The last six years have seen very different trajectories for house prices in Australia and New Zealand. Both markets saw remarkable gains after the onset of the Covid-19 pandemic followed by a marked downturn. However, in the last two years the Australian market has recovered those losses and is again at an all-time high while the kiwi market continues to languish.

The latest data from Cotality for the period to the end of October show that house price growth in Australia is now accelerating at the fastest pace in two years. Prices jumped nationally by 1.1% in October alone taking the annual growth rate to over 6%.

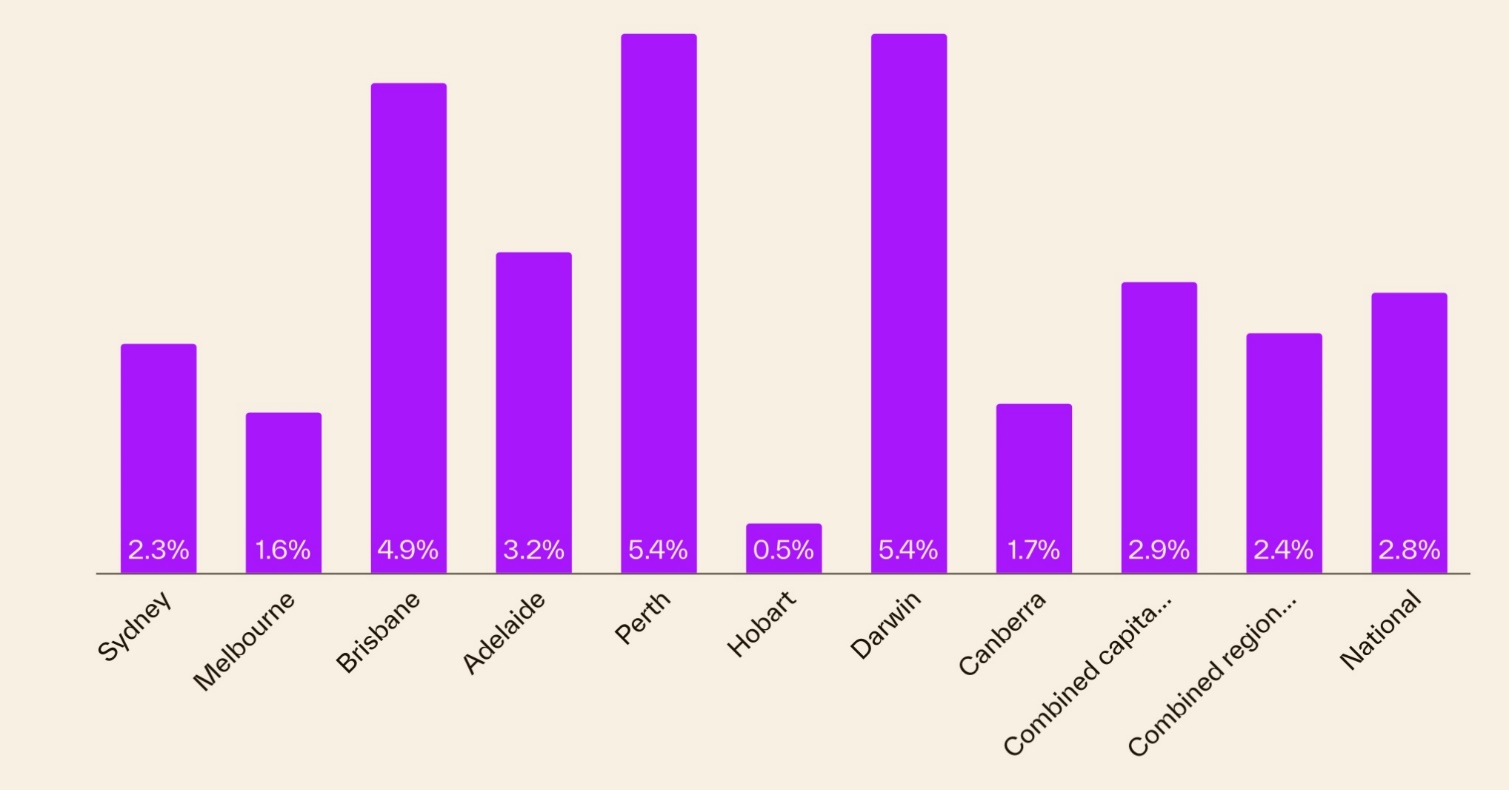

Some capital cities are experiencing even higher growth rates. In the three months to 31 October house prices in Perth and Darwin jumped by a remarkable 5.4% while those in Brisbane were not far behind, up 4.9%.

Cotality Home Value Index for the quarter to 31 October 2025

Source: Cotality

What’s causing this strength in the residential property market? Probably the single biggest contributor is the Reserve Bank of Australia cutting interest rates. The cash rate was 4.35% from the end of 2023 until the beginning of 2025. In February the RBA made the first of three 25 basis point cuts that have now taken the rate to the current 3.6%.

The federal government has also contributed to the surge in house prices, but not in a good way. Politicians in Australia of all persuasions are constantly saying that house prices are too high. Of course, they don’t really mean that, particularly when they’re in government. The last thing they want to do is upset voters who already own a home by overseeing a decline in property values. That’s both politically dangerous and bad for consumer confidence.

The impossible challenge for governments is to reconcile the preferences of existing homeowners and those still trying to get on the property ladder. The obvious answer is to increase the supply of new housing to meet demand, but the Australian federal government (like governments in NZ) seems incapable of doing that.

Rather than increasing supply, the response of both the federal government and the state governments is all too often to provide subsidies to first home buyers in the form of cash grants or stamp duty relief. This is an attempt to win the votes of first home buyers without upsetting existing homeowners. Politics aside, the problem is that it stimulates demand without addressing supply and therefore further inflates prices.

