House hunters should have plenty to choose from as we head into the peak selling months of February and March, with a surge of new listings in January and stock levels running high.

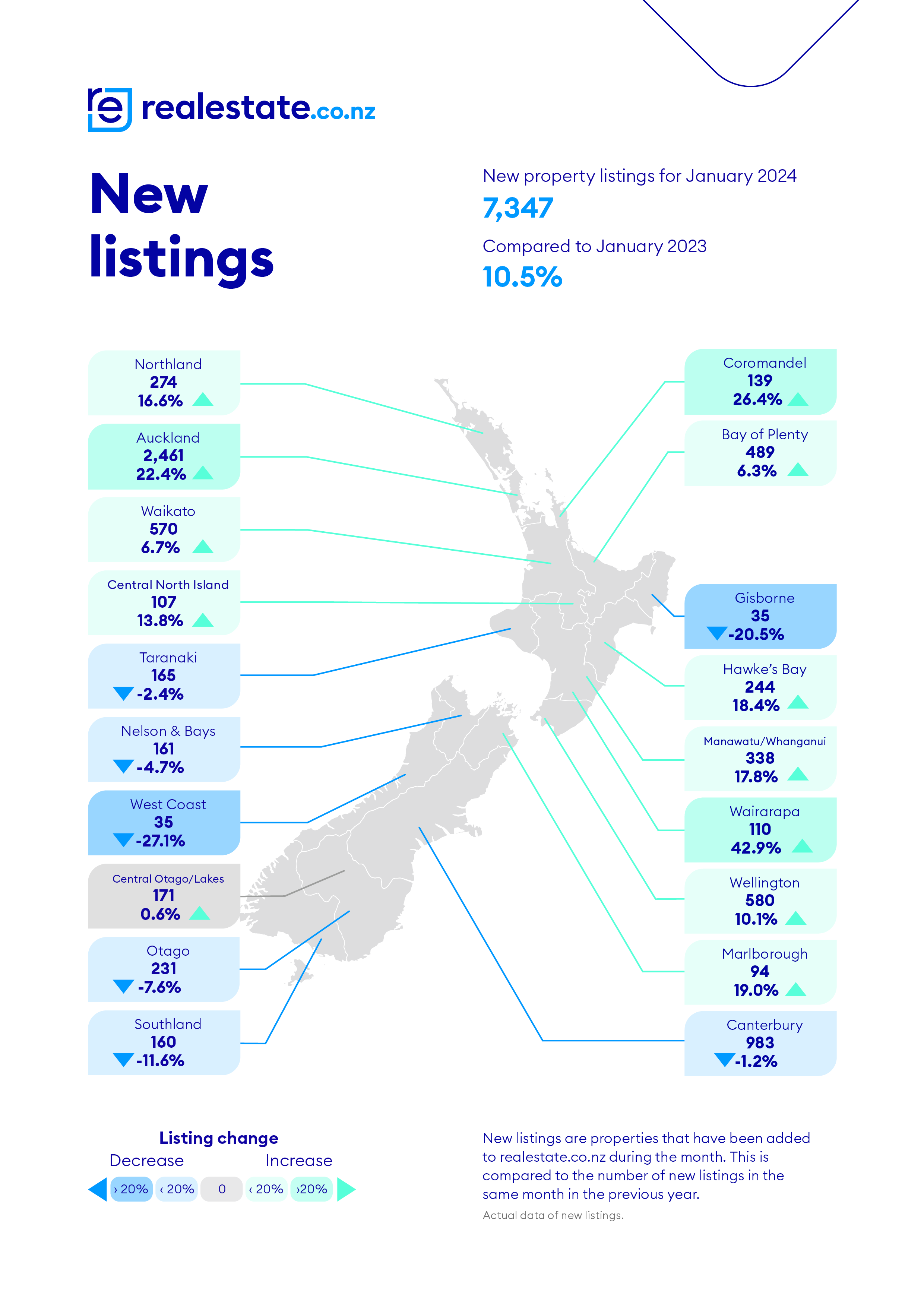

Property website realestate.co.nz received 7347 new residential listings throughout the country in January, up 10.5% compared to January last year.

