House prices are now in full retreat throughout the country, according to the latest figures from the Real Estate Institute of New Zealand, with prices in parts of Auckland declining by more than $400,000 over the last year.

According to the REINZ's House Price Index, which adjusts for differences in the mix of properties each month to give a more accurate picture of overall movements in the market compared to average or median prices, prices nationally have declined 13.9% over the 12 months to January and are now 16.2% lower than they were when the market peaked in November 2021.

The first table below shows the regional changes in the HPI, with the biggest fall occurring in Wellington where prices have dropped by almost a quarter (24.4%) compared to their November 2021 peak.

But the Auckland region wasn't far behind with a 21.4% decline from the November 2021 peak.

As the table shows, more than half the regions around the country (Northland, Waikato, Bay of Plenty, Gisborne/Hawkes Bay, Manawatu-Whanganui, Wellington) are now showing double digit percentage price falls from their market peaks.

Even areas where prices have proven more resilient are now showing declines, with the HPI for Taranaki down 4.3% from its peak.

Although the REINZ does not publish separate HPI figures for Queenstown-Lakes, the median price for the district in January this year was $20,000 lower than January last year.

The REINZ's median price figures also suggest there has been extreme price carnage in some of the Auckland and Wellington sub-districts that do not have their own HPI figures.

In Auckland, the median selling price in Rodney declined by $435,000 between January last year ($1,345,000) and January this year ($910,000), while the median price in Auckland's leafy central suburbs declined by $332,500. Over the same period the median in Manukau was down by $272,000, and in Waitakere it dropped by $253,000 for the year.

In January last year, all sub-districts of the Auckland region except Papakura had median prices well above $1 million, but in January this year only the North Shore had a median that remained above that figure, the rest have dropped to well below $1 million.

Within the Wellington region, median price declines over the year to January were particularly steep in South Wairarapa -$320,000, Wellington City -$175,000, Masterton -$170,000 and Kapiti Coast -$140,000.

