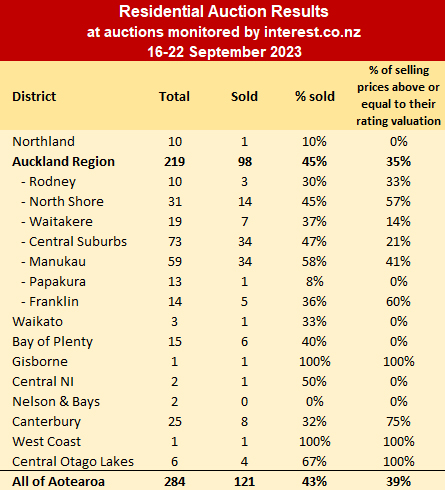

The sales rate at residential property auctions monitored by interest.co.nz slipped to 43% in the September 16-22 week, continuing a weakening trend in September.

Nationally, there were 10 more housing auctions last week but nine fewer sales. But the proportion selling at or above their rating valuation rose, even if more than six in 10 aren't yet making rating valuation levels.

In Auckland there was a noticeable fall off in auctions on the North Shore, even if the sales rate changed little. But those that did sell achieved improved prices with the highest proportion selling at or above rating values in more than a month.

That contrasts with a big rise in Auckland City central suburbs offerings, including apartments. But those that did sell didn't show any spark. About four in five didn't achieve rating values in this growing set. It was up to the Manukau and Franklin regions to pick up the central city drag, with improving sales rates and better rating value outcomes.

In Christchurch it is much more likely vendors will achieve rating valuation or better

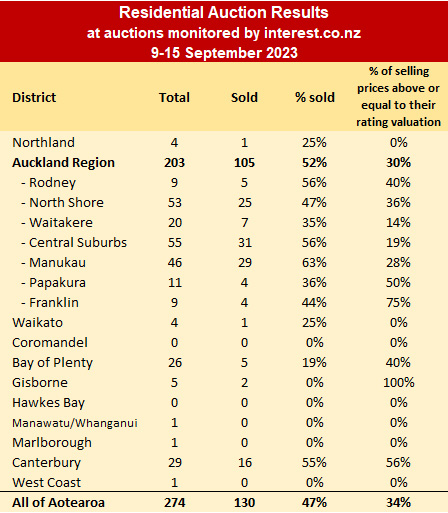

If real estate auction activity reflected in the auctions monitored by interest.co.nz is any indication, perhaps the spring selling season is off to a lacklustre start. So far in September, we have monitored just over 800 auctions with 382 selling. But as the month has progressed the sales rate has slipped. And only 38% have achieved rating valuations. That isn't a sign of a market recovery building. But, and it is an important but, auctions are a small corner of the overall housing resales market and may well not be telling the full story.

But it is a concern that in the first week of September the sales rate was 54%, falling to 47% in the second week, and in this latest week it's down to 43%. It isn't a trend realtors will tell you about, especially if they promote an 'auction' as their preferred sales method.

In the auction market, buyers have the upper hand.

Details of the individual properties offered at all of the auctions monitored by interest.co.nz, including the selling prices and rating valuations of those that sold, are available on our Residential Auction Results page.

[Greg Ninness is on vacation].

93 Comments

The housing market is in doldrums.. there'll be a few trying to blow their trumpet...

"Lower for longer"

Housing market- Lower for longer

Rates- Higher for longer

Quote from interest.co.nz "Globally, higher rates for longer is the trend setting in".. I should have taken a copy right on those buzz words

Its now "Higher For Longer, Maybe Forever". Strap in.

https://wolfstreet.com/2023/09/21/treasury-market-gets-a-memo-with-subj…

Good piece.

yes perhaps a neutral OCR is now more like 4% rather than 2.5-3%. In which case, given current inflation, it should probably be at least at 6%.

"I should have taken a copy right on those buzz words "

I think that ship has sailed - everyone is in on the act:

(367) The Higher For Longer Camp Consolidates! - YouTube

20% go yet.

There is hope for young Kiwis if they vote left.

Other wise sold out again by National.

Yawn

Greedy baby boomer

A new normal is upon us that some who carry unrealistic and outdated expectations will find highly unsettling. This will only serve to keep this a top heavy market for the foreseeable future.

