This Top 5 comes from interest.co.nz's Gareth Vaughan.

As always, we welcome your additions in the comments below or via email to david.chaston@interest.co.nz. And if you're interested in contributing the occasional Top 5 yourself, contact gareth.vaughan@interest.co.nz.

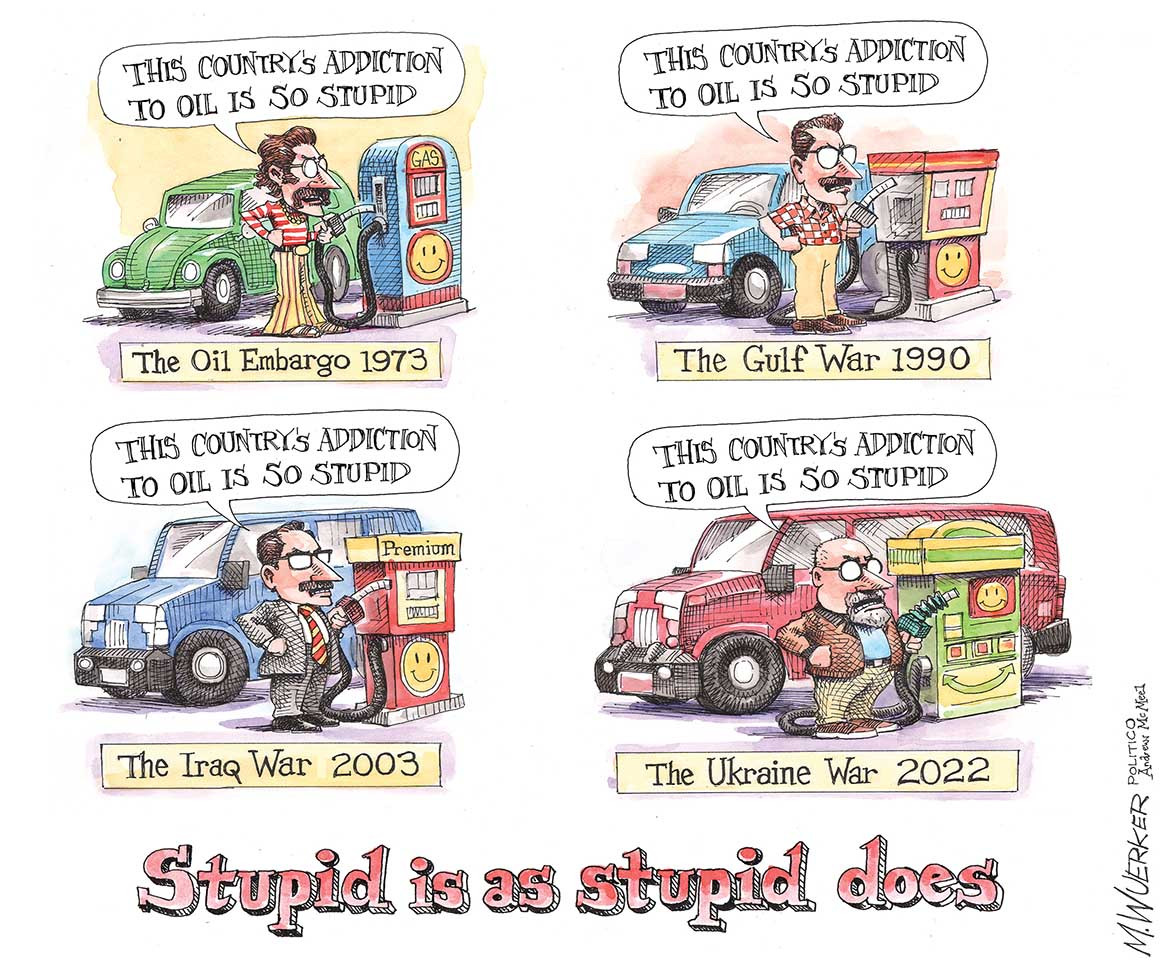

Cartoon: Matt Wuerker, Politico.

1) How bitcoin can strengthen the state.

Could it be governments, rather than individuals, who gain autonomy on the blockchain? This is a fascinating question posed by Samuel McIlhagga in an intriguing article for Palladium. Such a prospect won't go down well with libertarian cryptocurrency lovers. But it is a really good question.

McIlhagga looks at the embracing of bitcoin by El Salvador and its President Nayib Bukele, cryptocurrency developments in Russia, and whether cryptocurrency adoption could be a way for the Taliban to gain sovereignty for Afghanistan from the international financial system.

