The housing market continued to crawl along the bottom in July, with sales numbers and median prices both declining further compared to June.

The Real Estate Institute of New Zealand recorded 4903 residential property sales across the country in July, down 15.6% compared to June. That is, however, up 1.6% compared to July last year.

The national median selling price in July was $770,000, which was down 1.3% compared to June and down 4.9% compared to July last year.

Properties also took slightly longer to sell, with the national median days to sell at 48 days in July, up one day compared to July last year.

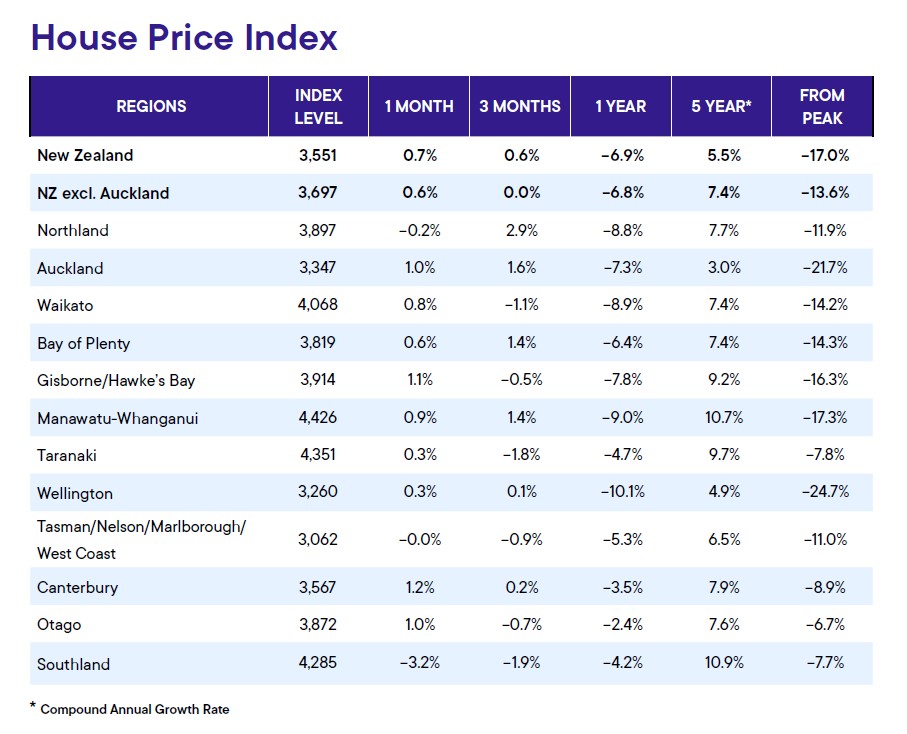

While the above figures paint a fairly glum picture of the mid-winter housing market, the REINZ House Price Index, which adjusts for differences in the mix of properties sold each month, had a slightly more upbeat story to tell.

The national HPI was up 0.7% in July compared to June, and up 0.6% over the three months to July, suggesting a very slight improvement in prices. However, it was still down 6.9% compared to July last year, and down 17.0% from its November 2021 peak.

"While there was a slight increase in the House Price Index compared to the previous month, the market continues to face challenges with a decline in value over the past year," the REINZ said in it's July report.

New listings in July were down 17.6% year-on-year.

"These listing decreases are similar to last month's, so although our sales people are reporting further increases in activity across the country, the looming election and ongoing tighter economic conditions are seeing sellers holding back," REINZ Chief Executive Jen Baird said.

The comment stream on this story is now closed.

Volumes sold - REINZ

Select chart tabs

Median price - REINZ

Select chart tabs

You can have articles like this delivered directly to your inbox via our free Property Newsletter. We send it out 3-5 times a week with all of our property-related news, including auction results, interest rate movements and market commentary and analysis. To start receiving them, register here (it's free) and when approved you can select any of our free email newsletters.

134 Comments

Its a Cold Cold Winter Indeed.

Wait for the Avalanche Of Listings In Spring !

I'm still a bit mystified by the lack of a bounce. Purely due to lack of listings, maybe?

Mid winter and leading up to elections is always stagnant.

