in the GFC - values fell about 10%.

But what they’re deceptively not telling people is that interest rates were nearly halved to support the market then - a 2 year fix went from around 9.8% to 5.8%.

https://www.rbnz.govt.nz/statistics/key-graphs/key-graph-mortgage-rates

That’s what saved the economy from a property crash here. Rates were also slashed in the US & Eurozone, and yet they still had falling values for nearly 10 years.

https://www.researchgate.net/figure/House-prices-in-Southern-Europe-ann…

It’s never sudden… it’s always gradual and sticky on the downside. It’s not because the market is resilient, it’s because property is simply a non-liquid asset.

I just wish people remembered this.

It wasn't long ago Tony was saying house prices won't drop...

12 Jan 2022

My best guess is that on average New Zealand house prices this year will rise by about 5%.

But does the flattening of house price growth mean falls are likely? Not really....

...it would be unreasonable to think that 2022 will be a year in which buyers will be able to snap up bargains.

https://www.oneroof.co.nz/news/tony-alexander-cant-get-a-mortgage-dont-…

Exactly. He's losing credibility big time just when I was starting to admire him more. Even though he doesn't work for a bank anymore, he's certainly not 'independent'. He's beholden to the property and RE sectors.

He's also been saying things like 'We economists think prices will fall about 10%'.

Firstly, his tone is annoying, secondly and more importantly he's only been saying that in the last month or so.

He's looking a bit desperate and pathetic.

Alexanders narrative will likely soon change to “well, everyone expected the gains of the last 18 months to be wiped out etc”

He’s like Trump with his ‘Alot of people are saying “add bullsh_t here” strategy to create a narrative.

TA is honest in that he doesn’t hide the fact he is sponsored by property companies.

I just wish MSM would explain this rather than positioning him as an ‘impartial economist’ when they use his soundbites to create headlines.

Basically he's Ashley Church but with an economics degree.

CAUTION: DGM lurking above and below.

Beware of misleading and deceptive comments.

TTP

OK, here’s something that’s not Doom and Gloom:

Congrats TTP, it’s been 13 months since you were last warned for dodgy practices! (that we know of)

https://www.nzherald.co.nz/business/property-brokers-gets-anti-money-la…

As chairman and chief of governance that must surely qualify you for some kind of office award?

hahaha hilarious coming from YOU

Good Friday humour

He needs to drop the title 'independent economist'...certaintly misleading for some.

I got a real estate pamphlet in the mail yesterday with a short piece in it written by Tony Alexander, and he was saying he can't tell if house prices are currently overvalued by 10, 15, 20 or even 25% at present.

Go figure.

At least he's honest and says he has no clue. Meanwhile, across the ditch where 90% of this platform aspire to emigrate, a non-waterfront knock-down sold this week having increased from $10m to $27m in just 2 years. https://www.realestate.com.au/news/vaucluse-home-sells-for-26m-15m-more…

Te Kooki - Hi Tim, how many accounts do you have exactly ?

Grow up nonce.

No, Carlos.

House prices are "tanking-down" and that's not about to change.

A downward price crash is evident - it will be dramatic.

2022

Well the One Roof property report just landed in my inbox, basically no change in prices for the last 3 months. Flattening growth, there is no "Tanking" evident as yet in Tauranga.

Use of 'average prices' is meaningless.

"Well the One Roof property report just landed in my inbox, basically no change in prices for the last 3 months. " LOL LOL LOL LOL. I get it Carlos67 - it is APRIL FOOLS DAY. Ok, very funny.

Property only goes up.

Interest rates will stay low for a very long time.

The Vaccine works, and is proven safe and effective.

We are the only source of truth.

APRIL FOOLS DAY !!!!!!

You have a problem with the vaccines? Keen to hear more on this.

The copying and pasting of the same hysterical comments on every article is a giveaway. Antivaxxers are nothing if not triggered.

other than the fact that they dont really work and kill and maim healthy people, no problem at all...

Thanks for letting me know to never take anything that you post seriously. Utterly unhinged take.

Carlos, don't point out facts.(i know you were not saying it is not coming) Just make up comments like house crash is here, and 7% interest rates are coming fact.

Think of it like a rocket propelled projectile. It accelerates away from the ground until the fuel runs out (that happened last year). It keeps rising for a bit, then it appears to float at the top of its arc… But that’s illusory; it’s constantly decelerating.

The point I picked up on on RNZ this morning was that sales times were increasing - which was the main reason for rising stock. New listing not doing much at all. This may be what is holding up prices....for now.

my Hutt valley data shows that

currently 630 houses on the markt

Length of time on the Market

403 of the houses have been on the market for over 30 days - 65% (last week it was 405)

243 of the houses have been on the market for over 60 days - 39% (last week it was 210)

The percentage and number of houses on the market longer than 2 months is growing each week – indicating a stagnation of house sales.

