November saw a pick up in housing market activity, but the market still has a considerable way to go before it returns to anything like good health.

The Real Estate Institute of NZ recorded 6422 residential property sales across the country in November, up by 12.2% compared to November last year, marking a clear lift in activity.

However, with the exception of November last year, when the market was at the bottom of the current slump, this November's sales were the lowest they have been for the month of November since 2011.

And excluding November last year, November this year was the first time sales have been below 7000 for the month of November since 2013.

And they are still down by 37% compared to the recent peak of 10,147 sales achieved in November 2020.

So there were signs of life in November but the market remains at a very low ebb.

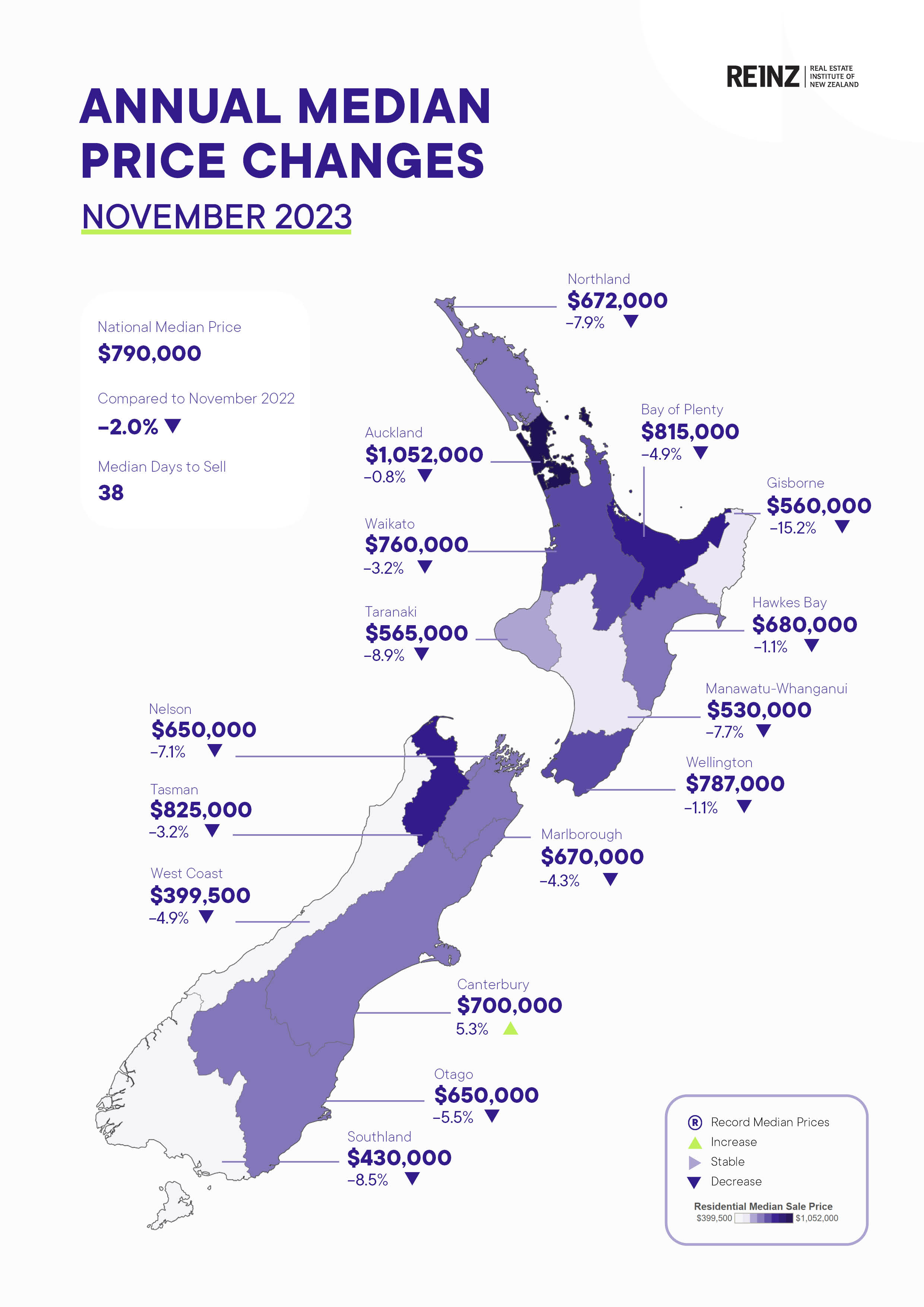

Prices increased slightly, with the REINZ's median selling price hitting $790,000 in November, up 0.1% for the month and down 0.2% compared to November last year - see the chart below for all regional median prices.

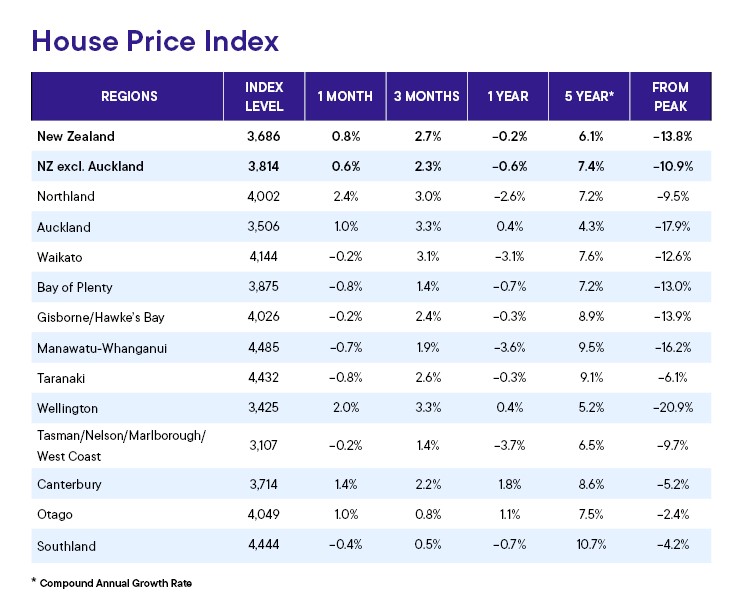

The REINZ's House Price Index (HPI), which adjusts for differences in the mix of properties sold each month was a little more lively, posting a 0.8% increase nationally for the month and a 2.7% increase over the last three months, but was still down 13.8% compared to its 2021 peak.

