After Covid-19 struck in early 2020, the Australian and New Zealand residential property markets both experienced a short dip followed by a dramatic rise, and then a falling away again. The trajectories were similar, but the movements were more pronounced in NZ’s case.

Since 2023, the two markets have diverged with house prices in Australia rising strongly while those in NZ have largely stagnated. There are likely numerous reasons for the divergence including a kiwi cash rate sitting 1.15% higher than its Aussie counterpart and a relatively weaker kiwi economy.

Last week the Assistant Governor (Economic) of the Reserve Bank of Australia, Sarah Hunter, gave a speech entitled ‘Housing Market Cycles and Fundamentals’. It’s useful in explaining fluctuations in Australian house prices since 2020 and it sheds light on the supply and demand factors that will influence the market in the immediate future.

Many of those factors are relevant to the NZ market.

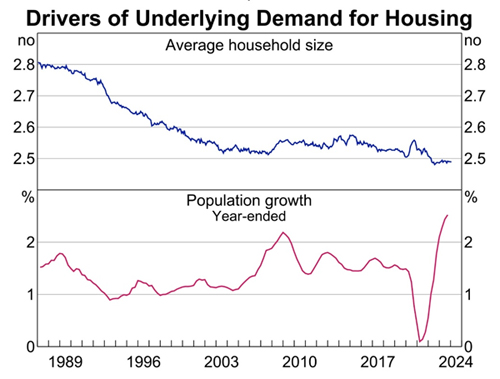

Hunter makes the important point that the underlying demand for housing ‘is fundamentally determined by the size of our population and the number of people that live (on average) in each dwelling’.

Much current analysis on both sides of the Tasman focuses solely on the population component. High net overseas migration is blamed for putting upward pressure on house prices. Just last week the Leader of the Opposition in Australia, Peter Dutton, promised to address the ‘housing crisis’ by slashing migration. He claims this will ‘free up’ 40,000 homes in the first year and 100,000 homes over five years.

Much less attention is given to the second demographic component of demand for housing, namely average household size. However, Assistant Governor Hunter’s speech highlights its impact.

Over the last 40 years, the average number of people in each Australian household has fallen from 2.8 to less than 2.5. This has clearly played a significant role in the demand for dwellings. As Hunter notes, if average household size returned to 2.8, Australia would need 1.2 million fewer dwellings.

Source: RBA

Average household size fell steadily in Australia from the mid-1980s through to the GFC and then plateaued. Since the pandemic it has fallen again and is now below 2.5 for the first time.

Hunter points out that the long-term decline is partly attributable to women having fewer children and to an ageing population (with more households consisting of older couples and singles). But the pandemic has introduced new factors like a post-lockdown desire for more space and the need for home offices in a ‘working from home’ environment.

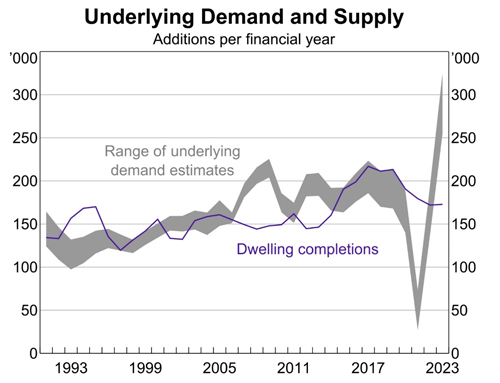

Australia’s rising population and declining average household size mean rising demand for housing. Basic economics says that, in an efficient market, supply responds to demand. However, in a market as complex as the housing market, the timing of that response is uneven and is affected by a range of factors.

The following graph from the RBA compares underlying demand and supply.

Source: RBA

Sarah Hunter sums up the current imbalance –

Supply, as measured by dwelling completions, has been much less volatile and has trended down in recent years. Overall then, growth in demand is currently running well ahead of supply. Hence the rapid rise in both rents and house prices.

Why hasn’t supply responded more quickly given rising prices?

There are many reasons including pandemic supply chain problems, labour shortages, and a rapid rise in the cost of building materials. And of course, the RBA’s own input – a leap in the cash rate from 0.1% to 4.35% in just 18 months which has dramatically increased the cost of doing business.