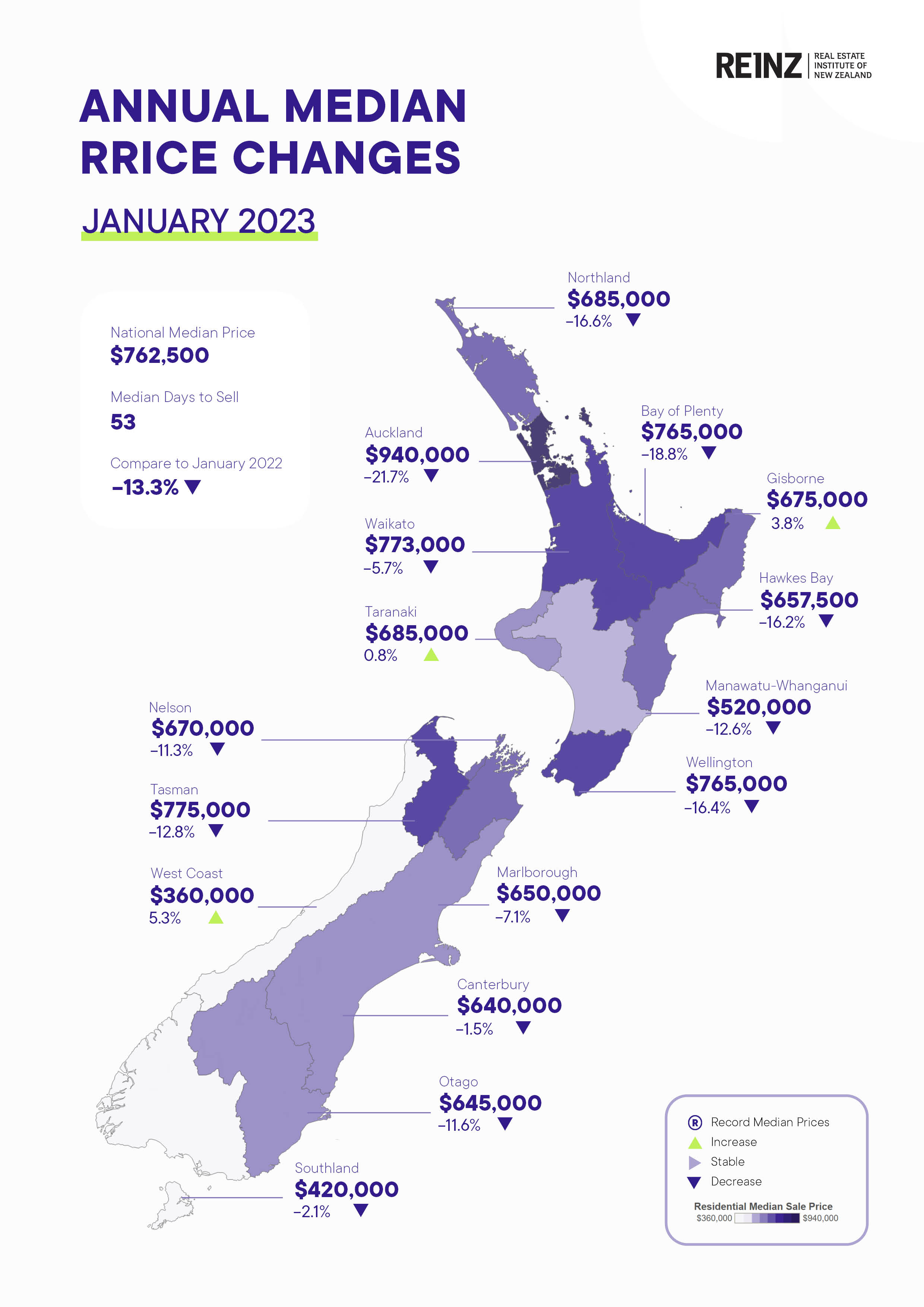

The second chart below shows the main regional median prices and their annual percentage change.

The comment stream on this story is now closed.

REINZ House Price Index - January 2023

- You can have articles like this delivered directly to your inbox via our free Property Newsletter. We send it out 3-5 times a week with all of our property-related news, including auction results, interest rate movements and market commentary and analysis. To start receiving them, register here (it's free) and when approved you can select any of our free email newsletters.

97 Comments

This is a serious downturn in the cycle, and it has further to go before it stabilises and the next upturn starts.

I prefer the term "price discovery" to 'property cycle'.

'Value discovery'? Or are we not down there yet?

What about 'rrice discovery'?

Wow. We 100% agree for once.

The perfect time to introduce policies to stabilize the housing market and take away the ability to speculate with non-value-added price increases will be at the bottom of this cycle.

While that would solve the housing affordability crisis, it will open up another one, namely, all those people with lost equity, many still paying off the debt on that lost equity, will have no ability to go back to the roulette wheel to win lucky with another housing boom before they retire.

The NZ economy is going to look as pretty and as productive as a farm that, as the flood waters recede, is left covered in silt and forestry slash.

"House price carnage" Some would argue carnage is coming from all directions. As the infrastructure repair effort ramps up, more rates, insurance and material cost price increases are in the pipeline. High sustained inflation and interest rates too. It makes it harder to time a bottoming of prices, let alone price recovery (upturn).

So we know that loss aversion refers to a phenomenon where a real or potential loss is perceived as psychologically or emotionally more severe than an equivalent gain (the pain of losing $100 is often far greater than the buzz of gaining the same amount).

This is why the impact of the the 'wealth effect' is so crucial to consumer spending. Would love to see how the actual data of all the 'nice to have' purchase occasions is tracking.

I wonder if Robbo, Orr, etc have ever explored the work of Shiller, Kahneman, and Thaler.

We shouldn’t base any public policy on junk behavioural economics, whether it’s the wealth effect or loss aversion. It doesn’t replicate. (At least Kahneman is intellectually honest about this).

Unfortunately, many public sector agencies have been put through a one day nudge course, so this nonsense is getting institutionalised.

