The crazy run-up in house prices in 2021 and 2022 is now unwinding.

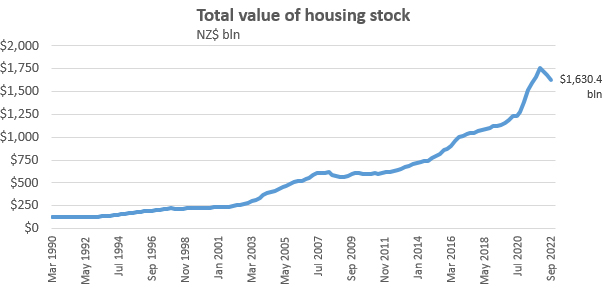

In 2020, the value of all residential housing (owner occupied and rented, combined) rose by +$194 bln to $1.386 tln. That was a +16.6% rise.

In 2021, that same value rose by another +$377 bln to $1.763 tln and a massive +27% rise.

But now those crazy animal spirits have vanished.

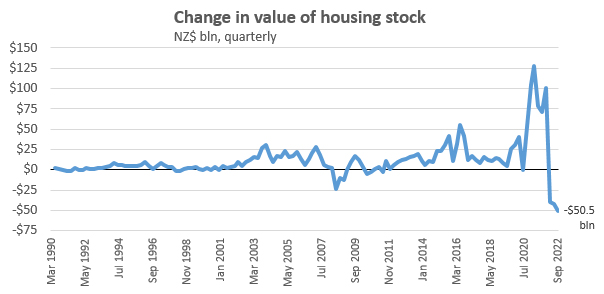

For the period to September 2022, it has been all downhill. And at an increasing speed.

In those nine months, data just released by the RBNZ (M10) shows -$132 bln has been erased from this 'value'.

-$40 bln went in the first ninety days, -$42 bln in the next 90 days to June, and -$51 bln went in the 90 days to September.

All up, that is a -7.5% retreat. It is small compared to the run-up since 2020. But it is the largest reversal in the history of New Zealand housing.

And don't forget, this overall 'value' retreat comes even though we are adding new housing stock at its biggest quantum ever. So the value-per-dwelling is going down faster than -7.5%.

There is a reasonable chance that the December quarter will have seen little change. The REINZ median house price data changed little, Barfoot selling price data didn't fall in the period either, and CoreLogic saw a "decreasing rate of house price falls" as 2022 wrapped up.

But these overall 'values' are all based on re-sales transactions, and those have been withering, especially in Q4-2022. The RBNZ's housing stock valuation is marked to market. The fact that sellers can't or won't sell on a falling market isn't accounted for.

CoreLogic noted that in these circumstances, the market may be at a "false dawn".

Rising interest rates, the prospect of a 2023 recession, and tax rules that are biting property investors, all count as depressing influences on house 'values'.

Further, new builds are adding to the housing stock, and probably at a rate faster than overall natural demand is growing. But these will sell at construction costs plus a margin, and those prices may be rising faster than overall market values. It is an unusual situation, probably unprecedented.

The situation of low demand weighing on house prices can probably only be 'rescued' by re-opened borders. But that may not 'solve' the declining-price problem either, because current prices are now at the limits of affordability, and affordability is getting tougher as mortgage interest rates rise. Returning Kiwis or new migrants will battle affordability too, and for them the issue will seem a steep one given few other global markets have prices as high as here.

We will only know we are making progress on housing affordability when house prices undergo a sustained fall, and faster than after-tax, after-inflation incomes.

This whole thing started in 2003 when the Clark/Cullen Government moved to institute a 39% top income tax rate. That proved to be at a level that incentivised a rush to shelter income, and the tax-free gains from rising housing values became a fad that could be accessed by 'anyone'.

But just to revert to December 2019 levels, the vale of all housing probably needs to fall by another -$440 bln and taking the realignment down by a total of -$½ tln. Then we might have more affordable housing. The chances? Unlikely you would assume, because it is an election year and there are probably few votes in it for the proposition. Far more likely are political parties responding to the impact of the negative wealth effect on those voters who do vote.

71 Comments

It's going to take years for construction to recover from the crash that is unfolding.

Exactly. The same old boom bust crap.

... it reminds me of the 1970's & 80's when all those Olympics athletes , predominately East German & Russians , were juiced up on steroids ... they won bags of gold medals , and set records which stood for decades ... and then those people slipped into obscurity , only for us to find that one by one they have died in their 30's , cancer ridden , victims of their state sponsored steroid programmes ...

