By David Skilling*

Vladimir Putin once said that whoever controlled artificial intelligence would control the world. Maybe so, but that won’t be Russia. John McCain’s description of Russia is closer to the mark: ‘It is a gas station run by a mafia that is masquerading as a country’. The direct global economic impact of Russia’s invasion of Ukraine is largely transmitted through energy and other commodities.

Technology is commonly thought to dominate the commanding heights of the global economy, such as the tech giants of the US and China (Amazon, Google, Alibaba, and many others). And over the past two years, innovation on vaccines has been central to economic and health outcomes. More broadly, some have argued we are in an intangibles economy where assets like brands, ideas, and relationships matter more than physical capital.

Technology indexes have soared over the past few decades, and economies that have strong technology capabilities have performed well – from Silicon Valley to Israel and Taiwan. And through Covid, investment in digital and other technologies has accelerated in many advanced economies. It is plausible that this stepped up investment will support a productivity renaissance.

National economic policy is often focused on developing an edge in technology, from the US and China to small economies such as Singapore and the Netherlands. And China, the EU, and the US, are increasingly focused on strengthening strategic autonomy in leading technology sectors.

The tangible economy

But the experience of the past two years, reinforced by the impact of Russia’s invasion of Ukraine, shows that the world has not dematerialised. Physical flows of goods and the supporting supply chains matter. High technology activities cannot function if the supporting physical supply chains don’t function: for example, this week Dutch semiconductor tech firm ASML reported major supply chain constraints on its production.

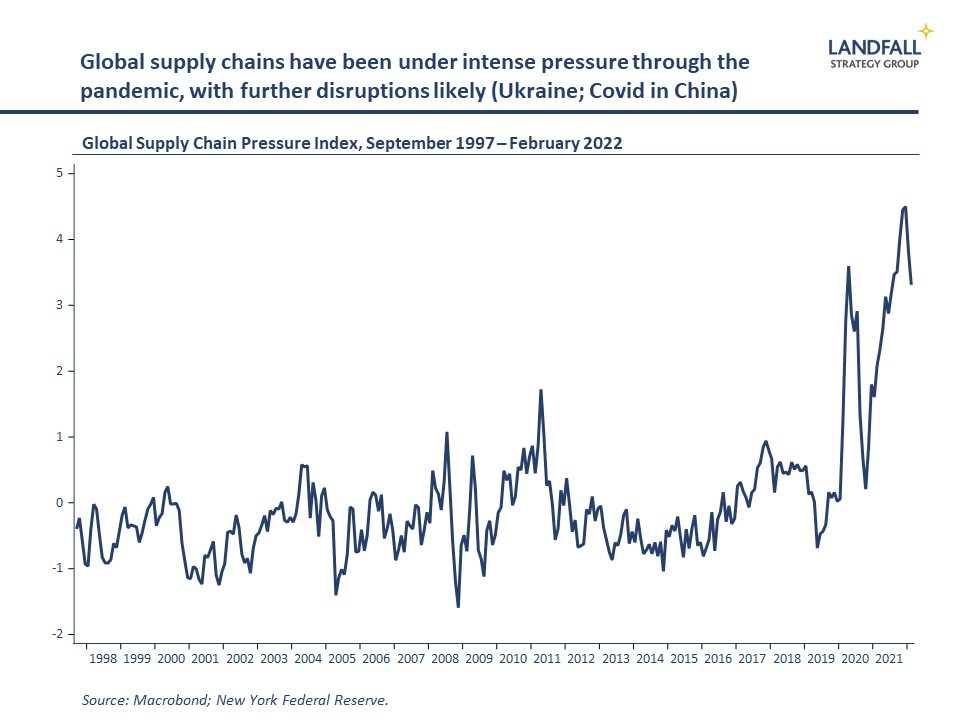

The strong global economic recovery through Covid, coupled with the rotation of consumer spending towards goods (and away from locally produced services), led to strong merchandise trade growth – and pressures on global supply chains. Shipping costs surged and there were global delays in shipping goods. And now the Covid lockdowns in China are causing further disruptions to global supply chains.

This is leading firms and countries to think much harder about supply chain resilience, from building inventories and diversifying suppliers to re/near-shoring activity.