That's what I've observed with Wellington. There isn't a dramatic increase in new listings (just my anecdotal observation), but listings remain high due to older stock not selling. The "x-factor" homes seem to sell (they're not ideal for investors or FHBs), though quality houses are few and far between in this city.

New listings have dried up a bit this week, but I'm wondering if they're trying to avoid an Easter break settlement dates. The next few weeks will be telling as we get past Easter and into the Winter months.

Typically new listings decline over winter in wellington as well as sales- too many houses are cold and damp or are positioned on the southerly winds, none of which are attractive selling points

That always cracks me up, like do buyers not expect seasons to change. I guess the surprise at the change in market conditions indicates that many don't.

Who are you referring to? I don't think anybody expects Wellington listings to increase over winter. Everybody knows it dries up, due to the reasons ikimpaul explained.

not sure if tronic was thinking this with his comment on change of season but given the high amount of stock on the Wellington market - more than 6 months relative to the sales rate- those who listed in Jan, Feb or March expecting to sell before winter came (effectively hiding those damp/ southerly issues) may find themselves having to now still hold viewings in Winter- further devaluing their houses.

It will be interesting to see how many houses come off the market in May to reappear in Spring September.

Buyers market??? Maybe after prices fall by 20%

Inflation has already cut prices by 10%

Don’t you know the inflation calculation doesn’t include house prices?

No but it includes the replacement cost of houses.

Don't bother to reply swingtrader, the math ability by many on here is so bad its not worth commenting on. Just let them go on believing house prices are falling with increased inflation, maybe if this keeps going houses will be free in 2 years time.

Carlos Carlos Carlos...my golden rule is everything you say is the exact opposite in real life..and the proof will be in the pudding (hopefully rubarb cobbler)

And earnings...

Prices could reset to pre COVID-19 levels. Yikes I'm sounding like a DGM but, really, the massive increases of last year were an anomaly and should never have occurred.

It's something that both spruikers and their opponents could agree on, that it shouldn't have happened like it did.

If they get as low as pre-covid levels I think they will fall further. NZ house prices are/were so high because people believed they would never crash. If the market crashes back to pre-covid levels the illusion that NZ house prices cannot crash will have truly popped and people will quickly lose faith. Without faith in ever increasing prices, we will see things settle down to affordable levels which is much lower than pre-covid prices. Same thing happened in pretty much every housing market bubble over the last decades.

I think you are dead right - it’s the end of the myth that house prices only ever go up.

So there’s a fair chance of a massive rush for the door once middle NZ realises this… and looks at what it’s costing them to ‘hold onto’ their rental property with no capital gains.

Residential property investment is a mugs game without the capital gains.

That’s why anyone that makes any decent money in it, eventually get’s into commercial property if they can.

yes, where the uninformed and "expert" residential investors get stroked.

I think buy & hold lazy boomer specuvesting is dead and gone. There is still opportunity for investors who want to develop or re-build certain sites if the entry cost is not unreasonable.

NZ house prices prices were so high because people believed with a shortage of housing of 50,000+ and the immigration tap set to full house prices would never crash

Lot's of different justifications for why the prices would not fall but all mostly based on faith. PHD student did some research on it a couple of years ago and presented it to AC, something like 95% of rental properties were cashflow neutral or negative. They only made sense for tax free capital gains. If the myth of guaranteed capital gains implodes you can see how the falls will be significantly more than pre-covid levels. BUT I think for most people to lose faith they have to first fall to pre-covid levels.

It feels like a return to normal levels. Perhaps only the social housing wait list will remain historically high.

If anyone wants a good laugh, check out Trademe. They've suppressed the number of listings on their search now and only show '32,000+'.

This isn't a buyers market – it's an all out crash.

What is a crash in your opinion? My thoughts would be national prices dropping 40% with Auckland starting the fall at 5/10% a month. What I think we are seeing is a quick stop to the crazy increases we were seeing. March has not shown the "crash" some thought/hoped for.

some thought/hoped for

I "hope" the DGM will show "some thought" rather than the usual thoughtless comments.

Why have you defined a crash as 40%?

House prices declined 19% between 2007-2009 during the GFC in the USA.

40% would take us back 24 months ish, just my thoughts, like everyone else on here what I say means nothing, however comments saying it's a crash right now are simply not true. Is one coming? I don't think so but a crash to one is not to another. It depends on your personal postion I guess. For me 20% wouldn't bother me, 40% would.

A 40% drop from peak would take us back to around 2017 prices. Median NZ peak ~900,000 -> ~540,000, corelogic HPI ~4,000 -> 2,400.

