In the last twelve months, the state of the residential housing market has often dominated headlines in Australia. The tone has sometimes been apocalyptic – tumbling house prices, soaring interest rates, the mortgage cliff, negative equity, and defaulting homeowners.

While house prices now appear to have bottomed out, the angst around interest rates continues. The Reserve Bank of Australia has been slower to raise rates than many of its overseas counterparts. Compare the Aussie cash rate of 4.1% with New Zealand’s 5.5% and the UK’s 5%.

Fortunately, Wednesday’s inflation figure for the year to May was 5.6%, lower than market expectations. Nevertheless, there’s still a risk of at least one more rate hike and that wouldn’t be good news for millions of mortgaged homeowners.

However, there’s one sector of the housing market that’s generally immune to interest rate movements and it appears to be booming. The prestige market.

The headline of a recent research note from the National Australia Bank says it all – ‘Luxury property continues to attract staggering prices’. In terms of interest rate rises, the bank says, ‘the prestige buying cohort has been largely unaffected when compared to the broader market’.

That’s certainly the case at the very top end according to figures published by The Australian. In the current financial year ending 30 June, the entry level price to make the list of the ten highest value sales in Australia was A$52 million. That’s significantly up on last year’s entry point of $34 million.

The highest price was $130 million paid by tech billionaire Scott Farquhar, co-founder of Atlassian, and his wife for a non-waterfront property in Point Piper. The vendor acquired the house back in 1996 for just $9 million.

Seven of the top ten properties were located in Sydney’s eastern suburbs and three in Melbourne’s Toorak.

One particular case demonstrates the strength of the market for premium properties. Businessman Arthur Tzaneros paid $61 million to purchase a house in Bellevue Hill, Sydney. He already had a house in nearby Vaucluse that he bought for $32 million in September 2021. As that house is now surplus to requirements, it’s reportedly back on the market for $50-55 million. Even at the lower end of expectations, that would be a gain of 56% for Tzaneros in less than two years.

Clearly interest rate rises are not a problem for everyone.

Another sign of the buoyancy in the luxury residential market is the strength of high-end apartments. Developer Lendlease is currently completing ‘One Sydney Harbour’, its mammoth three tower residential complex at Barangaroo on the western side of the CBD. Sales to date exceed $3.7 billion with over 90% of all apartments sold. That includes a three-storey penthouse that sold for $140 million several years ago, making it Australia’s most expensive residence.

Lendlease is also developing ‘One Circular Quay’ in the heart of Sydney with views of the Opera House and the Harbour Bridge. It’s a 58-storey tower with 158 apartments. Prices for a two-bedroom unit start at $11 million and Lendlease is seeking more than $140 million for the penthouse. While One Circular Quay is not due for completion until 2026, over half the apartments have already been sold.

Unsurprisingly, many apartments at these prices are purchased by international buyers.

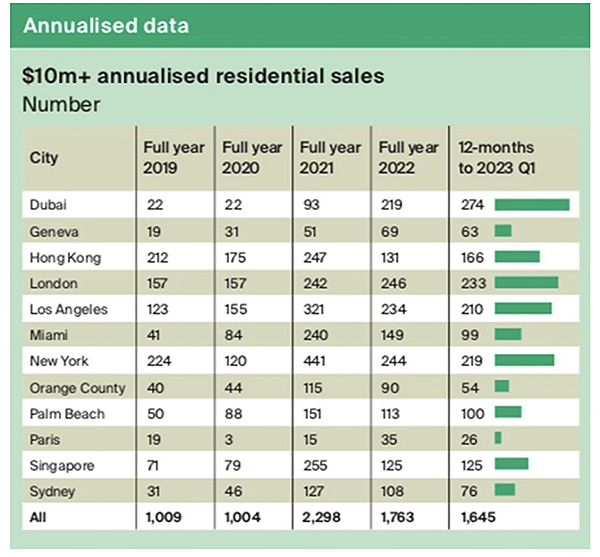

Sydney is one of 12 luxury residential markets around the world tracked by property services group Knight Frank. According to the group’s latest ‘Global Super-Prime Intelligence’ report, in the year to March 2023 Sydney placed ninth for the number of ‘super-prime’ sales – sales over US$10 million (A$15 million). It had 76 sales above that level.

Source: Knight Frank Australia

Knight Frank Australia’s Head of Residential Erin van Tuil said that ‘over the past five years Sydney’s super-prime market had matured and as a result will increasingly attract more international buyers’. The largest group of foreign owners of prime homes in Australia come from the UK, followed by the US, Singapore, and China.

Knight Frank’s assessment is backed up by the ‘Private Wealth Migration Report 2023’ from migration services firm Henley & Partners. That report tracks the net movement between countries of ‘high net worth individuals’ (HNWI) – individuals with investable assets of at least US$1 Million.

In the current year, Henley & Partners forecasts that Australia will have a net inflow of millionaire migrants higher than any other country. (New Zealand is also predicted to make the top ten.)

Source: Henley & Partners

The report states that ‘Australia consistently attracts sizeable numbers of millionaires every year, mainly from Asia and Africa, but more recently from high-income countries such as the UK’. It attributes Australia’s appeal to a range of factors, including the health and education systems, the weather and scenery, the safety and security, the advanced economy, and the points-based immigration system ‘which favours wealthy individuals and those with professional qualifications’.

Many of these factors are reflected in the strong showing of Australian cities in the latest ‘Global Liveability Index’ from the Economist Intelligence Unit. This year Melbourne is ranked number three, ahead of Sydney at number four. (Vienna and Copenhagen take the top two spots.) Perth and Adelaide are equal at number 12 and Brisbane is at number 16. (Auckland comes in at number 10.)