However, around the regions price trends were mixed, with five regions recording an increase in the HPI compared to October and seven recording a decline - see the table below for the full regional HPI figures.

"Local agents are reporting steady activity across different buyer groups, with more competition for buyers' attention in areas where listings have increased," REINZ Chief Executive Jen Baird said.

The comment stream on this story is now closed.

Volumes sold - REINZ

Select chart tabs

Median price - REINZ

Select chart tabs

Volume sales growth - REINZ

Select chart tabs

•You can have articles like this delivered directly to your inbox via our free Property Newsletter. We send it out 3-5 times a week with all of our property-related news, including auction results, interest rate movements and market commentary and analysis. To start receiving them, register here (it's free) and when approved you can select any of our free email newsletters.

148 Comments

What does it look like, relative to listings volume over the same decade.

So median price for a house in nz is around 12 x average wage and in Auckland 16 x. At this levels lots can and will go wrong. With interest rates staying around todays levels house price’s will start next phase down at start of 2024 no central banks will lower rates to silly levels again I think they have learned a lesson.

Speaking of lessons, the RBNZ will be thinking twice before removal of LVR too...https://www.nzherald.co.nz/business/reserve-bank-would-think-twice-befo…

We could have lower rates if we would accept low Loan to income limits.......and keep interest non deductable on rentals

Come next April or soon after, DTI might well be implemented.

Dtrh. Where are you getting the 12x median wage to median house price numbers for nz from? And 16x for Auckland.

They seem a bit high to me

He normally gets that info out of his ass. And generally contradicts himself, totally no integrity in anything that comes out this keyboard warrior.

Oh you're on fire..wonder what's tickled your senses..

he did say average wage not household income.......

Iceman stop throwing your toys out of the pram. I have told you many time go and see financial advisor he will help you with numbers.

Apparently the median wage is $61,692.80. So with median house price of $790k (from above article), that is 12.8x median wage.

Personally I doubt that house price to median wage is of any relevance, the more important factor is "can the median person afford the loan repayments for a median home". By both measures housing is crazily unaffordable.

Don't they usually use household income, rather than individual, when comparing with house prices? The median household income in Auckland is over $100k

Correct, but that doesn't make DTRH wrong.

Either way its meaningless, even at 3x household income a FHB will struggle in Turkey with 40% interest rates. You can't ignore interest rates and claim houses are unaffordable / affordable.

LOL. Turkey has a completely different approach to building buildings. e.g. far, far, far less red tape and the builds can take years and even a generation or more. And when a mortgage is applied for, they're typically tiny by comparison to ours.

Take away all the red tape, it still costs money to build houses.

Forget Turkey and look at NZ: In the last 3 years house prices have gone down, income has gone up, but I certainly don't think houses are more affordable now, the mortgage repayments on an average house are a lot more.

You've completely missed my point.

They buy the land, usually with considerable help from family and then they build over 5, 10, 20 or even 30 years as money allows. Drive around Greece and Turkey and there are partially built houses all over the place. This "slow build" process keeps prices down on existing houses.

Its not a good idea to believe everyone does it like we do in NZ or Oz. Other countries wouldn't stand for it. Rightly so.

It's not that they won't stand for it, it's that their situation dictates it. Houses are built as you say many developing places, in the countryside. Then in the cities, it's occuring much the same way as here, often worse. In the capital city of Bhutan, new houses are 600k, and the average wage is 1/100th of that - in the countryside, they're practically free (not commonly traded).

re ... "Then in the cities, it's occuring much the same way as here."

LOL. I suggest you do some research. Your baseless assumptions and sweeping generalizations are tiresome.

My research is information and statistics I read here, and travelling much of the globe and talking to the local population.

We can find exceptions for any claim, but if you're doing that more often than addressing overall observable trends you risk straying too far into magical thinking.

Look up the word "pompous". And also "twit".

You're calling me dumb and then resorting to petty name calling. You don't have to like what I say, but actual discourse is of no informational value when you get to that level. Go have a coffee or something.

I used a real world example above, and have seen the same thing going on many places, India, Mexico, Thailand, etc. Many places are quite different from NZ and Australia, but there's also some fairly observable commonalities in how certain market and societal aspects are playing out.

@chrisofnoname...... i really don't understand why a vast majority of people on here get so angry when an opposing fact or opinion get raised.... you don't have to be right or wrong, its and opinion, its not a case of you must be right. The name calling is wrong full stop.

safeashouses, do you think installing the following patch (band aid) might help? Yvil found it helped him cope immensely.

https://chromewebstore.google.com/detail/interestconz-commenter-bl/kbfa…

Suggesting your tolerance is quite low, in the end you might well be presented with a disproportionate amount of blank spaces on your screen.

@ retiredpoppy - I appreciate a robust conversation, however my tolerance to name calling is zero - not only will I not hide from it ( so no thanks to your suggestion) I will call it out.

There's also a difference between not agreeing with someone's opinion and acting like a diddlepants.

If having a view opposed is something you counter with name calling, there could be something less than airtight about it. Or you're way too emotionally caught up in it.

I think the issue is Painter that you sometimes just throw out opinion as fact.

If someone finds a post by me that way then if they can present compelling facts to the contrary that's something I'll take on board. It's how I've formed many of my views over time.

Safeashouses - excellent feedback. A question for you, just to be sure we are all singing from the same song sheet. Does being called a "Broken Clock" constitute name calling by someone whom has become too emotionally entangled??

by Pa1nter | 11th Dec 23, 2:53pm - You heard it here folks. The broken clock will be right on it's 3rd time around.