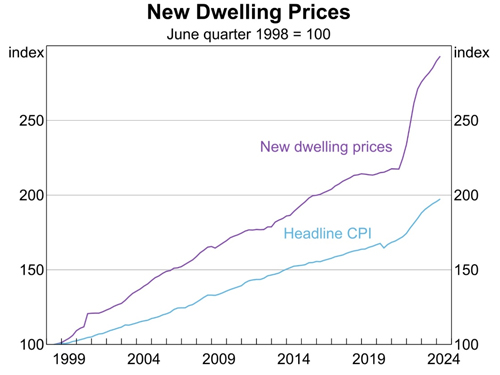

According to the RBA, the cost of building a new home is up nearly 40% since late 2019. The graph below illustrates that this rise is well ahead of general inflation.

Source: RBA

This cost challenge explains why building approvals have slumped in Australia. Fortunately building cost inflation has peaked and is now easing. CoreLogic’s Cordell Construction Cost Index (CCCI) recorded a rise of just 0.8% in the latest quarter to 30 April 2024.

Nevertheless, the RBA expects construction activity ‘to remain relatively subdued’.

What does that mean for the Australian housing market? Sarah Hunter’s conclusion –

Demand pressure, and so upward pressure on rents and prices, will remain until new supply comes online. We expect this response to take some time to materialise, given the current level of new dwelling approvals.

That’s good news for existing homeowners but not for those looking to buy.

Many features identified by the RBA are present in New Zealand. On the supply side, kiwi construction cost inflation leapt during the pandemic, peaking at 10.4% on an annual basis in the final quarter of 2022. The RBNZ’s official cash rate is 5.25% higher than it was in mid-2021. New dwelling consents have fallen sharply in the period since early 2022.

On the demand side, NZ has experienced even higher immigration on a per capita basis than Australia.

These similarities might suggest that NZ has a demand/supply imbalance like Australia that should be pushing up house prices more strongly.

The size of the average kiwi household may partly explain the divergence between the two housing markets. Perhaps the current economic position in NZ is seeing reduced new household formation – more young adults living with their parents, new immigrants living in more crowded accommodation.

According to Statistics NZ, the average NZ household size was 2.7 in 2018 at the time of the last census. In December 2021, Statistics NZ predicted that this number would drop slowly to 2.6 by 2043. More detailed and current data is required to determine the impact of this factor on kiwi house prices.

Finally, it’s worth noting that one small segment of the Australian housing market is immune to factors like household size and immigration levels – the very top end. The strength of this segment is evident from the latest Global Super-Prime Intelligence Report from real estate company Knight Frank.

That report records the number of house sales for more than US$10 million (more than NZ$16 million) in key international markets. In the last quarter of 2023, Sydney had 42 super-prime sales. That’s 42 properties sold for more than US$10 million in just three months. Dubai was first with 108 sales, but Sydney ranked fourth, not far behind New York and London, each with 52 sales.

Demand and supply dynamics operate very differently at that end of the market.

The first story in this series is here.

*Ross Stitt is a freelance writer with a PhD in political science. He is a New Zealander based in Sydney. His articles are part of our 'Understanding Australia' series.

44 Comments

Good article, thanks Ross.

Average household size is pretty irrelevant when the difference is explained by the number of children living in the home. Regardless of whether you have none, one, or six children - you still live in a single dwelling. So even if you chose to have no children, or chose to have one more, that would not change the number of dwellings required. Children dont live in homes on their own. Average number of adults living in a house would be a better measure.

I would lay odds on the difference in house prices is that Australia is attracting the highly skilled, well paid immigrants that NZ is failing to. This is why there are 15,000 less skilled immigrants a year coming to NZ than what arrived before Covid, they are all going to Australia, while NZ gets the Uber drivers and liquor shop workers. And these immigrants bring with them significant funds to buy homes. Even their international students are very wealthy, as most go to the Go8 Universities (Australia's version of Ivy League) which are expensive rather than lower cost ones or vocational institutions.