We shouldn’t base any public policy on junk behavioural economics, whether it’s the wealth effect or loss aversion. It doesn’t replicate. (At least Kahneman is intellectually honest about this).

With all respects Power, all purchase decisions are based on trade-offs. Conjoint analysis is pretty damn accurate as it is based around 'real life' behaviors and advanced computational analysis.

At some point these specuvestors who thought they were sitting on xx in cap gains will wake up and realise the latest weather vent is the nail in the coffin. Their paper gains have permanently evaporated.

Their dream of a Nat Govt inflating the ppty market now also crushed.

Yup, the market will have gone through a sustained period of winter carnage before a possible Nat-ACT govt takes charge.

Ive been a big critic of the current Labour govt but truth be told, I'd rather have Chippy on the wheel come Oct trying to rebuild our economy with something other than housing speculation and ultraloose migration.

Agreed. Nationals goose the property speculation and bank profit at all costs is unelectable.

Yes. However since Labour got elected, we’ve seen 2-3x increases in property prices, historically high migration and historically low OCR.

..........not so fast!!! Your 2-3x is faaaar from baked in now.

Some credit --- the interest change to rentals was brilliant. Only deductions for new builds.

National are on a hiding to nothing campaigning on changing that back. So disengaged its embarrassing for them.

Oh how they tide has turned since exit Jacinda.

Shall we call it Jexxit?

..........not so fast!!! Your 2-3x is faaaar from baked in now.

Can you please back it up with data and not feelings?

It depends on the region, but where I am in Lower Hutt, we have plenty of houses that went 2-3x from 2017 to 2021's peak.

Walk around:

https://homes.co.nz/address/lower-hutt/stokes-valley/1-420-stokes-valle…

Agreed, I think Wairarapa has doubled in that time. Check the HPI charts, they will show the increase

Our first home in 2017 ~$200k. Sold December 2021 for very late $500's.

80sqm Keith Hay on 1/5 acre in Masterton.

And you then bought something at $600-$700 + that has gone down 20 % in value ..?

A little higher than that. But yes probably something like 20% in value, although the bank is trying to tell us it's only 10%.

We bought with a nearly 50% deposit, had a very small mortgage on our old place so mostly gains. A DTI of around 3 at the moment so not stressing. Our daughter is 6 and her school is 300m away so we're not crying over paper losses.

This Jacinda light won't do anything but spend more and keep inflationary pressures high...

They keyword there is 'trying'. How have Labour done with trying to fix the housing issues in the last 5 years. Are New Zealanders better off?

Weren't they saying last year that the pace of building in the property market was catching up quickly and soon there would be a glut? Isn't that why there is a need for all this immigration...to fill all the new beds AND the fields. I would say they've had some success, except for rental prices making filling those new beds begin to be a bit tricky.

I would have to argue that with the vast increases in house and land price seen 2020 onwards on account of interest rates holding too low for too long, the FLP and lockdowns leaving NZ'ers with excess cash they would have otherwise spent on overseas travel (generalisation for the last point but real in many instances), there was huge incentive for developers to buy up and build for profit was ever increasing at the time. Councils were more than happy to take the cash for opening up more land as the money was there in front of them. The government itself cannot IMO be seen to be the cause therefore of building said houses, and the oversupply is simply due to the lag in time to build, however filling the glut will be a by product of immigration policy more so than it is a target of it

According to the figures in the above table, the median (literally, in every sense of the word) Wellington house we sold just under 3 years ago is just $30k above its 2020 sale price now, which after inflation represents a real drop. That sale was just before everything started to go crazy(er), so it's lost a paper $270k in the past 2 years.

Prices in Wellington still need to drop another $200k for a median house to get into the definition of affordable territory.

Except you can't separate comments about affordability without stating what the mortgage rates are and what the average family earns minus expenses...

I assume you mean that a $200 grand drop needs to occur with these other two things remaining what they are at present.

Why are you so interested in the "specuvestors", rastus? Are you an investor as well? If not, then why?

Interested? Because of the influence they have and the distortion and damaging affect on NZ - a once great place prior to this greed.