Remember the 40% gains were with reference to the starting, lower price. The 40% falls would be with reference to the peak price so they are much larger in real terms.

https://www.interest.co.nz/charts/real-estate/median-price-reinz

https://www.interest.co.nz/charts/real-estate/qv-house-price-index

Even 2017 prices are high, compared to the rest of the world.

Our median household income is $110,000. So a median house price of $540,000 would be about 5x income, and about "right", although still quite high.

I believe that we will see 40% falls from here.

is it 110K now? I thought it was circa 80K

Affordable in normal interest rate times is around 3x income. So a 60% fall would be better if we want to get back down to affordable levels...

Good point MFD, I still don't see a "crash" as some do however

I don't see a crash either, at this point in time.

I'd have thought a 40% fall quite unlikely, maybe a 5% chance of that happening. It would be devastating to the economy in the short term even if it improves many aspects of the country in the long run, including shaking the misplaced certainty of property investors which sucks up money that could be invested into something productive.

It is looking like continued price falls are the most likely direction from here though. No idea how long they'll last or how far they'll go.

I don't know why people think it's unlikely. Prices are so far detached from values and incomes, it's ridiculous, particularly in a time when we could see masses of people leaving NZ because other Western countries have implemented pandemic economic response policies and we have a government that can't deliver anything. We are a high cost medium wage country with insane house valuations, a bubble pumped up by cheap and easy money supported by the government and central bank aided by intense buyer belief that "prices always go up". That's all the signs of a massive bubble and if you pull the timescale back on this graph, you will see prices have gone almost parabolic. When markets go parabolic way outside their fundamentals, they are about to burst and have significant drops, see almost every market pump in history. Only difference with real estate in this country is the RBNZ/finance minister might decide to bail all property owners out, but they have painted themselves into a corner now, needing to raise interest rates and avoid pumping wealth inequality. Real estate markets go down slower though, so the pain will be felt over a longer time scale than say equity markets which often pop within a week or so. Real estate could be a couple of years of downward prices.

I agree prices are crazy and the recent blip upwards could easily blip back downwards. I'm a little cautious comparing to other bubbles as it's easy to have a selection bias here - we will crash the same as these other markets which crashed, but perhaps there are other examples out there of less dramatic outcomes following steep rises.

As you say, there are levers that can be pulled to pump things up again if the Government and/or RBNZ decide they need to. LVR ratios could be relaxed, tax laws changed, lending regulations relaxed, zoning laws changed, bank capital regulations relaxed, kiwisaver FHB incentives boosted - a whole bunch of actions other than direct interest rate drops that could confound our expectations of price drops.

One thing is crystal clear to me - investing in property right now would be insane. The rewards look muted and the risks look ominous. The chance of big capital gains in the next few years are small, and the yield is not sufficient on most properties to keep things afloat.

My usual disclaimer - FHBs who want to live in a property for 10 years+ and can afford it comfortable should go ahead and do what's right for their lives and not try to second guess the market.

Markets often over correct. I wouldn't be surprised if this bottoms out at 2016/17 values and then climbs back up to the long term trend line. I don't think that even a 40% -50% drop (From Nov 2021 peak) is out of the question - if it is allowed to unwind naturally. But it will be regional and some types of property will be more resilient than others. I wouldn't want to have bought a new build in the past 2 years. Developers will be discounting like crazy, so why buy a 2-3 year old property when you can be the first owner for less. The only way to stop this would be to give out a lot of permanent resident visa's and/or make borrowing easier again. I hope it is allowed to run it's course.

Some people need to go back to Year 10 maths....

In sharemarkets, a 10% drop is a "correction", 20% is a bear market, and 30% or more is a crash. Perhaps these criteria would be reasonable to apply to residential property market too.

All I'd say to you and for that matter everyone is wait for the HPI data. I'm confident the next release will show Auckland is something like 5-7% down from peak, and 3-5% down this calendar year.

The extent of the fall is going to be largely dependent on the extent of the OCR increase. If the OCR only increases to 1.75-2%, then price falls might only be limited to 10-20%.

If the OCR goes north of 3%, as ANZ are predicting, then all bets are off and could easily drop 20-30%, or even a bit higher.

A property crash is generally considered to be falls of at least 20%.

Its pretty clear that its not a level playing field when it comes to prices going up and prices going down. Apparently Mt Roskill is getting smashed but overall only Auckland is negative and at 0.1% for the quarter so who cares. Personally I though prices would be declining already across the board, this is not the case.

If you look at the collapse of the Irish property bubble, prices fell 35% from the peak over a period of 3 years (Jan 2007 - Jan 2010). That's 36 months or a decline of only around 1%/month on average. NZ is of course not exactly the same but price falls are unlikely to be as rapid as you suggest.