Loan testing at 9 percent

Restrictive lending policies have eased slightly

Im surprised there are any buyers or sales

Despite the snow, not cold in dunners, HPI is back with a bang

Interesting to note the elevation in the HPI.

Might be an omen of things to come……

TTP

Maybe - but given that just about every economic indicator is pointing south, I don't see where the confidence will come from to sustain any significant growth. I think it's more likely that the supply constraint of low listings has gone on for so long now that people are finally just having to move on the available stock.

Time will tell, I guess.

Confidence will come from oversupply of properties on the market

Current potential buyers are bored of the lack of diversity in the market right now - they really want to buy but they see the same old houses over and again. But once all the sellers which held on until now put their houses on the market in spring, the buyers will flock onto the new properties like there's no tomorrow. You see, they can't wait to buy, but they didn't have enough on offer to choose from

At least that's what the current REINZ CEO said today on the radio

people are waiting for the election, and waiting for spring.

There are only a few people that I've been talking to recently who are looking at buying (who are currently renting) but they aren't waiting for spring/elections.

They simply can't get mortgage lending to buy the houses they want. Their pre-approval they had earlier in the year has been slashed by 20% as banks reduce risk.

So they are waiting for prices to drop and if they don't drop, they are thinking about leaving the country.

There are many highly qualified young looking at their situation at the moment. Not just pay, but the social state of NZ Politics included). Then they look at the price of a s##tbox, rents (price and quality) and the hopeless public transport and they think ...why bother here.

One of mine gone, another about to - and most of their friends and colleagues at various stages of doing same.

The drop in housing need to be much more significant if we want to keep them.

Does the media not get it?

What is there for the media to get if their sponsors/advertisers/owners are part of the crony capitalism that requires prices to continue to get more and more detached from incomes?

There is nothing for them to get other than to sell propaganda.

I'm thinking exactly the same as your children, I just dont see a good future here.

Sorry to hear about your kids moving overseas rastus. It's happened a lot in our wider family in recent years. The kids are doing well, but watching grandkids grow up remotely isn't the same and the grandmas are sad about that part.

Yes it seems to be a cultural theme, kiwi kids heading to Aus for career prospects and other nationalities coming to NZ for the same. This is changing the make up of NZ and although there are infrastructure shocks it is the only way we can maintain any productivity (the negative spiral effect).

It's sad but honestly much sadder for them if they stay here. Such a depressing place for most aspirational 20's.

Not all gone. One chucked the job, forgot housing for the last few years and did the self employed business thing instead. Started from scratch, going well - looking to buy housing soon, but will only buy if well under cv (needs house/bus premises combo).

Fully support other two going, one already in Sydney (media funnily enough). Other nursing sees no reason to stay. Not so much a money issue, the encouragement and support of uselessness by the NZ system is a major reason.

The irony is, how much easier is it to buy a house in Sydney? Exactly.

You can save a lot more as a renter there which is a lot better than not saving much as a renter here. It's what I did my saving rate more than doubled in the same job even after paying much more in rent.

Sydney is an amazing city though it's massive so buying centrally obviously is going be expensive.

It trips me out, I was in Oz a long time but have been home ten years. There's little point in striving here. I'm a solo dad with 50 50 custody and just quit my second job teaching apprentices because I lost more money than I was making from loss of WFF.

I'm in a reasonable position and will probably buy a house and like my job, but it makes no sense to try to be more productive, the price of living is so high and many wages are barely above what I'd get on a benefit. It's not a lifestyle for me but I have friends who were health professionals I.e nurses, who've quit the workforce and are better of financially. It's insane.

The rational thing for many people is to create a life of being comfortably poor which is going to keep this country spiraling down. We need to move from a rentier economy to one that actually celebrates productivity and innovation. If it weren't for my kids I'd be on a plane tomorrow.

"..because I lost more money than I was making from loss of WFF"

Are you sure about that? WFF rebates at something like 25c per extra dollar earned, so after allowing for tax you should still be better off by 40% of your gross marginal income. Sure it's not great, but it's still getting ahead.

I worked one night a week and received 160 net, quit and now receive about 162 from WFF almost an exact swap. Not sure if I'd have gotten a rebate but I am sure I'm enjoying the extra time and less stress.

