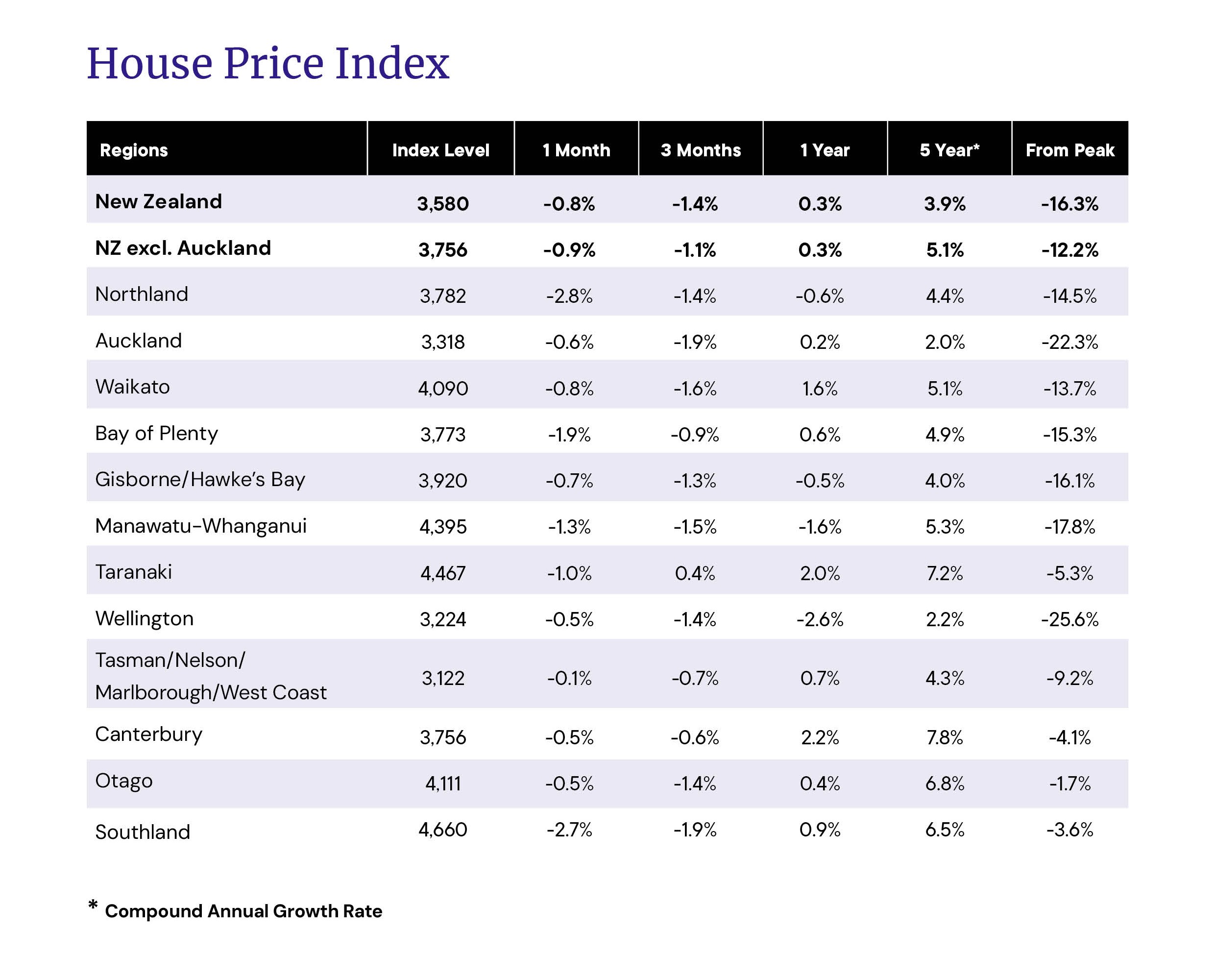

House prices declined for the fourth consecutive month in June, according to the Real Estate Institute of NZ's House Price Index (HPI).