Well , just substitute the players in this story with the names of the NZ Reserve Bank , government finance ministers ... and you have the NZ housing market ... juiced to the eyeballs , reaching record levels ... and now ... terminally ill ... ebbing away ...

Nice analogy.

From what I hear, being juiced in sports is just the norm these days.

The housing market is nothing more than supply and demand. The issue was that there were not enough houses for the demand.

Demand had gradually been increasing over the years due to the way the house construction industry has been structured to make the availability of land and new houses go up in cost a little slower than would satisfy the demand for housing.

But then with the COVID-19 pandemic lots of NZers returned home and wanted to buy or rent a house. Of course this put enormous pressure on the housing market and we saw the market value correspondingly increase.

Those tourist folk who had been doing low wage jobs such as working in hospo, of course left NZ, but they didn't own houses, and more folk with money returned than left.

so, over all, the demand to buy a house, or to rent a house, went through the roof. Building activities also increased because the property developers saw the opportunity to make pots of dosh.

Now that people with money are once again leaving NZ, and now that interest rates have doubled, and the equity requirements have been put in place, the demand for housing has fallen.

Has certainly fallen from the price point that people who own houses are wanting to sell.

Those who won out of this were the people who bought an existing house just before the pandemic hit, and who fixed their mortgage for 5 years just as the mortgage interest rates started to increase.

I dont think I've ever read a comment on this site with more anecdotal evidence in it than that.

Basically we had a demand issue, with historically low interest rates. Every man and his dog piled in. There was never a supply problem, just an endless stream of "investors".

An endless stream of investors outbidding aspiring FHB to a property title and renting it back to them. RBNZ C31 from 2014 to 2017 investors consistently outnumbered FHB 2 - 3x. In 2015, there were 65k investor borrowers vs 22k FHB. Did we really need 65k investors taking out an average of $335k in 2015???? FHB average was $323k.

Imagine if only half of that reversed

If the housing market continues on its current price trajectory, landlords might find their tenants in a position to buy their own home. One of the many new builds coming online for example. It would be a shame if this frenzy of adding "much needed" stock to the rental pool ended up being a temporary distortion and overshoots. Our rentier model of the past 20 years can only survive by forcing people to stay as tenants.

When i was watching the auctions online or on site in the last two years, I was just so flabbergasted on what all these people fighting it out in the auctions were thinking or not thinking.

Everyday normal kiwis, mum and dad fighting each other in auction rooms for that house, bidding higher and higher. It's was just not normal. They seemed like brainwashed people with access to too much liquidity with pre approval from banks.

I am sure they never thought that one day they got to pay that money back too and with interest ( in bold)

I am sure they never thought that one day they got to pay that money back too and with interest ( in bold)

And remember, this isn't 'real money' they are borrowing. You know, like loans backed by cash savings deposited at a bank. The banks more or less create this credit 'out of thin air.' Our property ponzi has some similarities to pulling a rabbit out of a hat.

They were real people who needed a home for their families, and who were buying in a sellers market where there was insufficient supply to meet demand.

They were real people who needed a home for their families, and who were buying in a sellers market where there was insufficient supply to meet demand.

That's the trade-off for your "prosperity"

They were real people who needed a home for their families, and who were buying in a sellers market where there was insufficient supply to meet demand.

I disagree, the aformentioned statement around investors was more accurate mased anecdotally on my experience for 2021 in Wellington. Predominantly investors snapping up houses thinking the capital gains gravy train would seemingly never end. Banks would lend out over 1m to FHB on a half decent income, think then what access to credit that the investors had wih a bit of equity to throw down on the deposit, a clear, real and well displayed advantage over FHB's at the time.

Yeah, I was a COVID refugee back in NZ with a fair swag of cash/no issues getting a mortgage, and I looked pretty hard at finding a pad to buy at the end of 2020 and through most of 2021, but never pulled the trigger simply because the prices versus what you get was insane and worsening by the day. I have zero regrets that I didn't get sucked in. Will await my opportunity, and if it doesn't arrive, ne'er mind, plenty of other options for me rather than to be debt enslaved for a house/property that isn't even that great.

You would not have any regrets buying like I did in September 2020.

I refuse to pay 2020 prices.... have the ability to, yet also refusing.