My personal finances are of no importance.

Serious downturn is widely accepted but who knows how far it might go and all the ramifications if vendors or potential ones begin to panic?

We know rising interest rates has drastically reduced what people can afford to pay. This has been reflected in the sales prices decreasing but also sales volumes reducing to record lows.

But we are yet to see the full impact on existing owners, as only a portion of the rate rises have flowed through. If the RBNZ predictions are correct (not that their forecasting track record inspires confidence) we will see interest rates remain high, as unemployment rises substantially.

So we run the real risk of an increasing number of “motivated” sellers at a time when there is a lack of buyers who can afford to borrow enough to pay current prices.

Well put.

Well actually some of us planned ahead and applied for an equity topup to a reasonable below peak price just before prices started 'adjusting' in Oz. Fortunately we now have a healthy upper limit and cash sitting waiting to be redrawn when we find the right property at the right price. Now that prices are looking up in NZ we will do a quick refresh and sell out of our Oz burbs property and into a lifestyle in NZ. We'll pay a little less than the value we get in Oz I order to maintain a buffer, and fortunately we have a property that appears to maintain a higher threshold than most that are falling in the outer burbs.

I had almost given up hope we could afford this in NZ but I won't complain that there appears to be a greater levelling out across the ditch.

Glorious, I look forward to buying at the bottom in a year or two.

You might need to buy something with a high fence with razor wire, security camera system, and guard dogs if we extrapolate the past 12 month price movements over the next few years.

I am still picking 2027 as the bottom

Lucky you, to know when the bottom is (not in hindsight) VM. Would you be so kind and share with us who don't own a crystal ball, when that is? Much appreciated!

It does not matter what anyone else thinks.

I think it's best to make up your own mind. (Assuming an acceptable level of competence).

Wait until transaction volumes increase and time on the market starts to decrease. That will be the signal of an upturn.

Few years away yet.

West coast the place to be!

Yes. Looking stable. But avoid rivers and beaches: high ground, but not too high.

Hamilton pretty much ok. If it wasn’t for the news I’d be wondering what the fuss was about. Non event in our household.

just need to sort out the ram raid industry.

That’s a mighty big river up there in the Waikato.

Be quick!!!!

I wonder if his basement boys got flooded?

$320k median decline in South Wairarapa is insane, probably 40% or more. Must be on extremely low sales volume.

Yes, I can’t open the property report but lately it’s been less than 10 sales per month. But we never hear about them even asking the agents outright, not many prices published and homes.co shows Wairarapa steadily increasing in price since 2021, list prices are mostly 2021 prices. Everyone thinks their modest lifestyle block is worth $2 million.

Land value can drop but materials and labour will remain stubbornly higher due to Gabrielle.

What happens when prices approach the cost of building? That might not be as low as some might hope. Having recently finished a modest renno in the provinces I can't reconcile a drop of more than another 10-15% with the "bottom", however hard I try to.

You do know it's possible for an existing building to cost less than a new one, right? Kind of like how new cars are generally more expensive than second-hand ones?

It hasn't been that way for a while, I'll admit, as specuvestors kept buying existing stock displacing FHBs into new builds, pushing the price of existing stock up. Until you see 'investors' return to the market in droves - possibly tied to interest rates and credit availability - expect to see the price of existing houses continue to drop.

Logical.

Housing policy changes alone won't bring speculators back into the market without another prolonged period of ultra-low interest rates.

For RBNZ to reinstate easing, tradable inflation has to drop to near-zero while non-tradables settle under 3%, bringing overall CPI to under 2%. How long before that happens?

Precisely. There's nothing preventing a house that cost $100k to build 20 years ago from selling for $200k except for the loose credit conditions.

I'd also argue, had mortgage rates stayed at 10% from 2008 onwards, we wouldn't see new building costs where they are today. If the margins behind a sheet of GIB have not increased to match people's ability to pay, then the Winstones pricing team are incompetent.

Second that

What happens when prices approach the cost of building?

People stop building.

