By Bernard Hickey

I've just moved to Wellington from Auckland and am going through the tortuous process of house hunting. It's been almost a decade since I last bought a house so I thought it would be worth sharing the internet tools around these days that I've found useful when hunting for a house.

I'd welcome your suggestions and tips too in the comments below.

Step 1: Find a house

This is often the hardest part. I use Trade Me's listings, filtering tools and email alerts extensively.

Make sure you login to your account so you can save properties to your watchlist and create new alerts.

My favourite tool is the 'latest listings' filter. I like to leave the options open for location and property type (ie apartment vs house) so I can be 'surprised'. Serendipity can be a useful thing that overly prescriptive searches can wipe out.

Sometimes I bounce on from the Trade Me listing to a listing on either Open2View or the agents' own website to get more pictures. It's hit and miss, but can be useful.

I often dive into the street view function on the Google Maps part of the listing to get a closer look. There's something addictive about wandering up and down the street in a virtual way to have a look at what the neighbours' houses look like. It can save you a time-wasting drive-by 'shooting'.

One of the most useful things about the TradeMe listing is the section at the bottom right hand corner with the recent sales information in the surrounding area for properties with a similar RV (registered valuation). We've created a spreadsheet with these addresses, their sales prices and their RVs to get an idea of how far above or below CVs properties in this area are going for.

We find the RV for a property by going to WatchMyStreet.co.nz This site is also useful because it has information on school zones, sunshine hours and the actual title number for the property. That's a useful link to click through to because it has the name of the owner and the bank that it is mortgaged to. This is useful for mortgagee sales. However, it's only available for Wellington. They are trying to get the information they need from councils in other regions.

Step 2: Think about where house prices might go

This is the million dollar question to answer. I'm sort of not kidding. Auckland City's average house price hit NZ$735,692 in April and was up 12.2% from a year ago, QV reports. If inflation keeps going at that rate for the next three years, that means the average price will surpasss NZ$1 million by 2016.

It's worth understanding how much house prices have risen by or fallen by in the neighbourhood you're buying in, and more generally in the city you're buying in and, more widely, around the New Zealand. Obviously, what prices might do in future will inform your thinking about how much it's worth bidding for a property.

It's hard to predict where prices will go, but factors such as migration levels, interest rates, economic growth and taxation policies will have an effect. Some of these factors will effect prices differently depending on where you live. WatchmyStreet gives an indication of what property values have done in your street and suburb over the last year.

This is QV's latest (April) spreadsheet of average property values in the various regions of New Zealand and what they've done over the last year. Here's a useful QV commentary for April on house prices.

Here's a useful collection of links from REINZ on what's happening to property prices around the country, as of April. This is a particularly useful link from REINZ that allows you to build a chart of monthly median house prices in your suburban region over any time from 1992.

This is a useful government summary of the regional economic statistics that can give you an idea of how your particular economy is going.

As a buyer I was thrilled to hear Prime Minister John Key recently describe the Wellington Regional Economy as 'dying'. Thanks John.

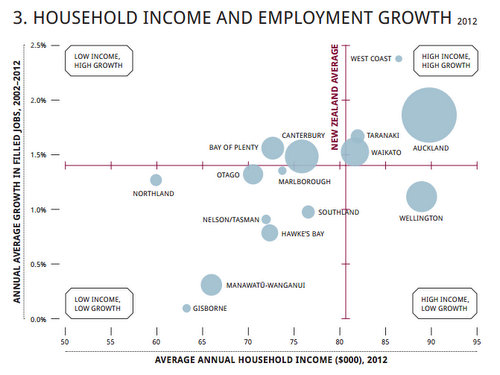

Here's a useful chart from that report showing a matrix of household income and employment growth by region. It shows Wellington has reasonably high incomes, but low employment growth. That would tend to limit house price inflation. Auckland, which has the highest income growth and employment growth also has the highest house prices and highest house price inflation. The 'bubble' size indicates the population of the region.

If your province is in the top right of the matrix then house prices are likely to be more buoyant over the longer run. Bottom left is not a place you want to be if you're hoping for prices to rise (after you've bought). For example, Northland, Gisborne and Manawatu/Wanganui are in the most bottom and the most left parts of the matrix. Their house prices are still 24%, 25% and 12% below their 2007 peaks, while Auckland is now 18% above its 2007 peak.

Step 3 - Think about how much to borrow

This is a tough one and raises all sorts of questions about what you think your income will do in years to come, how much risk in the form of debt you want to take on and how much disposable income you think you'll need.