There are some out there that think it will once again be a story of all hands on money pumps with Central Banks to the rescue when it all turns to custard. With Stagflation looking more a possibility than not, it may not be that easily coordinated.

Interesting to note that house prices are nudging up......

TTP

Interesting to note how the Dow Jones climbed in the first half of 1930.

My bets are on house prices falling further especially as we enter winter 2024. We shall see!

Yeah Right.

Just like interest rates.

https://www.oneroof.co.nz/news/44295

"on the day there was just one bidder. They upped their initial bid of $3.4m to $3.6m and then, after negotiation, the hammer came down at $3.95m."

Smart buyers know how to negotiate. Not the person chasing this house at single person auction, getting taken in by the agents sweet and tricky FOMO words

"But it is a concern that in the first week of September the sales rate was 54%, falling to 47% in the second week, and in this latest week it's down to 43%. It isn't a trend realtors will tell you about, especially if they promote an 'auction' as their preferred sales method.

In the auction market, buyers have the upper hand"

This presents readers with quite a dilemma. Which news platform is most trustworthy here? 🍒

Mostly nosey neighbours and tyre kickers creating a fake buzz.

"more than 200 people inspected the property... It was the talk of the town. We did a last-minute twilight viewing and 27 people came through – normally it’s two she told OneRoof."

Just sold a brick and tile house in West Harbour at auction. 8 registered bidders and got what we wanted for it. There was plenty of interest.

Well done!

Yes, congratulations! You found a fool. You stated in another thread that this house required extensive reno. Why was this not viable and why sell now if we are supposedly at the "bottom"?

That's rather a broad brush. Downsizing buyers may well have just sold a house for a tidy sum. People are buying and selling all the time in all market conditions. Life goes on.

Zachary, at least we agree on one thing, at this stage, houses are still fetching "tidy" sums. While there is still viable equity to be extracted, many have choices and will still try get on with their lives. In a buyers market, this looks demographically top heavy and is yet another reason prices are still trending down.

"Demographically top heavy"

Just like megan w

Is this supposed to be funny?

Whatever you find humourus is enshrined in the Bill of rights

She's definitely not part of the squeezed middle.

I found a fool? There were some very disappointed bidders, lots of keen competition. The purchaser had a property inspection 30 minutes before the auction. It did require extensive renovation, but did my homework, and decided it was better to accept a slightly lower price.

It was deceased estate, my mother died and in her will it was to be sold. I wasn't disappointed, we got exactly what we wanted.

Genuinely sorry to hear of your Mum passing.

Well done on the sale however, I repeat, you found a fool. You picked a good time to sell while knowing this time next year the picture will likely be very different (and not in a good way)

Congrats!

So sorry to hear the news of your mum passing. I had the same situation in 2021.

These are forced sales in most respects and need to occur in any market condition. Its helpful when a keen buyer is found, they make their choices.

We are in, what will be seen as a minor uptick, in an otherwise significant, longterm Asset bear market, IMHO.

How much under CV? (percentage wise?)

Answer will be 50% over 2021 cv

I'm betting 10 - 12% below 2021 CV.

only 1 auction in Waitakere (monitored, mind) fetched CV. 14% chance it was his (if 'just' means this week).

But he's holding tightly to that Riverhead floodplain!

Let's hope the new insurance location blacklist missed it.

I think it's this place. He mentioned on another article the other day sold for $1.3m or thereabouts. Has a $1.46m CV 2021.

https://www.bayleys.co.nz/listings/residential/auckland/waitakere/4-mar…

https://www.qv.co.nz/property-search/property-details/1590168/

Jesus - humans did this sleuthing.

Imagine what weaponised AI will be like collecting our personal details and pinging messages around.

Took 5 seconds. Homes.co.nz -> West Harbour -> sort by recent sales. Voila, a "brick and tile" house that sold within the timeline that wingman was telling everyone about.

11% under CV, but required extensive renovation.

Thanks for replying.

if they (RE agents) promote an 'auction' as their preferred sales method

This is a bad market to sell a house by auction, there simply aren't enough buyers out there to bid the price up. If you're a seller, get real and list your house with a realistic price displayed for all to see.

There's buyers out there, it's just difficult for many to bid high when banks are testing mortgage applications at 9% +/-...

Quality house’s in good location will always have a good chance of selling. The people who purchase the shabby rental or in run down area’s over last 4 years will be watching price’s evaporate.