NZ needs to look at the reasons why skilled immigrants are passing NZ by. Sure, lower pay is one reason. But the inability to buy a house here in NZ due to the foreign buyer ban is probably another. Another reason would be the insistence on "cultural compliance" as an employment condition and the threat to one's career if you don't fully embrace the ideology. A health system that dictates access to treatment based on your race, or University courses obsessed with replacing internationally accepted standards with "Maori Science/Math/Law" is not doing NZ any favours either. Ditto for the primary and secondary school education failures.

NZ needs to wake up and smell the coffee, because its not going to survive long attracting the lowest skilled and lowest paid third world workers who happily live 10 to a house, while Australia (and Canada, UK, USA etc) attract all the surgeons, professors, engineers, and business people and their (small) families.

Agree 100%. If you can't get into Australia, you come here and live with the filth that's socioeconomic policy

NZ first needs to address why our skilled workforce are leaving, then can worry about attracting skilled immigrants.

But the inability to buy a house here in NZ due to the foreign buyer ban is probably another.

It takes two years to get residency and buy a home. It's not a very long time - in fact it's very relaxed rules compared to many foreign countries trying to attract long term skilled young people. We would want them to stay, and not just get their keys cut for the ponzi.

Everything up until this quote was fairly good, then derailed into the race stuff again. Some ethnic groups do not trust the healthcare system, and a lot of that is culturally ingrained. Many health initiatives, such as vaccines, benefit us all as a society, so if we're looking at better outcomes which benefit us all, and some demographics need more engagement than others, we can't just sit back and say "oh well, their fault.", maybe - just maybe - those demographics need more engagement, education, and support.

The reasons why skilled people are leaving are probably the same as the reasons why nobody wants to come here. The "race stuff" is part and parcel of that. Unless you are one of the "doctors without borders" type who want to work with disadvantaged groups, you are probably going to prefer to work in a country where you simply do your job as you have been trained to do, and not have to worry about making a cultural faux pas that would see you brought before the disciplinary committee. In medicine, its become one of the primary reasons for international doctors leaving (and not arriving). In Australia over half their medical practitioners are internationally trained - they don't seem to have a problem "cultural code switching" there. Currently the insistence on all the "race stuff" means that all of us, not just Maori, are suffering from a collapsing health care system. But I guess that will make the Left happy as we are now all equally sick and untreated.

https://www.hcamag.com/nz/specialisation/diversity-inclusion/the-challe…

The research explored the experiences of international medical graduates (IMGs) – whom New Zealand relies on to fill medical practitioner shortages – and found that they struggle with cross-cultural code-switching.

It uncovered how the psychological challenges of cross-cultural code-switching due to professional and cultural differences could affect IMGs’ ability to practice effectively and influence whether they stay in New Zealand.

“Many of them leave New Zealand jobs because they experience stress, loss of identity or loss of confidence brought on by the struggle to adjust culturally,” lead author of the study, Mariska Mannes, said in a statement.

Secondly, two years is a long time to wait to have a home. One year is too long. Most people prefer to have a home organised before they even arrive in the country because they are bringing their families and pets with them. And that assumes they want to have residency. Many professionals may not plan on staying long term in NZ, and only want to stay a few years and maintain their non-resident status for tax purposes. Especially when NZ threatens to impose wealth taxes on NZ and international assets. Parents of international students often buy apartments for their kids to live in while studying at Uni for 3-4 years - another thing that will dictate where parents choose to send their kids.

What a load of drivel.

Our doctors are going to Australia for better pay and cheaper house prices, not because there may be (or not) a requirement to learn some te reo (or whatever). I have some insight into rural health delivery and alI I can say is thank god for MPAS because there would be no doctors in the regions otherwise. There are also international doctors who are happy to work in rural NZ.

Whatever mess you perceive NZ to be in is 99% because of pakeha with plenty of Maori driven to Australia by your economic ineptitude.

While I agree that pay is probably the primary driver, "requirement to learn some te reo (or whatever)" is a disingenuous comment. Anyone who has a connection to anyone working in public healthcare knows there is far more to it than this.