That jump in listings will be a relief to many, because new listings had slumped to just 4828 in December last year, which was down 27% compared to December 2022.

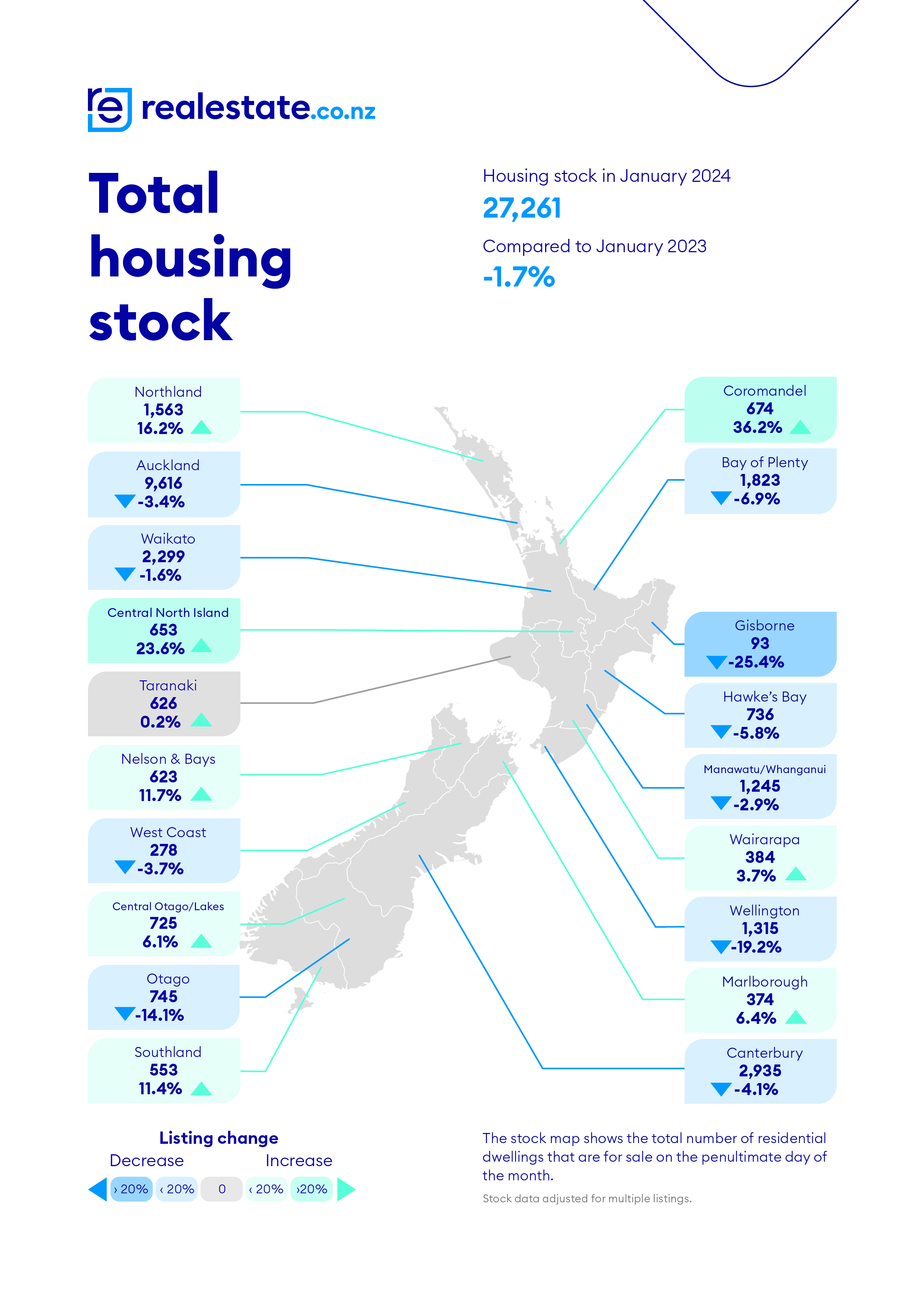

The surge in January listings pushed total stock levels of properties for sale back up to 27,261 at the end of the month, from 24,867 at the end of December 2023.