The latest such stunt is called the ‘Australian Government 5% deposit scheme’. In a nutshell, it enables a first home buyer to buy a house with a deposit of just 5% rather than the 20% that is usually required by lenders to get a home loan. Housing Australia provides a guarantee to the lender to make up the difference.

The scheme commenced on 1 October. According to some real estate agents, property investors have been buying houses in the lower price range favoured by first home buyers in anticipation of the scheme pushing up demand, and prices, in that range.

Investors are no doubt also encouraged by historically low vacancy rates for rental property and the corresponding lift in rents. According to the latest rental data from Cotality, ‘continued strength in rental demand has pushed the national vacancy rate to a new record low of 1.47%— less than half the pre-COVID decade average of 3.3%’.

In Sydney the vacancy rate for units has reached a record low of just 1.35%. This represents a chronic shortage of rental accommodation in a city that has a high population of foreign university students and new migrants. It translates into very high rents.

One of the biggest obstacles to increasing the supply of housing is undoubtedly the scarcity of suitable residential development sites in Australia’s capital cities. That’s often a result of both excessive regulation and rampant NIMBYism.

One politician determined to reduce that scarcity is the Labor Premier of New South Wales, Chris Minns. He’s on something of a crusade to increase housing density in Sydney. His government has made significant changes to planning laws to allow more low- and mid-rise housing near major transport links and town centers. Unsurprisingly, that has been met with considerable opposition, especially in some of Sydney’s wealthiest suburbs.

Woollahra in Sydney’s east is a classic example. The Premier is pursuing the resurrection of a train station in that suburb that was built but never operated. He wants to open the station, rezone the surrounding land, and build 10,000 new homes, including some ‘affordable housing’. Many locals in what is one of Australia’s wealthiest postcodes are horrified.

A similar story is unfolding across the habour in Mosman, a suburb with a median house price of around A$6 million. Locals are up in arms over a proposal to build a six-storey apartment block under the new planning laws. That case is on its way to court.