The article listed made little reference to "Maoridom" as the issue, it essentially said NZ has become feminised and incapable of being criticised or challenged.

I’m a doctor and I can tell you that people are leaving to Australia due to 1) better pay 2) better resourcing in the healthcare system 3) better hours 4) lifestyle in satellite cities likes Geelong, GC, Newcastle 5) cheaper cost of living. No NZ govt wants to address any of the above

I broke my thumb rather badly and needed surgery to put it back together and spent 5 days hanging around in Invercargill ED and the surgical ward for a hour long operation. It sucked. What I would say is all the doctors and nurses down there were great. Helpful, nice and really pleasant to be around. And also apologetic for having to wait so long to get fixed up. It’s no wonder so many are leaving after being overworked, overstressed, and underpaid. I don’t blame them one bit.

When a consultant uses MPAS to gain access to med school for their child despite attending a private school you know the system is flawed. The mother is Asian-Pacific.

When you read in NZDr about the GP who encountered racism at med school you wonder why? She describes her Grandfather as a Māori GP and looks European despite the token chin tattoo. She encountered no disadvantages in life and gained entry with a mark well below the European, Indian or Chinese applicant.

if you think Māori need Māori Drs you’ll then want Māori teachers, engineers and lawyers to serve Māori. MPAS is the most racist policy in NZ and should be dismantled.

"the reasons why nobody wants to come here"

You should read Interest's articles about migration, you will learn that there "are more than a few people who want to come here". (I can already see the excuse "yes but they are from poorer countries")

Well yes, I should clarify I meant "why highly skilled professionals dont want to come here". As is apparent from our immigration statistics.

Same reason international student numbers never bounced back, they dont want to pay 40k a year and encounter compulsory foundation studies learning Maori world views. We cant even export our education now due to this, Richard Dawkins pointing out our Maori world views in science made us the laughing stock of the science world.

Our Universities are turning into the equivalent of USA Tribal Colleges.

https://en.wikipedia.org/wiki/Tribal_colleges_and_universities

The sad thing is that they are condemning all NZ students to the same educational dustbin. I expect my degrees to qualify me to work anywhere in the world, not to keep me held hostage in NZ. If this keeps up, at some point other countries are going to start making NZers wanting to work overseas, requalify to practice their vocation in the same way third world workers have to requalify when they immigrate here.

I am not sure that is the case , https://www.universitiesnz.ac.nz/latest-news-and-publications/new-zealand-universities-shine-latest-international-rankings, but if it is, it is much more likely to do with not funding them enough, rather than any 'woke' outlook our specific universities have that the rest of the wolrds universities don't have.

The problem first stems from NZ and Aussie importing via their Commonwealth ties, the UK failed land use policies.

The present difference is more due that Aussie is still in the grips of a Labor Govt. command and Control economy that intervenes in the market and under the ideology of trying to make housing more affordable is trying to put out the fire with gasoline, thus does the opposite and pushes up house prices.

But to paraphrase Margaret Thatcher - eventually, you run out of other people's gasoline.

NZ is that much ahead of Australia in having a reality check. Aussies still has a card up their sleeve if they were ever stupid enough to use it, and that is to allow people you use their Aussie saver to buy a house.

At least when a non-homeowner in Aussie hits retirement they have a big nest egg to draw down on.

Even if Kiwi renters don't touch their Kiwisaver, it is hardly the equivalent the Aussies have.

New dwelling consents have fallen sharply in the period since early 2022.

On the demand side, NZ has experienced even higher immigration on a per capita basis than Australia.

These similarities might suggest that NZ has a demand/supply imbalance like Australia that should be pushing up house prices more strongly.

Yes consents have dropped, but dwelling completions have recently been at record highs. There is a huge supply of housing stock on the market, both to buy and rent.

This is the key difference with Australia. We had a building boom where everyone decided they would become a developer and make some easy money. This has come to an abrupt stop, but not before they were able to build a vast number of houses that are now proving very difficult to sell.

Combine that with the fact that many of those net 52,500 NZ citizens leaving the country last year owned houses, whereas most of the immigrants are on temporary visas and are renters.

