September is a bit of an in-between month for the housing market, where it's starting to emerge from the winter gloom but hasn't yet built up a head of steam to charge into summer.

That makes it difficult to pick how the market might track over the usual early summer rush, before it goes into hibernation for the Christmas/new year break.

Looking at the big picture stuff, two things that usually have a major impact on the housing market are interest rates, which affect demand, and the amount of stock for sale, which affects supply.

Mortgage interest rates have been declining since August last year, with the average two year fixed rate dropping to 4.6% in September this year from 6.0% in September last year.

Such a decline would normally trigger a surge in sales and selling prices but so far, that hasn't happened.

The Real Estate Institute of New Zealand reported 6346 residential sales in September this year, up just 3.1% compared to September last year. Meanwhile REINZ's median selling price was 1.5% lower in September this year than it was in September last year.

Basically, median houses prices have bounced around from month to month within the $750,000 to $800,000 band since the end of 2022, suggesting prices have been more or less flat for nearly three years.

One of the main reasons for the flat prices has been an oversupply of stock on the market, which has given buyers the upper hand in price negotiations.

Anecdotal evidence suggests the main reason for this is the number of vendors with unrealistically high price expectations.

With so many properties to choose from, those that are selling are the ones that are priced to market.

Those that are overpriced are left languishing, a bit like a cat that wants to catch birds but can't be bothered chasing them, so it sits in the sun with it's mouth open hoping a bird will fly into it.

At the end of September this year, property sales website Realestate.co.nz had 30,721 residential properties for sale, up 2.3% compared to September last year, but up 30.3% from September 2023.

So for the time being at least, buyers still have plenty to choose from.

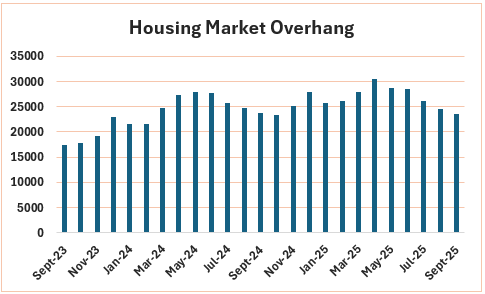

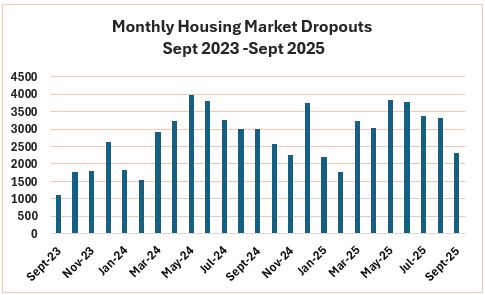

There are two other indicators interest.co.nz watches closely to get a hint of where the market is headed - the overhang and the dropouts.

The overhang is the number of properties that are left unsold at the end of their marketing campaigns each month, while the dropouts are the properties that have either been withdrawn from sale completely or are still listed for sale but are no longer being actively marketed.

Both sets of figures have steadily declined over the last four to five months, but both also follow a seasonal path. See the graphs below for the trends.

So far, the numbers suggest the overhang at the end of September this year was about the same as it was a year earlier, while dropouts have tended to be running at a higher level than 12 months ago with a sharpish drop in September.

Unfortunately all of that data doesn't really point to any major movements in the market one way or the other, apart from the usual seasonal variations.

So if you were going to have a punt on where the market is headed over summer, it might pay to have a bob each way.

Hopefully, October's figures will be more revealing.

The comment stream on this article is now closed.

6 Comments

LMFAO Everyday I'm Shuffling.

Full credit to interest.co.nz for publishing the housing market dropouts. I'm not aware of any other source of that info so thank you.

Price to market, or dropout. Marketing money, failed auction costs, and open home prep time thus wasted. Rinse and repeat with a different agent with promises of better marketing (that you pay for). Sounds like a money loss washing machine. Round and round we go.

The buyers are there for things that qualify under normal bank lending/income math. Opp's....we just approved greater debt limits for spec town and debt overshoot. If it still doesn't stack, just buy a plane ticket to Straya, which record numbers of young and peak working class tax payers are doing. Month after month. Where will the tax come from as more retire and future tax payers vote west.

Are the stupid house prices the tax avoiding goose cooking it for everyone...?

Straya is full too and I have a feeling they'll have a crash soon enough when all the dodgy loans come out. Always the same thing with humans, behaviour repeats itself. It;s more a matter of timeframe as to when it happens.

We just sold my parents house. A lucky sale in a way - as a good price achieved. My feeling is that there is more interest and people offering - but that is off-set by the large number of people coming to the market. I think our sale was good because it beat others to the market. At the start of the marketing campaign there was 6 homes in the suburb. At the end of the campaign there were 14 in the suburb and 6 in the street.

Mass exodus form your suburb and street? What's the underlying cause you reckon'?

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.