Stock levels are now almost back up to where they were at the end of January last year (27,732).

The number of properties for sale is now at its second highest level for the end of January (after January 2023) since January 2016.

That gives buyers plenty of choice.

However vendors appear to have reasonably high price expectations, with an average asking price of $891,960 in January, up from $854,794 in December.

However the average asking price has been volatile from month to month recently - it was $920,678 in October last year - and the monthly movements may be a result of changes in the mix of properties coming to market each month.

With so much stock available for sale, vendors will need to be realistic with their price expectations to achieve a sale and the next few weeks will tell if vendors' enthusiasm is matched by similar levels of enthusiasm from buyers.

"The start of the new year brought a dramatic shift in market activity," realestate.co.nz's January report said.

"Following a quiet December, realestate.co.nz data highlighted a 52.2% surge in new listings nationally, far exceeding the average 23.7% increase typically observed over the past five years between December and January," the report said.

The comment stream on this story is now closed.

•You can have articles like this delivered directly to your inbox via our free Property Newsletter. We send it out 3-5 times a week with all of our property-related news, including auction results, interest rate movements and market commentary and analysis. To start receiving them, register here (it's free) and when approved you can select any of our free email newsletters.

93 Comments

There will be a lot more in July. The market will flat for a spell unless those whose residency was fast-tracked all start buying.

Listings are increasing but vendor expectations are still too high. I think this will change as the beginnings of fear is starting to spread in the collective sentiment. Do you remember the mania in 2021? It feels totally different now after a few short years. Now we’re seeing more and more articles on distressed mortgagees, developers in trouble, construction work starting to dry out and the realisation that a new Nat govt can’t prop up the ponzi. Ordinary conversations reflect the change too. Phobos is in the air.

On top of that, there is the insanity that is playing out in China: 20 million unfinished building projects due to developers going bust! Reuters link: https://m.youtube.com/watch?v=y8Ce8heYO9Q.

These external events surely will affect us?

All ponzi's eventually run out of puff. Lots of debt holder and nothing to show for it.

"Nat govt can’t prop up the ponzi" - could be a big factor. A lot of boomers would have wanted to sell their rentals last year but held off until National were elected to see if prices went up. If you are retired a rental makes no sense when it is paying way less than a TD would, if it isn't a long term investment why wouldn't you take the easy money.

In addition it is looking less and less likely the RBNZ are going to cut this year.

What’s the basis for your final statement?

The strong US economy. The middle of the year is now only 5 months away, unless the US collapses before then or NZ gets some seriously bad data, I don't think the RBNZ will cut.

So our OCR decision making is beholden to them?

What happens if our economy really tanks, demand is destroyed, and inflation dies. The OCR is still not cut? And our economy tanks even more?

I don’t buy that at all.

Anyway, I don’t buy that the Fed won’t cut so I think the currency concern is moot. As well as strength, their economy has some cracks in it. As those cracks get larger, and as inflation continues to weaken, they will cut. Probably around mid year.

No I don't think our OCR decision making is beholden to them. But I do think our currency is going to take a bit of a hammering even without a cut, and if we did cut it could go real low, and that would create inflation on fuel and imported goods.

"What happens if our economy really tanks, demand is destroyed, and inflation dies" - sure they would probably cut, but it takes about 3 months to even get that data, so it would have to happen very soon.

Roger J Kerr doesn’t think our economy is going to tank and he doesn’t think domestic inflation is going to tank. He and you could be right.

OK now I know I'm wrong!

NZ is not the USA. Plenty of Americans didn't want the covid vaccine. But they all took the mortgage vaccine REFI 3% for 30 years fixed. The higher interest rates put the dampener on new credit creation and by association inflation. But people did not get necessarily hammered for their previous purchase decisions. The RBNZ went for the let it rip plan and many New Zealanders are certainly getting ripped a new one by their bank. Workers are demanding more money. Not to buy stuff but to pay their mortgage or their landlords mortgage via rent. That is inflationary.