I have noticed in downturns that shabby homes are quite popular if they can be bought cheaply. People try to make money doing them up.

If you are on a budget you can only buy what you can afford. If you have the right skills you do some reno work yourself, live in it for several years and then move up. This is what more people used to be prepared to do but not anymore, they want the new house from the get go.

Uh, what? People still do that. I know plenty who bought entry level houses and are in various stages of renovation.

Funny though, because I always hear stories about how in the 70's FHB bought new, they'd talk about not having carpet, driveway or landscaping so "buying new" from the get go is not a recent phenomenon. It's just most of the time when buying new you're stuck with the whole package. I'm sure many FHB today would settle for land and a single glazed box if it reduced the cost barrier of ditching the landlord.

Changes in the building code mean you simply cannot compare that 70's Keith Hay home on that 1/4 acre now to what you have to build now. That said if there was still a demand for a small 2 to 3 bed home with one bathroom they would build them but they don't. Land value has killed it, you have to pack them in like sardines now in the form of townhouses.

Probably 3 or 4 children and 2 parents sharing that 1 bathroom as well

How cheap,probably a lot less than over last few years. Many will have paid way to much and will have no way out without losing a fist full of dollars.

So the spring rush has sprung... a leak?

Quite a few of us here were calling a dead cat bounce.

Indeed. Bubble graphs have a late phase bull trap, followed by fear and capitulation on the return to mean. See what 2024 brings.

The property market is a bit like the weather forcast. They promised hot & dry, but so far, only wet & windy.

Everywhere I go around where I live there's spring construction getting under way. There's excavations 100m down the road from my current place as the developer begins another subdivision.

I've just begun construction of a new house in Riverhead. There were 6 blocks in the subdivision, all sold out.

Riverhead is gonna boom. SH16 widening - huge retirement village approved in the town - road widening planned through Riverhead - next to Coatesville, NZ's most expensive suburb - easy access to Westgate, North Shore, North/South Motorways and SH16 North - a Fletcher's consortium want to build 1,800 houses. Currently delayed because of traffic concerns and a small area of it prone to flooding.

So much for Great Depression 2.

Maybe. Maybe not.

There is a difference between being busy and making money.

Fletchers are not known for making good economic moves and they have a whole lot of carriages pushing that train along.

An interesting story I've told here once before.

Many years ago I bought some sections in West Harbour before anyone had ever heard of the place, one of them was the above auction, a house I had built for my mother. As I was building my first house adjacent to the future Westpark Marina, a guy wandered up to me and said, "nothing will ever happen out here". I made a fortune in West Harbour.

The vested have many stories, but very little supporting data….

...there's one at every BBQ! Wingman was on another thread telling how he made a fortune off the Stock Market 80s - bet his whole house on it he did and knew to get out just before it crashed. It all sounds a bit too good to be true. By now he'd be a household name - surely!

One never hears about the losses....

I get out and do things, not just tell people how dangerous it is out there. This forum is a little enclave of socialism, envy is a terrible affliction.

Getting out and doing things is the right approach.

I for one like to focus on business growth, I think responsible action during a downturn without taking on debt is a reasonable approach.

I just don’t think tales of riches and “buy the dip” really applies to the housing market for glaringly obvious reasons.

Burning FHB’s out of self interest doesn’t sit well with me, “wingman”

I don't see any envy in that post. I do see some disbelief. Property collectors yell envy everytime tax or an opposing view is outed. Weirdos.

As a single man in 1986, the bank let him withdraw $100k cash from his floating mortgage account, and dump in the stock market. All at the same time he built his late mother's house in 86 for $140k ($44k for the section in 85) with no finance involved, and bought a bunch of empty sections in West Harbour (assuming $40k a pop) before anyone had heard of the place.

A very whimsical set of circumstances for someone who would have been in their 20's - 30's? Who knows, maybe he was on a $100k p.a. salary in 1986?

I've owned about 13 properties, you stick with your friendly bank manager and term deposits Danny. I was on a good salary in 1986, but I also had a colossal amount of debt, I owned 2 industrial properties in Lincoln Road and about 3 houses at that time.

Anyone can do it, maybe even you. Some time in the future I'll tell you about my adventure buying a derelict house for $30,000 at a mortgagee sale and trying to evict the tenants.

