By David Skilling*

For all the materiality of the economic shock due to Covid – G20 GDP contracted by 9% in the year Q2 2020 – government policy and successful vaccines were able to support a rapid global economic recovery. But after dealing with pestilence, the world is now confronted with the economic consequences of war: a man-made economic crisis caused by the Russian invasion of Ukraine.

Global economic forecasts are being marked down, and inflation forecasts are being marked up, on the back of soaring energy and commodity prices. And in a structural sense, the Russian invasion and the international response will reshape the functioning of the global economic system. This is the ‘end of the beginning’, as I noted recently.

War by other means

The initial Western response to the Russian invasion was to provide additional military support to Ukrainian forces, who are fighting with remarkable courage and results. But over the past week or so, this has become an economic war against Russia for the US, Europe, and its partners. French Finance Minister Bruno Le Maire talks of ‘economic and financial total war against Russia’.

After an initial round of aggressive economic sanctions, such as disconnecting selected Russian banks from SWIFT, freezing Russian central bank assets, and imposing penalties on Russian institutions and individuals, this week has seen further economic pressure applied. The US and UK are banning Russian oil imports; restrictions on technology engagement with Russian firms are being extended (e.g. semiconductors); and there is increased freezing/seizure of assets (anyone want to buy Chelsea?). More is likely to come.

The exit of Western firms from the Russian market continued this week, including Goldman Sachs, Visa and Mastercard, as well as Starbucks and McDonalds (in a reminder that Tom Friedman’s ‘Golden Arches’ theory hasn’t aged well).

Choices such as banning Russian oil imports would have been unthinkable even a month ago. But at least for now, there is a political willingness to absorb economic costs – notably higher energy costs – in order to confront Russia and resist the challenge to the rules-based global system.

Although economic sanctions are not new, it is striking that a broad coalition of countries has imposed sweeping sanctions on a G20 economy (Russia was the 11th largest economy in the world in 2021) that has significant positions in exports of energy, food, and other key commodities.

This is the first meaningful conflict being (partly) fought using economic instruments in a deeply integrated global economy: it is perhaps the ‘first world economic war’, with effects stretching from New Zealand and Singapore to the Middle East and Europe. We are in uncharted waters.

These sanctions dramatically increase the costs borne by Russia, even if it is unlikely to immediately alter Mr Putin’s decision-making. Indeed, yesterday’s meeting between the Russian and Ukraine Foreign Ministers confirmed that the Russians are not yet approaching negotiations seriously. But the unexpectedly strong set of economic sanctions will likely deter future adventurism by Russia and others.

Global impact

Although the sanctions are focused on the Russian economy, which is in freefall, there will be broader costs as a G20 economy is removed from parts of the global economy. Higher inflation and reduced economic activity across much of the global economy is inevitable for a time, as global energy and commodity flows are disrupted.