I think it’s going to get a lot harder to demand more money as work dries up and employment tightens.

If we have a lower cash rate than the US and a worse performing economy, I can't see anyone wanting NZD, and a big drop in NZD will cause inflation. Whether that will stop the RBNZ cutting I don't know, it surely will be of concern to them.

If local demand dies then a higher cost of importing things will be moderated.

Local demand is dead. The house ATM is out of cash. It is currently cheaper to ship a container from China to NZ than from China to Australia. RBNZ is boosting in FOREX reserves for a reason. If they have to cut first then they need to defend the NZD to avoid another inflation bounce.

Why do you think inflation will bounce if the NZD weakens, when demand is dead? Businesses reliant on importing will simply have to cut costs.

And btw we’ve had big weakenings of the NZD in the past and it hasn’t had a big inflationary impact

More supply, less able to buy due to normalized cost of debt all indicates one direction in price under supply and demand logic. Perhaps every recent immigrants will go on a crazed buying frenzy.

Perhaps not. They could just wait for citizenship then hit west island as many already are.

Don't fall for the bull trap..

Seen it first-hand here in my neighbourhood in Napier where a lot of properties have come on to the market over the past 2 weeks. Sure am glad I am not trying to sell at this time!

I was having a browse at properties over the weekend on TradeMe. I thought "sheesh there's a heck of a lot more listings than normal" for Masterton.

Sure enough, as this article suggests, a 43% increase for Wairarapa.

I commented a couple of weeks ago that anecdotally there seemed to be a lot more for sale signs in our neighbourhood.

Another thing that stands out, is there's a ton of listings with actual price guides which was unheard of over the last few years.

https://www.trademe.co.nz/a/property/residential/sale/wellington/master…

Agree and I don’t think anyone is buying the $1.5m to $2m properties, but vendors are still listing up there. I guess it looks like a reckoning is going to happen this year. We should be seeing prices close to prepandemic, but listing prices have kept going up.

Shocking to me in the link above, is that there are multiple houses there listed under $400K, the occasional one is even under $300K.

Agreed. BEO $269,500 for example. Reminds me of our 2017 purchase (slightly smaller house on the same size section) for $200k.

Min wage has gone up again. Get that mortgage to $200k ($70k deposit) and you're talking less than $1500 per month mortgage on $6400 after tax household earnings if both full time minimum wage.

https://www.trademe.co.nz/a/property/residential/sale/wellington/master…

New listings - but from my observations, the majority are rubbish. Rentals, c##p locations and big cap spend required. Good home, good location still scarce.

Ex. So they'll want less for them

They will want plenty as specuvstors do. They will get less.

Wannabe property investors that piled into the market a few years ago when they were giving money away and now finding out they can't afford it at a relatively 'normal' cost of borrowing?

That's because its investors selling. Owner Occupiers cant afford to upsize their mortgages so are out of the market, only those who cant afford to hang on to their homes are selling. Good for FHB who want to buy something cheap and put in some sweat equity (assuming the entitled generation still do stuff like that?

'the entitled generation' - I assume you are referring to those who want their children and children's children to pay for their retirement via rent, specuvestment and super? The ones who want to have their cake and eat it too?

I'm talking about young people who want everything handed to them on a plate, without having to work for anything. From what I hear most FHB want a done up house thats just as good as their parents' place, and turn up their noses at anything that requires a bit of work.

I can assure you that any young couple buying a house will need to work very hard for a very long time. Much more so than when my parents easily bought a house at 23 on a single average income. And the house they bought was reasonably modern at the time, they weren't expected to buy an 1890's do up with outhouse and candles.

Did you hear that a the pub from your fellow boomer chapter?

No, from real estate agents and the guy who posted the exact same comment down below lol

It's now 8000 hours worked to save a deposit, vs 2000 hours 30 years ago. (I posted the maths a couple of years ago). Never mind the pesky business of paying rent and living in the meanwhile.

I assure you, young people are working much harder and longer for their deposits (as evidenced by the ever-increasing age of FHBs). And then the eye-watering percentage of their income they are having to pay for their mortgage, coupled with the price-gouging happening in our building supply industry, and there's not a lot left to even work with - can't labour if you can't afford the materials!

