The number of properties being auctioned and the sales rate both declined slightly for the second week in a row at the latest auctions monitored by interest.co.nz.

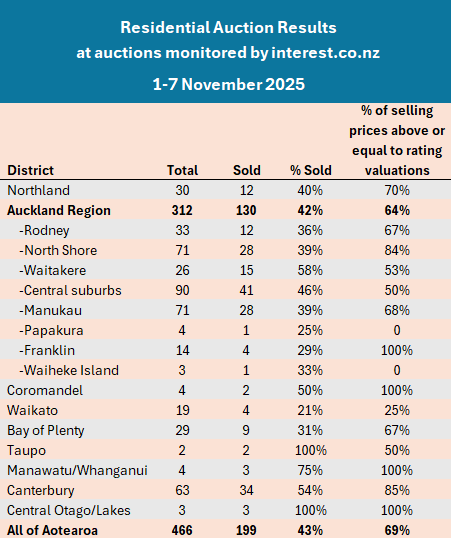

A total of 466 residential properties were up for grabs at auctions monitored over the week of 1-7 November. That's down from 485 the previous week and 487 the week before that.

Of the 466 properties on offer at the latest auctions, 199 sold under the hammer, giving an overall sales rate of 43%.

That was down a tad from 44% the previous week and 49% the week before that.

However, of the 199 properties that sold under the hammer at the latest auctions, 69% achieved prices equal to or above their rating valuations, the highest level in five weeks.

Overall, the auction rooms remain busy, buyers are active but remain cautious on price, and we aren't seeing any sign of a significant shift one way or the other in market sentiment.

Details of the individual properties offered at all of the auctions monitored by interest.co.nz, including the prices achieved for the properties that sold, are available on our Residential Auction Results page.

The comment stream on this article is now closed.

17 Comments

Still not spring takeoff. Price remains the issue.

So how will the flippers and specu leverage brigade make money unless they buy at much cheaper price. Cost of construction work has risen thanks to inflation. This means flippers and spec town needs to buy at much cheaper prices for that to stack up to today's market prices.

Those holding, rents down but rates and insurance etc up.

Popcorn.

Phew, I thought you guys all slept in. Little less drastic than usual, fairly low energy, but at least you made the effort.

Fair question. In a stagflation environment, how does the spec and leverage game make sense, especially in an already high price (expectations) game?

If we only look at markets and economies in small timeframes, like quarters and years, it doesn't. But then it's not very analogous to look at something that moves and trades fairly slowly (property) with something far more liquid like gold or meme stocks.

Personally I wouldn't see such activity providing much if any worthwhile return for several years. Although likewise I don't see the market reversing it's trend of the last few decades without a fundamental shift somewhere. Our governments will fumble here, leaving really only some sort of much larger international change, and good luck predicting the timing and nature of that.

It sounds like you agree with Averageman, but you don’t like popcorn.

Long term trends are a great comfort blanket but it doesn’t help clear the current oversupply of listings.

If I was brewing up popcorn for the sorts of "this time it's different" and "over leveraged specuvestors are going to fall over en masse" calls Averageman has been prophesizing over the years.....

I'd have wasted a lot of popcorn. The market has performed a lot healthier than much general consensus. The reasons were apparent even as the rates went up, the sorts of people who are in the property market aren't actually holding the same debt levels as 08' - thanks to the RBNZ instituting methods like LVRs are a decline of interest only borrowing.

As for oversupply, do we even know what a "normal" level of housing for sale is? People's frame of reference seems to be stuck on that period of 2021-22, where there was an undersupply of practically everything, and a whole lot of market fervour that I viewed as maniacal.

We can make a semi informed punt that lower rates will see demand raise over 12-24 months, at which time we'll probably see a market that's closer to stable.

Fair point, we can’t simply look at COVID stock levels to define oversupply. But we can draw on multiple data points to gauge supply vs demand dynamics. Currently:

- High number of listings with low clearance rates

- Stock overhang & dropouts still elevated

- Rental supply increasing / rents dropping

- Net migration cooling

- Rising number of occupants per dwelling

- Unemployment still ticking up

Looking a little further out NZ is facing stagflation, an L-shaped recovery along with fading population growth. All while house prices are still falling in real price terms.

Overleveraged specuvestors are getting extra special care from the banks this time around. We’ll see if the protection holds.

There is an admission in your comment that the housing market is not currently stable.

Looking a little further out NZ is facing stagflation, an L-shaped recovery along with fading population growth.

How far are we talking? These are 1-5 year factors. With something like population for instance, we can safely say in this environment that our governments will continue to compensate lower birth rates with migration - because they don't have a lot of other viable options. If averageman is scratching his head over why someone's building for profit, it's probably because this demographic are thinking in much longer time periods.

Overleveraged specuvestors are getting extra special care from the banks this time around

I actually think it's more to do with their population being much lower than some people seem to think. Credit has gotten harder to access in the last decade, so those playing in that "property for profit" realm either have much stronger assets, or incomes, or both.

There is an admission in your comment that the housing market is not currently stable.

I haven't thought it has been for 5 years now. But if there was a "stability" barometer, it's moving more towards that than market upheaval (short to medium term that is).

Cheers for the level headed convo.

Being level headed, it sure looks like your suggesting I have been right for the last 5 years. A bearish tone of hyperbole has been necessary to cut through vs the extreme ponzi pump for the win crowd circulating between bans here in the last ten years.

The other big difference today is that most of team pump couldnt afford the 27c a day to comment.

Being level headed, it sure likes your suggesting I have been right for the last 5 years. A bearish tone of hyperbole has been necessary

No, no it hasn't. If we make sound arguments they should stand on their own reasoning. No need to dress it up with dramatics.

We both assessed things were turning negative. That's no hard trick. How negative, for how long, what the ramifications have on everyone's lives, etc is far more useful to try and establish. You don't do that very clearly by running around chicken littling.

There's been no "tsunamis". Just a very wet, very lingering fart.

The other big difference today is that most of team pump couldnt afford the 27c a day to comment.

It appears commentors of all flavours can't seem to justify the 27 cents a day. Whether or not any of them can't afford it, I wouldn't contemplate to say.

your edit illustrated my point perfectly. You are really here to keep pushing a message, whether or not it's actually factual is of almost no consequence.

Yes agreed, the govt will try juice immigration. If only they had a magic button they could just press. An L-shaped recovery isn’t exactly an investor or job magnet though. They can extend for longer than 5 years too.

The govt has a proven track record of luring low wage workers. Perhaps they’ll help fill those empty rentals. Or push the occupants per dwelling number higher and drive up bunk bed demand.

It's sorta the Y shaped recovery floated fairly early on.

Those with cash are doing pretty good

Those reliant on credit less so

I believe something like 50% of retail spending in the USA is being conducted by the top 10% of the socio economic spectrum.

There’s features of a K shaped recovery but you’re reaching here.

The US K shaped recovery is powered by an upper arm of AI, tech, finance and Wall Street. Our economy is predominately a housing market that, as you say, has been unstable for 5 years.

In NZ the top 10% only drive 35% of spending in comparison. They’ll need to significantly increase their spending to convince the data.

Bagrie did a piece on this topic here

If our economy was predominantly based on housing, then we'd have had far more than single digit movements in GDP as the property market slowed and retracted. It's more based on agricultural commodity exports and consumption, the latter also impacted heavily by rising interest costs.

True

"Fair question"

Pa1nter didn't ask any question.

I think he was referring to his question

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.