We actually need a pause in construction to clear the backlog. Unfortunately much of the backlog is housing that most do not want to buy unless there is another round of FOMO.

This will result in many of those developers going bust over the next 6-12 months and the housing market taking another leg lower.

One of the fundamental differences in building between Australia and NZ is that in Australia the market is controlled by large land/apartment developers who sell everything off the plan. Hardly anyone does spec builds in Australia. So everything is presold, built, then occupied. Unlike NZ where amateur developers build 6 townhouses then try to sell them all off once built. Hence the huge oversupply that is about to hit the market as they complete. The other difference is the time taken to build - in NZ its an average of 2 years from time of consent, and add another 6 months to get that consent. In Australia its 6-12 months, so better matching of demand with supply when the market turns.

NZ has also been building homes that most people dont want to live in - they are small 2 bedroom townhouses with inpractical kitchens, no garage or parking, and no backyards. They were designed for investors to buy and rent out, and helped by Labour's tax policy which drove investors into such poor quality new builds. Now that mortgage rates have completely killed the investor market, those townhouses will sit empty as they appeal to neither investor or owner occupier. In Australia they build either stand alone family homes in new subdivisions, or they build decent high rise apartments in buildings designed for owner occupiers. They don't build rubbish like in NZ.

I think a lot of NZ developers were relying on Kainga Ora bailing them out, as they have been doing up to now. Looks like that door may be shutting as its now clear KO is broke and not in a position to be paying peak 2021 prices for developers unsold projects.

You may want to re-write your Aussie bit.

Well there is that. I'm currently living in a Melbourne apartment building that has been reclad (assisted by the Govt contributing to its cost). But the building is nice, and its very liveable. It's a good size, has basement parking, a pool, gym, residents lounge, and outdoor BBQ area. It has a cafe and supermarket in the building, and is 5 mins walk to the trams. And its pet friendly. I was more referring to the quality of life in the building, not the quality of the actual building.

I've also worked out that in Australia I can buy the equivalent priced apartment to my NZ house, it will come with all the facilities, and it will still cost me less in rates/insurance/water/body corporate fees than what my rates alone cost in NZ. NZ dwellings are not only expensive to build, they are expensive to live in as well.

Might need another rewrite

New apartments: high hopes, low quality as special levies and repairs hit owners (theage.com.au)

Fed up with losses, owners are dumping apartments - MacroBusiness

The right apartment, just like the right free-standing dwelling is fine, but what we are getting, both in NZ and Aussie, is high price and poor quality.

My caution to you, because you are not already aware, read up a bit more on this.

Horror stories

Don't know if you have had any experience in seeing an Aussie new build but likely no with your comment " they dont build rubbish like NZ". Having been in two, one in WA and one in NSW the standards were much lower than NZ,. The NSW one was better than the WA newbuild but still not as good as NZ standards.

"everyone decided they would become a developer and make some easy money"

... if that's the case it just shows how out of touch we wtih reality we are. There's nothing easy about making money by developing RE, I think the only people who believe that are people who have never tried to do it.

Somewhat true, it is actually easier to just sit on the land value increases that ramp up in a big way, doing sweet FA and then collecting massive profits selling to the next one while you pick better markets to move to for large increases.

If you do the paper subdivision alone that will multiply profits much further. Throw on some cheap prefab and voila massive boom.

Building actual houses that are meant to last 10years is much harder then sitting on the massive gains in the property market doing nothing, or if anything submitting a few forms to the council.

"Building actual houses that are meant to last 10years..."

Assume thats a reference to the Masterbuild 'Insurance product '(such as it is).....whereas the Building Act has a 5 fold requirement.

It may explain some of our quality issues.

NZ does not build enough homes full stop. We are almost at the bottom of the OECD for home building. Below Australia, and well below the OECD average.

https://static.ffx.io/images/w_960/40bd61376df1cec1d2f882c9072f3231ad6c…

NZ needs to ask why is building houses so hard here? I suggest the Christchurch post earthquake experience shows that when you make it easy, people build, and prices stay affordable.

NZ also imports relatively more people - there would be no housing problem if we had no population growth.