Also, side by side a $200k mortgage @ 20% vs a $600k mortgage @ 6% looks the same repayments wise. But it's the impact of wage inflation that really illustrates the issue.

A 5% increase in repayments on $200k goes from 30 year to 15 years. On the $600k mortgage, 5% increase goes from 30 years to 27 years.

"Also, side by side a $200k mortgage @ 20% vs a $600k mortgage @ 6% looks the same repayments wise. But it's the impact of wage inflation that really illustrates the issue.

A 5% increase in repayments on $200k goes from 30 year to 15 years. On the $600k mortgage, 5% increase goes from 30 years to 27 years. "

The important point that you have illustrated is not well understood stood by most.

A $600,000 mortgage at 6.0% p.a for 30 years is $43,589 per year in P&I

That same $43,589 at 20.0% p.a interest rate for 30 years on P&I is a mortgage of $217,028 (64% smaller mortgage)

A debt to income of say 2x vs 6x.

That same 5% increase in repayments of $2,179 per year in P&I

1) 0.36% of the $600,000 mortgage

2) 1.00% of the $217,028 mortgage

So on a smaller mortgage amount, that 5% increase in repayments reduces the mortgage balance by 2.76 times more (1.00% vs 0.36%) for the $217,028 mortgage, than the $600,000 mortgage.

They sounds terrible. And quite different to the FHBs I know who just want an OK house that isn't going to fall down, and a bit of a yard. This is in Christchurch - I guess their equivalents in Auckland have given up on the 'yard' bit.

Basically the same thing I was looking for when I bought my first about 15 years ago.

I think you'll find those entitled young people exist in far fewer numbers than entitled old folk. I know of only one young person that wants everything handed to them, they're a close relative, and they're never going to achieve anything in life let alone buy a house.

I know you think that the ticket to the property ladder is buying an old doer upper, but the real trick is to get in before the landlords that see upside potential. That ship sailed 5 - 10 years ago.

I'm sure Tony Alexander will put a positive spin on it! More people selling into the red hot market or something like that...

Lol

Yes it’s fun to speculate on how he will spin it

Less activity because it’s been such a hot, sunny summer and lots of people are still at the bach?

Yeah right, Many of them are apartments and townhouses, who'd want to buy those?!

If you're interested there are few of them in Browns Bay, for 600K you can get an AMAZING 2 bedies townhouse

Good houses always sell above the market price, saw one before XMAS, sold 200K above CV

"who'd want to buy those" - lots of people. It would drag down other properties too - why pay $1.5 mil for a detached 1950's do up when you can get a brand new townhouse for $600k?

Are you ok with a 2 sqm living room?! to hear your neighbours farting?!

Well.. I'm not

We live in a townhouse and hardly hear our neighbours at all. In fact, it’s much quieter than most suburban houses I have lived in.

How much more would you pay to avoid hearing your neighbours' farts?

If your options are living in a detached house next to the gang and hearing fights and domestic violence, or living in a good location with the occasional sound of the neighbours fart, I'd choose the latter. In fact if you only have 600k you probably can't afford the detached gang neighbour house.

What about a 2 sqm living room, are you/your wife ok with that?

for a bigger house and privacy I'd pay 100-200K more

Of course, if your limit is 600k, there's nothing else to do

What a load of rubbish. 2 sq m? Where?

You can buy a detached house in Browns Bay for $800k?

Where I live you have to pay about 50% more for an old detached house needing lots of work as you would for a new terraced house of the same size. And if you have that 50% extra for the detached, you may be better off buying a terrace in a better neighbourhood closer to the city.

Lol

Looking forward to John telling us where I can buy a detached house for 800k in Browns Bay. I’d be keen

I talked about 2 bedies, not 3

This one for example has a 2 sqm living room,

https://www.realestate.co.nz/42444874/residential/sale/6b-athena-drive-…

I'm not sure you understand how big (or rather small), 2 sqm is, lol.

Lol.