The mass popularity of Bukele’s policies among the Salvadoran population does not seem to come from a commitment to libertarian principles. Instead, Bitcoin’s popularity is found in its promise of independence from punitive developmental loans from the IMF and the U.S. Another benefit is the ability to retain value, lost through currency exchange commissions and banking charges, from remittance income flows from a migrant labor force that sends money back from North America. The success of Bitcoin and its adoption by nation-states opposed to the current global-order of debt financing signals that it might be governments, rather than individuals, that gain autonomy on the blockchain. El Salvador’s motivations and its success in achieving them have moved the logic of Bitcoin a long way from the decentralized vision set out by Satoshi Nakamoto in 2008.

Many operating within the sphere of crypto-anarchism, the scene that Bitcoin grew out of, are skeptical of Bukele’s rhetoric. They argue against the case for El Salvador as a libertarian technologically-accelerated paradise. I spoke with Pavol Luptak, a member of the Institute of Cryptoanarchy and co-founder of Paralelni Polis, to get a sense of the response in these circles. The group describes itself as “an island of liberty, technology, decentralization, and cryptocurrencies,” and is based in Slovakia. “I am afraid of a central element contained within governments, especially in the case of decentralized cryptocurrencies,” Luptak told me. “This is the case in El Salvador—its government is buying Bitcoin and their citizens do not own private keys in their government-approved apps (which are exclusively owned by the state). Another problem is that El Salvador is trying to enforce Bitcoin involuntarily.”

Others voiced similar concerns. “Bitcoin is being adopted by El Salvador as a fiat currency,” Rachel-Rose O’Leary, a coder at Dark Renaissance Technologies and lead writer for Coindesk between 2017 and 2018, told me. “The government is the sole custodian of the wallet keys. That means that Bukele has direct access to the entire society’s wealth. The history of cryptocurrency teaches that self-custody is the only way to ensure that your funds are protected. Having the entire society’s wealth in a single wallet that the government has access to creates a huge systemic risk for the Salvadoran people.” O’Leary believed that these problems are being obscured by the hype of crypto-advocates themselves. “Bitcoiners today are too drunk off a long bull market to realize that El Salvador is not evidence of [a decentralization] process: it’s simply the fiat paradigm taking on Bitcoin form.”

Meanwhile in New Zealand, we await a select committee report to parliament following an inquiry into cryptocurrency last year.

2) Rhino bonds.

There are some pretty interesting developments going on these days in the world of bonds, with much of the focus in the areas of sustainability and climate. And here's another one, the world's first rhino bond.

It comes from the World Bank, International Bank for Reconstruction and Development or IBRD. It's a wildlife conservation bond in support of South Africa’s efforts to conserve endangered species.

Also known as the “Rhino Bond,” this five-year $150 million Sustainable Development Bond includes a potential performance payment from the Global Environment Facility (GEF), which will contribute to protecting and increasing black rhino populations in two protected areas in South Africa, the Addo Elephant National Park (AENP) and the Great Fish River Nature Reserve (GFRNR). AENP is managed by the South African National Parks (SANParks) and GFRNR is managed by Eastern Cape Parks and Tourism Agency (ECPTA).

The WCB [Wildlife Conservation Bond] is a first-of-its-kind, outcome-based, financial instrument that channels investments to achieve conservation outcomes – measured in this case by an increase in black rhino populations. Rhinos are considered an umbrella species that play a crucial role in shaping entire ecosystems on which countless other species depend. Through the WCB, investors are supporting the financing of activities to protect and grow a critically endangered species with clear conservation targets, contributing directly to biodiversity, and bringing jobs to local communities through the creation of conservation-related employment in a rural and underserved region of South Africa.

Investors in the bond won't receive coupon payments on the bond. Rather, the issuer will make conservation investment payments to finance rhino conservation activities at the two parks.

If successful, as measured by the rhino growth rate independently calculated by Conservation Alpha and verified by the Zoological Society of London, investors will receive a success payment at maturity, paid by the IBRD with funds provided by a performance-based grant from the GEF, in addition to principal redemption of the bond. This represents a new approach in conservation financing that passes project risks to capital market investors and allows donors to pay for conservation outcomes. Credit Suisse was the sole structurer and joint bookrunner with Citibank.

As Bloomberg reports, there are five rhino species with most rhinos in South Africa and almost all of them white rhino.

Black rhino numbers have dropped to about 2,600 from 65,000 in 1970, and may once have been as high as 850,000, according to documentation from the World Bank. The animals are found in three other African countries, and can weigh as much as 1.4 tons -- much smaller than the white rhino.