Interestingly, Irish mortgage rates fell during that time period.

Exactly...was like this as well in the US when their bubble burst. Interest rates were dropping but house prices continued to fall regardless because it was speculative about capital gains as opposed to investment of cash flows/fundamentals.

Could be the same here if prices start dropping....even if interest rates are slashed, if the drop in capital gains gathers momentum, it might take more than what people think before buyers come back to the market....because who wants to lose their fingers catching the falling knife?

If people assume house prices ALWAYS rebound when interest rates drop....sure it's true most of the time...but not always.

Another thought - what about the self-perpetuating aspect of the demographic? Older folks holding onto their big family home looking to eventually fund a decent lifestyle in retirement, seeing a potential sustained drop - even if it's not high - over a number of years. That might prompt many that were thinking of offloading in the next couple of years to bring forward that decision.

It's not funny when you understand 16 bit integers

Ah, of course. Storing signed integers on positive discrete search data sounds like something they would do.

Correct. If you search for the word reduced, and mortgagee on trade me property, then you will see a number increasing quite a lot each day. It may start to look like the omnicron graph quite soon.

I’m glad I saw this coming and fixed all parts of my mortgage in the mid 3s through 2026.

I feel a bit sorry for people that purchased housing last year thinking this was a) normal, or b) woud not reverse itself with rapidly rising rates, which we will have for the next few years.

I have gone on trade me and looked at houses for sale and it says there are 12,596 so I don't know where you are seeing 30,000+

AT LAST says every first home buyer in NZ- even the herald is running this as their headline story.

Whats the date let’s mark this down in history...oh oh

Nationwide trade me has 237 listings with "reduced" in the text. This time last week it was 220. This time last month it was 150. Similar with text searches like "motivated"...

I follow Nelson and my trade me notifications over the last few weeks have been a steady stream of Auction to Deadline, Deadline to Negotiation, Negotiation to Asking price, Asking price to offers over (a lower value), asking price lowered by $20K to $50K.

Its just bloody refreshing to see asking prices rather than fairy sparkle snake oil dreams and smoke and mirror promises.

Waikato shows more listings as well as higher asking prices... excellent. More supply and even more demand

In their trip to 7+% interests rates are making the amount you can afford to repay going down 0.1% per day (starting from the almost bottom of 2.5%).

It might not look like much, but on an house of 1M-ish is like to lose 1000$ per day (circa, far fetched).

Renting that same house costs top 100$ per day.

Interesting times ahead

The loss of tax offset is having an impact. New purchases have no tax rinse angle. People holding on will have declining tax rinse, and increasing interest rates, a double negative. But hold on spec land, things will get better as record building consents and negative immigration continue. Another specuvestor double negative.

It's a long way back for the numbers to stack up.

Yip I rent to students and market rents are screaming up to cover the tax rules. Wellington.

Might be able to get away with increasing rents in Wellington, will be very hard to do in Auckland, with huge supply coming on line, and negative migration.

I don't understand why any student bothers to come to Wellington anymore.

Live in squalor and be crippled with ever increasing rent hikes in a dying cold city, to appease greedy NIMBYs who screech "I WORKED HARD FOR THIS".

You and JK call it a dying cold city, but it has low unemployment and plenty of high paying jobs

Wellington has essentially become the San Francisco of New Zealand:

- Highest earning city by average salary

- Center of NZ tech start ups

- the “alternative” / LGBT friendly capital of NZ

- Horrendous housing prices & NIMBY extremism doing everything it can to prevent new housing.

- Earthquakes

Wellingtonians and their cool as lifestyle is funded off the back of actual working tax payers.

Its like watching those anitvax protests unfold, tax payer funded protestors vs tax payer funded police, looking out for tax payer funded politicians. Its a Marxist nightmare snake eating itself.

(No offense Wellington)

Nice post…agree…had a good laugh 😂

Visiting Wellington is like time travelling back to the 1990s.

And most faculties are a bit average there, with one or two notable exceptions.

Thought you liked the water and vibrations, I mean vibrance ;).

Yawn

I've said this in the past, this is a global event and New Zealand is just a few steps ahead of the pack by going hard and early (harder rules for investors + rising interest rates) then the rest of the world will follow and it will be a full blown Global Housing Market Crash.

If you take the parallels of Covid-19 as an example, this contagion started from China (restricted capital outflows, Three Red Lines, Evergrande). New Zealand went hard and early by closing the international borders but it was only a matter of time until we could keep it out. The government could only kick the can down the road so far (so about 2 years) but once Omicron came, there was no amount of lockdowns or mandates that could keep us unaffected. Things can change quicker than you think, and we'd get used to it pretty quickly as well. We've been having tens of thousands of cases per day which feels like a long time, but if you look back only 6 weeks ago we haven't even cracked a thousand cases in one day since the start of the pandemic. So like Covid cases, these house price drops tend to start gradually, then all of a sudden.