Across the entire country, the HPI declined by 0.8% in June compared to May, and that fallowed monthly declines of -0.6% in May, -0.3% in April and -0.6% in March.

However the HPI was up by 0.3% compared to June last year but remains down by 16.3% from the market peak in late 2021.

The HPI declined in all regions of the country in June compared to May, with the biggest declines occurring in Northland -2.8%, Southland -2.7% and Bay of Plenty -1.9%, see the table below for the full regional figures.

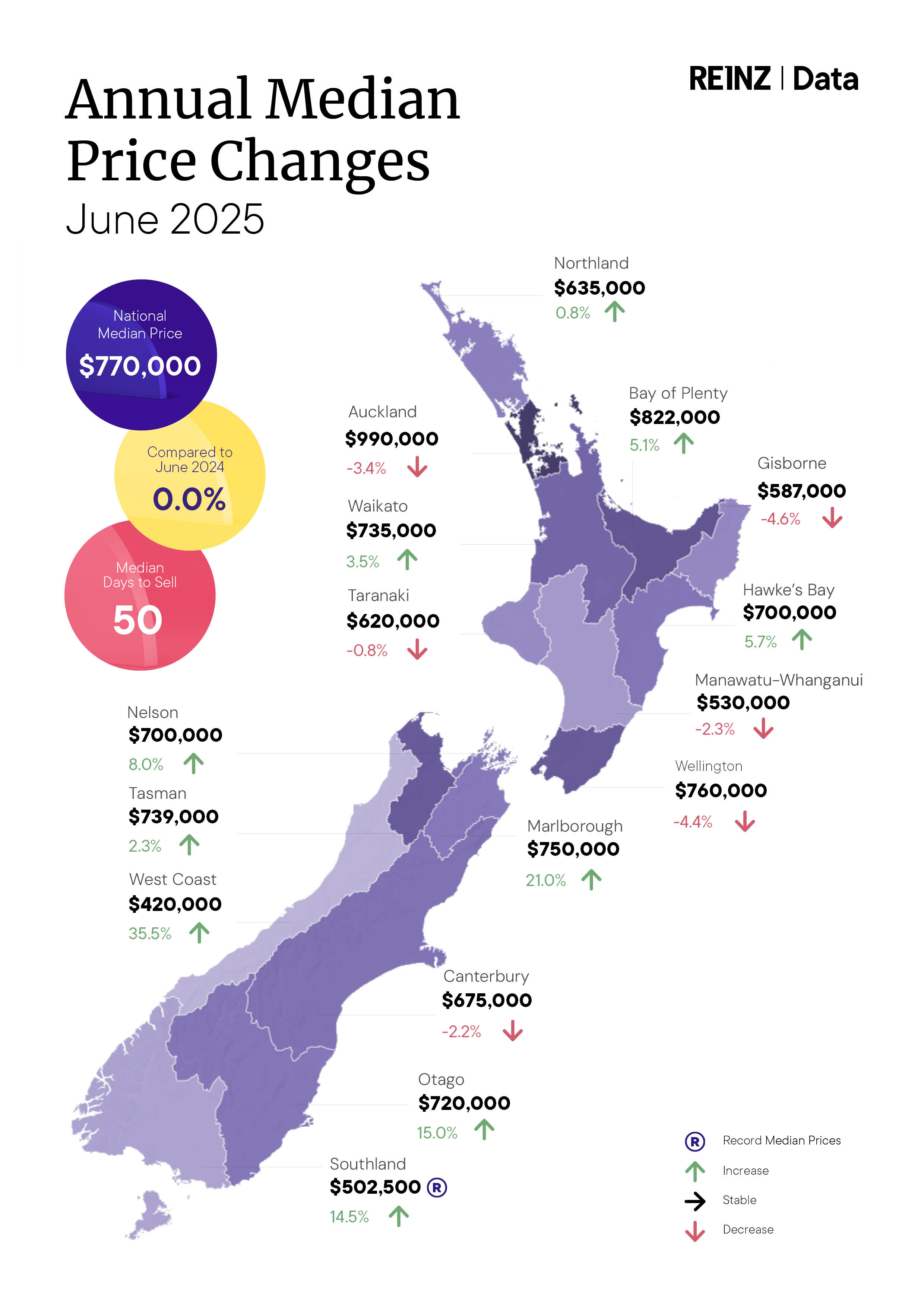

The national median selling price was $770,000 in June, up 0.5% compared to May but unchanged from June last year.