I just collected this data from the StatsNZ website for the period from 2019-2024 (population, private dwellings and households). What I found was over that six year period the percentage changes were:

Population up 8.5%

Private dwellings up 9.3%

Households up 12.9%

Anyone have an idea what these numbers tell us?

That the percentages are meaningless without the values they relate to. For instance a small amount of a very large number can outstrip a big percentage of a small number. Hope that maths lesson helps. (Kate I did expect better, not sure why you did not grasp mathematics & ethics when posting the above; knowing the structure is intentionally misleading or makes you look really unaware of how percentages work).

If the percentages are what you base anything on then you really need to do another stats 101 refresher. I really do suggest them as they are essential for the entire populace in helping prevent misleading information. I did a few of mine in primary as I really needed them for optimization logic, predictive & risk estimates and multiple equation solutions. ... but then not all kids play games.

For instance I can say I am tripling housing stock in an area while the population is increasing by only a fraction... the joke is like any mathematician I can define what gets counted as an area & the sizes which the percentages apply to (and what gets counted as outside).

The total population number of adults who live independently of each other is much much larger then the NZ housing stock and who gets counted as a single household (as stats NZ often drops off many families in this number also in a whoops they did not deserve to exist mode). But then I take it you did not read the fine print on stats NZ site either or understand how the census gets taken.

Hence we have a housing crisis and a shameful rate of growth in the number of families & people who are homeless. To the point you literally cannot ignore it anymore.

So, you are saying that Stats data is useless? The percentages relate to stats numbers for each of those categories and each of those years on a spreadsheet - those number then determining the percentage change within that period of years. But, let's say stats numbers are useless - I can go with that.

So, here's the proposition/premise that I am researching:

New Zealand does not have a shortage of housing; New Zealand has a shortage of affordable housing

How then would you go about proving or disproving that premise empirically?

We seem to take the supply-side argument about housing without question, as it is all our politicians talk about, (i.e., "we need to build more houses").

Whereas I suspect we have enough houses (private dwellings) - our only problem is affordability. That's what I'm trying to determine.

The method would be to compare historical (pre 'shortage') dwelling/population ratios with current. Last time I did this (a year or 2 ago) the number from memory was either better now or as near as as made no difference.

This would suggest that much of the stock is unavailable to either the FHB or rental market....likely tied up empty for capital gain (previous), air BnB and holiday homes/bachs.

There is another ratio that likely impacts affordability and that is the proportion of subsidised state rentals which has steadily declined as the population has increased since the 90s generating increased demand for private rentals.

Great, thanks. That's as I expected (i.e., better now or little difference) but I do need to do the research. What year or period did you assume to be pre 'shortage'?

Have just read this book and am wanting to do what statistical comparisons that I can between the UK and NZ.

From memory the 'pre shortage ' period I used was data from the 1996 census....the period nearest to the peak in state housing that i could find.

Someone who is au fait with navigating the Stats site may be able to find more data.

New Zealand does not have a shortage of housing

I've long said we have a housing affordability problem. We have plenty of houses but you have a lot of people owning multiple houses eg Gareth Morgan said he had 5 during the TOP 1.0 roadshow (he didn't rent them out). Many people have holiday houses that they don't want to rent out (at least in the for someone else to use at a home sense) either. Not sure how you prove it, but the evidence for me is that people are opting to live in cars instead of rent when there are houses available to rent in a given area. It's the price to rent that is stopping them. A land tax would help encourage these existing houses back onto the market.

We seem to take the supply-side argument about housing without question, as it is all our politicians talk about

That would mean talking about demand (immigration being the controllable part). They're all more concerned about being called racist/xenophobic and a short-term way to 'grow' the economy with population than the long-term future of NZ. They take the easy option for them, others are left to pay the price:

'It's so hard': How south Auckland mum ended up living in car with two kids (msn.com)

New Zealand has a shortage of affordable housing

Here are excerpts from a government paper from the current housing minister which is labeled "in confidence".