An unemployed family with 2 kids on a benefit receive $63,000 a year. This is more than what HALF of all workers in NZ earn - the median wage is $61,000.

I used to see the odd anecdotes on the WINZ Facebook page (before I was banned) where Solo mums of 2 would share a screenshot of their payment screen. Many were getting $1000+ per week in the hand. Jump on their Facebook profile and there's photos of new tattoos/drinking bourbon and cokes etc.

I wasn't trying to have a go at people on benefits, to me it's the same as having a go at landlord's. People use the system to their best advantage but our system is completely skewed against what actually makes a economy work, namely greater productivity per capita.

photos of new tattoos/drinking bourbon and cokes etc.

Much like yvil's Facebook

National certainly doesn't get it. All they want is for prices to go up again. And the exodus will only increase.

I am not sure if moving overseas (within the anglosphere) is a great solution to overcome high house prices. Home prices are high elsewhere in the anglosphere too. Sydney and Melbourne are not much cheaper than Auckland and Wellington for example, probably even more expensive actually. If they'll have to settle in a small town overseas to be able to afford a house there then a better solution might be to just move to a smaller town in New Zealand instead. Home prices are cheaper in the regions, if you can find work there of course, or work online.

Have you lived in small town nz ? Not recommended 1/5 stars.

Comparing Melbourne to Auckland holds no water.

Does the media not get it?

I heard this a few days ago: "it's difficult to understand something when your paycheck depends on you not understanding it"

Many who thought they would get Special Rates are now moving up to the Standard Rate.

How to Rapidly Move Up Interest Rates, Without Been Seen To Move Up Interest Rates. Taboo Subject on this site.

https://www.stuff.co.nz/business/money/300941816/the-home-loan-borrower…

Those that thought they where Special, but turns out they are Standard.

true that many first home buyers cannot get mortgage big enough to buy what they want. there is a gap of what people can afford to what sellers want.

but, the house prices seem always out of reach for many people, be that up market or down market. They always need to stretch to get on the wagon.

Price!

Under 800k selling if close to pre 2019 CV

Over 1 million selling to old retired "don't care just want this house" brigade

The mortgaged lot are waiting inorder to negate the higher interest rates by getting a lower price or seeing if they will drop again.

It feels like an equilibrium has been reached. The election is probably the next event to watch in terms of changing the current dynamic. We might see small gains in the last quarter of 2023 as that will be coupled with the usual Spring uptick. I can't see it being any more than a blip though until the OCR moderates. Time will tell.

Probably spot on.

Love the name Caughtinthemiddle, it kinda sums up the squeeze on the middle class workers in NZ.

This will continue till around Feb next year when the confidence is back post elections.

Where is your evidence? Please link data to support your claim.

Talk to me in 6-12 months. See this time and time again in every cycle.

to find another time when houses were so expensive compared to income you need to go back 120 years

https://i.dailymail.co.uk/1s/2020/01/30/12/24080552-7943741-Houses_have…

what cycle are you talking about? this is complete nonsense, full stop

I think that you will find that some people in our society would be very happy to turn NZ into something that resembled the class system of the Victorian era (per your chart with land completely out of reach of lower/labour working classes in the 1800's).

It is why many left the UK and moved here and yet we could easily slip into a system that our ancestors ran away from.

So what’s your nonsense prediction going to be then? House prices to drop another 50% as some of the other DGMs wish? Good luck..

Why would the median not return to around $600k, you know - the time when mortgage rates for 2yr terms were 3.5% and inflation was running at 1.62%.

If mortgage rates stay above 6% till 2027 (currently forecast by the RBNZ) why would prices not head back?

Return to 600k lol. Good luck with that fantasy.

I have asked a question, not made a statement.

Iceman - It seems that most of your analysis involves "LOLZ" or "Fantasy" or "luck". I have provided data points and seek reasons why median home prices wouldn't fall further. It is clear there is currently no shortage of housing (30k listings and record low sales), but a severe shortage of buyers.

How high would unemployment and mortgage rates have to go for prices to continue to fall? Do you have any analysis based on anything other than LOLZ?

Can you specify an exact date so we don't bother you too early Iceman?