The HPI adjusts for differences in the mix of properties sold each month and is regarded as the most reliable indicator of price movements, while the median price is not.

The number of properties sold in June was a bit up and down.

The REINZ recorded 5865 residential property sales in June, down 20.6% compared to May but up 20.3% compared to June last year.

"June is typically a quieter month for real estate, and while the seasonal slowdown was expected, sales came in slightly below typical early winter levels," REINZ Chief Executive Lizzy Ryley said.

The comment stream on this article is now closed.

Volumes sold - REINZ

Select chart tabs

Median price - REINZ

Select chart tabs

29 Comments

Down, down, down in Ponzi Town,

Where bubbles burst and hopes can drown.

Up, up, up where green shoots grow,

In paddock, port, and real cash flow.

Auckland is falling at a steady 0.6% per month for 3 months in a row..... so 7.2%pa.

makes sense as offers are falling in sync with asking prices, and no one pays ask in a falling market.

This sucker is going down

You can see the bubble deflating in this chart here of real NZ house prices:

https://fred.stlouisfed.org/series/QNZR628BIS

It will be interesting if we now have reached the new floor for real house prices, or whether the next support is somewhere in the 2008-2014 level which is another significant fall from here (could be a bit drop in nominal terms or flat nominal with higher inflation). I think its possible we still have a decade of falling prices ahead of us in real terms at least (uncertain about how it will come in either falling nominal terms or higher inflation or a combination of both).

Interesting that from this chart you can see that if you purchased a house in the mid 1970's you had to wait until the mid 1990's until you 'got your money back' in terms of positive real return. I think its possible that those who purchased around 2020 may need to wait the same amount of time to see a positive real return (but who knows for certain of course....)

Anyone who purchased property or properties in the 1980's and 1990's and off loaded them near the peak would have done exceptionally well (both in nominal terms but more importantly in real terms - ie the real increase in financial wealth of what their money can buy them).

That is a very useful graph and commentary, To unpick it:

- Yes AC - prices did double every 10 years up to 2000. However, that was keeping up with inflation so did the value of your car,

- Prior to 2010 interest rates were higher than inflation - so you could make on housing but it wasn't a guarantee.

- The period where house price inflation was higher than interest rates was since 2010, when the rest of the world went through shock and we somehow missed that.

My basis of valuation is 3%pa increase since 2018 - so inline with inflation.

I also often cite 1,000 times the weekly rental - as a useful measure of how much people want to live there and how affluent people there are. Auckland is the outlier here - because Wellington salaries and rentals are higher. Provincial NZ is still in that zone. However, Auckland got bid up to 1,500 times the annual rental but many of those who bought at the peak in Wellington are getting 1,000 times the weekly rental.

My expectation was Auckland to be flat for two more years - but that graph suggests perhaps longer

Auckland got to 3250 times rental in Oct 2021 as crap housing on land was valued v highly

Wow, Newstalk ZB just ran a very positive new story in its 9am news talking about positive house price growth citing this same REINZ report.

They were leading with the 0.3% increase for year to date, I think

If someone can get a transcript, please post.

That's because NewstalkZB has scrubbed any mention or graphics of the House Price Index from their reporting, which recorded falls in all regions.

They've very conveniently chosen to focus only on median price changes. As if the HPI quietly slipped out the back door while no one was looking. There is zero mention of the “HPI" or "House Price Index" in their article.