All the signs are that wealthy migrants (and investors) will continue to view the lucky country as an enticing destination. That augurs well for the Australian property market in general, and for the top end in Sydney and Melbourne in particular.

It’s hard to imagine, but today’s dizzying prices for super-prime Sydney real estate may soon look like a bargain.

*Ross Stitt is a freelance writer with a PhD in political science. He is a New Zealander based in Sydney. His articles are part of our 'Understanding Australia' series.

24 Comments

The title makes no mention that the article focuses exclusively on the luxury market and says nothing about the overall state of the whole market

That's misleading

To be fair David Parker makes decisions on taxation using the same approach...

I like that 😉

Another world.

As an aside, there is an interesting comment: "New Zealand is also predicted to make the top ten (of countries with a net inflow of millionaire migrants)."

So often I read comments on this site with a strong prejudice slagging-off immigrants as being poor, cant afford housing, and are Uber drivers.

The reality is that a number of immigrants enter under the active investor criteria with $15million . . . . and despite the common doom and gloom about NZ, we gain more financially wealthy than we loose. (In addition there is also the entrepreneur visa with $100k to invest as well as living expenses).

By the way, those who slag Uber drivers should put their prejudices aside and have a friendly talk with their driver. Many are simply working second jobs to get ahead and a number are well qualified (doctors etc) waiting for their qualifications to be recognised.

That’s awesome news! They must be coming to invest their money in productive business!

ROFLMAO...well played.

Oh, yeah, we're being flooded with rich immigrants:

According to the Ministry of Business, Immigration and Employment (MBIE), just 15 people have applied for the new investor visa since it was launched six months ago. That compares with 492, according to BusinessDesk, who applied in 2021 under the previous criteria, which was in place until mid-2022.

sauce: https://www.theguardian.com/world/2023/apr/06/new-zealand-loses-appeal-…, Apr 2023 (sorry, paywalled at 3 free articles / month)

The new conditions explained: https://nzil.co.nz/visa-information/investor-visa/; basically "I'm loaded and I want to buy a house in NZ" is no longer good enough

But, yeah, please do keep telling us how the wealthy immigrants are saving the housing market - I always love the mental gymnastics employed in this argument, and also about the soon-to-be-visible bottoming out of the market, especially with the ramp up of the discourse going on in the past month - 6 weeks

There really is nothing to back up the first two paragraphs. The Sydney market, luxury and normal, have kept booming.

That dead cat sure can bounce. I guess human psychology never changes.

I wonder if it's partly due to Russia's war in Ukraine that some rich europeans are choosing to move somewhere far away from the effects of an escalating war, not least of which is the potential for a nuclear disaster (Zaporizhzhia power plant exploding for example), etc. Places like Aus and NZ ("first world" countries) which are really far away, seem quite attractive from that point of view. Not to mention all the other great things which make Aus and NZ attractive countries to live in.

One can only hope that this property boom in the luxury market isn't going to spill over into the lower end of the property market any time soon.

Just wait until climate change really kicks into gear and growing food in many counties becomes problematic. Going forward, New Zealand is going to be the go to bolt hole location to escape all sorts of serious issues. Kiwis are pretty dumb though, the lights will not come on until boat loads of illegal immigrants start trying to get here.

That's what the big red country to our North West is for. Closer to Asia, way too much coastline to police.

I don't think they need to police it, its so inhospitable you wouldn't last a week and that's without the snakes thrown in for good measure to improve "Border security"

I don't think you understand. They are simply Asylum Seekers. Just ask any of the 5 million that Uncle Joe let in through the southern border of the US since he came to power in 2021. And that view is supported by the 77 million who voted for him. TWhereas the other 70 million MAGA supporters think more like Kiwi's and Aussies on that issue. About 10% may be Asylum seekers. Doubtful the millions of 18 to 30 years old single men that have been welcomed into the country are. MAGA supporters would simply accept the obvious--Illegals-period! But the President has the authority to close his eyes and look the other way.

Has anyone read this article? Care to share?

And we think Auckland is expensive: Prices for a two-bedroom unit start at $11 million and Lendlease is seeking more than $140 million for the penthouse.

I wonder if a similar thing is happening in nz. Queenstown so far has had rising prices over the last few months where the rest of the country has had some quite steep declines.

Good point Jamin

Thanks for writing an article about the high end of Real Estate for a change, it's very interesting!

"I paid 17% interest rates back in the day" is one of the favourite boomer self-victimisation myths in Aussie and NZ.

Ridiculed by the MSM.

news.com.au/finance/economy/interest-rates/double-whammy-facing-aussie-homeowners-as-interest-rates-soar-while-wages-stagnate/news-story/013d5cacec26162df72dd688fff03cea

I keep hearing this high interest rate back in the day story recently. It is to minimize the current problems.

The reason why interest rates were so high back then, was because inflation was so high.

Interest rate - inflation = Real interest rate.

Inflation was sometimes so high, people were paying negative real rates.

I suspect it's more about "one-upmanship" from a narcissistic generation. They were the real mememe generation, couldn't save hard when term deposit rates were double digits to buy the house with cash. Instead rushed out and took out multiple mortgages in their early 20's and got very lucky with favorable monetary policy going forward.

They certainly did manufacture their own crisis. Could they not just save for a few years and buy the house with cash? Seems like they're the very frivolous, mememememe generation that they like to label young people. Quite embarrassing really.

Saving 2 - 3 years worth of salary @ 15% TD rates to buy a house with cash, vs saving 2 - 3 years worth of salary @ 2% TD for a down payment. Yet the former chose to take out multiple mortgages at 17%, 22% (changes every day) mortgage rates.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.