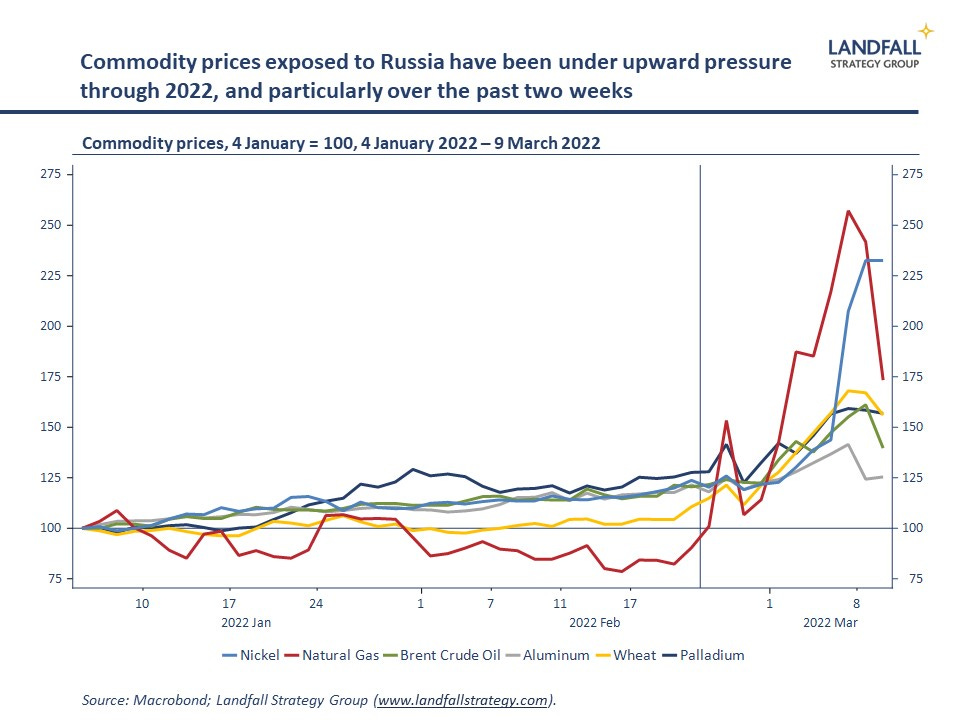

Many of these costs are due to the direct impact of the Russian invasion of Ukraine. For example, the production and distribution of commodities such as wheat and fertiliser have been hugely disrupted by the invasion, creating concerns about global food security. And oil and gas prices were moving sharply higher before sanctions on concerns about Russian supply.

These disruptions have been reinforced by sanctions: the ban on imports of Russian oil from the US and UK effectively reduces global supply; and participants in other commodity markets in which Russia has significant positions are more often unable/unwilling to transact with Russian counterparties. Russia has now threatened bans on exports of selected commodities, which could place further pressure on prices and global supply chains.

Concerns about the unwinding of the ‘great moderation’ due to these frictions on globalisation is a key reason why financial markets have sold off so heavily. The 1973 oil price shock that followed the Yom Kippur war in which oil prices increased by ~3x in six months, contributing to stagflation (and political instability) in many advanced economies, is an imperfect analogy. But these risks should be taken seriously. Inflation in the US (7.9%) and Eurozone (5.8%) is already at multi-decade highs, and growth in economic activity is slowing.

Beyond these substantial near-term costs, the invasion and the policy response will lead countries and firms to reduce economic exposure to countries with which political disputes may arise. This will accelerate the drive for strategic autonomy in supply chains as well as economic and financial decoupling.