Everyone is different and I'm no financial advisor, but these links might be useful in trying to calculate how big a mortgage you can handle, or more importantly, think you can afford to handle.

It's a useful reality check from the suggestions your banker might make or the affordability and serviceability calculations your banker might give you. Remember, your banker wants you to borrow up the limits of your affordability (and often then some). Your banker may be very friendly now, but he/she is not your friend in the long run and will not be your friend if something goes very wrong. Talk to anyone who was encouraged to take on a monstrous mortgage by their banker and then was forced into a mortgagee sale when they lost their job/got sick/got divorced/had a business failure. Thankfully, our banks don't pull the trigger as easily or as often as in some other countries, but it still happens.

Here's the mortgage calculator on interest.co.nz. It allows you to compare two mortgages and tweak the size of the mortgage, the interest rate, the frequency of the payments and the fees. It then shows you how much you pay in interest over the life of the mortgage. The bank calculators often don't let you do this. They don't want you to know....

Play with it for a while and you will not be able to sleep at night. The numbers can be enormous.

My rule of thumb is not to borrow so much that your debt servicing and capital repayment costs would be more than 40% of disposable income with interest rates at 10%. Have a look too at whether you could handle going down to one income if your partner or yourself lost a job or got sick or pregnant. I'm always surprised that mortgage brokers and bankers don't hand out condoms and birth control pills when they get your signature on the mortgage!

Step 4 - Think about where interest rates might go and whether to fix or float

This can also be very tricky because interest rates are driven by a myriad of economic factors, both here and abroad. The decision to fix vs float will also depend on your own circumstances, such as your job prospects, your family prospects and your own tolerance for risk.

My view is that interest rates are staying low (and possibly going lower) for longer because deflationary pressures are sweeping the globe. A multi-decade drive to repay and/or restructure debt, the growth-slowing effects of ageing populations, and the income-suppressing effects of globalisation and higher corporate profits will, in my opinion, keep inflation low and interest rates low. So far, massive amounts of money printing seems only to have inflated asset prices rather than boost the real economy and inflation.

Economists currently see the Reserve Bank starting to put up interest rates from the March quarter of next year and then rising by around 2% over 2014 and 2015, but they have been predicting rising rates since early 2009 and have been mostly wrong. The Reserve Bank itself is forecasting putting up interest rates by only 1.2% over 2014/15. That suggests floating mortgage rates would rise over 6.5% some time in 2015. Can you handle that?

Here's the calculator on interest.co.nz we've created to help you work out whether fixing is cheaper than floating. For example, if I was to borrow NZ$400,000 for 2 years at the going rate of 5.45%, that would be NZ$746 more expensive for me than sticking to a 5.2% floating rate over the two years of the loan, assuming a slight increase in the Official Cash Rate.

Those are a few tips and tricks.

We welcome yours in the comments below.

(Updated with more links/tips/detail on WatchmyStreet only being in Wellington)

6 Comments

My, what a pretty piece this is Bernard. Thank you. I do enjoy it when as a result of blind luck (and being an early adopter of the credit crunch) my suburb looks $o fine.

Bernard, one of the most important things when considering buying a house in Wellington (this from a born and bred Wellingtonian) is sun, sun, sun. Those beautiful hills with their wonderous views of Wellington can be a hindrance as well. There are places in Wadestown, Khandallah, and Hataitai for instance with harbour views that only see the sun for about three hours in the winter months as well as Thorndon. If you have the money - Eastbourne and some parts of Seatoun are the only places I would live if I was back in Wellington. Oh and Oriental Bay of course!!!! Need to win Lotto. But then there are lovely parts of Lower Hutt that are sunny and warm - but oh the commute along that Hutt Road in peak hour traffic and when there is a disaster you are stuck!!!

Good point about the sun. When I lived there I was recommended to go house-hunting in the middle of winter so you cold see how much sun a property got in the winter. All those twisty gullies can be deceiving.

Eastbourne is lovely and Oriental Bay (I lived there for four years is wonderful). Roseneath/Evans Bay can be stunning (over the hill from Oriental Bay). For a different feel, Paekakariki.

Otago Regional Council has the sun data for Dunedin on its website- initially an Otago academic developed it for his personal use when house hunting.

Under Step 1 where you state that RV stands of Registered Valuation - this is incorrect. RV stands for Rating Valuation, and CV for Capital Value - both of which are the same thing. Trademe has access to rating values, but cannot access Registered Valuations, as these are confidential betweeen the valuer and their client.

Many thanks

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.