Instead of paying a coupon, the issuer will make contributions toward conserving the animals and the buyers of the bond will receive a payment from the Global Environment Facility based on preset targets for population growth. To receive the maximum payment the rhino population will need to increase by more than 4% per annum.

The bond was sold at 94.8% of its “nominal aggregate amount” and will pay out a maximum success payment of $13.8 million, the World Bank said. Conservation Alpha has been tasked with determining the success of the program and its payments. The verification agent is the Zoological Society of London.

3) A tour of London with a difference.

Many New Zealanders who've visited London, or lived in London, will have done some form of sight seeing tour. I did. And I remember it well. That's because one of my friends was the guide and I was the butt of his steady stream of jokes.

But this month, following Russia's invasion of Ukraine, journalist and author Oliver Bullough brought us a London tour with a difference. Appearing on a large screen on the back of a small truck driving around the city, Bullough's tour is very timely given the UK government is finally sanctioning Russian oligarchs such as Chelsea Football Club owner Roman Abramovich.

I'm going to show you how Putin's allies spent billions of pounds of stolen money in London without getting caught, and how for years successive British governments have let them do it. Let's take a tour of London with a difference.

My name is Oliver Bullough and I've spent years investigating how this city has become the money laundering capital of the world.

You can watch Bullough's tour below.

Buckle up. Come on a tour of London with a difference and find out how Putin's oligarchs hide and spend their money in the capital. Money-laundering expert @OliverBullough is your guide. 💰 pic.twitter.com/0nC1LJgWOe

— Led By Donkeys (@ByDonkeys) March 4, 2022

4) Could a transition to a circular economy create investment opportunities?

Many readers will have heard of the concept of a circular economy, where there's a focus on eliminating waste and continually using resources. One of its best known proponents is English economist Kate Raworth, author of Doughnut Economics, Seven Ways to Think Like a 21st-century Economist.

You know an idea's getting traction when it makes the agenda at an investment conference run by a major investment bank. To this point a report from Credit Suisse's recent Asian Investment Conference in Hong Kong landed in my email inbox on Friday. And what was included in it? A note entitled Going circular – how will the transition to a circular economy create investment opportunities?

Below is the summary.

Circular economy presents an opportunity for impactful investment returns, economically, environmentally, and socially: Combustion and disintegration of plastic have clear negative impacts on human health and the environment. Currently, even the best waste management systems cost a lot, and do not always work well when faced with current plastic packaging designs. It is clear by now that we cannot reduce or recycle our way out of the problem. Fundamentally, waste should instead be seen as a commodity. Circular economy of plastics is a missed opportunity, where investors should be able to find appropriate solutions/substitutions that deliver profits in an environmentally friendly manner. From a social perspective, this should help ~20mn people who do waste picking in the informal economy secure better jobs.

Proportion of plastics from fossil fuel to alternatives is still 98% to 2%, more investment in both downstream and upstream solutions is needed: It was shown that we can reduce plastics going into the ocean by 80% in 20 years but only if both upstream and downstream solutions are adopted. Circulate Capital invests in recycling supply chains in South East Asia and partners with leading corporations like Unilever, Coca Cola and P&G to divert waste from the environment. The firm invested in Srichakra Polyplast in India, which brought in technology from Europe to enable bottle-to-bottle PET recycling, one of the first in the country. In upstream, innovative materials like biopolymers made of bio-based instead of virgin feedstock can reduce carbon footprint and are more likely compostable at end of life. Circulate Capital invested in Phase Change Solutions, a manufacturer of bio-based phase change materials that stabilise temperatures across different applications, such as in cold chain logistics. Essentially this is a replacement of styrofoam as an insulation product, with a longer usable time and is compostable at end of life. Main biopolymers include polylactic acid (PLA) made from corn/starch, and polyhydroxyalkanoates (PHA) made from lipids/fats/cooking oil.

Scale and cost are the main bottlenecks: The circular economy in the fast fashion supply chain is behind the curve because of technical challenges and the lower “visibility” of the problem from a consumer’s point of view. In the apparel space, Circulate Capital invested in Circ, which can depolymerize the polyester but leave the cotton structure intact, i.e. returning clothes to their raw materials. For concrete, there are not a lot of great innovations ready for capital. Concrete is difficult to transport and to break it up, therefore design for end of life becomes more important. On repair, since repair cost is generally high compared to upfront price, it is less economical and can often be less convenient. While there are different pilot circular economy projects, overall, targeted policy interventions are required to boost scale and lower costs.

