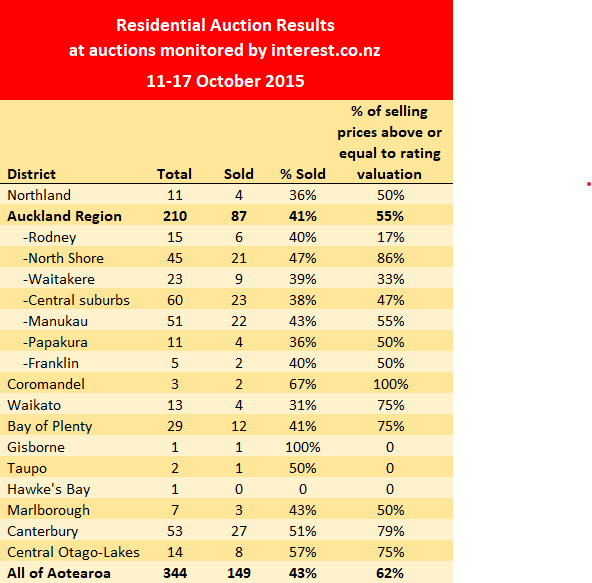

There was a slight drop in activity at the latest auctions, with interest.co.nz monitoring the auctions of 344 residential properties around the country over the week of 11-17 October, down from 357 the previous week.

However, that may have been the calm before the storm, with early Orders of Sale suggesting there could be as many as 450 properties going under the hammer in the coming week, which would push activity squarely into the early summer season.

While the number of properties being offered at auction has fluctuated a bit over the last few weeks, there has been no significant movement in the sales rate, with 149 properties selling under the hammer at the latest auctions.

That gave an overall sales rate of 43%, bang in the middle of where it has been for the last couple of months.

Similarly, there does not appear to be much movement in selling prices.

So it appears to be a bit of a Goldilocks market at the moment - neither too hot nor too cold.

Perhaps the jump in the number of properties being auctioned in the coming week will provide more clues about where the market is headed over summer.

Details of the individual properties offered at all of the auctions covered by interest.co.nz, including the selling prices of those that sold, can be viewed on our Residential Auction Results page.

The comment stream on this article is now closed.

14 Comments

There is not much happening, in our busiest selling season in selling prices. So... no clearance until 26/7 summer?

So it appears to be a bit of a Goldilocks market at the moment - neither too hot nor too cold.

He gave an example of a conversation he’d had with an owner who hadn’t been able to sell his property. Sales were happening in the first-home buyer market and on the high-end market, where cashed up buyers aren’t going into retirement villages.

But there was nothing happening and no interest in the mid-market, which in this case was somewhere between $1 million and $1.5 million, English said.

“And they were scratching their head, asking, Okay, so what's actually going to happen with this? Is it automatically going to go up in value? To which I said, Well, I don't think so. You might have to rent it out, and that's one reason rents are going down in some of our urban areas”.

I'm sorry to hear that things are tough for you ITG. Hang in there, I believe things will improve in Q1 2026.

Things are great Yvil, we got out of flipping houses ages ago, I am the holder of no bags.

You may be the holder of no bags, but your comments make it obvious that you are holding deep resentment and bitterness for RE matters.

ITGUY, were you an REA, you'd make a good auctioneer I reckon, have a patter and able to think fast on your feet

My partner and brother in law both were.

It wasn't a hobby they where doing 30+ a year, it involves a whole team of people. The money was in 6-800 sq m sites in Manurewa, then went to townhouses etc, then disappeared as prices went ever further higher.

Then you have to move to subdivision. There is still good money here if you buy right, You need deep pockets to do large now as holding times are years with council, but you can still break a few hectares off something around me and make a few $$$.

Now would be the time to become a licensed salesperson I reckon for anyone motivated

Two people have told me this week how cold the mornings have been.

And judging by todays auction report, it isnt just the weather that’s cooled off.

The auction numbers were better in Sept

Yes, I was also told that the afternoons were warmer than the mornings, that's great to know.

I know two families that have rented in Brisbane and fly out the entire family before Xmas, houses have not sold - both around 1.8mil, they have offers... but at the wasting every ones time type.

Both owe next to nothing so its all equity, but still they want prices from the peak.

Its a great time to be a renter because paying interest on a mortgage is dead money if its way higher then rent and prices are going no where.

Looks like the next suckers have all wised up....or fled to Straya. Good luck sellers....

I wouldn't call duncan garner a succker, he's jumped into the market

https://www.nzherald.co.nz/the-listener/opinion/duncan-garner-ive-bough…

I'd call him lots of things. Hes defiantly a victim of being exploited by specu leverage greed since his divorce.

He just wanted stability and control of shelter.

Really. Do go on

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.