From the get go, lets set some realistic standards and perhaps by extending your "calling out" of put downs too, utopia is within reach.

@retiredpoppy, broken clock? name calling? you are better than that, also its between you and painter. However broken clock ? It could be like a rolex or something, still a very nice clock :)

LOL! , please try and appreciate that this forum has come a long way with the quality of postings - a long way. It's best to view the momentary flare ups as nothing more than mere pixels on your screen by anonymous emotional posters. If people are prepared to dish it out, they should be prepared to receive it too.

The "Flare-ups" are daily, predictable, tedious, and I doubt they help anyone make financial decisions...

Couldn't get more cringe if you tried

What do you mean?

In Egypt you see many building with unfinished rooftops. Its because once the building is finished you have to pay tax, consents etc. So they "never" finish them. Maybe we need to do that here??!!

Difference would be it rains here while there no where as much.

You might have misunderstod the no-mortgage approach there. Some places operate on ownership versus our borrow culture.

Interest is illegal in Islamic banking. Instead the banks charge a fixed amount up front. With that and also the generally high risk environment of a developing world country, the cost of borrowing is higher. So many try to buy apart from institutional borrowing. I suspect there is a lot of family borrowing though.

Did you see what happened in Turkey when they had that last big earthquake? The only building still standing in one block was the one belonging to the Institute of Engineers.

Apparently they have earthquake building standards but you just bribe the officials to avoid them.

Turkey has a tax regime where you pay when complete, hence many houses unfinished.

I remember being on a Greek island back in early 90 ‘s huge amount of buildings were left slightly unfinished like they were going to build another floor on top ask one of the locals why they said it was something to do with tax not needed to paid until completed.

That might've changed by now. In 2019 when I was last there, over a month and a wide swathe of the country I saw very few houses under construction, even in the tourist areas. People can't afford to have empty houses so much there, from what I understood.

Worked in Turkey and have a small point to add. The Diyarbakir earthquake this year was smaller than the 2011 Christchurch earthquake but it killed 55000 people. Mostly down to the lack of earthquake building standards being followed.

There is very little regulation to build in Turkey but there are major downsides that I am not sure NZ wants to emulate.

I have been to Turkey, there is not a single thing about the place that we want to copy in New Zealand.

Now come on Zwifter. The iskender kebabs are delicious.

The steam and foam bath houses are cool, I like Turkish delight, and yeah kebabs are to die for...

You must have gone to the wrong places or had your eyes closed. Some magnificent places in Turkey

Well, Hagia Sophia a bit more upscale than typical kiwi gaff, but not really the point. Interest rates do matter with affordability, hence average Turkish home loan far smaller than NZ. I think that was the point…

Yea I think this is where my confusion comes from. I’m use to looking at household income, not individual income.

it'll be not exactly fair compare a median salary to house price, it's more appropriate comparing median household income to median house price.

Jimbo this is correct it is used all over the world and is a good indicator when looking at housing bubbles and many areas in New Zealand are in one of the largest ever seen. If you look at history housing bubbles never end well.

Very true.

And we only need to go back to 2008. Most of us should be able to remember that incident.

Housing bubbles are extremely dangerous as the total value of housing stock is way, way bigger than the total value of share markets.

Edit: I should add that central bankers need to be very, very careful with their rhetoric that they don't trigger a collapse. Even a small increase in unemployment - if it is seen as the beginning of something larger - might be enough to trigger a domino effect. (Another reason why I see i-rates beginning to come down to more palatable levels early next year.)

"Housing bubbles are extremely dangerous as the total value of housing stock is way, way bigger than the total value of share markets."

At it's peak the estimated value of housing stock by the RBNZ was NZ$1.76 trillion.

https://www.rbnz.govt.nz/statistics/series/economic-indicators/housing

Quick fact check:

national average home value $907,387 (QV)

average national salary $70,069 ( Newshub)

So 12.95x - Not medians, but 12x above passes the envelope test

So median price for a house in nz is around 12 x average wage and in Auckland 16 x. At this levels lots can and will go wrong.

In Singapore it's been 15x for a while now for freehold property.

What can go wrong is more likely less people owning homes. There's absolutely nothing to say the price of anything needs to reduce to what a certain demographic can and can't afford, all you can determine is people can't afford them.

Yeah but they’ve got the HDB. Not comparable.

Our leasehold houses are comparable from a P/I level as theirs, sometimes cheaper.

We don't use those sort of titles in our pricing metrics, so it's more apt to compare apples with apples (freehold vs freehold).

New Zealand has 15 people per square kilometre Singapore has 7000 people per square kilometre hopefully Pa1nter you can see comparing the two countries is nonsense

I'm not claiming density similarity, ones effectively a city state. I'm pointing out that you can have very high P/I levels and it can stay that way, or even keep increasing, and it's irrelevant what the average person can afford.

If someone in NZ wants to improve those maths, unlike Singapore they can move somewhere in the same country where you can buy a house for a few hundred thousand.

Is there a gold standard to working out the 12x or whatever multiple everyone seems to quote?

I assume it’s the median house price divided by the median household wage before tax. Is this correct.

For such a commonly quoted stat, I assume there must be a gold standard calculation?

Like the house prices double every 7 years stat?

You mean house prices going up 7% over the long term and doubling roughly every 10 years?

I lose track what is the latest guaranteed house price increase that spruikers spout. But yes, I meant the 10 year myth.

Impossible to make a hard and fast rule on it, but there's a trend that's tricky to dismiss.

On the flipside, most of the theories about why houses are gonna be more affordable, get proven to be totally wrong.

"Impossible to make a hard and fast rule on it, but there's a trend that's tricky to dismiss."

Similar long term price trends with share indicies in NZ and US.

Regardless of the long term upward price trend of both these asset classes, that doesn't stop owner occupiers from losing ownership of their home, significant financial losses or even going broke.

