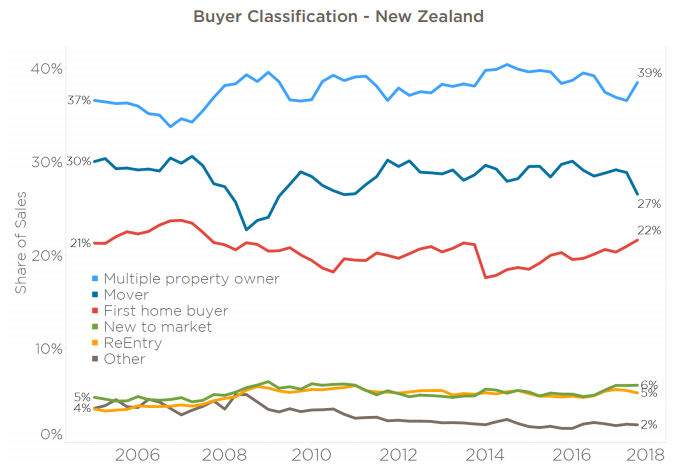

First home buyers have captured their highest share of home sales in a decade, as the share of purchases by owner-occupiers who are moving house has fallen, figures out from Corelogic show.

Meanwhile, ‘multiple property owners’, after tracking down over the past few years, saw their share jump over the third quarter of 2017, boosted by investors who didn't require mortgages to make their purchases.

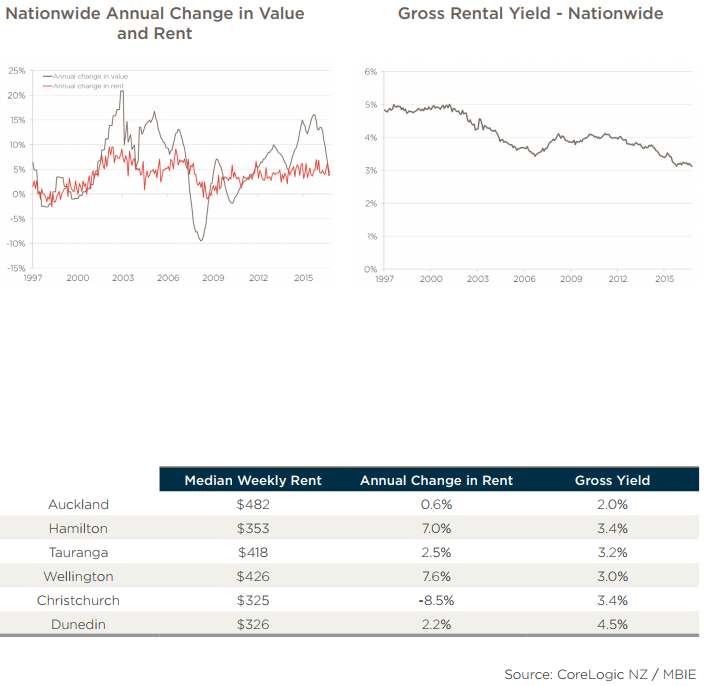

At the same time, Corelogic says nationwide gross rental yield fell again over the past month to its equal record low in the past 20 years. The figures are contained in Corelogic’s market update for October/November.

Read Corelogic’s media release below. The full report can be read here.

With the new coalition Government now in place, its impact on NZ’s property market is much anticipated. Investors will undoubtedly be in the spotlight - despite already being impacted by tightening credit conditions, stricter LVR restrictions and previously rising property values reducing rental yield.

CoreLogic Head of Research Nick Goodall comments: “It’s likely that investors will be weighing up the value of remaining active in the market, but I don’t think we’ll see their mass-exodus from the market. Changes will take some time to be implemented and the outlook for the economy is relatively good, despite some savvy political expectation setting, warning against ‘tougher times’ ”.

CoreLogic observed that nationwide, first home buyers have increased their market share to the highest level of activity (21.6% of sales) we’ve seen since way back in Q3 2007.

“In spite of tougher lending conditions, first home buyers have not been as affected as other groups. They’re finding a way in the market by readjusting their expectations on property location and type, whilst others can’t (or won’t). As a result, first home buyers’ market share has actually increased”.

Released today, the latest CoreLogic NZ October/November Property Market & Economic Update Report covers the main economic factors influencing the housing market ranging from sales volumes, values, and active buyer types in both the national and main centre housing markets.

CoreLogic’s unique measure of property market activity (bank requested mortgage valuations) shows weakness nationwide: “the prolonged coalition discussions stalled market activity in October and with the new Government proposing further scrutiny on property speculators, it’s unlikely we’ll see a lift in activity in the short term” Goodall explains. “Based on current market activity, we expect October’s sales volumes will remain low, following on from an already weak September”.

Nationwide annual value growth has also dropped again - NZ is experiencing its lowest rate of property value growth since August 2012 at just 4.3%, but there are pockets of improvement: Napier is the standout main urban area performer, with 18.4% annual growth and 5.2% growth in the last three months.

Report (found here) highlights include:

► Buyer Classification: (Q3 is now complete): Hamilton’s First Home Buyers continue to rise; Wellington’s Multiple Property Owners remain active, and are increasing in Dunedin.

► Values: In East Auckland, the suburbs of Cockle Bay and Mellons Bay have experienced steep drops in value in the last 3 months at -3.5% and -4.8% respectively. The North Shore’s Schnapper Rock has also experienced a similar drop (-4.7%). Looking to the South - the average property in Christchurch has fallen by almost $10,000 since November last year.

► Rents: nationwide gross rental yield saw a minor drop to 3.1% in September - the equal lowest (with September 2016) for at least 20 years.

The report's specific comments on the share of purchases by different groups:

First home buyers have increased their share to the highest level of activity we’ve seen since Q3 2007.

Over the long term we’ve seen multiple property owners’ share of sales nationwide decrease since 2014, however there was a significant lift in Q3 this year.

Those multiple property owners purchasing with a mortgage however increased only marginally from 24.1% in Q2 to 24.7% in Q3.

The remaining 13-14% of multiple property owners buy without a mortgage although they could be using existing lines of credit to support the purchase.

Corelogic's comments on rents are below:

Nationwide annual rental growth rose slightly last month, to 4.0%, but sits below the rolling 2 year average of 4.8%.

Nationwide gross rental yield saw a minor drop to 3.1% - the equal lowest (with September 2016) for at least 20 years.

Christchurch rent continues to drop, now down 8.5% over the past year. Rental growth in Dunedin has now slowed after recently enjoying double digit growth.

Meanwhile Wellington and Hamilton currently have the greatest annual increases of 7.6% and 7.0% respectively.

Gross yield is still very low across the main centres with all but Dunedin (4.5%) below 3.5%.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.