Should FHB jump in and try to catch a falling knife.

https://www.macrobusiness.com.au/2022/03/new-zealands-housing-market-is…

From OneRoof this week:

Ray White national auctioneer John Bowring was also puzzled as to why motivated buyers were holding back. “Back in September you had 10 other buyers nagging at your shoulder, now you’re the only buyer,” he said.

“They hated 10 buyers, now they hate being the only one. There’s no competition, you’re not up against others and paying $400,000 more than you should have.”

That "paying $400,000 more than you should have" says it all, really, doesn't it?

It was a Ray White agent in Tuakau that advised me (last summer) to offer as much as I could borrow, as prices could only go up so it didn’t matter if I overpaid. They said the main thing was to win the property. Obviously the advice was ignored, as it was nonsense.

I got the same kind of advice, which I also ignored. I did end up paying probably 20-30k than I should have for my house, but who knows really. I did do two things which I am really pleased about now: I bought a house that suits my needs and that most importantly I like and am happy to live in indefinitely, and I ensured that I could still pay the mortgage if interest rates went to 10%, and there would still be room for the odd takeaway (though renovation plans would have to go).

I was buying on behalf of a relative. They stuck to their budget and ended up with a great place. They were selling and buying in the same market with good equity so are not worried about what happens over the next few years. The tactics employed by some agents are shocking. Don’t know how they sleep at night.

"Realestate.co.nz said a buyer's market had emerged in the Wellington region"

A buyer's market? It's not true, not when house prices went up some 50% since COVID. How many can afford to buy a house in Auckland these days. Without savings/assets or help from parents/family, it seems impossible.

Those who egged on first home buyers to buy into the peak of an insane bubble should be ashamed of themselves.

The unfortunate sods that believed the spruiker garbage are going to be enjoying negative equity on a their lousy forever house in due course.

Meanwhile the smarter kiwis are headed to the airport in droves. ✈️✅

Agree. And let's not forget the government deliberately stoked this obscene housing bubble. Unfortunately, those who borrowed massively under relaxed lending rules and low interest rates are about to be burned badly once they find themselves in negative equity and unable to afford their mortgage payments.

Agree there's 5 or 6 spruikers on this website (or not anymore in the case of one clown) who should hang their heads in shame.

But will they take accountability?

No, they will just disappear, like CWBW.

How could you ever face up to people on this website again when your whole narrative has been that prices can't possibly ever crash in NZ?

To be fair, at least Yvil has changed his view a bit over the last 4-5 months.

Meanwhile the smarter kiwis are headed to the airport in droves. ✈️✅

Farewell, Brock Landers! Enjoy living amidst the crocodiles, snakes and used car dealers. 👍😃

TTP

No crocs. Snakes leave you alone if you leave them alone.

Used car dealers are better than used house dealers.

Flying back to New Zealand next week. It's feijoa season :p

Brisbane is a great city, and Australia is a great country.

All the best for Brock.

I have just heard through a good source that the next release HPI in Auckland is gong to show prices up 10% in Auckland.

for the year?

It would have to be.

February's HPI for Auckland was also up 10% YoY, but that masks a 5.5% fall in the index since November's peak.

Well the figure in print is up 3.9% for the first quarter to 1st April 2022 in Tauranga. Growth is down from 4.4% up until February so basically we still have 4% down here year to date. Just don't see a crash myself, people need to hold off calling a crash until we are obviously in one.

When is that due out?

APRIL FOOL'S.

As opposed to the load of FOOL'S on here the other 364 days a year as well ? LOL

Ahh, there it is... I was sure I'd see an April fools joke in here today :)

Haha got me good!

Brutal! :)

...when will this translate into (significantly) lower prices? What is the general time lag between increased supply into the market and price reduction?

I've been watching a few Auckland properties on Trademe, one of them really stands out. Listed on the 30th of November, it was passed in at auction in December and has since been listed for a rapidly declining asking price:

22 December: 1,450,000

18 January: 1,399,000

2 February: 1,300,000

3 February: 1,325,000

16 February: 1,299,000

4 March: 1,175,000

18 March: 1,100,000

Thats down $350k asking price in 100 days, $3,500 per day.

I think I know the one - do up in not so great area? I lol when I saw the initial listing price...

From the photos it looks a bit dated but not a complete shack like some I've seen, its just a tired 3brm on a big section that cant easily be developed. Homes.co.nz has it valued at 1.8m, its 2017 CV was 1.25m so this is asking 10% below 2017 cv.