“Our beautiful home has been on the market since March. We will lose it all by this March if we cannot sell.”

https://www.stuff.co.nz/business/money/301024956/stuck-on-136-interest-…

Other reports

1) May 2022 - https://www.nzherald.co.nz/nz/waiting-for-the-guillotine-to-fall-how-in…

2) July 2022 - https://www.oneroof.co.nz/news/homeowners-scramble-for-interest-only-li…

3) Nov 2022 - https://www.stuff.co.nz/business/130353910/no-money-in-negative-equity-…

4) Jan 2023 - https://www.nzherald.co.nz/bay-of-plenty-times/news/homeowners-scared-a…

5) Feb 2023 - https://www.nzherald.co.nz/business/mortgage-shock-900fortnight-rise-fo…

6) May 2023 - https://www.nzherald.co.nz/kahu/peak-ocr-pain-auckland-couple-working-f…

7) May 2023 - https://www.oneroof.co.nz/news/latest-news/interest-rate-pain-banks-urg…

😎 July 2023 - https://www.oneroof.co.nz/news/they-dont-know-how-theyll-afford-it-home…

9) July 2023 https://www.oneroof.co.nz/news/desperate-homeowners-turning-to-third-ti…

10) July 2023 - https://www.stuff.co.nz/business/property/132483897/mortgage-rate-pain-…

11) Nov 2023 - https://www.oneroof.co.nz/news/refix-terror-homeowner-has-to-stump-up-a…

Many will simply be unable to maintain their higher mortgage payments as they renew their mortgage interest rate. Those that followed the advice of some commenters and bought in the 2021 - 2022 period using high amounts of leverage are going to lose a significant chunk of their equity, for some it could be their entire life savings. Some will be in negative equity and will owe money to their lender even after the residential property has been sold.

There will also be the non financial costs, the impact on their mental health.

Had close relatives lose their owner occupied home and all their other real estate in a previous downturn. This family never financially recovered, and had to stay in social housing. When the parents died, their estate did not have sufficient funds to cover the cost of their funerals. Their adult children covered this cost. One adult child currently aged in their late 40's, has a university degree, is a saver, and single is still unable to afford to buy.

Anyone telling you that you 100% can't lose owning a house is lying to you.

But, as far as financial moves go, it's a much safer bet than most anything else.

Here is what one buyer in Nov 2021 had to say on another thread

"We purchased November 2021 "

"Although being FHBs we were told many times “house prices always go up” “you never loose when buying in Tauranga” etc. I often argued these statements but with a decent income, sick of renting and a couple of kids, it made sense to buy for stability - if only the stability part remained true. Haha"

https://www.interest.co.nz/property/125605/david-cunningham-looks-wild-…

We can always find exceptions to definitive claims, sure. But if you're wanting to make a general determination, it's better not to have your view reliant on those same exceptional circumstances. Otherwise you'd never do anything, or make your decisions based on something which has a much lower chance of a preferred outcome.

Mate if you ever get caught short of a job, open your own financial consulting business. Charge $100 an hour for the same advice you are giving away free on here.

Most of this stuff seems fairly self evident. If people around me want advice on finances, running a business, etc, I'll happily share what I know with them for free.

When there are extremely elevated house price risks, it makes no sense for owner occupiers to buyers using high amounts of leverage to buy.

Doing so can lead to significant financial loss (even more than 100% of a person's life's savings in some cases as they're in negative equity), mental stress, and in some cases bankruptcy.

Under those conditions, it is better to rent than buy. I would prefer to pay 10-20% higher rent, than to risk losing 50-250% of my total life savings - I would prefer inaction, rather than the action of jumping off a cliff with no parachute (i.e financial suicide). Look at those examples above who are at significant increased probability of a reduced standard of life due to fewer financial resources.

Most people are unable to recognise conditions when there are extremely elevated house price risks.

There will be conditions where it will be more financially attractive to buy, rather than rent.

We have some fairly elevated financial risks in the general economy. Buying a house in those sorts of conditions comes at a higher risk.

But there's a big jump from "here see these exceptions to housing never fails", to trying to determine whether all the housing inflation you're seeing comes solely down to a prediction of a bubble about to go pop.

There was no prediction of a bubble about to go pop.

Expected returns in the future were assessed as inadequate. When returns are inadequate, then there is no reason to buy.

There were numerous warnings that many buyers chose to ignore. Warnings were given by the RBNZ governor on the elevated house price risks.

1) Feb 2021: https://www.stuff.co.nz/national/politics/300238808/reserve-bank-govern…

2) March 2021: https://www.stuff.co.nz/business/124430525/adrian-orr-frets-over-soarin…

3) Nov 2021: https://www.rbnz.govt.nz/hub/publications/speech/2021/speech2021-11-02

4) Nov 2021: https://www.1news.co.nz/2021/11/24/first-home-buyers-encouraged-to-wait…

If borrowers chose to ignore those warnings, that is entirely their choice. Those borrowers who borrowed large amounts are free to choose, yet they are not free to choose the consequences of their choice.

People who borrowed large amounts at or near record low interest rates may now find themselves in cashflow stress and mental stress. There is only one person responsible for the borrower getting themselves into that situation and that is the person who voluntarily chose to sign their name on the mortgage contract and agree with the terms and conditions of that mortgage contract with their lender.

Expected returns in the future were assessed as inadequate. When returns are inadequate, then there is no reason to buy.

Every time I've thought "there's no way houses could be more expensive", my assessment was totally off.

Buying when returns are inadequate is often the best time to buy anything.

"Buying when returns are inadequate is often the best time to buy anything."

To me, that seems like speculation.

Some people are unknowingly betting 500% of their entire net worth (i.e. buying a residential property using a 80% LVR mortgage) on the speculation of a lifetime when house price risks are elevated.

A market moving in the short term isn't a great gauge of longer term performance.

Any healthy returns require some level of speculation. Or buying low and selling high.