5) Leave Clarke Gayford alone.

Of all the crazy things said and done in New Zealand over the past couple of years, and there's been a lot of both, the ongoing conspiracy theories about the Prime Minister's fiancé Clarke Gayford rates right up there.

In a Substack article Dylan Reeve points out there's a Facebook group dedicated to the apparent mystery of Gayford’s location with nearly 35,000 members. There is all sorts of speculation and numerous theories thrown around. Here's Reeve with one of the many bats**t crazy ones.

As police clashed with protesters and arsonists outside parliament at the beginning of the month, there were predictable claims that the event was timed to provide a smokescreen for Gayford’s court appearance in Whangarei the same day. One viral first-person Facebook story even alleges that a police officer in a Wellington bar the night before the protest raid told the author that Gayford was “up on his drug charges up north,” adding, in a too-good-to-be-true way, “why do you think we have to wait until Wednesday to go in, it’s all about distraction mate.”

Now I'm old enough to remember some pretty ugly stuff being said about Helen Clark and her husband Peter Davis. And some bats**t theories on why John Key had really quit politics in 2016, although Bronagh Key was mercifully left out of those.

New Zealand, especially Wellington, remains a village. If Gayford was actually in trouble with the law, do people really think it could be kept secret? I mean there'd be plenty of opposition MPs, and many in the media, just itching to exposure something like that. Time for those spreading this nonsense to grow up.

Startling data:

— Ben Collins (@oneunderscore__) March 20, 2022

26 percent of unvaccinated people in Canada believe Russia invading Ukraine is justified.

2 percent of vaccinated people in Canada believe the same.

More evidence antivaxx communities are evolving into general pro-authoritarian spaces.https://t.co/p3QxkiLjPS pic.twitter.com/83tkkaWWYc

34 Comments

What an odd way to research in Canada, by way of covid vaccination(s) being the demarcation line. But if nothing else, it does at least illustrate how odd the world and society can be nowadays.

The odd thing is that anybody would take the "research" at face value.

It's a very insightful way to carry out the research. The anti-vax narrative is mainly informed by conspiracy theorist / unscientific nonsense propagated through social media. During lockdown in the UK my sister went from being a sensible ordinary common sense human being to genuinely believing that doctors in the UK were injecting people with a product to sterilise them because Bill Gates had decided we were overpopulated. When she got covid she refused to get tested because she didn't believe Covid existed. Practically overnight she went from being an executive level HR manager in a multinational firm to a "an expert researcher on epidemiology, virus, vaccines, medical ethics, etc..." She had previously vaccinated all her children and had good relationships with her family. She ended up being cut off from most of her friends and family and disbelieving absolutely anything that did not align with her conspiracy theory views. We even arranged for her to talk to some doctor friends but she refused because she thought they would lie to her as they were in on the conspiracy. This was done purely after "going down the rabbit hole" of conspiracy theory social media during time of high personal stress for her. How this happens is well documented and explained in several easy access documentaries. This same process can be deployed politically to suck in vulnerable people who are unprepared/unaware of how the process works.

What I read here is our health institutions don't acknowledge how stress might affect one's decision making. If they do, they don't have the resources to provide support.

Of course the constant fear pushed by government and media isn't going to help anyone.

Funny you should recount that situation. Except it would be funny if it wasn’t true. Likewise I have a sister who four years ago thought our PM was the great redeemer, Mother Teresa personified. But now unfortunately the same as your experience and exactly that Bill Gates scenario. She has seen a photo of Bill & our PM together, and there’s your proof. What is worse is the vilification now directed at our PM, a complete 180. Now I am hardly a fan of our PM but the tirade would have made an 17th century judge in Salem sound like Miss Piggy. Hard to know what to do about it actually, harbouring that sort of baggage is simply self destructive.

I interpret the results of the survey as indicating that it is the vaxxed that support authoritarianism, at least in Canada anyway.

I think it would have helped these people if the government's behaviour didn't seem to back it up; e.g. vaccine passport legislation passed under urgency a week after we first learnt of it, with literally no submissions from the public or judicial review, after being told earlier that we would not have it. Before COVID I didn't even realise just how much power the DG of Health had, and I was outraged when I found out. People have felt backed into a corner, and many reacted accordingly. To claim that anti-vaccination people are pro-authoritarianism is some supreme double-think.