New Zealand has among the least affordable houses in the world, the result of a persistent undersupply of houses. Unaffordable housing has far-reaching social and economic consequences – children and families living in cars and motels, declining home ownership, health problems from overcrowding, poor productivity, and lower living standards for all New Zealanders. The Government spends more than $4 billion each year on accommodation support, which has doubled since 2017.

New Zealand has among the least affordable housing markets in the OECD. Between 2000 and 2021, inflation adjusted house prices in New Zealand rose 256 compared with 64 per cent in the United States and 110 per cent in Great Britain. After-inflation house prices in New Zealand have increased by more than any other OECD country over the past 30 years. This has had significant wellbeing impacts:

- In 2022, 46% of renting households spent more than 30% of their disposable income on rent, up from 19% in 1988.

- House prices have risen 230% since 2003, compared to 114% for median household income, which has made saving for a first home deposit increasingly difficult for many New Zealanders.

- Home ownership has dropped from 74% in the 1990s to 65% in 2018.

- Rapidly rising demand for social housing, which has resulted in over 3,200 families living in motels6 and more than 400 living in their cars.

It’s useful in explaining fluctuations in Australian house prices since 2020 and it sheds light on the supply and demand factors that will influence the market in the immediate future.

Many of those factors are relevant to the NZ market.

Hunter makes the important point that the underlying demand for housing ‘is fundamentally determined by the size of our population and the number of people that live (on average) in each dwelling’.

1) Underlying supply vs underlying demand

2) Effective supply vs effective demand

One impacts market prices in the residential real estate ownership market, the other doesn't.

In economists speak - stock vs flows.

Many people confused the two and got caught out in Auckland & Wellington in the 2020 - 2022 period.

In real estate agent speak - buyer's market vs seller's market. High inventory vs low inventory market conditions.

As an example:

1) Auckland currently has a housing shortage in one of those categories. My estimate is the shortage is over 100,000 residential dwellings given the current population, and residents per dwelling of 2.3 for Auckland.

2) yet the REINZ house price index in Auckland has fallen 20% from the peak of Nov 2021.

Most people don't understand how the above situation can happen.

Auckland currently has a housing shortage in one of those categories.

Which category?

Auckland City Council's evaluation of the UNDERLYING housing shortage.

https://www.greaterauckland.org.nz/2021/02/16/how-big-is-our-housing-sh…

Note: This is different from the current EFFECTIVE housing surplus in Auckland which has resulted in the 20% house price falls in Auckland from the peak.

This is how there can be an UNDERLYING housing shortage with an EFFECTIVE housing surplus (which leads to house price falls). Most people do not understand this difference.

Right, thanks for the explanation! Perfectly understood now!

FYI, the use of UNDERLYING housing supply vs UNDERLYING housing demand is for council town planning purposes - planning for long term infrastructure (roads, sewerage, power generation, rubbish processing plants, etc) and service needs for those communities (e.g schools, parks, public services such as rubbish disposal, supermarkets, public transportation, etc)

Many people take the UNDERLYING shortage and use it to justify / rationalise / explain recent house price changes, and make projections for future house price changes.

For decades, NZs tax system has incentivised investment in unproductive assets and disincentivised hard work. This has seen billions of dollars being poured into the property market at the expense of other enterprises that create jobs and increase incomes. This has primarily benefited older generations and the already wealthy at the expense of young, the educated, the skilled and the ambitious.

The unintended consequences of this are that NZers are now extremely indebted to overseas owned banks as the price we have to pay for our perceived “wealth”, I.e., the value of our houses. This is effectively a tax on the whole economy.

in most other western countries, you get a personal allowance meaning you don’t pay any income tax on the first 10-20k earned, yet in NZ if you're hardworking and ambitious, you're taxed on the first dollar earned. But if you own a few properties and make a capital gain from doing nothing, you pay no tax on that gain.

NZ is only a good place to live or move to if you are either:

1. Already rich, having made your fortune elsewhere and want to move somewhere where you can protect your capital from taxation by storing it in real estate.

2. From a third world country and want to move somewhere that's better than where you're from, but you probably don't meet the entry requirements or skill levels to get into Australia, the US, Europe etc.

Until NZ addresses the fundamental causes, things will only get worse.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.