The housing market returned mixed results in December with stronger sales numbers but slightly softer prices overall.

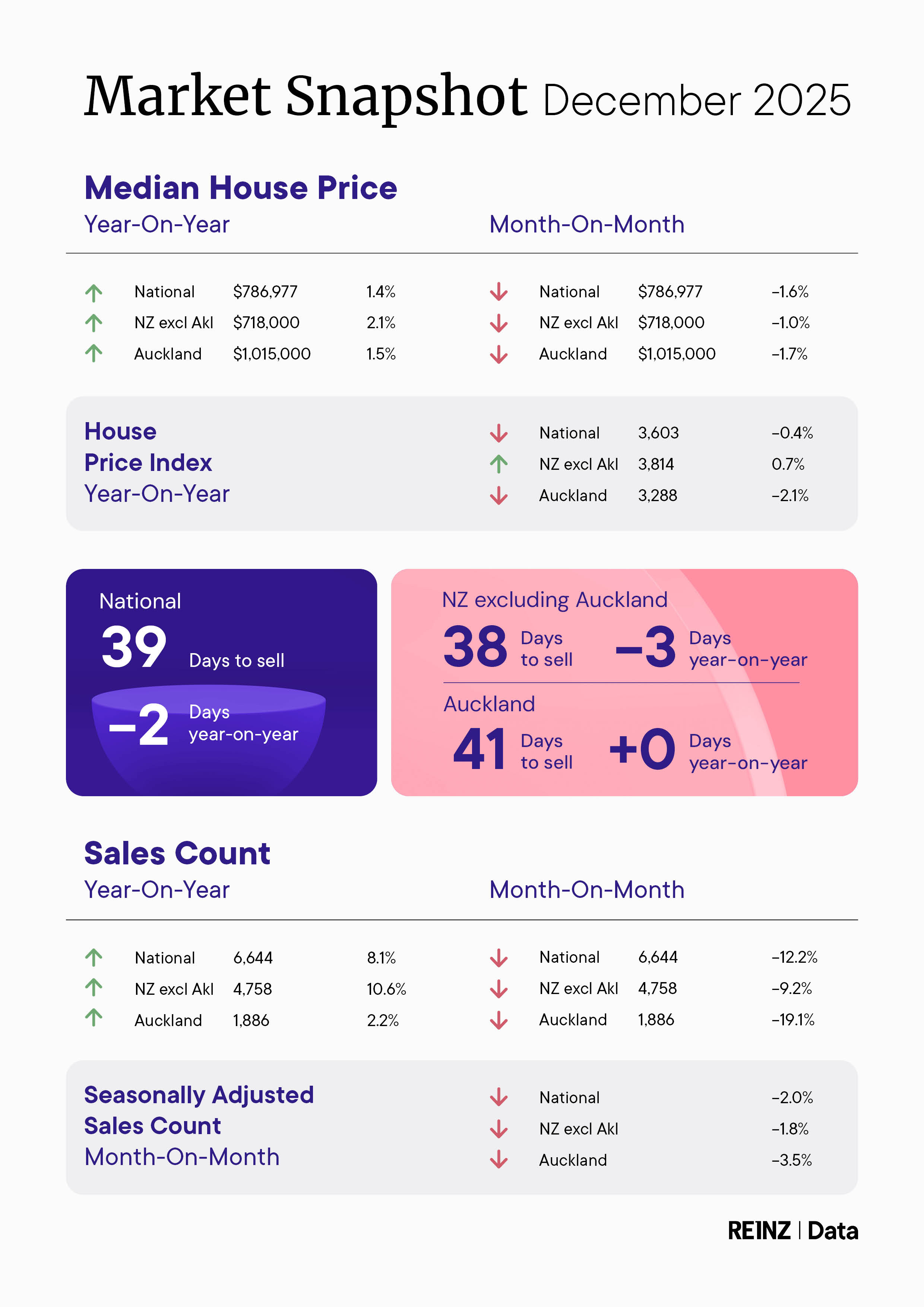

According to the Real Estate Institute of New Zealand (REINZ), 6644 residential properties were sold throughout the country in December, up 8.1% compared to December 2024.

However, sales activity was more muted in Auckland where 1886 residential properties were sold in December, up 2.2% compared to December 2024.

In the rest of the country (excluding Auckland), 4758 properties were sold in December, up 10.6%.

"December is usually a quiet month for the housing market, however, compared to the same time last year, activity appeared stronger in several areas," REINZ Chief Executive Lizzy Ryley said.

"Local salespeople reported mixed conditions, with some regions having experienced higher levels of buyer interest," she said.

"In particular, attendance at open homes and enquiries around listings were above what was seen at this time last year, suggesting improved engagement despite the typical seasonal slowdown," Ryley said.

However, while sales activity firmed, prices appeared softer overall.