Where's your evidence to refute that

Please link to facebook group.

It amazes me that tax law, and hollow political promises, inspires confidence.

Liquidity draining from markets esp credit markets. China , commodities, oil price and USA treasuries plus QT all contributing. Plus steady rollovers onto higher rates. Bigger crises to come in next 6m but prob just more division in NZ

The NZ mortgage-holding public are on the front line Mike, the rollovers are a killer much more blood to be spilled. The boat will stay afloat thanks to the new bailers we are adding to the population, which force will win I wonder?

The US Eq market is soaking it up to a degree but the growth is super, super fragile (FANGS anyone?) let's all pray AI is more than a fancy chat bot...

let's all pray AI is more than a fancy chat bot...

Let's all pray it's not. Haven't you seen Terminator?

Because USA treasuries are having to pay ridiculous yield to fund Gov deficit, swaps market rates bound to go higher for small countries. Does not matter what RBNZ does. There is too much debt and no growth to fund the interest payments

This was always going to happen when delusional zero rates finished. Covid splurge just accelerated it

Half pop has sod all disposable income

Its not about confidence

Don't think there's much further to fall. The 5 year gains actually look sustainable and immigration taps have helped us find a bottom. Market not likely to do much to upside unless recession drops rates and Nats fold to the Landlord brigade.

Nats fold to the Landlord brigade? Nats are the Landlord brigade

Just a note to say the Landlord brigade are also the Business-owning brigade. Want to grow your business? get a loan (chortle) for your house... If we are interested in growing productivity (I suspect we are not based on the politics of the day) we will want to ether fix the risk ratios/banking oligopoly or have house prices rise even further out of wack with the rest of the planet... My vote is to fix the banking market but not holding my breath.

I'm still on the fence as the whether this is the bottom for prices.

From a probability analysis perspective, my guess (which we are all guessing right?) would be the following:

- Prices start consistently rising over spring/summer 20%

- Price remain mostly flat for a few years while wages rise (to offset higher rates) 40%

- Prices continue to fall/recession hits/general asset price destruction 40%

Be interesting to hear others think...and whether the average of our combined probability analysis works out close to what eventuates.

Its the bottom. Its a National/ACT government in October and even a 25bps OCR rise in November will make no difference, however a fall will as its a signal. Summer coming and it needs to be better weather than the last two and away we go again. Immigration is up, expect small house price gains over 2024. Things look about as predictable as you can get.

The government books are looking in such bad shape that Luxon will have no other option but to delay the interest deductibility and PAYE tax cuts for the time being. Failing to do so, he risks pulling Liz Truss and subjecting our sovereign credit ratings to a downgrade.

Slashing wasted spending on some large projects isn't going to cut it either. The lifetime spending worth billions on those projects haven't gone into the Crown budgets yet, so the potential savings from scrapping these projects saves a few millions each from the cost of writing business cases and investigating funding options.

Advisor you are most probably right but what could throw it the other way is Nats raise the super age to min 67. Which would make the books look better long term. Nats need Act. Act have been adamant they will reinstate the tax deductions. They have both seen the spectacular fall from grace Labour have done when not following thru. While I also think once in power and they are looking at the books and what Robertson stuffed up it will be interesting

National/Act cutting taxes will be upward pressure on inflation, ensuring that OCR/interest rates remain higher for longer. That likely means continued house price falls. Even reintroducing interest deductibility for landlords doesn’t really make the numbers stack up for most investors while buying at 8% interest rates.

Yip, cutting taxes may also trigger a credit down grade from ratings agencies, especially if we are looking like we're going into a recession and going to have to increase deficit spending.

Luxon will risk doing a Lizz Truss in my opinion.

My guess for most likely path:

1) Flat market until rates start heading down next year

2) Decent short term price growth based on ‘muscle memory’ of price action over the last few decades

3) Underwhelming performance over the next decade due to ebbing secular tailwinds (rates, tax, immigration).

Plenty of other ways it could play out, of course.

That's pretty much how I see it, although I'd frontload the bounce a bit - those that can will try to get ahead of the next upturn. The market will try to burst ahead as it has done in the past, but it will slowly dawn on people that we've reached somewhat of an equilibrium, and they shouldn't expect house prices to out-perform wage growth/inflation like they have in the past. Add to that the first-hand experience people now have to convince them that markets can and do go south, which should keep a lid on too much euphoria.