See their article here: Median house price falls in Auckland, increases in regions

Thanks for the link. The actual news item on the radio was even more chirpy

Interestingly, their Youtube channel references the House Price Index and claims it is "rising"

See here: Midday Edition: 15 July 2025

Anyone mentioning UP and "positive growth" on relation to the NZ housing market is in total and all out, cloud cuckoo land with a large dose of LaLaland.

These failed spruikers have worn off their fingerprints at the constant grasping at the last straw......in vain attempts to turn a stinking, turd pile market, into a silk purse.

These overleveraged monkeys, smell of total desperation!

Its another bottom Freddy

Smacky bottom.

3.9% return for 5 years (National HPI) is a bit like the expected return on a Term Deposit - less the tens of thousands of dollars of mortgage payments (and insurance costs, and maintenance costs, and rates) that would have come from this same investment over the same period.

But remember - 'houses are always a superior investment to a Term Deposit' according to the Property Gospels.

Most of the time yes, but not always in my opinion.

The housing tax free capital gains gravy train was a regular cash cow, until the investment world flipped the 180 after 2021.

The gravy train has run dry and the bearings are flogged out. The train has jumped the track and is careening towards the cliff.

- Some investment luddites are still stuck on the death train and wondering in bewilderment at their total "bad luck"......

Quite simply, they were not paying attention.

Indeed. Its been a golden run for some time, so perhaps Specuvestor land just thought it would go on for ever. Historical performance is no guarantee of future results, regardless of how much one thinks it should be. Also known as blind faith.

The equation needs to be adjusted for the cost of finance compared to the rental return. The problem overlooked by the market is depreciation. If we think of houses like we think of cars - they wear out. So a house, after 20 years will need a new kitchen, bathroom, repaint and a new roof. The 2-3% depreciation a year on the fabric is not just an accounting entry.

Ongoing downer with winter and the economy being stalled without feverish house building operating and buckets of wasteful govt spending. So whats left, milk, and rockets into space....?

If Kevin oleary says that AI and crypto will save America then why not milk and rockets

Its not the bottom of the housing market until its a matched market with about equal buyers and sellers

we need clearance and its not happening at these price levels.

Some would argue lower interest rates could help but I suggest NZers are wary now that they can rise causing price drops.

This June had 20 percent higher house sales t/o than last June, how much higher should it go. Trumps angling to get lower rates, so when that happens our dollar goes up and theirs down. We won't need higher interest rates to control the inflation. We'll be getting even lower TD rates but then I might have a go at crypto or the shares

I think if Trump gets his way on lower interest rates, then inflation will take off again and rates will be even higher in two years time than they were 1-2 years ago.

lower rates may trigger hyper inflation....

be warned and trade accordingly

Pardon,? explain your rationale please. As I said, our higher exchange will do the work. Our stubborn inflation is rates and insurance but these are slowly backing off. Building costs down, fuel down and rents down (OH dear how sad)

Is it possible, that One on One Boomer, has some now very pesky rentals, to liquidate?

- seems to be, with such rose-tinted hallucinations conjured up, when parsing over such terrible HPI sales stats, that are fully soaked in market weakness, akin to the last crashing event of the 1970s.

Should have shot these old rental laggards in 2021/22, as now they are losing value year on year, with rates, insurances and maintenance costs bolting away......

Praying on the massive spending USA+tax new cuts, to act in the interests of the overleveraged, to lower the worlds interest rates ??? - is like praying to the vampires to give away free blood. Dreamin mate!

You make assumptions, wrong assumptions. Am I to assume that you're an actual gecko

Soz Boomer, you are not true to label?

Most Boomers, I know are late to the peak property bubble and feverously working out how to dump their unmaintained rentals. Or spinning stories as to why the next property boom is about to crack on with it.

Soz Boomer, property cycle has a stripped cogs and a broken derailer. The parts are now long obsolete.

Even the Housing Minister is no longer your backstopping protector.

Lots of pent up supply….

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.