Similar dump in asking price for a "2" bed charature apartment on Karangahape road - "vendors have bought" watched it go from a nice square mil, to 900, to 850, to 799... I think its down more now

A one bedder newly fitted out appartment in Taranaki Street, Welly will go in the market early next week. We will see what it goes for

And so the standoff continues, fewer listings, longer time to sell, fewer sales, little change in price. It all means buyers and sellers are sticking to their guns and not ready to move.

Price discovery is indeed harder in a falling market.

Anyone hear ash church on the one roof property show on Newstalk last week, it was pure snake oil sales.

he makes me puke and get really angry newstalk has to put him on due to sponsership deal.

I've seen him less at the NZ Herald in the last few weeks , maybe I am not paying enough attention or caring enough, or maybe they are pulling back his profile a bit because he's starting to look really really stupid???

I don't listen to A Church

who do you listen to?

Tony Alexander (I find his many surveys very informative) and Interest (the articles but not many commenters).

How about you?

The guy who said in January that house prices will rise 5% in 2022.

LOL!!!!!!!

And now is saying that it could be -10%, as if he never said +5%!

The guy is just a paid voice of the RE industry

I care little about his (or other people's) house price predictions, I prefer to look at his many, timely surveys and graphs, and come to my own conclusion

Whatever. If his surveys and analysis are so good why is he so far out on his forecasts, in such a short period of time?

he gives what investors and RE people want to hear. If you are happy with living in that bubble of thinking and advice, then that’s up to you.

I don't listen to almost anyone in NZ - I simply don't rate the vast majority of them, although I think Stephen Topliss at BNZ is quite good and underrated and one or two university people. There's some international voices that I have a lot of time for.

I do listen to some of the more informed commenters here, such as JFoe and Independent Observer, who make some great comments.

Your own comments are great... a great load of toff hahaha

Just jealous and bitter that I have been so accurate. Much more so than any economist. Haha.

walk on, HouseWorks.

HM, here's a post from P8 of last night, please read it. Surely you would have to agree he has more substance than TTP and is not the same person?

by printer8 | 31st Mar 22, 9:01pm

What I think is important about a comfortable retirement.

al123 "Why do you feel the need to be so antagonistic" - the answer is that in my post above I argued that people put too much importance on money which your challenged. It is probably that I get annoyed that our Retirement Commissioner - and many people commenting on retirement often with a vested interest - focus solely on money and neglect what I consider to be far more important factor such as one's health.

As posted, I am seven years retired. I have a close group of about eight who meet weekly for a couple of hours each Friday for a enjoyable beer (note "a" beer about $7.00 for a Steiney) and great banter.

It is quite an ecliptic group with some with with little income other than national superannuation; but yes, all own their own home albeit from pretty basic to reasonably good properties. I earnt the most during my working life and I am the most financially comfortable of the group, however while I own a comfortable home I don't have the best home.

The seven years retired and our group has given me plenty of opportunity to think about retirement and conclude what I consider the four more important factors rather than money in retirement. There is one of the group who although financially comfortable is without a partner and very lonely and unhappy. Another, who never earnt more than $50,000 pa during his working life as the sole income, has bought a cheapish caravan and just completed a great three months trip down south.

Money is definitely not the most important factor.

I agree, owning one's own home is important to having a comfortable retirement under current superannuation allowances. As said in my post, one only needs to drive around and look at the council's social housing to see retired people unhappily living in "ghetto" like conditions.

Housing affordability for FHB does concern me. I have posted a number of times some figures I saw a few years ago; homeownership rates for 25 to 35 year-olds has fallen from 65% in 1988 to 35% in 2018. This has been a continuing trend and yes, accelerated especially over the past two or three years and there are long term underlying factors other than a need for short term falls.

Housing should be seen not only as providing for one's family but also for retirement and that fall in homeownership rates is of significant concern.

My only comments to young regarding long term and retirement is that making sound social and financial decisions is more important than what you earn - and while important more so than regular savings. One can get upset, but getting pregnant at 16, or not getting qualifications (either academic or trade) and being on basic wage for life are not the best decisions in ensuring a comfortable life and retirement. OK, I consider my self pretty comfortable and current issues such as inflation and the price of petrol don't concern me at all which I put down to having a balanced life and making sound decisions in life.

I have consistently advocated for FHB to buy their own home. Short-term increases or declines in the market are irrelevant in the long-term; provided one can service the mortgage, a home provides social and financial security and as this article points out a basis for a comfortable retirement in the longer-term. Yes, many (but certainly not all) boomers have benefited from homeownership and there is no reason to suggest that it won't apply for the future. Despite what some have posted, I strongly advocate using KiwiSaver for homeownership as one is contributing to their retirement and one's earning late is likely to be higher.

Unfortunately over the past four or five years, I have seen both too much scaremongering on this site and in some instances some poor decision making.