"A market moving in the short term isn't a great gauge of longer term performance.

Any healthy returns require some level of speculation. Or buying low and selling high."

If you believe that house prices will make attractive returns from current median house price levels (the same price that most owner occupiers pay) , then this is your opportunity to get rich. Take your opportunity, go ahead and walk your talk.

I invest directly into active commercial pursuits, and don't need to acquire more property. I'd prefer additional cashflow over capital appreciation.

It's not just the job of the RBNZ to issue warnings, but to actually regulate banking and lending activity. Many people especially first home buyers are inexperienced emotional buyers who may not be particularly numerically or financially literate. Both banks but especially the RBNZ have a duty to ensure those borrowers are properly informed and guided so that disaster does not automatically eventuate for everyone involved.

" but to actually regulate banking and lending activity."

The extreme house price risks were preventable back in 2016 when the then Finance Minister did not give the RBNZ the tools they requested to address macroprudential risks. There was lobbying by those with their vested financial self interests to not implement the debt to income measures. It may also have become a political issue with the upcoming elections at the time and may have cost potential votes for the incumbent government at the time - this policy would have adversely impacted property investors, and most owner occupier buyers - a potentially large voting constituency.

RBNZ's DTI plans hit by Government changes | interest.co.nz

If you assume it would have taken 30 months (include time for preparation of the exposure draft), then the DTI framework may have been ready to go sometime in in 2019. This would have been before interest rates reached their record low levels in mid 2021.

If a debt to income ratio of 5 was imposed back in 2019, then a significant amount of lending would not have been made (and house prices would have been less likely to have reached their record levels).

As a result of that single decision, this will result in potentially thousands of highly leveraged owner occupiers who purchased in 2020 - 2022 being collateral damage. This will cause cashflow stress, mental stress and unfortunately, some will resort to self harm.

This will likely also lead to an increase in demand for social housing.

"Anyone telling you that you 100% can't lose owning a house is lying to you."

Here were 2 comments made by commenters:

a) 9th Nov 21, 5:52pm

"Or maybe right the opposite, don't hesitate, be brave and go for it, you'll be fine"

b) 14th Oct 21, 11:25am

Shrewd investors will capitalise on perceived price weakness - cementing their position for the next market upswing.

Well located property remains a prime investment for the long term. (But you already know that.)

This advice focused only on the potential returns and had no mention of any risk factors. Some of those who followed this advice in the 2020-2022 period may now be in cashflow stress, mental stress and at risk of losing their home.

Neither of those posts are saying there's absolutely no risk.

Most of us are hesitant to make big decisions, from fear. This is due to engrained parts of the human psyche, originally designed to keep us safe from predators, that now end up preventing people from making self beneficial choices.

I've owned and run many businesses over the years. I think that's something more people should do, instead of enduring paid employment. More would, but they fear the lack of security that comes with being independent of a secure income, underwritten by someone else. I think it's easy, but I've done it, and by now have the mechanics roughly worked out.

But I would be far less likely to tell people to go for it, start your own business, over just buying a house. Because I know the failure rate for someone getting into business ownership is astronomically higher than owning a house.

The next 5-10 years is going to tell us whether you're on to something, or misinterpreting a finite period of activity compared to a longer term trend and phenomenon.

Doubling every 10 years is a myth. In the last 20 years, average house prices have not increased 100% every ten years. Only 86%. The damn deceitful liars!

2003 $ 263k

2013 $466k 77% increase

2023 $909k 95% increase

86% average

The key question is: will that historical rate of median house price growth continue into the future? Why or why not?

What are the odds that the median house price in 10 years time increase at the 77 - 86% increase? - are the odds high, medium or low?

What were the key variables that caused the historical house price growth of the last 40 years and can that be expected to continue for the next 40 years?

What are the odds that house price growth will exceed inflation?

All tied to a) cost of servicing credit and b) wages. Once you reach the lower limit of mortgage rates, then it's only wage growth that can support a doubling of prices every 10 years.

Well agnostium, if you look at the table, you'll see that over the last 5 years, NZ's compound yearly price increase is 6.1%, slightly under the 7% needed to double in 10 years time, but then again this time frame includes the biggest value drop for the least 40 years.

Drumroll....... sorry, can't hear any..

And these figures include the initial hype about the National party coming to power and so called removal of foreign buyer ban..

Sorry spruikers.. you'll need to shout louder and still will be fruitless..

DGM- what constitutes a spruiker?

Anyone that doesn't believe houses will magically become more affordable on their own, apparently.

Anyone saying "house prices are going up" using anecdotal evidence, or cherry-picked data (e.g. minor price movements on limited volumes), rather than with reasoned economic argument.

If that's the rule it's not very well followed. People seem to think anyone they're debating is from the Facebook property investors page or the like.

@Chrisofnoname. I have 15 years of my own stats and I can state that house prices in my opinion has gone up.

What facebook page were you talking about again Pa1nter?

Can't say for sure, but plenty of the people railing about property on here, seem to look at it.

This site is about as social media as I'll get, but it sure seems like there's a demographic getting fired up at one place, and then transporting that wherever they wind up next.

Good for you. It'd be cool if you'd share it. (Sorry. I can't share mine as I don't own them. I really wish I could though.)

I am not saying property doesn't go up. It does. Well mostly. But over time it does. But it's mostly the land. The house? Unlikely.

But nowhere near as much as people like to think.

Once all costs are honestly and completely included very few people are getting rich by buying rentals.

Collectively our math is awful. And many (most?) "property investors" are - IMNSHO - amongst the worst.

The house? Unlikely

There's been significant cost price inflation on new house building for decades now, for at least half a dozen reasons. That's going to continue, and maybe get worse.

Hence, the relative value of an old house that already exists, will continue to rise.

Housing is going up for the first time in a long time in Tokyo and much of that is because it's simply costing more to generate them.

"very few people are getting rich by buying rental's"

Keep believing that and stay poor Chris.

Do you have access to a dictionary or Google?