Part of the Premier’s argument is that Sydney’s wealthy eastern suburbs and the so-called ‘leafy’ North Shore have not done their share of the ‘heavy lifting’ required to meet the city’s pressing need for new housing. He sees no reason why they should not play a part in solving the housing crisis.

As house prices take off again in Australia, and the Premier emerges as the politician most focused on addressing the supply side of the housing crisis, he may be onto a winner.

*Ross Stitt is a freelance writer with a PhD in political science. He is a New Zealander based in Sydney. His articles are part of our 'Understanding Australia' series.

12 Comments

The ability for the average family to sell up in NZ, relocate and buy again in Australia is over for most. Auckland down 25% over the past three years, Australia +25% and A$/NZ$ at 1.16 & 7% purchase duty = game over for established homeowners.

You will be leaving Grey Lynn and moving to Punch Bowl or Lakemba.

The young will still do very well to move, however.

Those that sold up, left in 2020-2021 and bought in Oz will be relatively ok however. If that were me, I'd be selling towards the peak in Oz and looking to come back with plenty of cash, buy outright and pursue my passions in NZ. We really don;t know how good we have it here despite the overarching negative sentiment around. I can walk into nature from home in 5-10min, drive to nature in 5min or the beach, head into the mountains to mountain bike, run, walk, swim in various rivers only 10min drive away, national parks not far off also.

There certainly are other lifestyles on offer in larger cities, more variety in food, restaurants, more people, better gigs and concerts, better public transport, but at the cost of access to nature usually. Each to their own of course, but NZ is the place for me. Hopefully many others overseas see this too and return to the homeland.

If you sold in 2021 in NZ and moved to and bought in Aust, you will have brained it. Like +75% vis a vis staying put.

Australia is a big country; there is plenty of nature to enjoy. For some returning isn't an option as the kids are settled there and they have a superior standard of living, for others returning home makes sense.

They might earn more money, but it's pretty debateable whether the standard of living is much different. If you're hand to mouth here, your probably still gonna be doing that there.

And there's more ways to have better fun for free here.

The ABS just reported that the value of the Australian housing stock was above $11 trillion - 4.14x annual GDP [https://www.abs.gov.au/statistics/economy/price-indexes-and-inflation/t…].

The US is currently 1.6x GDP. Japan was approx 3x during their epic bubble.

An enormous amount of capital devoted to a very low productivity asset. The real economy cannot grow without massive expansion of the money supply.

It's more like 5 * GDP, but you're not considering other variables such as Super, household wealth etc. Australia has the natural resources to pay its way even at higher multiples. The gap to NZ is only going to get wider.

Australia has the natural resources to pay its way even at higher multiples.

The Aussie economy is not getting wealthier because of resources. Aussie matched the US in real per capita growth from 1985 to 2000 when the dot com bust and GFC 2009 held the US back and mining investment boom pushed Australia forward. But this has faltered in the post-pandemic period. It is evident that since 2010 Australia has become overly-reliant on population growth for economic expansion.

The end of the first mining boom put Aussie on a path it has not been able to change. Thinking the Ponzi and monetary policy alone can alter this is wrong-headed.

If they were to have a downturn in the mining sector now, the effects would be profound. As it has always been, the easiest way to store minerals is leave them in the ground and turf the workforce until the next big order comes in. I have family over there who have been through a few of these, and it does bring into question the risk that comes with the high pay check of roles in the mining sector.

So while Aussie doubles down on the Ponzi and mobilizes every kitchen sink in the nation to throw at it, a shock number of Australian small businesses say they are on the brink of collapse as high rents, energy prices and regulatory burdens plague the private sector.

This is a direct result of the Ponzi as the whole economy is damaged as land prices are distorted beyond recognition.

Boomers reckon this is good economic management.

https://www.skynews.com.au/business/finance/shock-number-of-small-busin…

Waiting for speculators operating in Aussie to start seeing better deals here. Add in the inevitable ramp in immigration because the government has no other plan, and here comes the next round of property euphoria.

"What’s causing this strength in the residential property market?"

Have a look at the immigration numbers

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.