They stop building where land value is low. In Auckland the land value is such a big component of the value - the land price drops and they start building - or the person sitting on the building consent says "selling the land I take a bath anyway' - I will just build anyway.

What happens when prices approach the cost of building?

The construction industry collapses, which will happen later this year and in 2024

I don't see it as carnage as the places prices have fallen by 300k also probably rose by 600k within a short period of year and half.

So they are still 300k up so still high and unreasonable.

With inflation the prices probably should only have risen by 50-60k in that year and half. So all those with houses are still sitting on big gains.

The valuations need a reset downwards to be reasonable.

So they are still 300k up so still high and unreasonable.

Depends how quickly you can realize that gain. If you can it all. Arguably you're worse off because of 2nd-order effects, such as the destruction of the wealth effect.

The wealth effect doesn't exist.

The wealth effect doesn't exist.

Other people tell me the same. The work of people like Robert Shiller suggests that it does exist. Also, the RBA has also done research that suggests the wealth effect is alive and well.

There is a robust cross-sectional relationship between changes in housing wealth and new vehicle registrations. Even though new vehicle registrations are a relatively narrow measure of consumption, because this measure is available across postcodes, it is well suited to identifying a relationship between housing wealth and consumption.

The preferred estimate suggests that a 1 per cent increase in housing wealth is associated with a one-half per cent increase in new vehicle registrations. Evidence from the United States indicates that new vehicle consumption is particularly sensitive to a change in housing wealth and, under the assumption that this is also true for Australia, the estimates imply that each dollar increase in housing wealth is associated with an increase in total consumption of less than one-quarter of a cent.

https://www.rba.gov.au/publications/bulletin/2015/sep/2.html

That's true. The RBA has published research in the past decade concluding that wealth effect does exist.

RBA estimates that a 10 per cent change in housing wealth affects consumption by 0.75 per cent in the short run and 1.5 per cent in the long run.

RBA estimates that a 10 per cent change in housing wealth affects consumption by 0.75 per cent in the short run and 1.5 per cent in the long run.

Which I think probably doesn't accurately reflect the here and the now. The RBA's research has been done throughout a time series of 'prices double every 7-10 years'.

Did they research the negative wealth effect. Or is that part of the current experiment (to sit im their ivory tower and note what happens as house prices fall?)

Funny how we argue the perceived psychological effects of paper money on spending which affects single digit percentages of the economy but completely ignore the psychological effects of overvalued house prices on an entire generation and its demographic consequences

See my post above - our house sold 3 years ago was the Wellington median price (and house). It's now only $30k off the 2020 sale price. That's a 4% gain over 3 years if there's been no improvements to the property...

No. That's what you think it's worth based on aggregate sales data.

It was a median house - bedrooms, land, square metreage in a median suburb. The aggregate data should be within the ballpark. The point is, Wellington is seeing a bit of sense.

*If you believe the market was sensical in 2020

If you bought before that $600k rise, then you're sweet. But for the market to measure a rise of $600k, there needs to be corresponding sales. It's those purchasers that have lost $300k.

Housing market will continue to fall as average wage couples still have no chance of buying in Auckland and many other area’s from scratch, many who purchased at the top of market when rates were around 3% will now see huge raises in monthly cost when they have to refinance.

We also need to reflect that houses haven't sold so the data is thin. If you compare Wellington to Auckland, my impression is that people said "well that's what it is worth" and moved on while Auckland said "this is a passing glitch and I will take my property off the market"

If you compare the actual sales in Wellington they are down 22% compared to Jan last year (257/329) compared to Auckland down 30% (943/1346)

My impression is that Wellington may currently look worse - but the sales at the lower levels in Auckland haven't eventuated yet. Therefore the HPI is correct for the mix of sales (great tool) but doesn't reflect the people who are holding off selling.

20% of the houses selling are down 15% on the index. 80% of the houses are not selling and thus aren't measured. So one can only assume that 15% is best case.

Imagine if we could pair pre-approvals data (amounts + maximum deposit) with HPI data.