Most of the people using the term don't seem to.

Nor the word "ponzi".

To be fair - as far as real estate is concerned, it is an Aussie term that we've picked up on but isn't used widely around the world. For example, 'Mericans call politicians the same in some places in the US but in other places you'll get a blank stare.

@ DGM thanks my question was not clear I change and add two more words: What constitutes to being a spruiker for you?

Someone who doesn't believe in doom and gloom for real estate.

Low volume of sales suggest any rises may be tenuous.

With i-rate cuts on the horizon it's unlikely to signal a dead-cat bounce. But it would indicate an aimless market with no clear direction. So just bouncing along at current levels? Maybe. Maybe not.

Peak sales months are November and March. So this November has been weak. Will March '24 be weak too? If so, I expect prices to slide slowly lower ... until the RBNZ comes riding to the rescue ... Sometime soon after March '24.

(But don't expect retail mortgage rates to come down quick. They never do. Because ... you know ... banks and their profits.)

I expect that the new governments attempts to address Housing Supply will only begin to be felt in two-three years time and will ultimately be underwhelming. Meanwhile immigration is colossal.

Maybe. Maybe not. Or more correctly, in some regions maybe NO, and in other regions maybe YES.

https://www.stuff.co.nz/business/property/301023478/heres-what-the-gove…

I understand the NIMBYs in ChCh want to "opt out" of the MDRS.

Anyone know what their Council plans to do?

Where will this government get all this money from?

"The Government has promised to introduce a $1 billion Build-for-Growth fund"

"A portion of GST collected on new residential builds may be shared with councils"

The incoming U.S ,then global recession will ensure that all time highs for NZ property prices wont be seen again until the mid to late 2040's.

That'd require a decade long depression, not a recession.

In which case house prices will be the least of most people's worries.

re ... "In which case house prices will be the least of most people's worries."

Not true. Look up what happened to those with mortgages in the USA in the Great Depression.

They struggled to afford the rest of lifes necessities, like people without houses?

Lazy and dumb.

No. Asset values - especially house and land values plummeted - but people were left paying the same on their mortgages and so banks foreclosed but were then left with land & houses nobody wanted. Until ... (Sorry. That's another story. Look it up.)

Still doesn't make it false, as a societal concern, home affordability is of lesser concern if everyone's struggling to survive a basic existence.

The US now has non recourse mortgages so people who can't afford them can hand the keys back to the bank & walk away.

The banks having their own skin in the game should also inhibit irresponsible lending practices.

Hooray !! ....about time someone mentioned that ! as the banks have no counter party risk in NZ, as they can "hound the crap" out of the mortgagee for the outstanding mortgage and interest due, long after the house is sold !

Should bring it in to NZ ....but they won't, as no good for the banks, right cobber ;) ......said with an Australian twang.

Exactly, and I cannot see the early warning sign of a depression - runaway inflation. Instead, what we are seeing is stubborn sticky inflation in all our major trading partners economies around 3-10%. The outcome of this will be that house prices will fall in real terms but may have nominal price growth.

Um ... No. Runaway general inflation is not an early warning sign. In a single asset class, maybe, but not always.

Look at the 1921 depression. 15.6% inflation in 1920 turned into -10% deflation and a depression in 1921.

Auckland City median up 7.8% in a month!

This site is becoming the number 1 source of good news stories ✔️

Merry Xmas all!

Yup. Apartment yields rise and prices follow.

How are people managing to afford a house at these prices with interest rates being what they are... I am absolutely baffled. Even the FHB lower quartile is a hugely onerous debt burden.

- great income/low expenses

- big deposit

- financial backing by others

- no holidays

- low quality of life

- in debt to the bank for life.

When I bought a house interest rates where 22%....

Our young people are leaving as they cannot see a way forward in NZ, mainly because of lower wages and higher house prices, there are some so blind they cannot see..... I think the vast majority of these smart kids are from national voting homes....

- someone around the water cooler said interest rates will go down in a year or two. Ride it out.

There is no way in NZ inflation can get back down to 2%, the rates bills alone would be 2% of your yearly spend, WGTN council needs 30 bill to sort water in next 30 years, thats $140,000 for EVERY PERSON in Wellington, all 212,700 of them, infants and elderly included. How can inflation of your household spend return to 2% band with water, rail roading education and Health all blowing out in cost. Oh yeah also policing, jails, defense costs, i hear we will be masssively short energy not to mention gas.

Thats right it can never return to 2%, and we have to factor in converting to renewables from almost free fossil fuels.... wake up people cheap money is gone.....

If only monetary policy were guided by anything other than interest rates.

Never? Really?

Bang the rise into just one year - adding to inflation in just that year ... and all years subsequent have rises at the the rate of inflation.

@Pa1nter ...... do you realise for 2024, if in NZ interest rates do go down, it will mean the banks are in trouble, as they are not selling enough mortgages (their bread & butter) ...while rents will stay at their elevated levels, so more property "speculators" will be buying, rather than FHB's, so the cycle will continue, with FHB's locked out of the market, being bid out by investors.

NZ will end up like Zurich where the average house price is $3 million NZD and there will be at the very least 70% renting for life ....while that number will only grow.

So carry on your merry way, as your astute "business plan" will just drive down the standard of living, while Auckland will become even worse, with overcrowded rental housing, insufficient infrastructure (as the taxpayer can't afford it) , even more people that have skills and experience leaving for overseas ... only to be replaced with immigrants, who haven't got the means and qualifications to go any where else, but just want to get out of their own country.

Meanwhile a city like Auckland falls further and further down the list of cities to live in around the world - while it's already the most dangerous city in Australasia....have you ever walked down Queen St at 2am ?

Good to see you are thinking ahead for you and your family - but stuff everyone else !

I do realize these things. Much of what I'm saying, I don't personally endorse as a good thing.

April spruiker wanted to know how people can afford housing at the moment and I gave examples of the sorts of situations that can. That's not the same as saying it's a good thing.