Kudos. Sounds like everything has panned out very well for you, combination of hard work, appetite for risk and lady luck riding shotgun the whole way. Don't take some online stranger's skepticism to heart, your tidbits just sounded too good to be true and curiosity piqued.

Have you written a book? I'll gladly purchase a copy.

I’ve got the flux capacitor fired up, leshgo!

Great Scott!😳

Others were in the same locked and loaded position in '86, it didn't end well as businesses went to the wall

I remember it. I mortgaged one of my houses up to the max and piled in to the stock market, but made sure I got before doomsday in October '87.

It was all too good to be true, money was like water. I did end up in a bind and had to sell one of my houses, mortgage rates went up to 20%+.

...good to see your story conveniently evolve into admission of a loss. If you had from the outset, it all might have seemed more plausible. If, like you say, no one gets rich watching the news and this news platform is an enclave of envious socialists, why on earth do you come here?

At the time your work colleague sunk their entire Superannuation into stocks (probably at your initial recommendation), did you warn him/her of what you thought was coming? What do you think of those who are warning you now?

Your posts consistently raise more questions than answers....

You can take this or leave it, I don't care. I sold my last property for a tad under $2m profit.

I didn't warn anyone, what people do with their money is their business, not mine. People can warn me all they like - I'll be spending over $2m shortly on another new build, which I expect to be a very satisfactory investment indeed.

"Anyone can do it"

Yeah.... nah this is where you're wrong and not openly admitting we don't live in a pure capitalist state. Your ability to borrow to buy assets has been far more accessible than it is to many today.

Given if you had to start out today fresh out of school 18, how would that play out?

With all due respect, you've built wealth off borrowed future generations work. Kudos to you but don't try preach that anyone can do that, it's simply not true, not anymore at least.

You're wrong.

When I first started out I approached the AMP to obtain a mortgage to buy property. I'd been with the AMP since birth. They refused because I wasn't a married man. I went to the local real estate agent, Beltons, who had contacts with a building society and he said he'd obtain the money for me, which he did.

How do you think Frank Lowy got to be a billionaire? Sitting on his hands and everyone else telling him it couldn't be done?

You guys can preach doomsday and economic Armageddon until the cows come home, but I'm not listening. I was warned decades ago by accountants and solicitors about taking risks, but I'm glad I ignored them.

Not sure how your comment shows I'm wrong... I'll ask again, if you were 18 today fresh outta school, how'd you do it?

average home 980k, you let me know how'd you start?

Please go, I will wait.

As I said, you fail to admit that we live in a non-capitalist state in which those closest to the money printer like yourself are able to borrow to invest, while a huge portion, mostly younger people have no borrowing ability.

It's not even about taking risk, I'm huge risk taker, it's if that risk is even something you have the ability to take or not....

Too right RP!

Riverhead has changed beyond all recognition over my life time, and I'm not even that old. In the early 2000's we used to race up and down ridge rd like it was a rally stage.

I watched PBS news on Face TV last night (about 11pm) and it included a residential property report. The main points discussed were:

The USA were having EXACTLY the same problems as New Zealand is undergoing. They are:

Mortgage interest rates are too high to encourage buying.

Houses are just too expensive to buy.

There are too few houses being listed i.e. inventory low.

Owners who bought houses when interest rates were low and fixed for a longish term are not wanting to sell and upgrade to another property when interest rates are now so high and it's completely unknown as to when they might come down again.

Who would have believed this? According to the crescendo of NZ ultra-conservative (Nanny Herald) media New Zealand is the only country where this phenomenon is occurring. It's all Labour's fault and NACT will pull the proverbial white rabbit out of the hat.

On the whole NZ is not well served with the provision of international news. The Americans have PBS, and CNN who both seem to supply "neutral" reporting. I only watch "Fox" now and again for comic relief.

People get rich taking risks, not watching the news.

MSM is entertainment. All western nations have a variation of the same problems, and everybody is waiting for the QE to come save the day again. I’m not even convinced that its a foregone conclusion anymore and the long term swaps are feeling the same upward risks.

Then again, rates hold high, then suddenly QE rolls out as a few banks fail and get bailed out, and we’re all happy with our ever growing asset wealth squishing the next generation like bugs forgetting that someone at some point has to foot the bill.

But yea, I personally don’t think we’ll get the full QE everyone is hoping for. IMO QT is the name of the game from here on out, and the covid reaction was the curtain call. There are too many ways to siphon money out of the economy for another 10 year sustained QE experiment to have the effect it was originally designed to achieve.