#5, shows precisely why media pundits such as yourself are only trusted by those too lazy, willfully ignorant or blinded to question. Publishing the conclusion of justification is not supported by results as far as I can see. More like a large number of incensed meddlers that insist that something must be seen to be done as opposed to those who may just see those options as largely ineffective in preventing the carnage, as they have to date.

As for the Gayford saga, I see the old stfu approach rules over material input. The solution seems simple but still, no appearance. One sighting in public would make it dissolve.

spinach,

"Publishing the conclusion of justification is not supported by results as far as I can see." Incomprehensible and badly written.

There does seem to be a strong correlation between not being able to construct coherent sentences and beliefs in conspiracies.

Pleez kwote yaw sauce.

One sighting, in shorts and jandals to make sure there's no ankle bracelet.

I'm having a difficult time trying to decipher this.

It reads like he had a difficult time trying to type it too.

And did you see the clip of Mr Luxon being asked about rent.

Looks like the human race might be about to enter Mad Max days, though Mad Vlad has a certain ring to it.

Just think, everything we've been doing, has been leading us to this.

It's a very, very, very weird world.

“Such a prospect won't go down well with libertarian cryptocurrency lovers.”

I think you’ll find that widespread state and institutional adoption of Bitcoin is exactly what most libertarian Bitcoin advocates want. State and institutional adoption just strengthens the network and aids widespread use of Bitcoin.

What if they own it all what's the point then

"Time for those spreading this nonsense to grow up."

Yet you've reprinted it here, effectively giving it more energy and included more nonsense.

You'd think there would be politicians itching to use this in their mudslinging too but not a cooee.

https://www.nzherald.co.nz/nz/political-figure-identified-in-former-ric…

I think this is where the Clarke Gayford story has originated

https://www.nzherald.co.nz/nz/operation-trojan-shield-well-known-kiwi-e…

This and other Clarke Gayford stories have been around for a few years. Some people can’t seem to abide a woman prime minister, especially if they are Labour. I’m also noticing that comments on interest.co articles are becoming increasingly unhinged - lots of rants about how totalitarian and/ or communist this government is, hating on Jacinda Arden etc etc. I’m losing interest.

Yup agree..switched off a few months ago and left the tin hats to it..

Nailed it. Pseudoscience has been left to propagate freely on here, and some fairly extreme right wing views/conspiracy theories have taken the opportunity to jump right in behind. I have come to the conclusion that the editor(s) don't really care as it generates free content below the line, but it's an abrogation of their societal and journalistic responsibilities. Five years ago the public forum was required reading, now it's just like the NBR comments sections on steroids.

I wish this site would stick to finance. Keith Woodford alone would be worth subscribing for. The politics is well covered elsewhere.

Russia announces that their objective was to take the Donbass Region of Ukraine. A success.

In other words, there is no longer any need to fight.

A withdrawal from Kyiv and the rest of Ukraine- let's see.

I thought the Donblass was always the aim. The action around Kiev seems to be just enough to draw focus of the military and the media. The Donblas makes sense.

But but. While it's attractive to become another armchair general, and make these assumptions, Mr Putin has not rung me to confirm his plan.

As for the Donblas, the Ukrainians claim it as their own. And have been shelling it since 2014. (14,000 dead in that time - both sides.) So the Ukrainians have been shelling their "own Citizens". It's well established but not mentioned in the media these last few weeks.

Nope, Donblas was never the aim. The aim was regime change and installation of a puppet government sympathetic to Kremlin. The emphasis on this new narrative is Putin and his regime trying to save face to maintain the perception of infallibility at home.

You sound very certain. Where do you get your information from?

I'm sure they said Ukraine was the first domino in a game of global world domination?

I've got nothing against Clarke, but what the heck has he got against our fish?!

We have AML laws which can mean 30 minutes of paperwork to bank an Aussie cheque - yet we have State sanctioned money laundering for billions.

It’s a bloody joke - the banks are the launderers but they run the line that it’s joe public.

It’s a bit like Uber isn’t it. Sidestep all the regulations and all of a sudden it’s cheaper and quicker.

Said facebook page lead me here. Its a tongue in cheek type of thing, asking people to entertain with their posts. It started a couple of months ago yet said dude still hasnt fronted up. Odd. And why oh why has Interest shown interest. I really cannot fathom that. I thought it was all just a joke. Two months later no real photo opportunities posted what is one to think?

Fascinating to me is the growing numbers on that page, the real anger and frustration with this government and its leader. Many who say they voted for Jacinda, and never would again.

I have never been a facebook fan, but I find it quite cathartic hearing that other individuals have an opinion different to the 'five million'

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.