I was tongue in cheek when I said he was the same person.

And the last time I said that it was a mistake, there was a P8 comment under a TTP comment. And I corrected it.

I have no time for P8. He has consistently misrepresented what I have said. No time for that behaviour.

I have better things to do than argue with someone who consistently misrepresents me. End of story.

Pretty ironic that in a post talking about P8's comments having 'substance' you quote the one in which he admits to resorting to childish personal insults because I (quite mildly) challenged one of his views.

He’s childish and often misrepresents.

It may be senility.

Be kind.

IT Guy... don’t get me started on ‘the Church’… he really is the property preacher.

I never knew he was on the radio but found it after it was mentioned by a commentator on here.

My ears are still hurting!

Why do you listen to A Church?

First and last time Yvil!

What made me angry about church is that he talks as if he has a crystal ball and knows the future. he never mentions that past performace is only an indicater of possible future results. most share market commentators sounded the same on friday 18th oct 1987

i have spent 25 years sitting on trading floors. markets can also fall not just rise forever

he is a sales guy!!! never ask a sales guy for advice

Yes IT Guy.... he's just so friggin annoying with how he talks with such authority on what the market is going to do... and anyone that calls or texts with a concern is talked down like they don't understand that the nz property market 'only ever goes up'... which is basically his answer to every question.

I can't believe he actually thinks it's going to get 'back to normal' in 3-4 months time and that Auckland is at the start of a boom cycle.

If anyone wants their ears to hurt:

https://www.newstalkzb.co.nz/on-air/the-weekend-collective/the-oneroof-…

'I can't believe he actually thinks it's going to get 'back to normal' in 3-4 months time and that Auckland is at the start of a boom cycle. '

Please tell me you aren't pulling our legs, I really really don't want to listen to him!

Quite unbelievable if that's really what he's saying.

Yep, he thinks Auckland is in a boom cycle that started in 2020

HM - you have to listen to it now!

It would be comedy if it wasn’t such a tragedy for the poor souls that took his advice in 2020 that interest rates will stay low for a very long time…. and borrowed as much as they could to maximise their capital gains.

See DDDebt, when you write comments like these, it really shows that you don't know what you're talking about.

That's what he said Yvil - and that's what people would have acted on if they trusted his advice.

Ashley Church - Aug 2020

"For all of these reasons it’s my view that mortgage interest rates of zero percent are extremely unlikely – but that there’s a possibility that we could see fixed rates at one percent, or lower, by the end of next year if economy activity (as measured by the Gross Domestic Product figures) hasn’t picked up substantially, before that.

One thing is certain though. Mortgage interest rates are going to stay lower, for longer. Of that, we can be quite certain"

https://www.oneroof.co.nz/news/ashley-church-could-mortgage-interest-ra…

Wow. What a guru.

The guy is poor at forecasting and also has no shame.

mind you if people have bought every word this charlatan has said, they have only themselves to blame, really.

God, 35 minutes of trash, can you direct me to when roughly in that 35 minutes he says that please?

I can't sorry HM... you'll have to listen to it

The most outlandish thing (there are several) he say's is that there is nothing specifically causing house prices to drop, and that it's a purely a confidence thing, and only slowing because of fear etc... and that will disappear in the next few weeks, couple of months.

Ok I will trust you, I am not putting myself through the torture of listening to it all!

It was someone near the start - I tried to find but I didn't want to listen to it all again sorry!

I just tortured myself and listened to it. It was about halfway through. According to him It’s only lack of ‘confidence’ that is currently, temporarily holding the market back. And the confidence will return in a few weeks…

nothing to do with insane unaffordability or rising interest rates…

the guy spouts rubbish

Good on ya HM.

Church is a pure snake oil salesman like IT Guy correctly described him.

I can’t think of anyone that preaches property rubbish harder than the Church.

He (Church) said "there is nothing specifically causing house prices to drop"

That is rubbish indeed

Since you put the link up, I thought I'd click it. I didn't have the patience to listen to more than 10 min but, after reading your post I expected Church to be obnoxious and making some outlandish claims, turns out he sounds like a decent chap and he's making sense. It seems it's your one eyed hate of house prices being out of your reach that make you so hateful DDDebt

Yvil - you need to listen longer. His claims are absolutely outlandish... which is exactly what makes him so obnoxious.

Where is he making sense?... Auckland house prices will go up this year?

https://www.oneroof.co.nz/news/mt-roskill-property-values-fall-166000-w…

Yes, I hate house prices being out of reach for the next generation, and yes my view on that will stay the same (very one-eyed, I know) until they are more affordable.

Don't you see that affordability is a subjective notion? To many, a $100'000 is totally unaffordable. To me, buying a house 30 years ago was unaffordable but it is affordable today

Yvil… are you for real?… I’m starting to think you might be Ashley Church… or you certainly think like him.