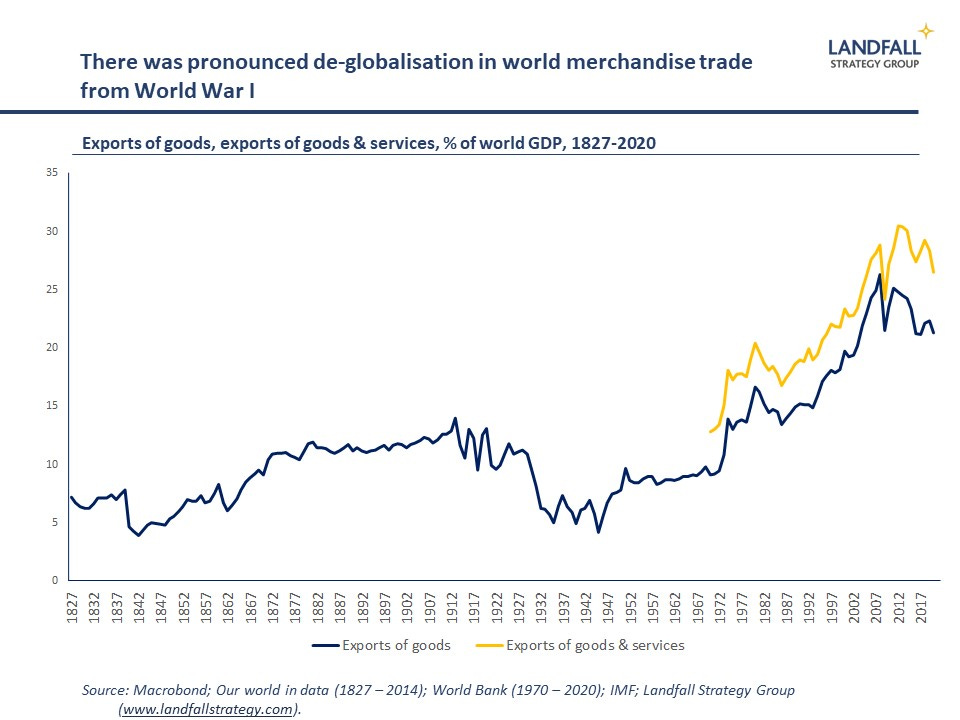

I don’t expect de-globalisation of the type seen after WWI. But there will be meaningful change in the pattern of global flows – much more shaped by political factors, and more regional in nature.

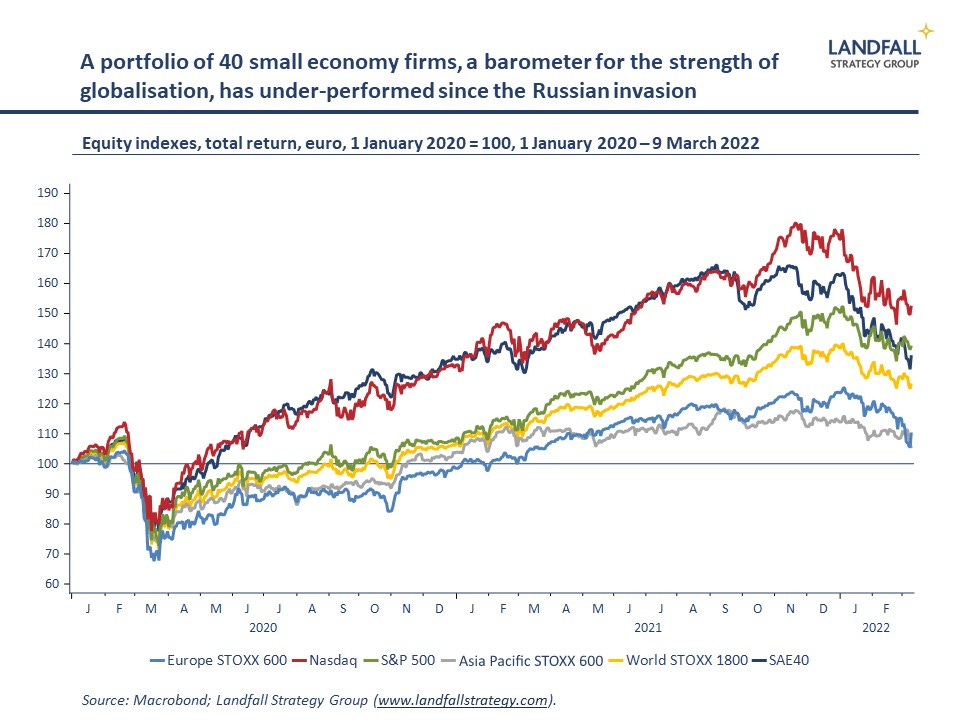

One indication of the current challenges to globalisation is the relative performance of small advanced economy markets; the canaries in the mine of the global economy. I have created a portfolio of 40 large, globally-exposed firms from a range of small economies, that provide a barometer of the strength of globalisation.

This small economy portfolio has performed strongly through Covid (and prior) but has under-performed over the past few months – and notably since the Russian invasion (down by ~10%). This weak recent performance of small economy firms suggests structural change in the global economy.

And several small economy markets that are traditionally highly sensitive to globalisation have also sold off. This is partly due to Russia-specific exposures, but also their broader exposure to the global economy. However, small advanced economies are resilient, and I am confident in their ability to adapt to new global realities.

What next?

Although economic war has been deliberately chosen because of the scale of Russia’s challenge to the rules-based global system, it will inevitably have far-reaching effects on the functioning of the global economy.

Whereas the physical conflict in Ukraine will eventually end, this economic war will be very long-lived – it has its own political logic. The formal sanctions will be in place for a long time – at a minimum, until the Russian invasion is reversed, and perhaps Mr Putin is gone. But even if/when sanctions are lifted, the drive for economic independence from Russia (notably in energy) will continue. And many companies will be reluctant to return rapidly to the Russian market due to stakeholder pressure.