It’s certainly pokey but it’s 20-25 square metres NOT 2 sq m 😂🤡

Even If you portion off the living area from the dining and kitchen area it’s still nowhere near 2. Maybe 10

Sounds like John needs to educate himself a bit on dimensions

He could be a Flat Earther?

re ... "Are you ok with a 2 sqm living room?! to hear your neighbours farting?! "

Building regs have changed significantly in the last decade to make shared buildings much more soundproof. e.g.

1. Minimum living room size is roughly 3.8m x 3.8m. = 14.4sqm. But because the open plan set up includes a 'dining area' it's usually more like 6m x 3.8m = 23sqm. And those are minimums. (As an aside, large screen flat TVs have reduced the need for a larger living rooms - funny how tech changes things.)

2. Inter-tenancy walls (and floors) are now subject to much more stringent minimum Db ratings. Everyone exceeds them as the cost to rectify after the wall is complete is significant. The loudest fart - some 118.1 decibels apparently - would scarcely be heard.

Aside from those being forced to sell due to high interest rates, this is also the effect of the 5 year Brightline period rolling off. Now all those who bought in 2018 and 2019 can sell up. From July everyone who bought prior to July 2022 can sell up. There is going to be a surge of listings then.

They may have capital loss by then.

NACT are bringing in a 20 year reverse brightline test - any capital loss on property can be 100% claimed from IRD. This will encourage more investment in property which will obviously bring house prices down.

"NACT are bringing in a 20 year reverse brightline test"

I must have missed that gem. Gotta link?

I thought that was ridiculous enough to imply sarcasm. But yeah maybe it is a bit too believable...

LOL. I thought it might be. But with the NACTF you never know what nonsense they'll come up with. (And, just quietly, there are some aspects of doing exactly that, that far too many would see as completely fair and reasonable.)

re ... "They may have capital loss by then."

The fourth National Government, way back in in 1990s, kicked off the "residential rental property" boom. Even before then, residential property was an okay'ish investment.

The vast majority rentiers, most of whom bought 5 or more years ago will be sitting on an untaxed gross capital gain. So prices would need to fall much, much further before those gains were wiped out. I just can't see that happening under our current government. Can you?

Those that bought in the last 5 years are a small % of the total. The NACTF will make their 'hanging on' worth their while - or at least much more of a coin-toss.

Selling a rental in winter can be very expensive if the property is vacant. And an occupied property won't ever show at its best. My guess is some will be forced (by their banks) to sell at the first opportunity but many will wait until Summer 2025.

"The fourth National Government, way back in in 1990s, kicked off the "residential rental property" boom."

What tax rule changes in particular are you referring to?

Only the beginning of the slippery slope of no buyers at overinflated prices, with interest rates remaining the same for the rest of the year (unless there is a recession) ....but don't worry AC, TA and the honest as the day is long, TTP have all got your back, so you have nothing at all to worry about, so rest easy folks.

All "property ponzi parties" always have a limited shelf life....and the shelf on this one is losing it's grip on the wall of financial reality.

Some people logic is a bit of a worry, who cares about a lot of listings ? People are just looking to move, if they sell their house they just end up buying another and on more than one occasion I have seen people move just up the road or not even leaving their current suburb. House get bought and sold far too frequently in NZ, the average must be like 4 years and owners get bored or something.

If you are right and it is people moving, then we will see a big increase in buyers as well as sellers. Time will tell I guess, feel free to hold your breath but I won't be.

A few months back, I sat down and did some number crunching with some 'property investor' friends who wish to sell their rentals but wanted to do 'spruce ups' before selling. Mostly kitchen and bathroom updates, garden tidy ups, fresh paint, minor repairs, etc.

All wanted to sell this summer. It turns out that the maths says it is better to wait for next summer. We ran a spreadsheet with numerous inputs and outputs tested. And used wine to ensure we thought of all factors ;-) And re-checked in the following week - with no wine. ;-)

Some of the contributing factors to this outcome were a) lower mortgage rates, b) larger reno labor pool and more competitive pricing, c) lower reno product pricing (especially from China), d) greater buyer pool, e) clearer tax implications, f) fewer new builds on offer, g) time unrented, etc. A big downer is that a recession, driven by our friendly RBNZ, may mean it takes way longer sell.