We'll always have cycles, but I think the trend will pretty much match inflation from here. Clearly, it's not sustainable or desirable for the real value of residential property to keep climbing - the story of ever-reducing interest rates that drove that has come to an end.

The Party Hasn't Even Started !

Lol. Keep waiting for your party to start, then complain that prices are too high again in few years.

I don't think it's the bottom IO. I'm pretty sure that NZ is going into a proper recession from Q3 2023 and well into 2024. This can only have one outcome, less money velocity (read money to spend) meaning more RE sellers and less buyers. House prices will keep dropping more.

Agreed. FHB's should consider making low ball offers from early 2024. There is also increasing risk China's economy could well and truly blindside us, sending everything even deeper south. TD's are super attractive and helping those deposits grow in face of a depreciating asset.

We had our first, of hopefully not many, client go into liquidation yesterday. Fortunately we are in the hole for a mere 15k on this one. Could've been worse. The clamps are coming on hard and won't be released for sometime.

Sorry to hear that Sluggy :-( You probably already know this but it might be worthwhile repeating; don't let bad payers get behind, the further overdue an account is, the less likely it is to be paid. Keep on top of them.

I cant see how house price growth can occur. Numbers dont make it a viable for FHB, nor for investors after policy change.

After what we saw in 2020, it wouldn't surprise me at all if central bankers and governments lose the plot again if/when recession hits and bailout debt holders and we see asset prices go up again.

But that said, if they do intervene in the markets (again) then all they are doing are accelerating our economies towards a cliff.

Think inflation is high now?

Just wait to see what happens if governments create even more debt to bail out economies during a recession in the next few years. There will be credit rating downgrades globally on government debt, risk will rise significant, consequently the required return on that debt will rise, interest rates will rise, taxes will then have to rise to avoid defaults to pay for all that interest on all the additional government debt. It risks turning into a real horror show.

What we are seeing are the consequences of refusing to take our medicine post GFC.

If I were National/Luxon I would be dodging this election and giving it 3 more years then come in when the dust settles and win 60% of the vote.

You can almost see what might happen, is National try to cut taxes in the next 12-24 months, but the economy is such a mess that they actually have to increase government debt while rates are rising, and any suggestions of tax cuts will cause all sorts of problems (per what happened in the UK recently with Liz Truss). They end up looking like fools, not being able to deliver anything they said they would, and end up looking just like what Labour look like right now. Not fit for government.

I don’t think it’s the bottom. I think it’s a bull trap.

Yip, there is the very real possibility that we are in the complacency phase of a bubble:

https://media.springernature.com/lw685/springer-static/image/chp%3A10.1…

With the bulls saying 'right glad that is over, time for the next rally again very soon'.

They could be right, but there is also the risk of being spectacularly wrong.

Its 10am all the DGM's must be still in bed.

I thought Zwifter might be HW2 reincarnated...but then again, HW2 was quite bright.

Yip Zwifter may as well still be in bed given the mental effort put into the post above.

Isn't it Carlos? Seems to have pretty similar views.

The DGMs are probably busy being productive in their day jobs.

How far below is the bottom? Mariana Trench?

All the money in this country stuck in real estate.. Nothing left to get anything else done.

Just look at the policies of political parties in the election year. It just so sad to see, no real development is going to happen at this pace in next 3 years. We can't even pay to get good drugs for saving the life of fellow citizens. Shame really.

God save NZ

Nguturoa, you're so on the money!

Spruikers spruiking, gloomers glooming.

"Round and round and round she goes, where she stops, nobody knows."

There is another group stating facts

NZ Govt Bonds and swaps on the move upwards bigly!

MORE MORTGEGE RATE RISES IN THE NEXT FEW WEEKS! ITS GUARANTEED!

The high cost of funds is the indisputable HOT Deathray Gun to the Ponzi Iceberg.

Interest rates to the moon in NZ 2023 2024 2025. Ponzi goes POOF. Goneburgers.