More broadly, precedent has been set for the use of sweeping economic sanctions. The US, Europe, and others will increasingly use trade, investment, and technology instruments, in strategic competition with their rivals.

As regular readers will know, my baseline case is for a fragmented global economy to emerge along the fault-lines of competing political poles. These realities mean that companies will need to take geopolitics more seriously in their strategy and capital allocation processes.

And governments will need to manage national external exposures, invest in building strategic autonomy and supply chain resilience (military, energy, and so on), and manage the distributive consequences of disrupted global flows (higher energy, food prices). The highly open European economy is ground zero for these policy debates. The EU meetings hosted by President Macron in Versailles yesterday and today will provide a perspective on emerging policy thinking on these issues.

The brutal and misjudged Russian invasion of Ukraine has permanently changed the global economic and political context. Expect significant costs as global flows are disrupted, and also the emergence of a more explicitly political global economic system. There is no going back.

*David Skilling ((@dskilling) is director at economic advisory firm Landfall Strategy Group. You can subscribe to receive David Skilling’s notes by email here.

52 Comments

Although economic sanctions are not new, it is striking that a broad coalition of countries has imposed sweeping sanctions on a G20 economy (Russia was the 11th largest economy in the world in 2021) that has significant positions in exports of energy, food, and other key commodities.

An economy of this size is generally incapable of executing military actions in another country, currently covering the size of the UK. Furthermore, a supposedly united West seems incapable of mounting a counter offensive as they have executed in the past against Iraq etc, for instance.

The West is desperately in need of an economic model that better reflects the raw power of a super power nation such as Russia.

Furthermore, a supposedly united West seems incapable of mounting a counter offensive as they have executed in the past against Iraq etc, for instance.

Its amazing what a few thousand nuclear warheads can do to peacekeeping resolve.

The RS-28 Sarmat is particularly daunting.

Not sure what your point is. Just because Russia is developing a new missile system does not make the country great.

Russia has a few more nukes than the US according to this link

https://www.statista.com/statistics/264435/number-of-nuclear-warheads-w…

The world has enough nuclear weapons to destroy the world multiple times over. If there is a north hemisphere launch the resulting nuclear winter would be catastrophic. In that case it is pointless what the delivery system is. In that case Russia is in an arms race with itself (that is Putin's paranoia). Putin hasn't moved on from the old Soviet era thinking - the rest of the world has. One thing in the list of nuclear warheads I find interesting is that China only has 350 nukes.

I found it amusing in one of those movies where the White House was taken and the threat was to set off all the nukes in the US in their bunkers - only problem is that it would create a nuclear winter that would encompass the entire northern hemisphere.

... it does defy commonsense to have enough nuclear warheads to kill the world multiple times over ... once would suffice ... I mean , death is usually fatal the first time ... after that , who cares ... who's left to care ...

And , if we avoid that , we'll just muddle through ... as humanity always has ( to this point in time ) ... two steps forward ... one back ... two forward .... the Homo sapiens dance of life ...

What economic model do you suggest the West should adopt to reflect Russia as a “super power’?

I am not an economist, but the CIA employs another standard to value relative GDP output of most nations.

Given Russias economy is about to approximate an actual "two cow" scenario thanks to sanctions I can't bring myself to be too concerned who has the biggest pointy stick. We get it Vlad, everyone has pointy sticks and we could all end up with no eyes.

It is really an interesting juncture. We've swallowed globalisation hook, line and sinker, because who wouldn't want to buy T-shirts from Kmart for $6.

Time will tell but I get the feeling the small inflation we are seeing is the tip of the iceberg, and our reserve bank and government arent going to save us from it (although no doubt plenty of people will waggle fingers their way).

Imagine too what might pass if nautical drones endanger global shipping routes.

I wonder what the West would do if China invaded Taiwan? Imagine the inflation if we stopped buying cheap crap from there!