Unfortunately for you, you will never be able to buy at 2020 prices...

Are you serious Yvil?

While I’m sure you remain desperate for people to buy that drek, the people who can do basic math can see you’re looking at no better than 2017 prices before support at the bottom is found.

Thats if you’re lucky or did you conveniently forget about macro economics 😂

Yes, of course I'm serious. You may think you know what's going to happen with prices because you know "basic maths" but the reality is that you or I or anyone, simply doesn't know the future with any degree of certainty. History would suggest that house prices rarely drop by more than 30% in NZ which it would need to do to go back to 2020 prices.

Houses are already selling at their "2019" prices, many are not selling at all. Maybe I'll buy two if the current trajectory holds.

That is quite simply, totally untrue. Prices rose over 15% in 2020 and almost 30% in 2021.

That is quite simply, totally untrue. Prices rose over 15% in 2020 and almost 30% in 2021

Extrapolating the past into the future is not smart, particularly if it discounts or ignores worse case scenarios. But if it's a game you have to pay for mental comfort, make sure you have a robust forecasting model that you have memorized downpat for the neighbourhood BBQ and water cooler conversations.

There is no extrapolation into the future at all. Just a rebuttal that TODAY prices have already gone back to 2019 prices. No extrapolation, just actual facts

There is no extrapolation into the future at all. Just a rebuttal that TODAY prices have already gone back to 2019 prices. No extrapolation, just actual facts

Your comment illustrates how people think about market prices and their prices today and price movements into the future. You have no idea what "prices" of houses are today. All you have is a mental construct based on past house price sale indexes. For that reason, even if those indexes should a 30% increase over a time period during Covid, it does not mean house prices increased 30%, unless of course those sales are representative of the total housing mkt. Even then, that is not today.

2020 prices and lets not forget the two years wasted rent on top of that.

And paying interest on a mortgage is not 30 years wasted ?

Not when you increase your payments by 5% each year (not dissimilar to rent increases) and smash it out in 15 years.

Yep exactly right, changes in circumstances and work opportunities saw the mortgage gone in under 15 years and the inheritance came along after that.

I'd rather be mtge free at 45 - 50 than renting. $500k mtge at 8% / 30 yr vs $500 pw rent. Increase both at 5% p.a., mtge free in 15yr. A renter can invest savings from no mtge/rates/insurance.

Say they save $500 per week, return 5% compound = $560k in 15 yrs & $560k in rent. The owner maybe $1 million in 15 yr (50:50 P&I), $100k rates, $150k insurance. The mtge free 50 y/o won't pay nearly $1.2m in rent in the 15 yrs to 65.

The renter could then buy, but what's a house worth? If we manage a DTI of 4, and a h'hold income today of $110k. All increasing at 5% p.a., a $550k house could be worth $1.1m in 15 yr, so they have a 50% deposit yay. Maybe our house prices end up like Ireland, which dropped to around 3.5x at 2012 trough, but are now 8x the average income https://businessplus.ie/news/house-prices-average-income/.

More stock, lower prices, higher interest rates, declining tax rinse, sales highlighting market reality. All equals capital decline with a rush of much more downside.

Those not speculating are just enjoying todays sunshine.

Any party that comes out to allow prices to fall, but to house the bad loans on the government's books will win.

This isn't necessarily what is the best move for the economy, but the voting demographic who do own houses with mortgages are very desperate to be saved.

It comes at a very big price if we do save the property speculators. They will learn nothing, a bubble will be blown up again and they will be in the same position all over again in a few years time.

Nothing was learned from 2008 apparently, so we pay the price with interest accrued this time.

I mean, we had no issue bailing out the grey haired brigade that invested in various finance companies to the tune of $2b back in 2010.

Why can't we do that again this time for recent FHB? That would be $100k each for 20,000 borrowers. Oh wait, moral hazard only applies to boomers.

well.. as a renter I would say that I'd prefer to use that 100$ each to build even more houses, not to give them to banks.

I mean, we had no issue bailing out the grey haired brigade that invested in various finance companies to the tune of $2b back in 2010.

Remembee the argument that not bailing out SCF would have been a dagger into the heart of the South Island economy? No doubt some rural gentry had money kept with SCF leading to Team Lord Key making the call. In some ways, that's an example of the 'game of mates' that has long captured NZ.