Spruikers sweating bullets much??? think so :)

The forecast diary payout drop is going to have a big impact on the regions, you can expect to see considerable falls in the regions now as they catch up to AKL / WGTN falls. In WGTN there will be a lot of layoffs in Gov at the end of the year.

Banks are getting a lot more restrictive on the amount they will lend, and I am also seeing young people actually leaving for Aussie. The ones managing to sell houses here will consider themselves the lucky ones next year. Its a lot like when the country kicked out Muldoon, there is considerable austerity coming, country debt rating cuts coming.

The amount of debt on residential housing as a percentage of borrowing in NZ is mind blowing. There is a good reason why bank provisioning for bad debt is so high, this time it will not be converted into profit in a few years time as a tax rort.

NZ housing market has fallen faster then the US in the GFC, and now rates are in the mid 7's.

Family in the building business (Waste systems and tanks) say there are just so few rural jobs starting at the moment. They can survive on maintenance of the existing but its dire.

DIARY payout could reduce inflation

On bank lending Mr A reported that banks are slightly easing lending restrictions. Hahahaha yes right.

I think Canterbury is ripe for some big falls in the next few months, the dairy payout drop is going to put much more pressure on the region as a whole. Drops have been fairly modest so far.

I have a friend who for a number of years worked in the Agricultural sector for one of the major Stock and Station agents in Canterbury. He's adamant you could see the financial pain starting in the rural sector and then a number of months later it would show up in Christchurch.

Golly ... NZ's retail banks rely on ever increasing house prices for their increases in profit ... Lots of bankers going without bonuses this year ... even less money sloshing around in the economy.

The next 3-6 months are going to be awful.

As predicted October will be rock bottom as far as the people are concerned. We should see a record election turnout, if you want change get out and vote. Don't come back here next year whining about the state of things if Labour get back in and you couldn't be bothered to even vote

Change to a property spruiker government? No thanks.

I don’t think they could do it better than Labour honestly.

National want build to- let at a commercial level, this will screw ma and pa investor, so I do not understand why you say this?

Is that what we want though? Or do we want more people owning their own homes?

Here's some reasons:

1. Reinstate interest deductibility to investors

2. Reduce the bright line test

3. Allow foreign property buyers

4. Encourage lower density housing

5. Tell the reserve bank not to consider sustainable house prices.

6. Likely increase immigration more to ensure an extreme housing deficit.

7. Allow people to use Kiwisaver for bonds which makes it easier to landlords to raise rents.

In other words, undo all the actually useful things Labour have done on housing.

Full speed ahead for directing every cent of investment capital into housing rather than doing anything productive. It's OK - Blackrock are here to fill the gaps.

That's why they are the party for the property market, not the party for business. They never talk about anything innovative.

Last election Judith Collins was talking about spending millions laying fibre to far flung locations when Starlink satellites had already been in the air for 18 months. So clueless.

YIKE..!

All of these news about the property market crash (it is now technically a crash in Auckland and Wellington) is a blessing. I have just returned from Spain and the economy (with all its problems) is doing so much better than 2005 when everything was around property, when we all thought that we were rich for owning a stupid appartment. The Spanish economy moved away from the smoke and mirrors of an economy that was built on nothing but speculation to a more real economy, many NZrs still live in the lalalandbank.

Yeah it is just so unproductive and backward. The amount of money wasted on interest and given to banks and the real estate industry is obscene.

It screws with incentives too. It's deeply engrained that to become wealthy you just need to leverage the banks money for tax free capital gains. No need to do anything innovative and the banks don't want to know even if you want to.

Not sure if Spain is a good comparison, with an unemployment rate of 28% for young adults. Spain's economy may have improved since 2005, but it's still not great.

Greetings from Andalucía. Spain's economy is mixed but far more diversified and resilient than before GFC and housing collapse. There is some pretty impressive industry, and robust and profitable banking sector. But still high youth unemployment, ongoing regional depopulation and quite severe climate change effects. Needs a good new government though.

What does the prophet say .

The above is all idle gossip based on a vibe or select readings of the scribes spin..

The only thing for sure is death and taxes

And as Jesus said in the scribes:

"it is easier for a camel to go through the eye of a needle than for a rich person to enter the Kingdom of God"

And yet people are willing to take a political stand to ensure they gain riches in the form of capital gains (that will disadvantage the poor). To which Jesus would then say:

"For what is a man profited, if he shall gain the whole world, and lose his own soul?"