All companies that trade on the us stock exchanges to stop manufacturing goods in China.

End of war.

end of the Ukrainian war maybe, but potentially the beginning of another one somewhere else

We wouldn’t be able to build a can to piss into if we stop importing stuff from China. We’ve gone decades without making anything here except milk powder and base metals (an industry also hanging by on a thin piece of string).

Imagine too what might pass if nautical drones endanger global shipping routes.

or sea floor internet cables...

Indeed. The duplicitous central banks are only there to "save" us from prices falling.

Us or them?

It is a bit more than 'cheap t'shirts' however.....its an inflation busting bottomless pit of mobile labour and unfettered investment opportunity.

What's the difference between globalisation and capitalism?

Nothing...one eventually requires the other to continue forever growth.

Globalisation always needs Cronies on the political side to get things the way the Global Companies have to have them to make their top guys bucketloads of money. From personal witnessing of Uber forcing our government to change rules built up over a hundred years to suit their lossmaking business model. Our minister of transport at the time, Simon Bridges, capitulated to them suspiciously quickly. His political acumen has been exposed since, but a bit late for a lot of decent, honest, hardworking Kiwis.

NZ is actually in a fairly good position I reckon. Most of our electricity is renewable and unlikely to see any significant price pressures, and as for fuel use, we use way too much and could seriously cut back on that easily (people could walk to the dairy for example or get a job closer to home in our tight labour market). Personally I see high fuel prices as a good thing, it should cut down our dependence on it. I saw someone in the herald say it was utterly ridiculous or something like that; I thought it was ridiculous that they felt entitled to a non-renewable planet destroying substance imported from volatile countries for a fixed low price.

Just on the 'job closer to home' thing; there are vast parts of Auckland dominated by industrial (East Tamaki) and other parts housing (West Auckland). That's a logical outcome of zoning. It also means that some intra-regional travel is going to needed one way or the other. So while it's easy enough to say 'just work closer to home' it's not a reality that our cities really allow for by design.

As for 'high fuel prices being a good thing'; if you have the capital to lay out for an EV, then yea, you can just switch, but you would have done that by now already. For those who can't (and I'd wager a bunch of people throwing 40% of their income at Auckland mortgages are in there) then it just becomes a tax on going to work, that people in well-off central areas with public transit options can avoid, and that people forced to live far out due to affordability issues can't. Yes, I could make a 40kwh Leaf work for me. Can I save for one after paying for a mortgage and the fuel I need to get to work? Unfortunately not.

The reality is that people end up having to pay for fuel to work, play sport, shop or see family. It's cheaper to pay to drive to the supermarket than shop at the local dairy by walking

People just pay what the have to for fuel, group their trips, and pull back on other spending. That's not a great situation for the economy, though perhaps the reduced replacement of items that don't need replacing (from cars, to tv's to clothes) is probably better for the environment.

I reckon working from home is more effective at fuel savings across the economy

China can't win a global economic war. They can antagonize, but you don't become more prosperous by watching all the international employers shut up shop and leave.

All? I think you are under the misapprehension that there aren't enough countries pissed off at the current global economic hegemony, that they aren't already in the process of moving to a multipolar world.

'were able to support a rapid global economic recovery.'

This is an otherwise thoughtful article - thank you for that.

But since 2008 - and arguably much earlier - one dollar of GDP has required more thn one dollar of debt. That isn't a recovery; that's a bigger collection of forward bets.

https://surplusenergyeconomics.wordpress.com/

in order to confront Russia and resist the challenge to the rules-based global system

Please. Nobody who has been paying any attention to world affairs over the past 20 years can possibly believe that we have operated according to a "rules-based global system".

Remember "you're either with us or against us"? (https://www.bugunderglass.com/wp-content/uploads/2015/05/banksy-beetle.jpg)

The US-led west has never cared about rules or consensus, they act unilaterally in defiance of international law all the time, most notably in the middle east and Latin America (the latter of which the US apparently considers to be their back yard).

How can we possibly sit here and accuse anyone else of not playing fair?

Like Russia consider Ukraine to be in their backyard. Only difference is the US via the CIA got locals in the particular S American country to do the dirty work.