Better to legislate for non recourse mortgage loans as USA so banks have their own skin in the ponzi game, that should moderate the excess

Maybe the bank's test rate used on the application should be the maximum rate that can be charged against that loan for the entire duration.

If a bank wants to test at 5.8% and then 12 months later rates are above 6%, tough shit, the borrower is fixing at 5.8%. Maybe the banks will apply better risk assessments, rather than baiting people into borrowing more and then going "oops there goes your deposit, oh well you mid-20's borrowers should have known interest rates couldn't stay low forever".

Good idea but it won't happen. The Aussie banks direct NZ Govt, not the other way around. The biggest gang in NZ

What about retroactively making housing loans non-recourse, so if you do end up in negative equity make the banks wear it. If the banks go under we'll have to bail them out, but there's a few billion in yearly profits and reserves that would get eaten first

Would you even have banks in NZ if that was the regulated as such? Wonder why they have that in the US? Such a big market I suppose they can make regulations like that...

Of course we would, banks make a lot of money and if the current ones left someone would replace them. We could even start our own bank.

Most people can simply go bankrupt. This is effectively the same.

Big fan of non recourse loans. Massive opposition to retroactive legislation of almost any kind.

... who is this " we " , you speak of ? ... many of us were appalled by Cullen introducing the government guarantee on bank term deposits , and by Key extending it to include finance companies ...

Stupidity isn't the sole reserve of Labour or National ... it crosses the political divide ... " stupidity " is the bridge which links them both ...

A good example of this stupidity is when Labour AND National brought in this rule where 3X3 story houses can be built on most large sections in Ak, Wn etc.

Why!!!!! What were they thinking!!!!

Look at Britain, 2 story houses everywhere. No problems at all.

Now every property has this potentially happening next door. Incredibly unsettling for those with any views or sunlight in that direction. Forever more. Why???

Are you sure on that Nzdan? My parents lost everything but their house in a finance company crash around that time, they did not get bailed out. I would be surprised if it was everyone, perhaps just those in government guaranteed schemes?

Of course if they want the government (aka the Taxpayer) to wear the cost of the bad housing loans they'll also want the government to not raise taxes to pay for it.

What we're seeing here is doublespeak for "I want someone else to pay for my own poor financial decisions".

Don't forget a revival of their smug attitude

This is a great summary of where the housing market is at and how it got here David, thanks.

There is also the issue of what is known as a stranded asset, ie a technological shift, or change in regulation that makes the asset plummet in value.

An example is when they introduced healthy home regulations like insulation minimums. These only applied to rental properties as compulsory so there are a large number of owner-occupied homes that are less than the minimum and if sold to another owner occupier then all good, but if sold to someone to rent then they need, by law, to be upgraded. This means the market for these properties is reflectively cut in half, or the sales price has to be discounted by the cost to upgrade.

This is on top of the fact that auctions as a sales technique that is used to extract maximum FOMO value from the market, no longer works.

There is still approx. 30% of the value of NZ property being non-value-added costs, ie costs that only exist due to the market's ability to ask more for something than what a truly free market could build it for, but adds no extra amenity value.

Many land policy regulations, council bureaucracy, and sales techniques like auctions all collude to extract as much extra money from the buyer as the buyer can be forced/conned into paying.

This whole thing started in 2003 when the Clark/Cullen Government moved to institute a 39% top income tax rate.

Wow that's an incredibly lazy and reductive "reasoning" for the housing bubble.

Should we mention the gutting of social housing and turning it over to the "free market" via the accommodation supplement. Resulting in spiraling rents and landlords becoming the 2nd larger recipients of welfare payments (after pensioners)?

Should we mention the deregulation of banking sector and distortions caused by risk weighting on residential housing?

Should we mention that we have one of the highest levels of immigration per head of population in the OECD with no plan on how to provide the necessary infrastructure, combined with an RMA used to stifle housing construction?

Should we mention we are the only country in the OECD that doesn't have at least one of the following taxes: Estate tax, capital gains tax or land tax

No need, we can boil it down to the fact we applied a 39% tax rate on income.

Exactly. Very reductive. It was significant, but one of many significant factors.

I think the high immigration in the 2000’s was massive, especially as much of it was high wealth immigration (compared to the lower skill profile of immigrants from 2010 onwards).

And also as you say the very restrictive planning régime (that coincided with that high immigration).

not to mention demographics (the baby boomer ‘bulge’), structural changes re: bank lending and interest rates etc etc.