But the gospel for Nat fan is "greed -- for lack of a better word -- is good!"

Funny that being our right-leaning party, they should support conservative policies that are based on Christian faith.

And yet jesus would say to the current bunch of National party members:

"Watch out! Be on your guard against all kinds of greed; life does not consist in an abundance of possessions" (Luke 12:15)

7 house Luxon certainly doesn't have a shortage of possessions - but why I think he will be a failure like John Key - he doesn't really understand what is going on down in struggle street. Becoming prime minister is more of an ego accomplishment, than a desire to serve the people and their needs.

Com'on guys, give a break to "the prophet" "jesus" and "gospel", Interest is not Gloriavale, it's a financial site.

Agree it's a financial website, but financial decisions are made based upon the psychology/culture of the people at the given time. And if the people are lacking in moral and ethics, how can they possibly make rational decisions?

Faith/belief has been a key component for thousands of years to guide people in how to behave individually and collectively - when that is lost, like it has been in the western world in recent decades, people can act selfishly and unethically, and as a result, society falls apart such as our has.

Perhaps we need more guidance from the gospels, not less. If we loved thy neighbour, instead of trying to turn thy neighbour into thy rent slave (out of fear of the future and a lack of faith that everything will be ok), then we wouldn't find ourselves in this financial and social mess. We would have community and stability, less fear and anxiety about the future, because we are looking out for one another, not trying to get rich off the other guy by gambling on the direction of something like house prices.

We don’t need gospel and faith to not be arseholes to each other.

I completely agree, we can, but will we? (not act like arseholes to each other - in recent decades people have stopped going to church and we've started acting like arseholes). Throughout history societies have been based around behaviour that pleased a god or gods. My argument isn't whether this is right or wrong, just an observation of human traits/history.

In an absence of this (a faith in something greater than ourselves), what is guiding peoples behaviour/principles? Complete self interest and faith in Adam Smith's invisible hand theory? And if this is true, how is that working out in the current environment?

Some (most?) of our worst behaviour has been about pleasing ‘our’ god. I think religion is irrelevant to this. The has always been good and bad people weather they have belief or not.

This isn't about whether there are good or bad people, but it is the way in which we go about cooperating with one another and how those decisions impact financial and social stability of the nation (or humanity) as a whole. If we don't have something that collectively binds us, we risk falling apart.

I think we are approaching this from different levels and each are entitled to our views - and I don't disagree with you that there are always good and bad people (which appears to be your view), so in that sense, I think you are right.

Mm. I see what you mean.

The problem I have with that is that you’re using a falsehood to promote a social agenda.

You'll need to clarify what falsehood i'm promoting and what social agenda because I'm struggling to connect the dots.

Our society (at least in the western world), was founded upon the principles of christianity - whether you like this view or not (and regardless of your own beliefs - this is history). Do you disagree? (if so please explain - but do so after reading this site: https://en.wikipedia.org/wiki/Role_of_Christianity_in_civilization)

The core teaching of any religion is the golden rule. To treat others the way we wish to be treated. Is this a social agenda that you have a problem with? That we shouldn't try to treat others the way we wish to be treated?

All Wikipedia tells me is that the church was hugely influential which is hardy surprising given their power.

But I think you’re putting the cart before the horse. If you were to say that Christianity was founded on good ethics then that changes the story completely. I don’t disagree with many of the things that say Jesus for example said. But he was just a dude teaching mostly good ethics.

The falsehood is god. There is no god. But you knew that is what I was referring to.

Brave points in a technocratic non values process driven Mandarin evasive language world of management speak . I agree

I think we’re living through a bull trap.

Agreed.

Auckland City down -39% from peak. Can we call it a crash yet?? Or does it need to be -40%, or -50%??

NOV 21 $1.54M JUL 23 $0.94M

"Can we call it a crash yet?"

Absolutely not you naughty boy. We are now at the beginning of the "recovery phase", the C world shall never be mentioned, ever.

Why would the median not return to around $600k, you know - the time when mortgage rates for 2yr terms were 3.5% and inflation was running at 1.62%.