Ukraine actually is Russia's backyard. And Germany's. And France's. And the Turks'. And the Mongols'. Good grief. People queue up and take turns to invade and occupy the Ukraine. What is happening there is nothing new, and not at all surprising. It would be good if people could study a bit of history. Ukraine had already been occupied and invaded by the Huns and the Tartars probably, before the USA had even been invented. And now they pretend it is of utmost importance to the USA if Russia has one of it's turns in the Ukraine. The only people in USA who care about the Ukraine are all the politicians whose kids are taking payments from Ukraine gas companies, and the Industrial Military Complex people who can smell a lot of money to be made if their Crony Politician mates behave correctly.

Not sure what the point of your statement is? A thousand years ago we had horrible empires that dominated by military might, therefore it's ok for Russia to Invade Ukraine because it's people voted for the wrong party?

If Russia parked nukes, nazis and biolabs in Mexico and threatened to militarily take back Texas then would USA undertake a military operation too perhaps? They got quite antsy when missiles appeared in Cuba not so long ago.

The rules-based global system is the same as it ever was - rules for thee, not thy. Do as I say, not as I do!

Bingo.

The west continues to ignore that it's been pushing many countries away with its bully boy tactics. Eventually(now) there comes a group of pissed off competitors that group together become an equally large multipolar competitor.

"But at least for now, there is a political willingness to absorb economic costs – notably higher energy costs" The West, particularly Germany US and UK have now a good excuse for high energy costs which were making themselves quite apparent due to their energy policies before the Russo-Ukranian war. The energy costs have now just got worse. Putin has handed the Greens in the widest sense (No Green party in the US) a move away from fossil fuels.

"‘first world economic war’, with effects stretching from New Zealand and Singapore to the Middle East and Europe."

The pain is being spread a lot wider than a real war and cheaper per country. The biggest pain will rest on Russia and the Ukraine.

elsewhere in MSM in the last day

" He gave no details but Ukrainian Foreign Minister Dmytro Kuleba said Kyiv would not surrender or accept any ultimatums"

The war with its modern attendant mass destruction goes on.

Welcome to the return of risk in decision making, now how to cost it is the dilemma.

... Putin may be the prick the worldwide debt bubble desperately needed ... he might go down in history as saving us from ourselves ... or at least , saving us from our central bankers who've flooded the system with $ Trillions of debt ...

Time to pause ... to unwind ... to cash in our windfall gains on houses , NFT's , and Buttcoin ... if we can find a buyer ...

someone is listening to you GBH https://www.theguardian.com/environment/2022/mar/12/finland-opens-nuclear-power-plant-amid-concerns-of-europe-energy-war

If you want to test the water then don't put both feet in it, that was the mistake done by Nato.

Putin is a true nationalist & can do anything to save Russia, and inexperienced Zelensky was fooled and betrayed which lead to pain for 44 million Ukrainians.

This led to pain for the whole world by increasing the inflation pinch which can be avoided by good leaders and unfortunately kiwis are lead by labor who don't care about us after coming into power and keep loosening the financial policy and running away to address any crisis by saying it is not in our mandate and cannot be controlled by us.

The "Rules Based International Order" holds that you can invade or kill anyone you like, but only if you're waving the Stars and Stripes. For anyone else it's an unforgivable crime.

War hysteria is at fever pitch right now, but once time passes and western citizens start to bear costs, Ukraine will be dropped quicker than a hot potato.

Without the misstep by Vladimir Putin we might never have had the opportunity to turn the screws on him. He did most of the work himself when he made massive strategic error by blundering right into a trap.

You need to read some Sun Tzu.

Meanwhile back in little old New Zealand life goes on:

At an imposing edifice a shiny headed man walks up to the front door and rings the bell. (Sound of door opening)

Max K: Hi Luxy.

Luxy: Hi Max is dad in? He invited me round. He said he had thought up a strategic plan to win the 2023 election.

Max: Yeah, follow me …..he’s in his office. We’ve just had a business meeting with the Chow bros. You know them? You would have heard….