I guess what I'm saying is that supply may be just as good next summer if others have done the same analysis we did and reached the same conclusion.

All very rational and considered!

They might get more money now than they will next year with the spruce ups, especially with that 6% they will get from a year of TD.

It probably all comes down to the RBNZ, I think a small OCR cut is already priced in (house prices are way too high at current interest rates), it might need >1% cut to make any real increase to prices, and even then there could be plenty wanting to sell to dampen the price increases.

Did you take into account the surge in listings that will happen post July this year as the Brightline period is wound back? What if half of those are still languishing on the market by summer 2025? Waiting to sell into an oversupplied market may not achieve a price higher than what you can sell for today, indeed it may be a lot lower.

They are the "can't go wrong with property", "you will always make money in the long term", "there is no better investment" type people. So they may wait a very long time before they accept a paper loss from the peak.

"They are the "can't go wrong with property", "you will always make money in the long term", "there is no better investment" type people"

How many of these adages have owner-occupier buyers been told by those with their vested financial self interest in order to persuade buyers to transact?

1) you can never lose with property

2) you never go wrong with bricks and mortar

3) house prices always go up / never go down

4) rent is dead money

5) people should own their own home over renting

6) there is population growth so property prices don't go down / will always rise

7) everyone needs somewhere to live so property will always be in demand and property prices will rise

😎 there is an underlying housing shortage so property prices will not go down by much

9) house prices double every 10 years (7.2% p.a)

10) no one who has bought property in the past 10 years has regretted it

11) real estate is a hedge against inflation

12) time in the market, is more important than timing the market

13) don't wait to buy real estate. Buy real estate and wait

14) buy land, they aren't making any more of it

15) Buying real estate is not only the best way. It is the quickest way and the safest way, but the only way to become wealthy. – Marshall Field

16) Everyone wants a piece of land. It’s the only sure investment. It can never depreciate like a car or washing machine. Land will only double its value in ten years. – Sam Shepard

Meanwhile there is a long history of housing bubbles around the world that those property promoters with their vested financial self interests don't want potential buyers to know about.

The highly leveraged owner occupier buyers of 2021 - 2022 may now be facing cashflow stress, mental stress and a large loss on their equity deposit (some have lost over 100% of their initial equity deposit and now in negative equity) as a result of that single decision to buy. Some of those buyers on lower incomes, nearer to retirement may never financially recover, and may need social housing.

CAVEAT EMPTOR.

Sure did. The vast majority of rental properties were purchased way before the bright-line rules would have affected the owners. So in essence we're only looking at owners who purchased recently. We don't know exactly how the NACTF will change the bright-line rules as yet. If they retrospectively change it back to just two years then that 'rush' in July will only be a slightly bit bigger than the tiny rush I expect if the 5-year rule stays.

Whilst that is true, it is also true that the vast majority of financially stressed landlords are those who purchased within the last 5 years with big mortgages that the rent does not cover, and who are now being forced to sell up. Along with those that leveraged the equity in those older existing properties to buy more, and will now be forced to sell more than the last property they bought. So removal of the Brightline will have a significant effect on those who bought or leveraged up within the last 5 years.

It will free up all the investment properties bought during the boom of 2020-2021 of which there was a lot (80,000 to be exact). Apart from those in negative equity, a lot of them will be looking to get out with some tax free gains while they still have them, because otherwise they are going backwards by having to top up cashflow negative properties. Add in those who are looking to offload holiday homes because they are now a big financial drain on household finances.

This is what many people don’t know that they don’t know. Especially those who focus on price to determine their future price expectations - price extrapolators, price trend followers, and price chartists.

Many people are completely oblivious to this data point and its potential impact.

There are other potential time pressured or cashflow pressured sellers who are not identified above.

Remember at its peak, the value of residential dwellings in NZ was $1.7 trillion and it is the largest asset class in NZ.

Took the plunge and bought our first home last week in Birkenhead so just to give a sense of the sentiment I gathered since late November and in the 30+ open homes visited.