But certainly Clark and Co can take a large chunk of the blame for the housing debacle.

Of course if there are more houses, but there is less demand for houses, then the market value for a house will be less than if there were fewer houses and more demand.

Another way to measure the value of housing is the replacement value.

I think you'll find that if you measured that, it would be significantly higher now than it was before the COVID-19 pandemic, and with inflation the way it is, the replacement value of housing will continue to increase.

It could be argued that replacement value of a house it its true value.

So David, if the replacement value is it's true value, and the used market has fallen well below that, what happens next? New construction plummets? The price of used houses rises? What's your view?

New construction plummets, which is what is in the process of happening right now.

So let's say for the argument that the cost of replacement for an average house is $900k, and that this will stay static ( there may be an argument this cost could drop a little, but we're in inflationary times, so not likely). Then let's say the used market for this house is $800k, so most building stops because not too many people want to lose $100k by building a house for $900k that's only worth $800k. So eventually the price of the used house will rise from its current $800k back to $900k, that right? So it's just a question of when?

Hi Harvey, the price a new build is basically land cost + building cost. The cost of building is not coming down but what is happening now is that land values are retreating. So when land values have reduced sufficiently so that a developer can buy the land + build the house + get a profit margin, then development will resume. Note, there is a significant time lag from when a piece of land is bought for development, and the time it takes to design, consent and build the house on top.

Well put.

I would add that land values may not need to keep falling to get to the point that development stacks up again *if* interest rates happened to plummet again. However, as that is unlikely (save some kind of massive black swan), then yes land prices will need to keep falling until development starts to be feasible again. And/or plateau for a few years.

It’s also important to emphasise that the cost of construction is critical to feasibility of development and therefore how much housing gets built. Possibly more important than the cost of land. Right now, building costs (materials and labour) represent around 40-50% of the sales price of a typical medium density townhouse, while land costs typically represent around 20-30% (depending on the density of development). So construction costs are another major part of the mix. They will need to decline or flatten out for several years as well.

Note that the new density standards introduced by the government and working through council’s plan change could ultimately assist with development feasibility. But that won’t be finalised until about April 2024.

Why shouldn’t the cost of building a house also come down ?

On average the cost to build a house (2022 figures) is $320K. That’s for a finish that will exceed many NZ standards.

One of the biggest factors have been labour. Supply and demand. Just as prices for homes has gone up (to a silly level) so is the price tradies could charge for their services. As demand drops, so will what they can charge.

Add to that material prices are also expected to come down as China returns to some kind of normalcy in 2023/2024.

My "reckons" is as follows:

- Land is the biggest component, so that will be the area that may see the biggest potential falls,

- Council fees is up there as well. Since the council derives revenue from these fees, if that dries up then they may have to cut

- Labour. This is limited, no builder is going to work for $5 per hour. Profit margins from larger firms on the other hand?

- Materials. I find it hard to believe manufacturers have not increased their wholesale prices at a rate well above their cost input increases to gouge at people's ability to pay. Would a sheet of GIB still sell for $30+ if mortgage rates stayed at 9 - 10% since 2008?

-Presumably councils factor in subdivision revenue in their budgets so maybe if they do reduce costs there, there will be commensurate rates increases.

- margins for larger building companies are less than smaller ones, 3-5% for group home builders. As some fall on hard times they'll likely rationalise starting at head office, hard to say if that'll trickle down to lower prices

-if local manufacturers were gouging that much, there'd be a good business case to import. Usually once you add freight, local hardware is cheaper.

About the only area I see some reduction in costs is if the industry returns to more normal footing, at the moment and for the last 3 years completion times are up to 4x longer than they should be. Expensive.

Well there is a good business case to import as was evident with our GIB fiasco. The problem was all the BRANZ red tape, council and design specifications has monopolized key components.

The Chinese company is able to export standard 1200mm x 2400mm plasterboard for about $21 per sheet, including manufacturing, shipping and taxes.

All while the cost of international container shipping has tripled in cost? So what you're saying, is if we can import for $21 per sheet then local hardware should be cheaper at what? $18 per sheet?

https://www.stuff.co.nz/business/128697392/unable-to-source-gib-here-fr…

I haven't see imported plasterboard at $21 per sheet. You can get closer to 24/25 per sheet for something no named, you still can't really source actual gib reliably, but that's about what you pay if you're buying volume. It's also about what you'd pay in a market like the US.