Deglobalisation demands a local economy with a strong currency, not a bunch of overpriced houses. Who are the USAs biggest technological and mechanical threats? They desperately want to be the factory of the world again.

The new normal:

"Rates Higher Forever"

Many are banking their lives and futures on rates coming down in 6 to 12 months and it saving their bacon.

Not happening. Get the memo!

For the record and future seaches.

Mortgagee listing count via seach trademe

October = 26

March = 37

Sat around 35 - 40 on most of my searches between March and August. Seemed steady.

Today = 48.

Super low... what % of listings would that be?

Currently low but increasing forced sales, Its the ultimate and Titanic sinking iceberg, with only 5% of the killer showing.................

95% are in trouble and praying for sub 4 or 5% mortgage rates, to come back in 2024, to save the day.

ITS NOT HAPPENING.

Infact I believe we will see many mortgage resets in 2024, will the written in the 8s, 9s and 10%s

Remember the bs saying from 16 years ago?? "The banks are strong" in the weeks/months leading upto the banking collapses in US/Eur, leading into the GFC.

The truth was: "WHEN ITS THIS BAD, THEY HAVE TO LIE"

The GFC got the almighty can kick, as did Covid, and here we are in the everything bubble. The straw asset castle has soggy, rotten foundations. The plough shears have started to slash this bubble and its collapse is part way through.

The current LIE, today, that just has to be told is: "The market has bottomed" The REA industry and some Very Exposed Banks have and need to spin this LIE. Again and Again.

Tony the Comb was on his self Vested Interest REA job again yesterday, recrafting the now well worn Goebbels type LIE "the bottom is in, months ago" Complete swindling BS!

TA - Buy now, don't wait! My Oneroof paymaster needs your blood !

Don't fall for it and be the Heavy Bag Holder or the Banks useful idiot. Beware and be Warned!

At what point in time are you going to admit you were wrong if its doesn't all fall on it's face ? or are you another one of these doomers that just keeps kicking the can down the road until you are eventually right ? Sure you will be right one day, the market is just cyclic.

At what point in time will you admit you're wrong? Probably the same time when your postings go dark as this shit fest carries on it's way down to where it rationally should be......

I understand Zwiffy, your part of the merryband of Fellow Travellers of Tony A/Onewoofers, who are Leveraged Up the Wazoo........

With mortgages above 5%, the only way this market can go- is South. It simple and obvious maths.

More mortgage hikes are in the Pipe.

I see you and others that are donkey deep, see this momentary Bull Trap uptik and the "Return to Normal" as certain resumption in the 40 year NZ property ponzi, that was only contingent on cheap and cheaper DDDebt.

This downcycle will be one for the history books!

The Ponzi is exposed and its time is up. Bring on the DTI of 3 to 6x.

♻️4 phases of market cycles. Cycles are everywhere and our lives are… | by Altindex - Your source of the truth. | Medium

Gonna be interesting which banks start exiting their over leveraged first. Perhaps the safety clicking to automatic will be DTI policy from the RBNZ.

Chilli basted popcorn....

Yes the markets are cyclic, but we are ending a 30 year debt supercycle. Need to look at the macroeconomic picture, rather than a myopic focus on NZ.

And mortgagee sales follow a fixed and short sales timetable. No sitting around for 90 days or more unsold. Thus the smallish number hides the actual numbers being turned over when compared to non-distressed sales.

The mortgagee sales will grow from now on.

I hear 500,000. people are not paying there mortgage at the moment.

Banks like ASB are hiding them I understand Backrock are looking after their bad depth.

Time for the banks to feel the pain on the con job they have done on the residential property sense the GFC..

Its gone up by 11. "You don't say"

No... they told us we've turned a corner.

The main thing I got from this article is the discovery that it is impossible to make the F sound in "Higher For Longer" with a mouth stuffed full of popcorn.

That "higher for longer" phrase works for your pine forest 🤣

lol !

When house prices are stagnant why are real estate companies still pushing auctions ? Why, so they can earn money of you from the auction fee. Auctions were generally only recommended in heated markets, but now the agencies use the auction fee as a money earner for the business. Even if the house doesn't sell they are making money out of you from the fees. That's why agents are always pushing auctions.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.