Nationwide residential property values remain flat overall but are still in decline in most parts of Auckland, according to the QV House Price Index for the three months to the end of November.

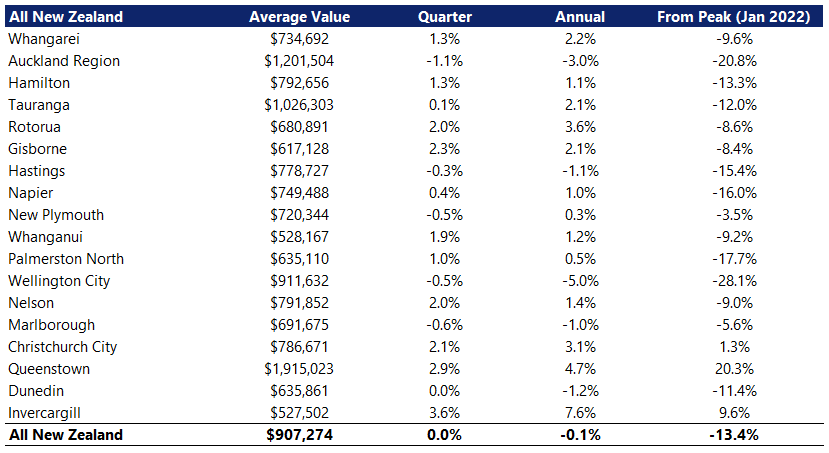

The average value of New Zealand dwellings was $907,274 at the end of November, almost unchanged, being up just 0.03% from the previous quarter, and down 0.1% from the same period of last year.

The average dwelling value remains $139,858 lower (-13.4%) compared to its peak of $1,047,132 in January 2022.

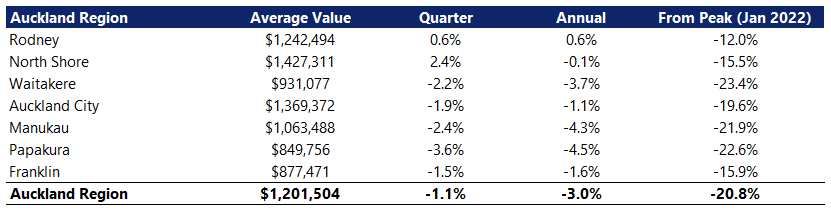

Around the country there were considerable variations in value trends, with the biggest quarterly declines recorded in Auckland -1.1% and Marlborough -0.6%, followed by Wellington City and New Plymouth, both -0.5%.

The biggest quarterly increases were in Invercargill, +3.6%, Queenstown +2.9% and Gisborne +2.3%. See the tables below for the detailed figures covering most major urban areas.

QV spokesperson Andrea Rush said residential property values across the country had entered a phase of consolidation.

"While this stability might suggest a pause in the market, the picture underneath is far more varied," Rush said.

"At a regional level, growth and decline diverge sharply - some are seeing value gains... while the greater Auckland region has recorded a further decline, continuing a run of recent months that exerts downward pressure on the national average, she said.

"And for many households, ongoing affordability and cost of living pressures remain acute."

"Over the past five years the cost of living as measured by CPI inflation, has increased by around 21%, placing additional pressure on household budgets," she said.

"Wages in many sectors have not kept pace with inflation meaning many households now have less real income available to save for a deposit or to comfortably service a mortgage," she said.

Rush said financial pressures were also being felt by existing home owners.

"The cost of owning and maintaining a property has increased, with rises in council rates, insurance premiums, trades and building costs, renovation expenses and development contributions," she said.

"These ongoing expenses mean many households are having to prioritise carefully, with some deferring improvements or considering downsizing as they get older."

Rush said these factors point to a shift in this country's residential landscape.

"Values are no longer rising rapidly but the cost of entering or remaining in the housing market remains high," she said.

"For prospective buyers, property continues to represent a considerable financial commitment - for homeowners, maintenance and ongoing costs continue to bite."

"For the residential sector, we may be entering a period in which affordability, economic pressures and regional differences play a larger role than headline value growth," Rush said.

The comment stream on this article is now closed.

|

|

|

9 Comments

Low net immigration and now rising interest rates would suggest there are further declines to come.

Agreed. Auk and Wel still firmly in retreat. Seminar believers who leveraged up in 20/21 are completeing a 4th year of capital loss.

Keep watching offshore rates, they do appear to be rising at the long end, US 10Y now 4.17% was below 4 not that long ago

There has been valuable time afforded to those whom followed well founded advice to accumulate larger interest saving deposits. Those who, from 2022, continued to spread fear year after year that FHB's only had a slither of an opportunity to enter the market more affordably, deserve to sweat. Collectively this selfish approach has predictably left many high and dry now that the tide is slowly gone out. I support home ownership for all the right reasons. Houses are for living in!

Personally, I am pleased with this new normal of slowly deflating house prices. On the downside, continued job losses are very real and turning many lives upside down.

To me looks like History repeating itself: at first decline in Auckland/Wellington, then spreading to the regions. Let's see if the "rule" is proved correct again.

Normally this occurs, it's not clear if farming/agri will support a longer correction timeframe (it seems to have worked so far), or if regions actually have falls to come.

Or if cheaper regions are dragging people out of major cities due to cheaper properties.

the demise of regions that Shamubeel Eaqub predicted has not come to pass, even though those councils are struggling re rateable populations and deffered maintenace issues

If anything, many are moving from AKL and WLG to Christchurch and the regions, thus bolstering them.

So many townhouses in Auckland are likely skewing the average down considerably. HPI becoming more and more the only relevant metric.

I'll be encouraging QV to lower my land value based on sales in the area. Didn't drop it low enough from their assessment. It appears to me they use a shotgun approach without any objective analysis. Get paid by the Council/Govt for which they do the minimum amount of work and I suspect not in accordance with the ratings valuation Act.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.