If mortgage rates stay above 6% till 2027 (currently forecast by the RBNZ) why would prices not head back?

Incomes may rise to cushion the falls. Let's say incomes are up 20% since the last time median prices were $600k, that would imply a $700k nominal price all being equal.

Incomes have not kept up with inflation.

Inflation has been

- 2020 1.7%

- 2021 3.9%

- 2022 7.2%

- 2023 6%* minimum.

There isn't much left from a 20% pay rise over the same period. Most companies only dished out a 4% to 6% pay rise this year (less than inflation)

True, but over time those rises do accumulate and will set a price floor.

- 2019 was when the Median REINZ house price was $600k according to Interest.co charts. The average weekly wage at the time was $1016.

- It's now $1273 according to this article, so that's 25% up.

https://www.newshub.co.nz/home/money/2023/08/median-weekly-hourly-wage-…

https://figure.nz/chart/nrYUawzOEbEdxJvE-8OSb3U9YEmWoHkBV

Hot off the press! That will keep up with inflation this year, at this stage.

OK doing napkin math's the fortnightly mortgage repayments on a $500k loan would be

- 2019 @ 3.5% = $992

- 2023 @ 7.39% = $1,528

Apologies, edited my comment because I realized the data was included in your 2022 bullet point.

Just remember, if CPI increase = wage increase then people are "just keeping up", however that's on 2/3rds (plus or minus) of their income. The 1/3rd of their income that typically goes towards housing is also increasing at CPI, so in dollar terms they can afford to service a bigger loan (depending on mortgage rates of course).

Fair point. In 2019 the average 2 year fixed rate was 4.5%, this year it's 6.7% (according to int.co charts).

- $500k @ 4.5% @ 30 year = $1169 per fortnight vs $2032 fortnightly wage = 57% of pay

- $500k @ 6.7% @ 30 year = $1489 per fortnight vs $2546 fortnightly wage = 58% of pay

So purely as the numbers stand $600k is a possibility.

Are these wage figures before or after tax? Does the fact the tax brackets haven't moved affect the calculation?

Before tax. And yes good point I would imagine the tax brackets not shifting would affect the calculation by about 2%. That's the difference in take home pay.

https://figure.nz/chart/nrYUawzOEbEdxJvE-8OSb3U9YEmWoHkBV

I guess it's a race between prices retreating and wages catching up. Nominal prices could reach $600k, depends on how sticky they are on the way down and how quickly wages rise.

It might, for an 80m2 house

Ah yes, the sheeple are slowly awakening from their debt fueled party ...it's around 4am and a few have left, but a small number are out in the cold, on the deck vaping away, still arguing that interest rates will have to come down .....they are realising there is an actual "cost" to these mortgages and as they come off those "party high" low rates, the hangover begins to kick in .....

Mikey shouts through a cloud of smoke, how could those "family friendly" banks do this to us ? Dan retorts "family friendly" yeah they are just another business, with a business model any small business owner could only dream of !

"I'm off to Aussie, stuff this" mumbles Chris downing his 5th rum n' coke .....

"Well, doesn't matter where you go, there you are" chimes in Pat, our resident optimist ....and anyway these things run in cycles and she'll be right in a few months....

"She'll be right"..... until it isn't" interjects Sam our true DGM, and don't you realise the world is turning upside down, both politically and economically at the moment ....wait for those CBDC's to come in and the gummint will be watching every dollar you spend ...it's all part of the plan ! ....control you, control the population through all means, however nefarious...

Then our host pops his head out the door and says "keep the noise down" , the multiple property owning landlord next door is still in shock that these interest rates haven't come down, as he never did some basic back of the envelope calculations, as to what would happen if they went up !

Just another "fun filled" Saturday night here in the city of "sales"...... nothing really changes, until it hits you in the face.

It's starting to hit now. More to come.

Auckland sales 1645 in July

Monthly average sales 2008-2023 was 3300

A few more sales than last July, esp in AC

Hardly surprising when migration into NZ was net 86k in last 12 months. Increase in pop is never mentioned when making comparisons of house sales.

Some figs or research on house buying v income would be far more illuminating

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.