Seemed like plenty of interest around, not sure how many are just curious neighbours but lots of properties listed for only 3 weeks had over 90 groups through them (not sure what standard is in Auckland but agents seemed pleased enough obviously in comparison to early 2023). But in conversations with agents buyers niggly on work they have to do and precious about any maintenance. It seems many FHBs in suburbs nearish to central Auckland are not willing to put in some work themselves and are just seeing the tradie price in their eyes when looking at do-ups. One property (CV 1,040) we put in a $927k offer due to the sheer amount of work required (failing retaining walls, asbestos paint inside, non-internal access garage, cross-lease, etc. Buyer accepted higher offer with more conditions and it fell through. Agent was then calling me to bid more even though since our offer failing cladding issues were discovered... This property has since been withdrawn from market, (sellers were trying to sell out investment property).

Agents told me the amount of conversations they were having when asking why buyers weren't interested in properties because of things like 'astroturf' and unwilling to be putting down grass themselves (with full drainage already installed)... really on the margin stuff for a near $million investment fixes that will cost practically nothing. I think maybe just a higher proportion of FHBs these days have a lot less practical keeness, but those that do can find great deals and add lots of value to their property for some effort. Or maybe as with us, not willing to pay the purchase price near their budget max because then you're stuck in a crappy home as you try and save enough to do a reno with a huge mortgage.

I'd say if you're putting up an owner occupied well-maintained property up on the market you'll do fine. Our property has a few niggles, we managed to grab it about 7% below CV on the day. Other properties that I would say were modernised well, especially flat, easy care sites with good indoor-outdoor flow and at least parking for a couple vehicles were going well above CV on auction day.

Trying to think if it's better to bury my head in the sand now around market sentiment since we aren't looking to sell for 5+ years and we can afford our house at current interest rates (somewhat hoping they'll reduce but also realistic they may stick for a couple years). Hey if in 5 years it's even worth what we paid for it now I'll be happy and even at some loss. I'm not in this property for an investment in the end. I want a home with my wife. I want freedom.

1. Congratulations.

2. A million bucks just ain't worth what it was anymore.

In 5 years you'll get at least what you paid plus inflation. Freedom is wonderful but always comes at a cost (and, damn it, so many people ignore how much houses really cost.) Congrats.

I wonder how much of the listing surge is down to the brightside test being pegged back to two years? There must be a number of people liberated to sell their properties without a burdensome tax.

It hasnt happened yet. If you sell today you pay the Brightline tax. Any sale contract must be post July 2024.

Thanks for that. So another surge mid year...?

There were no auctions in the last 1.5 months, what did you expect to happen, buyers cancel their vacation and buy a property instead?!

It's like saying, in the last 2 months the number of job has reduced 90% (OMG.. we're facing a serious recession ;)

Let's wait and see the next quarter Feb-Apr before jumping into conclusions

Rates staying high and more sellers then buyers = lower prices.....

10% down this year and the same next year, NZ is priced to high given crap wages, when compared to most other locations.

Interesting call. It feels like everyone has been assuming this is a period of flat prices before the next rise. But as you say its hard to know why prices would go up, other than RBNZ lowering rates (but due to a bad recession). It may have been a period of flat prices due to low supply before everyone sells at once.

I think I will start writing that book, an expose on how the supposedly independent and objective media in NZ are desperately bound up with the property ponzi and most certainly haven’t presented a balanced story

FYI, Lessons out of Ireland

https://inquiries.oireachtas.ie/banking/hearings/julien-mercille-on-the…

I still think flattish is the most likely outcome, but yeah I think a drop of 5-10% is far from improbable, especially if the economy really tanks

Indeed. Take away the prospect of capital gains, add a possibility of capital losses and see spec town flee. All the way to the safety of a 6% deposit.

Let them pay tax.

Can we please stop using American graphics to illustrate I.Co's real estate commentary?

Increase in listing is clear, but houses are sitting and not selling due to high price expectations. Less going to auction, less selling at auctions. More houses are deadline sales to hide the lack of interest, followed by fixed price when they do not sell.

Something has to give. RB proposed limits of debt to income, ANZ saying RB will increase the rate, POP?

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.