Early indications suggest the housing market could tip even further in buyers' favour over summer, with a rush of new listings and high stock levels persisting in October.

Property website Realestate.co.nz received 12,209 new residential listings in October. That was 5.5% higher than October last year, and the most for the month of October since 2018.

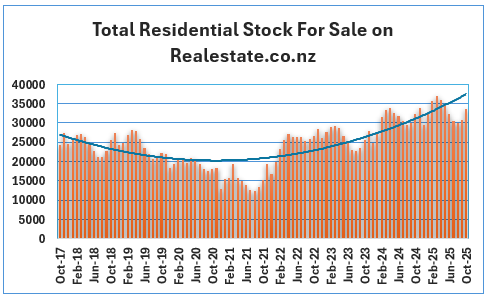

This helped push the total stock of properties for sale on Realestate.co.nz to 33,588 at the end of October, up 3.9% compared to October last year and the highest for an October month since 2014.

It is normal for new listings and stock levels to increase in October, as the market shakes off the winter blues and perks up for the initial summer season before going into hibernation over the Christmas/new year break.

However, both new listings and stock levels increased at a faster rate between September and October this year than they did over the same period last year.

New listings on Realestate.co.nz increased by 30% between September and October this year compared to a 19.8% increase over the same period last year. Stock levels increased by 9.3% between September and October this year compared to a 7.7% increase over the same period last year.

So both the size of the listings and stock increases in October, and the rates at which they have increased, are greater than they were a year ago.

That will ensure potential buyers have plenty of properties to choose from at the start of the summer season, and will likely maintain the buyer's market conditions that persisted through winter, which helped to keep a lid on property prices.

The comment stream on this article is now closed.

10 Comments

Oh the humanity. Specu bubble looks more and more like popping every week.

Popcorn.

I am not seeing as much pain as in the past, banks are transferring people to interest only..... and likely extending mortgage to pay the interest

the market is still so high there is equity in property to act as security.

Wow. That is really keeping the junkies on life support to keep the bloated debt in play.

Yes, but borrowers are allowed to request a change to interest only and if they have enough equity and meet bank credit rules it is likely to get approved. At some point these properties come OFF market as they become -ve equity positions.... as long as interest is still being paid.

UK banking went through this post 1987 crash.

Delaying pain by inflating the debt balloon while stifling the rush to the exits

"Specu bubble looks more and more like popping every week"

You've been saying this for the last 3 years now.

Yep. And house prices went up so much in that time. Fundamentals...oh wait.

The Weather Girls - It’s Raining M̶e̶n̶ Supply

Be interesting to get the figures on unsold retirement villas at present. I have one that has been vacated for about a year and still not sold and capital released. The old dear vacated that and then purchased the hospital care. This too has been available now for about 4 months and still sits.

No wonder share price of the said company is dropping.

Too big to fail?

I'd like to invite readers to comment on Lynda Moore's articles. I think she writes a lot very pertinent articles about money and the behaviour surrounding it, which can help us all.

https://www.interest.co.nz/personal-finance/136000/lynda-moore-wants-yo…

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.