FFS, There is absolutely no arguing that NZ house prices are severely unaffordable.

We topped the world in the IMF list in 2016… so where do you think that puts affordability now?

https://i.stuff.co.nz/business/money/83750475/nz-tops-imfs-housing-unaf…

If you don’t believe that, do your own numbers.

I have no desire to further debate this with you. You live in a world of your own.

Enjoy your weekend.

Yes I'm for real DDDebt, I never said NZ housing was affordable by most metrics, I said affordability is a subjective notion, just like being rich is a subjective notion. There are hundreds of millions of people in Asia who think you are rich, another few hundreds of millions in South America who would describe you as "rich" and then many more hundreds of million people in Asia who would think you are filthy rich. The world is bigger than your oyster DDDebt, what one person deems as affordable, another considers totally out of reach.

I wish you a good weekend too : )

There are some generally accepted measures of housing affordability - usually housing is considered affordable when it takes up less than 30-40% of income. The Ministry of housing uses 30%, for example. This site uses 40% in the affordability reports posted here. Generally spending over 50% is considered being in severe housing stress. The purpose of those measures isn't to claim that every single individual who spends more than that on housing has a problem - if you're earning $500k a year, then you could spend 75% of your income on housing and still have more money left over than the average household has to spend. The point of them is that in most cases, having to spend more than that on housing will put stress on your ability to pay other bills. The median household take home pay is around $80k, I think? If you're spending 50% on housing, you'll have around $770 a week left over. That's not much les than the pension for a couple, and out of that you'll need to cover transport to work. Having kids will likely be out of the question. Saving for retirement ditto. Housing is something everyone needs. If an average household in a country is struggling to pay for both housing and live a basic decent life (including paying bills, going to the dentist, being able to have kids and save a little for retirement etc) then it seems reasonable to say it's objectively true that housing is unaffordable, even if it's not unaffordable to you.

I agree with everything you said al, and of course I'm familiar with the metrics you mention. Yes, in a perfect world, we would all own a house but in reality there are much bigger problems in the world, such as hunger and war. I stand by my comment that "affordability is subjective" when one complains, in the warmth and safety of their house, on a computer obviously with internet connection, that the world is unfair because they can only afford to rent a house but not buy a house.

I am not complaining. I own a house. My point was when people talk about housing affordability, they are usually referring to one of the objective measures mentioned above. If you don't think those methods should be called 'affordability methods' that's fine, but isn't it still useful to have a measure that tells you 'once housing costs reach this point, an average earner is going to have trouble meeting their housing costs and afford the basics of a decent life in country x'? 'Affordability' does seem like a useful short hand for that. Of course war is a bigger problem than housing affordability - but the fact that there is a war in Ukraine for example doesn't mean that it's not also a problem if a pensioner in Blenheim can't afford to pay rent and the power bill. (Affordability isn't just about mortgages - rental affordability can also be measured).

confirmed idiot

AC makes perfect sense with reasoning and is more balanced than those saying the opposite. His 2020 prediction that it was a good time to buy was absolutely correct

He said in late 2021 that interest rates will stay low for a long time.

he said in late 2021 that prices will rise by a small amount in 2022.

these are but a few of his gems.

pity those FHBs who believed what he said.

Hold on HM, you agree with Church, you said yourself multiple times that you expect interest rates to stay low at probably about 6%

Yes, if you didn't borrow to your maximum and can afford the debt servicing next year when rates are 6%+ - but for many that will be 3x what they took out a mortgage for so they won't and will lose their shirt.

I know people in this situation. They are going to lose their life savings, and potentially still owe the bank.

Church was specifically asked on the show what to do if your mortgage interest only costs have gone from 22k per year to 47k per year.

His advice, 'ride it out' which is fine if you can afford the extra payments. But most people can't find another 25k per annum net, especially with a rapidly rising cost of living.

Townhouses for rent in Auckland up to 450, a few more new shitboxes listed. Not massively up from the 430 a week or two back, but on a gentle upwards track, will keep tracking over coming weeks.

This is pretty hilarious - it's a guy from Ray White explaining in a Oneroof article why prices have dropped in Feilding: "Fleming reckoned people needed a rest from the real estate market because of everything that's going on, including the war in the Ukraine."

Yup, I'm sure the reason the first home buyers in Feilding have pulled back is because they are just so exhausted from worrying about Ukraine.

Wow.

great comedy to finish the week!

I bet we will keep hearing some crackers over coming months.

I wouldn't extend any credibility to Real estate.co.nz. You've got to remember that absolutely everything that any of these Real Estate sites say or do has the ultimate goal of creating or sustaining momentum in property sales.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.