There was a sharp jump in the number of residential properties being listed for sale in October, signalling the start of the spring/summer selling season.

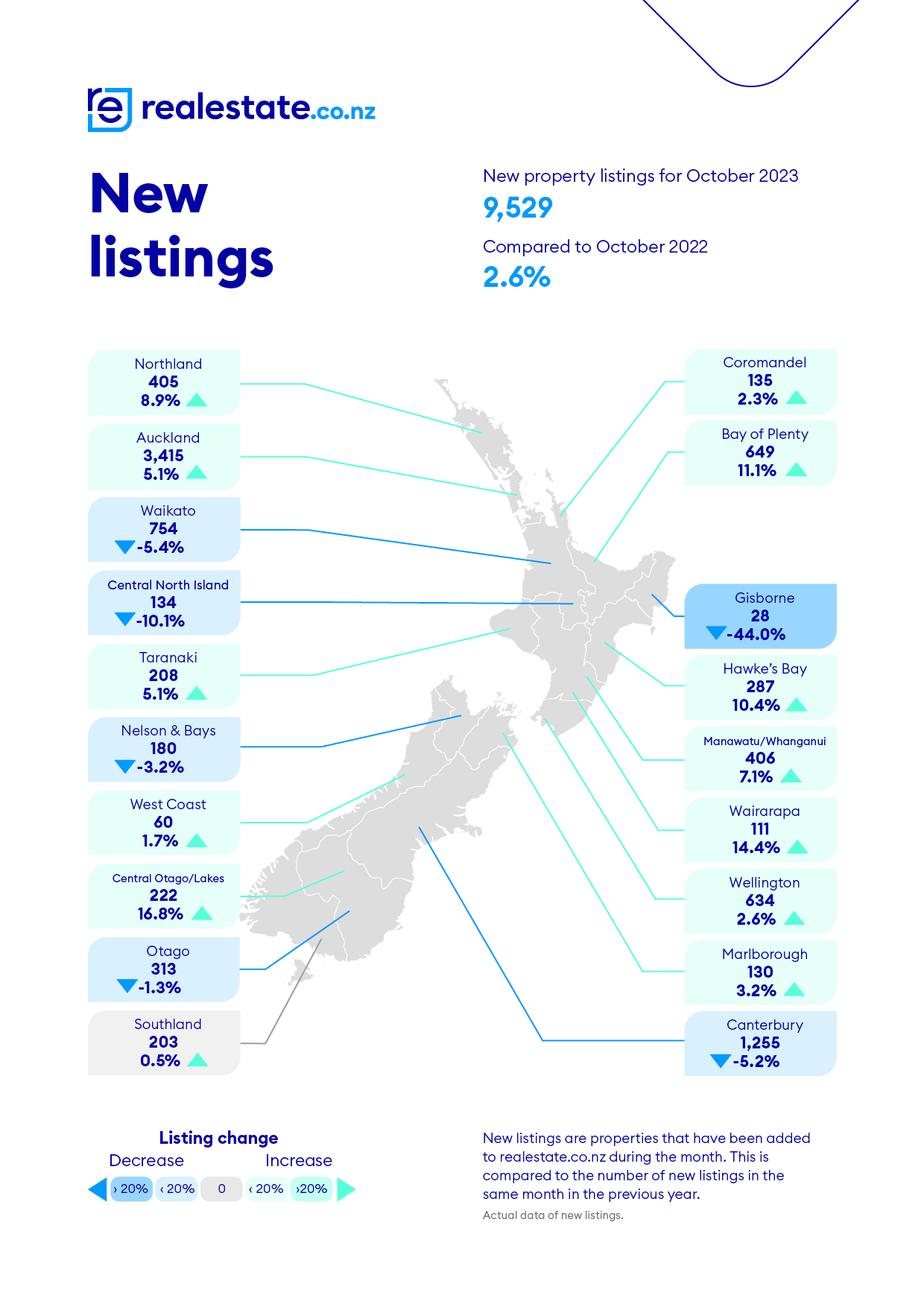

Property website Realestate.co.nz received 9529 new listings in October, up 22% compared to September but only up 2.6% compared to October last year.

There is usually a significant increase in new listings in October, with new listings in October last year jumping by 18% compared to September 2022.

However this year's October listings were still down by 14% compared to October 2021 and down by 18% compared to October 2020.

The latest figures suggest the market is following its usual seasonal trend, with numbers up slightly on where they were at this time last year. But there appears to be some distance to go before the numbers get back up to where they were in 2020 and 2021.

The graph below shows monthly new listings on Realestate.co.nz since October 2018.

The comment stream on this story is now closed.

- You can have articles like this delivered directly to your inbox via our free Property Newsletter. We send it out 3-5 times a week with all of our property-related news, including auction results, interest rate movements and market commentary and analysis. To start receiving them, register here (it's free) and when approved you can select any of our free email newsletters.

12 Comments

Well according to our Sith Lord

It's time to buy for FHB.. Investors, please form an orderly queue!

Me.. I'll just buy some salted caramel popcorns..

In this market with its current stretched fundamentals, FHB's are canon fodder. They are unwittingly being expended financially in order to protect something that's widely regarded as too big to fail.

We haven't even seen the real downturn yet. Many will find themselves in very unfamiliar and worrying territory that's out of their control because the bank controls them.

Autumn 2024! - Reality awaits.....

FHB are going to need to be on decent incomes and pretty committed to both working and no kids. There is something magic about property, just when you think its going to crash, away it goes again. Times are changing, you just have to be prepared to change to meet the new normal.

Me.. I'll just buy some salted caramel popcorns..

Caution, Chairman Moa, the proletariat have been known to choke on caramel popcorn - salted or unsalted - especially when they become ebullient. 🤯

Settle down, my titillated friend.

TTP

Jump in listings, and....continued jumps in the cost of debt required to purchase. Surely equals greater supply, and and ongoing restricted pool of buyers. Perhaps Taika Waititi will go on a property bender and buy everything for sale with his movie money.

HFL.

Don't forget the 100,000+ immigrants with wealth beyond our dreams coming to buy up all the real estate.

Post election exuberance

'Very sharp' construction downturn likely, as residential consents slump

https://www.rnz.co.nz/news/business/501379/very-sharp-construction-down…

It will be way more than 16%. I expect at least 25-30% decline in actual builds (I predicted a 40% decline in consented dwellings)

Further, he mentions the post-GFC slump, but the slump between 06-08 was MUCH bigger as the cost of credit soared (interest rates) and the availability of credit shrivelled (collapse of mezzanine finance)

Total listings still down about 10% from the highs I have seen.

I am firmly in the camp of not wanting real estate to go up in value out of synch with wages and inflation. However, the data points to a change in the market like it or not. I believe this is being driven by the influx of migrants into NZ. National are unlikely to reverse this to any great degree.

Nobody wins here, not even property investors. Hospitals, schools and roads are needed by each of us. We simply haven't earned the right to enjoy the benefits of large migration when our infrastructure is being so comprehensively outstripped by those of us already calling NZ home.

Yes it’s getting out of control. Every 3 years they add another Hawke’s Bay worth of people to Auckland, but we’ve still got the same hospitals and the same small city attitude (more roads will fix it etc). Before we know it we will have the population of Sydney but the infrastructure of Auckland.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.