How many sheets of gib do you think go into a house and how much cheaper do you think the house will cost to build if you save a couple bucks a sheet on gib?

As a generalization, the replacement value/cost to build value is the minimum a property is worth. Because if it was with less than this then there is no incentive to build.

But the real question is, "what is the true cost to build?" For example for development land, the raw land value should be the same or only slightly more than its next-best-use economic value.

So in a truly free market, if a developer was buying land that was being used for dairy farming, they would and could buy that at approx. $50,000 per ha. However, due to poor Govt. land use policies with how they zone, they create an artificial next-best use economic value called land banking. This enables the land available to build on now to be deliberately limited ie a monopoly restriction, and now the land is artificially inflated up in value to extract as much value out of it as the market can bear, ie $2,000,000 plus per ha. And cannot be bought for less than this.

For the buyers of the end house product, to afford this unnecessary extra coat they have to take it from the future in carrying extra debt, or other more immediate funds they would have spent on health, education, savings, and/or working extra hours.

The only way developers can 'help' with this is to build smaller lower quality houses to 'fit' within the maximum value that can be extracted. But in doing this, any saving is within one build cycle captured by the regulations that are the most restrictive, namely land, and consenting costs.

Thus it is a rinse and repeat; the costs of which go up greater than any pay increase you get, until the day no more can be extracted, and the market crashes.

Any guesses about where we are in that cycle?

So we have to let people sell land and develop the way they want, this zoning is holding up land prices, we could end it, but council....

Micheal Pettis on the current state of the China housing bubble:

Property prices relative to household income are still two to four times in China what they are in the rest of the world, and the sector accounts for more than twice the share of economic activity.

Good luck if you're expecting busloads of Chinese scouring NZ suburbs willing to take your bolthole for a king's ransom.

https://www.scmp.com/comment/opinion/article/3206254/painful-it-china-m…

Depends if your suburb is a central leafy green one.

This is also a good bit from the article and is completely relevant for NZ:

"Businesses that bet aggressively on the property sector by buying more land than they need for their operations, or that gear their operations to serving an ever-expanding property sector, will also outperform their competitors.

Households who borrow aggressively to buy the largest – and most – flats they can afford become rich far more quickly. Property developers who invent new ways to leverage their land purchases grow faster than their more prudent competitors. Even local governments learn to speculate on ever-rising land sale revenues for their funding, and will reorient their spending to fund projects designed to fuel further rising land sale revenues.

Over time, as the more “prudent” banks, businesses, households and local governments fall behind their competitors, the economy shifts its operations and balance sheets in ways that become increasingly speculative and dependent on rising real estate prices. At some point, which China reached around a decade ago, their speculative behaviour itself becomes a main driver of continued rising prices."

Factoids...

27k of stock on Trademe. Growing by 200 a day!

39k of new builds (thank to Arderns late and over zealous " housing for the homeless/car living AKA poor " rollout) that are not selling due to these so called " affordable " housing being... "UNAFFORDABLE".. WHAT A CLUSTER !!!

50000 SECTIONS CONSENTED FOR DEVELOPMENT OVER THE NEXT 3 MONTHS.

SO.... WE HAVE CLOSE TO 80K OF UNAFFORDABLE HOUSES JUST STARTING TO BE DISCOUNTED. WE HAVE THOUSAND OF UNSOLD SECTIONS THAT WILL SIT UNSOLD. And buyers drying up faster than summer grass on northlands farm's.

Soooo.,. Huge supply v low demand =

Crash!!!💥💥💥

Factoids...

27k of stock on Trademe. Growing by 200 a day!

39k of new builds (thank to Arderns late and over zealous " housing for the homeless/car living AKA poor " rollout) that are not selling due to these so called " affordable " housing being... "UNAFFORDABLE".. WHAT A CLUSTER !!!

50000 SECTIONS CONSENTED FOR DEVELOPMENT OVER THE NEXT 3 MONTHS.

SO.... WE HAVE CLOSE TO 80K OF UNAFFORDABLE HOUSES JUST STARTING TO BE DISCOUNTED. WE HAVE THOUSAND OF UNSOLD SECTIONS THAT WILL SIT UNSOLD. And buyers drying up faster than summer grass on northlands farm's.

Soooo.,. Huge supply v low demand =

Crash!!!💥💥💥

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.