"How are people managing to afford a house at these prices with interest rates being what they are... I am absolutely baffled. Even the FHB lower quartile is a hugely onerous debt burden."

Some of the financing methods that have been used to address housing affordability challenges and has resulted in high house valuations:

A) For owner occupier buyers:

1) bank of mum and dad for a larger deposit resulting in a smaller mortgage which is manageable

2) more incomes to support the mortgage -

- joint ownership beyond the 2 income earners - sometimes 3, 4 co owners - e.g multi generational - parents and adult working children, 4 single siblings, bank of mum and dad - https://youtu.be/GNcBfJQX3_w

- other income sources - flatmates, boarders in house

- rent out other dwellings - garage, etc

B) For non owner occupier buyers:

- property investment syndicates - heard reports of 2 - 5 different groups combining their earning / borrowing power for a mortgage to buy one residential property

There have been recent buyers that are in cashflow stress due to renewal of their mortgage interest rate. The lenders have assisted these borrowers where possible by amending the terms of the mortgage contract to reduce the cashflow stress of the household. Despite this, there are 19,200 mortgages currently in arrears.

This from Stuff this afternoon.

I would like to see prices moderate in real terms over the next 5 years. Personally, I now see migration as being the king maker in terms which way prices are now moving. This will obviously cause regional variations with migrant destinations being effected earlier and harder which we are seeing.

My grave concern is that the government and the RBNZ are going to need to move deftly, and in concert to manage migration, and the OCR without causing a massive surge in property values as inflation weakens while avoiding a hard landing. I just don't believe that they possess that degree of finesse.

If you're looking for logic in house prices, you probably won't find one.

The facts are:

Not enough houses/'good' houses in Auckland, especially on north shore.

The higher the rent, the more people want to buy.

More people are coming, more foreign money, continued price rise.

At least 80% of the mortgages already moved to 7% rate.

Once the mortgage rates start to decrease, we'll see a big jump in prices.

Just wait until the Nippon Clippons on our failing, overdue to be replaced but not being replaced bridge fail. North Shore prices will half overnight.

House prices in some areas have met Ashley Church's definition of a property market crash.

Will Ashley tell you this? Will those with vested financial self interests tell you this?

1) From Ashley Church

"But what constitutes a housing market crash? ...... I define a property market crash as a 20% drop in the median sales price from market peak, and which lasts for more than 12 months." - https://www.oneroof.co.nz/news/ashley-church-four-reasons-the-housing-m…

2) REINZ median house price changes from peak as at Oct 2023

Some areas below have now met Ashley's definition of a property market crash.

Locations where median house prices are down 20% or more from their peak:

1) Far North District: -24.2%

2) Kaipara: -31.0%

3) Central suburbs of Auckland: -25.0%

4) Manukau: -20.2%

5) Papakura: -27.5%

6) Waitakere: -27.0%

7) Matamata - Piako: -28.8%

9) South Waikato: -37.0%

10) Thames - Coromandel: -25.4%

11) Waikato district: -26.3%

12) Kawerau: -36.1%

13) Rotorua: -22.1%

14) Western Bay of Plenty: -25.2%

15) Gisborne: -20.3%

16) Stratford: -32.6%

17) Horowhenua: -24.3%

18) Rangiteki: -40.9%

19) Ruapehu: -29.2%

20) Whanganui: -23.1%

21) Carterton: -23.8%

22) Lower Hutt: -24.0%

23) Masterton: -21.2%

24) Porirua: -21.8%

25) South Wairarapa: -58.0%

26) Upper Hutt: -23.6%

27) Wellington City: -24.6%

28) Buller: -30.5%

29) Westland: -29.2%

30) Waimate: -29.3%

31) Southland district: -26.2%

Remember that for most owner occupiers, the equity deposit is 20%, so for those who bought at or near the peak, most of their equity (which could be their entire lifetime savings) has evaporated in just 2 years. In some cases, property owners are now in negative equity.

The purchase of a owner occupied residential property is likely to be the largest purchase for most households and the source of funds for retirement.

Also remember, that the above are nominal prices and not yet adjusted for inflation.

EDIT: All compared to Oct 2023 median house prices

Is that table vs peak published somewhere? South Wairarapa is a stand out.

"Is that table vs peak published somewhere?"

Not to my knowledge. I went through the data.

"South Wairarapa is a stand out."

Refer May 2022, REINZ Property report - the median house price reported was $1,310,000 vs the latest reported median house price in November of $635,0000 - above table has typo - it should be -51.5% (the -58.0% was the price comparison of the peak with October 2023)

https://www.reinz.co.nz/Web/Web/Data-and-Products/Property-reports.aspx

"almost all of the country became possessed by the idea that home prices could never fall significantly. That was a mass delusion, reinforced by rapidly rising prices that discredited the few skeptics who warned of trouble. Delusions, whether about tulips or Internet stocks, produce bubbles. And when bubbles pop, they can generate waves of trouble that hit shores far from their origin." - Warren Buffett on the US housing bubble

Remember that these are some reasons given in the mainstream media, property market commentators, property market promoters, bank lending promoters masking as bank economists, real estate agents, property market mentors & other sources as to why property prices in Auckland will not fall by much and that there is a low probability that property prices will fall dramatically:

-

during the GFC, house prices in Auckland fell only 7-10%

-

over the past 50 years, house prices in Auckland have averaged 7.2% per annum (or commonly referred to as house prices doubling every 10 years). This trend can be expected to continue into the future - https://youtu.be/Agp9xFWoBX4?t=172

-

there is a shortage of underlying housing in Auckland, so property prices won't fall by much - https://www.interest.co.nz/property/97513/auckland-councils-chief-econom...

-

there is a growing population which means that there will be more demand for houses - https://www.stuff.co.nz/business/106883553/house-prices-have-fallen-but-...