Luxy: The brothel owners?

Max: Ah hah, that’s history Luxy. They’ve redeemed themselves. (Knocks on John K’s office door).

JK: Come in. (Luxy and Max enter). Take a seat Luxy.

Luxy: Hi John. What’s up?

JK: I’ve got a nice little earner. It will see New Zealand’s indebtedness cancelled out with a few strokes of the pen and you’ll sail in at the next election. As you know I’ve got global contacts and I’ve called in a few favours from Putin’s Russian oligarchs. They’re desperate to park their dough safely to avoid the sanctions so I’ve set up a few accounts at the local banks who, of course, are all onboard. And I had to act quickly. So it’s good to go…..there’s billions come in already.

But we won’t say anything publicly until the right moment. Except, in the meantime, Max and me and the Chows are going to dip into the trough for a negligible amount, say a billion, to get our new housing project off the ground…you could look upon it as my commission.

Luxy: I’m speechless master John... sorry, I meant John …..you’re a financial genius.

JK: The oligarchs aren’t gonna take any interest on their dough so the banks are getting it interest-free. It’s a win-win. (He taps the side of his nose with his forefinger.)

Luxy: Genius JK, pure genius.

JK: But Luxy, the point is, we’re gonna make the public think it’s your idea. Here’s what we’ll do……

(The conversation reduces to hushed tones, heads and shoulders bend closer to each other, and Luxy’s head shines brighter and brighter with delight.)

.

I hope you're wrong, but your satire is probably closer to the truth than many realize. Is it any coincidence that JK and Max only recently were in the news about their new housing venture with the Chows and then Luxon's "state of the nation" speech was all about resetting the tax system in property developers and landlords favor...I fear we (that is NZ) may be closer to an oligarchy than many realize.

Economic war? I see no economic war, it's a "special economic operation."

John Robb has long championed the notion of a swarm for military purposes, drones etc. But here we have an Economic Sanctions Swarm, his tweet reads:

"The network swarm in action.

Open source organization.

Maximalist goals.

No way to mitigate it, modify it, or turn it off.

+ ignores the reality of nuclear weapons, global economic damage, shortages (for those unable to afford high energy/food costs inbound), etc."

Effectively no control over this, as it is self- organizing......

... apparently , the world's total GDP is around $US 94 Trillion ...

Russia has a GDP of $US 1.4 Trillion ... just marginally ahead of our next door neighbour , Australia ... and miles behind tiny tech & entertainment hotspot , South Korea ...

... so .. if Russia at 1.5 % of the worlds total GDP is sanctioned out of existence , who gives a toss ... they're just not that important in the grand scheme of things ... we can survive & thrive without Putin ... 1.5 % ! ... paaaah ....

Pretty much my view. This is an error so grand it will take a generation or two after the war has finished and President Putin has been moved along for Russia to build new trading relationships and diplomatic bridges.

As long as he isn’t nuts enough to press the big red button!

I am not an economist but I wonder, if the heat really turns up on the international situation and global trade starts to unravel, then what percentage of the world's GDP would Russia have? How much bigger would the South Korean economy be if no one was discretionary funds to spend of buying the latest K pop merchandise and Samsung phones?

On the Beach - just bought the dream car today... if the movie gets it right - it could be free tomorrow morning. Seriously scary thought.

Often think back on the Cuban Missile Crisis, I was too young to know what was going on, but I do wonder whether my folks had the same sinking feeling then. I suppose they did.

A conventional war and an economic war is ongoing. A trade war can easily turn into an economic warfare, between US and China.

The US has warned China that helping Russia to avoid sanctions has consequences.

Xi is saddened by the war in Ukraine. China Foreign Ministry supports Russia, and even mentions Tucker Carlson, like Russian media.

Arab countries rely on Ukraine and Russian, for wheat.

High fuel prices are wreaking havoc on businesses. Pain at the pump.

What can the Yanks do? Their Crony Capitalists are up to their necks in China. Any US politician that ruins those deals will lose a lot of financial support. Except from the people who stand to gain from production being returned to the US. The Deplorables, I think they are called.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.