By Bernard Hickey

A monthly survey of over 10,000 real estate agents in July has found a continued strengthening of indicators of buyer demand and activity, along with a reducing supplies of listings.

The Bank of New Zealand Real Estate Institute of New Zealand (BNZ-REINZ) survey found all the measures of buyer interest, prices and activity improved from early June, but the indicator of requests for appraisals by sellers dropped.

"That means decreasing supply at the same time as measures of demand are rising. For instance a record net 27.9% of agents say they are noticing more investors in the market, while 44% - up from 40% in June – say they are seeing more first home buyers," said BNZ Chief Economist Tony Alexander in the attached BNZ-REINZ Residential Market Survey.

"As noted last month, conditions have switched around decidedly toward being a sellers market – as other analysts have also noted from their datasets – with a net 18.3% of agents feeling buyers are more motivated than sellers," Alexander said.

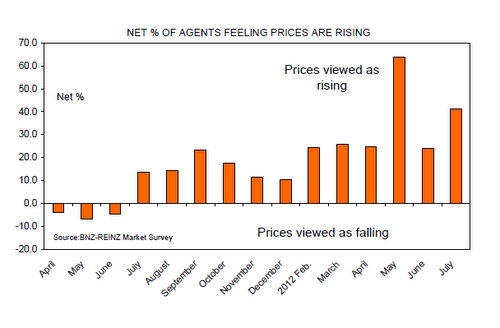

"The combination of rising demand, easing supply, and sellers holding the power suggests little other than prices rising – hence a net 41.1% of agents reporting that is exactly what they are observing," he said.

"With interest rates set to stay low for this year and perhaps all of next while economic growth continues at a reasonable if unexciting pace, New Zealand’s residential property market is likely to remain in its sellers market phase at least well into 2014. Beyond that depends very much upon what at this stage are unpredictable interest rate rises further out, and by how much dwelling supply can grow in an environment where builder shortages seem certain to appear."

The survey found a net 26% of agents saw more people going through open homes, up from a net 13% the previous month.

A record net 28% saw auction clearance rates rising. "This also is a sign of a strong market," Alexander said.

A net 13% of agents said they saw the number of requests for appraisals by potential sellers falling away, up from 1% in May.

"The movement of this measure back firmly into negative territory is suggestive of vendors feeling in no particular hurry to list their properties and accords with the growing anecdotal feedback of listings being in short supply," Alexander said.

A net 28% saw more rental property investors in the market, up from 27% a month ago, which reflected the cuts in fixed mortgage rates two months ago.

A net 41% felt prices were rising. A record net 18% believed that buyers were more motivated than sellers.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.