Fun rationalisation, but market statistics aren't based on what people wanted to happen, but what did happen.

Trying to account for everyone that didn't sell/list because prices were too low is as meaningless as accounting for people that didn't buy because prices were too high.

Note that those numbers (though lower) aren't trivial, still enough to be representative.

What goes up must come down.

Fantastic

There's gonna be no shortage of suitable imagery for putting on this year's HPI articles. Just go for a row around the streets of Gizzy with your camera and save a fortune on stock photo licenses.

It doesn't yet feel that we are in the "fear" part of the market cycle but we are not far off....

My view is it will start increasing soon and once the slide starts its hard to stop.

I like investing well after the capitulation part and into the dismay which bumps across the bottom for a year or more.

Thats always been the best time for me :)

prices still look like they have a bit further to fall before there is a corrective whip back from over-sold positions the other way.

Haha good ol' Tony...

Yeah… ‘whip back’ suggests a rebound, something noticeably stronger than what I, for one, thinks will occur ( which is eventually a stabilisation, then small incremental gains)

Got to give to him and the industry - they continue to come up with creative statements to try and stir fomo... I'd struggle to say "be quick" in so many different ways...

His rapid fire seven reasons was quite funny. He then caveats by saying none of that means prices will suddenly revert, and prices have a bit further to fall.

Most of his points are highly contestable.

And OneRoof features a story about a FHB buying an apartment for 25k…. Quick look of the photo I think it’s leasehold and leaky.

Jesus friggin Christ

Prices need to fall another 40% then I’d say they’d be at fair value.

I think if you could buy an auckland rental for $600k it would still be a lousy investment when compared with putting the deposit on a good term deposit rate

the tide has gone out on this one

40% falls won't be enough

its a long way back until the investment spits out an actual cash return each month that competes with a term deposit, considering the capital risk and hassle

without capital gains there is no reason to purchase

game over

Exactly. Doing very well to find a property offering a 4.5% gross return.

And the better returns (4-4.5%) tend to be in new townhouses, which for the most part (excepting better, very well located ones) are unlikely to see much in the way of capital gains next 5-10 years.

you have to factor in the weather event...

on the plus side you have some properties being temporarily removed from the selling pool which provides a cap on supply.

off set this with the uncertainty of whether the house has hidden structural damage which will dampen buyer confidence

... Though regions that didn't have the bad weather also experienced the slide.

House prices in decline. Never thought my houses were worth what the online agent manipulated estimation tools said they were, so no big. That said I'm not stacking ridiculous debt in an attempt to avoid paying tax either. I guess the risk downside of being a speculator (debt not supported by income) is starting to occur...and wax in specarus's wings are melting, and they no longer generate lift.

The fall back to price being supported by yield is a long one.

I work in a law firm. We have recently had a few solicitors 'seconded' from our property team to litigation and family law because of the lack of transactional work at the moment. Also an uptick in cases on purchasers failing to settle etc. Even had one where it turned out the purchaser was completely fictitous. Interesting times ahead.

Real estate, conveyencing, mortgage brokers, builders, tradies, developers ... and related industries are all seeing the start of the quietbust cycle.

Its great you can dedeploy staff. Orr wants to see layoffs in significant numbers.. these industries and then retail are the likely ones to provide them

Pity we don't have a capital gains tax. Losses could offset tax paid elsewhere.

Prices can’t fall Then, prices will only fall 11-15%

Auckland 21% so far and not finished

30% drop now looking not outrageous

I think it's easy for people to dismiss. As you say, Auckland down 21% so far. Does it feel like it though? Not really, the rain's still wet. The sun shines. Wind blows. It's only when the bank starts knocking on their door that it effects them personally and it becomes "real".

Price rises and falls over time as a zig zag

Buying before bottom loses money

Bottom of sales will be 6-9 months after rates stop rising

Meaning at least May 24 before drop stops

Why do you think the bottom is 6-9 months after rates stop rising?

Usual lag. Fixed rates renewing higher

wages lag prices

Economic effects take time with rate rises

😊

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.