-

we have inward immigration which means more demand for houses

-

Auckland is an attractive city with an attractive lifestyle - that makes it desirable and attracts foreigners to move to Auckland and hence raise the demand for houses

-

we mustn't forget either the vested interests in ongoing stability. No government, central bank or trading bank with mortgage exposure wants materially lower house prices. Nor does an incumbent Beehive want falling house prices going into an election campaign https://www.stuff.co.nz/business/110499233/think-house-prices-are-going-...

-

the economy is doing well, with low unemployment - https://www.stuff.co.nz/business/110499233/think-house-prices-are-going-...

-

there has been insufficient construction of new builds to meet the housing shortage - https://www.stuff.co.nz/business/106883553/house-prices-have-fallen-but-...

-

there are high construction costs to building a house. House prices cannot fall below their construction cost. - https://www.stuff.co.nz/business/106883553/house-prices-have-fallen-but-...

-

people don't sell their houses at a loss - https://www.stuff.co.nz/business/106883553/house-prices-have-fallen-but-...

-

continued inflation means that house prices will continue to rise in the future

-

The fact is, debt levels have barely changed from the beginning to the end of those 10 years, compared to GDP levels, compared to household assets, compared to household disposable incomes. And much more importantly, debt servicing is very much easier now, an item that is almost universally overlooked. We are not pushing out to unsustainable levels now, and even if they creep up a little, we are far from that point. https://www.interest.co.nz/opinion/95894/if-you-think-new-zealands-house...

-

in aggregate household debt servicing is low in New Zealand - currently at just under 8% of disposable income of households - https://www.rbnz.govt.nz/statistics/key-graphs/key-graph-household-debt

-

property market participants & commentators who have been correct in their predictions about recent property price trends have more credibility and hence their predictions of upward prices are believed by a wider audience (such as Ashley Church, Tony Alexander, Ron Hoy Fong, Matthew Gilligan, etc). - https://www.stuff.co.nz/business/84322204/all-predictions-of-an-auckland...

-

previous warnings about a house price crash have been wrong - property prices have continued rising upward significantly since these warnings were given, so there is little reason to believe these warnings.(such as Bernard Hickey) - https://www.stuff.co.nz/business/84322204/all-predictions-of-an-auckland...

-

its unlikely Auckland prices collapse. I think the main two reasons though are:a) Affordability has been this bad, and worse, in the past and it only resulted in about a 10% drop. b) The number of homes built over the last decade has been too low and will take some time to recover - https://www.interest.co.nz/property/100670/housing-market-continues-hibe...

-

real estate is a hedge against inflation so I don't see house prices in Auckland falling much further. [https://www.propertytalk.com/forum/forum/property-investment-forums/new…]

-

Not a single person who bought 10 years ago has ever regretted buying / have you met anyone who has bought a house and regretted buying it?

One interesting sidenote: a previously high profile property commentator who owned 60 investment properties at one time, went low profile and sold their entire portfolio of investment properties.

"almost all of the country became possessed by the idea that home prices could never fall significantly. "

What were property commentators (and potential vested financial self interests) saying at or just after the peak?

1) Tony Alexander - 19 reasons why there's no crash - December 2021

https://ndhadeliver.natlib.govt.nz/delivery/DeliveryManagerServlet?dps_…

2) Catherine Masters - July 2022

Why the New Zealand housing market is nowhere near crash point

https://www.oneroof.co.nz/news/why-the-new-zealand-housing-market-is-no…

3) Ashley Church - April 2022

Four reasons the housing market won't crash

https://www.oneroof.co.nz/news/ashley-church-four-reasons-the-housing-m…

4) Kelvin Davidson - Dec 2021

“But will prices actually fall? I’m not convinced because in the past a serious housing downturn has come with a recession, but no one is suggesting that and unemployment is low at 3.4 per cent.”

https://www.stuff.co.nz/life-style/homed/real-estate/127305870/what-lie…

5) Nov 2021 - Here's why it might be fruitless to pin your hopes on a house price crash

https://www.stuff.co.nz/business/300449314/heres-why-it-might-be-fruitl…

Whoa. Stop quoting facts, especially ones created by the industry. The vested will get flustered.

REINZ median house price changes from peak as at Nov 2023

Some areas below have now met Ashley's definition of a property market crash.

Locations where median house prices are down 20% or more from their peak:

1) Franklin: -21.4%

2) North Shore: -20.3%

3) Papakura: -29.8%

4) Waitakere: -21.1%

5) Hauraki: -20.7%

6) Otorohanga: -37.1%

7) South Waikato: -21.2%

8) Thames - Coromandel: -28.0%

9) Opotiki: :-21.8%

10) Rotorua: -24.0%

11) Tauranga City:-20.5%

12) Whakatane: -22.6%

13) Gisborne: -21.7%

14) Central Hawkes Bay: -27.6%

15) Hastings: -23.2%

16) Horowhenua: -24.3%

17) Rangiteki: -29.4%

18) Ruapehu: -32.3%

19) Whanganui: -23.1%

20) Kapiti Coast: -20.6%

21) Lower Hutt: -25.5%

22) South Wairarapa: -51.5%

23) Upper Hutt: -22.5%

24) Wellington City: -24.2%

25) Nelson: -21.7%

26) Buller: -33.7%

27) Westland: -33.4%

28) Hurunui: -22.3%

29) Clutha: -35.3%

31) Southland district: -25.4%

Don’t forget over last two years inflation is up around 15% and NZD has lost 15% of its value, with interest rates staying around this level the housing market will be taking more hits over coming months.

Back down we go.

Thanks David. Timely article. Timely reminder.

Will it temper the irrational exuberance among the property bulls? Probably not. There are way too many much louder voices hysterically screaming buy, buy, buy.

"There are way too many much louder voices hysterically screaming buy, buy, buy."

There are those businesses with vested financial self interests that need revenues to survive. They will have marketing budgets to promote their business activities. (e.g real estate agents, mortgage brokers, lenders, etc)

For those property price bears, there is no financial interest and hence no marketing budget.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.