The average value of New Zealand homes dropped almost $10,000 in the September quarter (Q3), Quotable Value (QV) says.

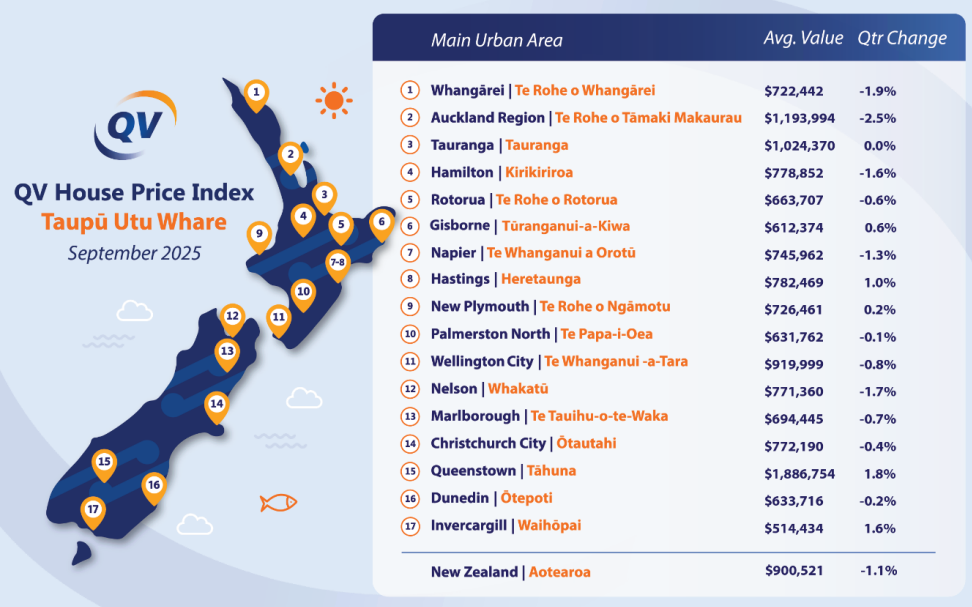

The QV House Price Index shows the average value of all dwellings throughout the country was $900,521 in Q3, down $9958 (-1.1%) from the June quarter (Q2).

The biggest decline was in the Auckland Region where the average dwelling value fell $38,346 (-2.5%).

Within the Auckland Region the biggest decline was in Manukau, where the average dwelling value declined by 3.3% in Q3.

The only district within the Auckland Region to post a gain in Q3 was Rodney where the average value of homes was up 1.3%.

All other main centres except Tauranga also posted falls in average dwelling values in Q3, with Hamilton -1.5%, Wellington City -0.8%, Christchurch -0.4% and Dunedin -0.2%.

The average value in Tauranga was unchanged from Q2.

Five provincial centres posted value gains in Q3 - centres - Gisborne +0.6%, Hastings +1.0%, New Plymouth +0.2%, Queenstown +1.8% and Invercargill +1.6%. See the full regional values in the table below.

"For now it remains a buyer's market, however deposit requirements and the ability to service mortgages remain barriers for many first buyers," QV spokesperson Andrea Rush said.

"Lower mortgage rates may encourage a modest rise in activity, but any rebound in prices in likely to remain constrained by the broader economic recession, cost of living pressures, rising unemployment and ongoing global uncertainty," she said.

The comment stream on this article is now closed.

7 Comments

I love how this data so clearly lines up with REINZ HPI for Auckland?

This reminds me of Chinese GDP numbers.

I forget the exact details, but the thing to remember is QV reported values lag the REINZ values by something like 2-3 months.

Down down down....in ponzi town.

Hopefully the specuvestors get a margin call. One cannot help but wonder if the RBNZ allowing further leverage on specu housing is to allow the over leveraged to avoid liquidation under liquidity rules. True extend and pretend.

Just saying...

Once you’ve got the loan you are no longer subject to liquidity rules are you?

Unless you need liquidating and then you go on another list.

Average home is held for 7 years, if rules have changed and prices are flat it can impact moving to another house as you must again meet lending rules.... but after 7 years as a good payer you will probably qualify for another low equity loan, being a good dairy cow and producing so much margin for the bank. Mooooooooo

Prices have been essentially flat for 2.5 years now. Marginally rising in some places, perhaps a hint of downhill in Auckland and Northland.

https://www.interest.co.nz/charts/real-estate/median-price-reinz

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.