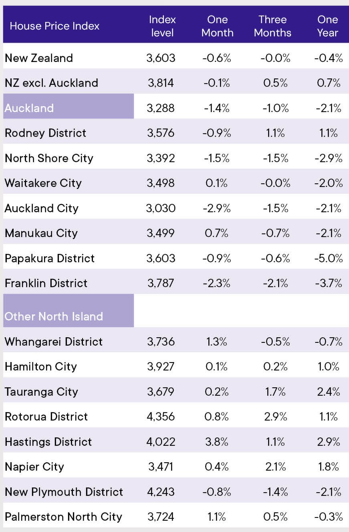

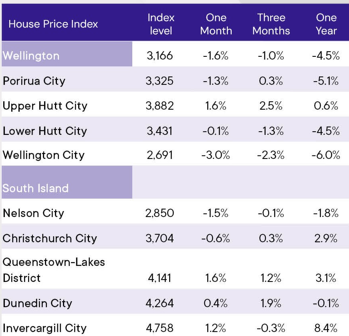

The REINZ House Price Index (HPI), widely regarded as the most accurate measure of house price movements because it adjusts for differences in the mix of sales each month, declined by 0.6% in December versus November, and finished 2025 down 0.4% compared to December 2024.

In Auckland the HPI declined by 1.4% in December compared to November, and was down 2.1% compared to December 2024. See the table below for the full regional figures.

The REINZ's national median selling price was $786,977 in December, down 1.6% compared to November, but was up 1.4% compared to December 2024.

- The comment stream on this story is now closed.

REINZ House Price Index - December 2025

19 Comments

Sellers meeting the market?

agreed easier to meet the market then demand fairytale prices from 2021

The glut houses for sale means more sold, as well as more unsold

HPI down 0.4% for 2025

The REINZ House Price Index (HPI), widely regarded as the most accurate measure of house price movements because it adjusts for differences in the mix of sales finished 2025 down 0.4% compared to December 2024.

In Auckland the HPI declined by 1.4% in December compared to November, and was down 2.1% compared to December 2024. See the table below for the full regional figures.

prices are falling at an annualised rate of 14.34 % in Auckland (based on dec month) hardly a slight fall.

You're going to be on a hell of a mental rollercoaster if you keep on extrapolating annualised rates from noisy monthly data.

Take home message for me is 2025 was the third year of flat prices following a sharp rise and fall. Relative stability and house prices steadily coming into line with wages seems like a good situation to me - long may it continue.

This is such a nonsensical post, you just quoted the annual drop as being 2.1% for Auckland, then you extrapolate December's only result to get a yearly drop of 14%. Why don't you just go all in and say that in 71.4 months (about 6 years) houses will have dropped by 100% and will be free?

putting it another way, for Auckland, 66% of 2025 years falls occurred in December.......

You're clutching at straws there IT. The real estate market is stabilising. Hyper-focusing on month-by-month numbers is a waste of time when investing for the long term.

You're clutching at straws there IT. The real estate market is stabilising. Hyper-focusing on month-by-month numbers is a waste of time when investing for the long term.

Not necessarily. If you know the probability of house prices falling 2.1% or greater in a month is an outlier in terms of a distribution of all monthly price movements, it might be in your interests to pay attention (assuming that the price of houses is important to you) as there could be a disturbance in the force.

And the trademe asking price plummet is a lead indicator of actual future prices, market is definitely on the move, but not upwards

And if you look at above its not just Auckland, all of NZ has had a bad Q4, forget Q1-3 thats yesterdays news and is already reflected in prices been achieved now.

Treasury has like a 1.9% rise this year , its wafer thin.........................

Why don't you just go all in and say that in 71.4 months (about 6 years) houses will have dropped by 100% and will be free?

Because it's mathematically impossible for the price to reach 0 (free).

With a constant 2.1% monthly decline, the price approaches 0 but never actually reaches 0 in finite time.

Kinda feel this is the real reason behind the about face on planning regs from the blue team. Towers looking over swimming pools doesn't impress the blue rinse brigade but I feel that they're beginning to understand the effect of a sustained increase in housing supply and its downward effect on prices, and they don't like it one bit

It's hard not to be cynical. The disdain towards poor people in our nation is not explicitly expressed, but it's there. We're very class based and that's usually defined by postcode and pecking order on a socio-economic scale.

I wonder what the poor people are doing today?

Let them eat cake

Probably not a lot. Root cause perhaps?

https://www.nzherald.co.nz/property/auckland-has-541-new-unsold-apartme…

The residential property downturn and slow market have resulted in Auckland having a record 521 new, unsold apartments finished in the last three years, a new study has found.

Tamba Carleton of real estate consultancy and agency CBRE studied the toll the poor market had on apartments in the country’s largest city.

Of unsold units, she identified:

- 472 suburban units or 21% of the stock completed in the last three years;

- 42 fringe city units or 13% of stock completed in the last three years;

- Seven CBD units or 23% of the stock completed in the last three years.

CBRE tracked all Auckland apartment projects from inception to completion and beyond, she said.

Advertisement

To calculate unsold stock, CBRE took market or saleable apartment projects completed in the past three years and updated the final presale volume before completion against current ownership records.

probably nothing hamish

As I said earlier, I'm not hyper-focused on the month-by-month movement of any particular market. Long term, real estate has proven to be a good inflation hedge and I believe it will continue to be the case in the decades to come.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.