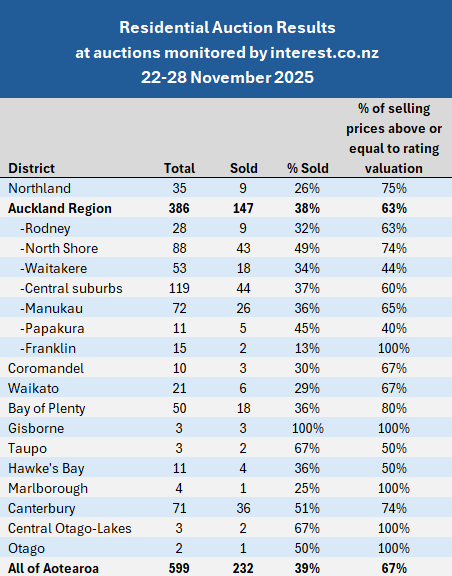

Residential auction activity shifted into top gear over the last week, with interest.co.nz monitoring the auctions of 599 properties around the country over the week from 22 to 28 November.

That was up from 532 the previous week and 436 the week prior to that, and was within a hair's breadth of this year's high of 601 properties auctioned in the last week of February.

So whatever else this summer's property market has in store, this latest result suggests the auction rooms will be busy.

Of the 599 properties on offer at the latest auctions, 232 sold under the hammer, giving an overall sales result of 39%.

That was the first time the sales result has been below 40% since the beginning of September. While it's only slightly lower then the results over the previous three months, it suggests buyers are maintaining the cautious stance that's been a feature of the market this year.

Details of the individual properties offered at all of the auctions monitored by interest.co.nz, including the prices achieved for those that sold, are available on our Residential Auction Results page.

The comment stream on this article is now closed.

22 Comments

So peak selling time in NZ and just 26% selling above the now much lower, already downgraded CVs.

Overleveraged Spruiker town must be in tears.

Proof the NZ Property Ponzi is broken and faulty, beyond its normal, always upswinging, "property cycle" over the last 40 years......

The propeller and staircase propertyheads, must be dizzy with dismay? - at drinking the property seminar koolaid and being the usefull idiot, market props, into this epic property crash.

Jusy wait till the massive iceberg of withdrawn, unsold sales, re-makes its appearance as the now moreso desperado sellers, are forced into transacting!

Higher yearly rates, insurance and general delapidation will force many hands into 2026 to 2028 capitulation.

Yet Gold and SILVER have never shone brighter......what will occur when even only 5% of the population, own a little?

The property seminars will be tumble weed twirling, ghost towns......

.....

Yvil thinks 5% gains next year, lets see, RBNZ thinks only income increase, and with what I see in corporate profits that will be 2.5% max

Yvils gonna look like the deaf and blind deer in the headlights (like Tony Combs promise in 2021 of good 5% gains in 2022)

When 2026 sees the property crash hit new lows......where will his fortune telling credibility lie?

I hope we will review this comment in 6 months time.

Lol, so people should move from investing in a house, with a roof, kitchen, toilet, walls, heating etc, and pile into something far more valuable; small pieces of shiny rocks.

Gotta catch em all!

I’ve got a few bytes of data I could sell you for $91k USD if you want something really valuable.

That's funny, all the records that you actually own "that piece of dirt" are on a raid disk pack as a few bytes of data, as are your balances, debt and money from your tennant.

Its all fairy dust, its just what fairy you believe in most..... The fiat fairy is constantly being devalued, even as you sleep.

People are waking up that the property fairy is looking pretty knackered. Whereas the BTC and shiny fairy seem to have had recent legs.

What fairy will be next?

Interested to know how you came up with 26%. The table says 67%

It's gecko maths. Come up with the answer first, then adjust your maths to suit.

Glad you lot came here to learn something......

Read the stats! - get your calculator out...not that hard. 155x SOLD AT OR ABOVE CV.....yes just over 1/4 of total offered. Lets call it say 26%.

Bit embarrassing, some cannot grasp the basics here and need it spoon fed !

Auction clearance rates typically hover at around 50%. Maybe if the norm was 100%, yours would be a neat stat.

I remember back in 2018 I sold my home at auction and out of the ten properties in the session mine was the only one that sold. There's a common misconception that auction sales rates in NZ were closer to 100% in the past.

they where high 80%' in 2020

That was an anomaly though, during the COVID mania...a very odd time. An exception that proves the rule.

Proves the rule that if you are offered a silly bid you should take it.

Aussie see's 70-80% clearance as a sellers market, 70% balanced and 50-60% buyers

Pretty sure that Auckland was routinely hitting 80%+ in the mid 2010s when prices were flying and so were the overseas buyers.

Think it is pretty normal during the mania periods. Twice in a decade in a slow moving market like real estate is hardly anomalous.

Sales do look up. It is peak selling season afterall. Bank contacts all say pre approval applications are up, but lending still soft. Sales still far less than the mad days of 5-10 years ago.

Capital gains continue to look dead. If you buy on a yield that actually works you probably need near 40-50% equity. At that point commercial is a far option.

Don't you need 40% equity as an investor?

Commercial is generally preferred for most sorts of trading.

Used to be 30% deposit however thanks to RBNZ it's now eased up...some banks are doing as low as 15% deposit for investment properties - existing build. 10% deposit for new build.

🔥

If you've missed out on the 'black friday sales' you may start paying full price...

Its funny that the same thing can sell at a discount or full price

Bid low young grasshopper, its where you will find opportunity, as you cannot control what someone will pay as you want to exit.

Price before black friday $399, price for black friday sale -> $399 down from $699 BUY QUICK SALE ON

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.