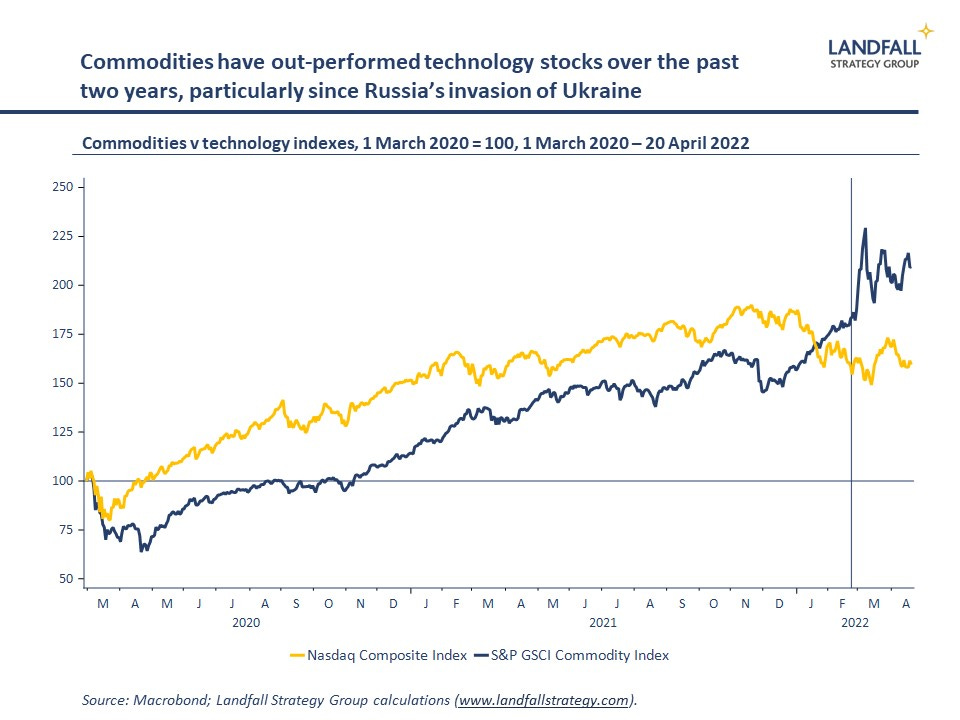

Countries and firms are also exposed to the supply and prices of energy, food, and other commodities. Global commodity prices, from energy and agriculture to industrial metals, have risen much faster than the tech-heavy Nasdaq index over the past two years – and particularly since the Russian invasion of Ukraine.

Oil and gas prices have increased markedly. Although advanced economies are much less energy intensive than during the oil price shocks of the 1970s, this will still cause economic pain to firms and households – as the IMF’s World Economic Outlook noted this week. Those countries that have energy independence will have an advantage; the US is advantaged relative to Europe, for example, because of its domestic energy resources.

Over time, renewable energy and green hydrogen offer the potential for greater resilience against these shocks. Many countries are ramping up plans for renewable energy production over the next decade and beyond, partly to reduce external exposures (e.g. to Russian gas) as well as to meet net zero commitments.

Geopolitics will be reshaped by these new networks of energy flows, with the centrality of oil exporters reducing as countries build out (or import) renewable energy. In turn, however, renewable energy will require access to industrial metals such as copper and lithium. Few advanced economies have direct reserves of these metals; the need to source these inputs creates some new exposures (and the prices of these industrial metals have increased sharply).

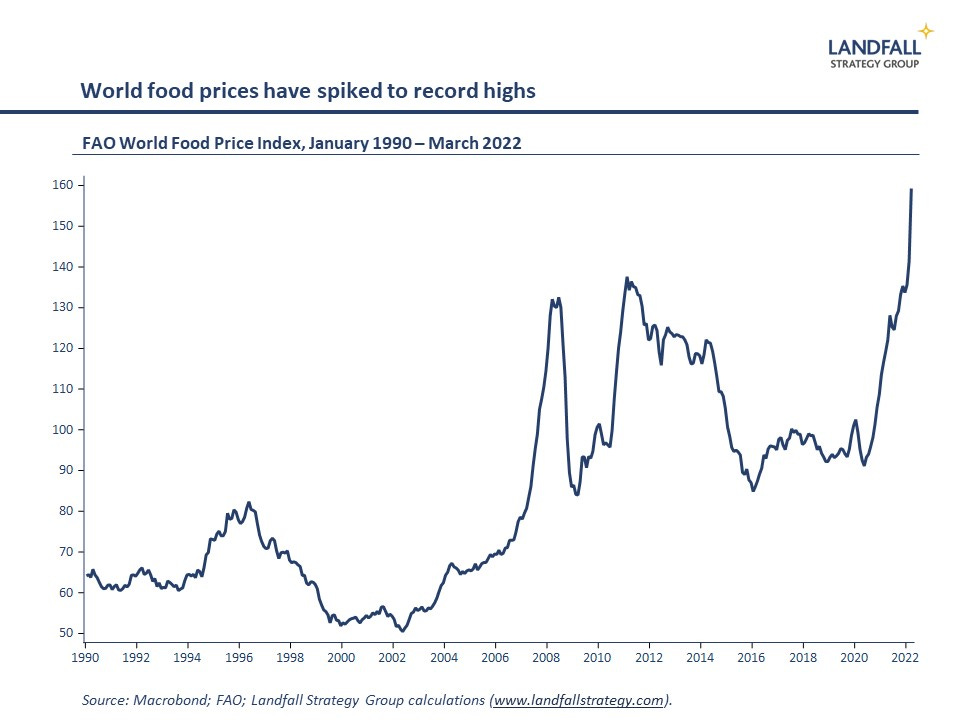

Food security has also become a big issue. Global food prices are at record highs, and are likely to sit there for some time. The lost supply of wheat and other agricultural commodities from Ukraine and Russia is already causing major disruptions, particularly in exposed markets such as Lebanon and Egypt.

High food prices are a common cause of political instability in emerging markets, as seen in Sri Lanka and elsewhere over the past few weeks. Looking forward, climate change will likely cause additional pressure on food supply: droughts/floods, reducing yields, and so on.

These higher food and energy prices have made large contributions to the surge in inflation around the world, leading to the need for higher interest rates.

The ability to secure reliable supplies of energy, food, and commodities, as well as access to well-functioning supply chains, will be an important aspect of national resilience and economic performance. Global markets have worked well for some time in supporting the efficient flows of goods and commodities. But a combination of geopolitical tensions, a fragmenting global economy, the transition to net zero, as well as commercial incentives around production, are creating structural pressures.

Let’s get physical

Those countries and firms that can combine technology/innovation leadership as well as security of supply of critical flows of commodities and goods will out-perform. And particularly when these attributes are coupled with strong institutions, a structural driver of national success.

The global economy may have important weightless properties – with more economic value coming from intangibles – but weighty matters of physical flows and commodities remain vital. Geography is not dead.

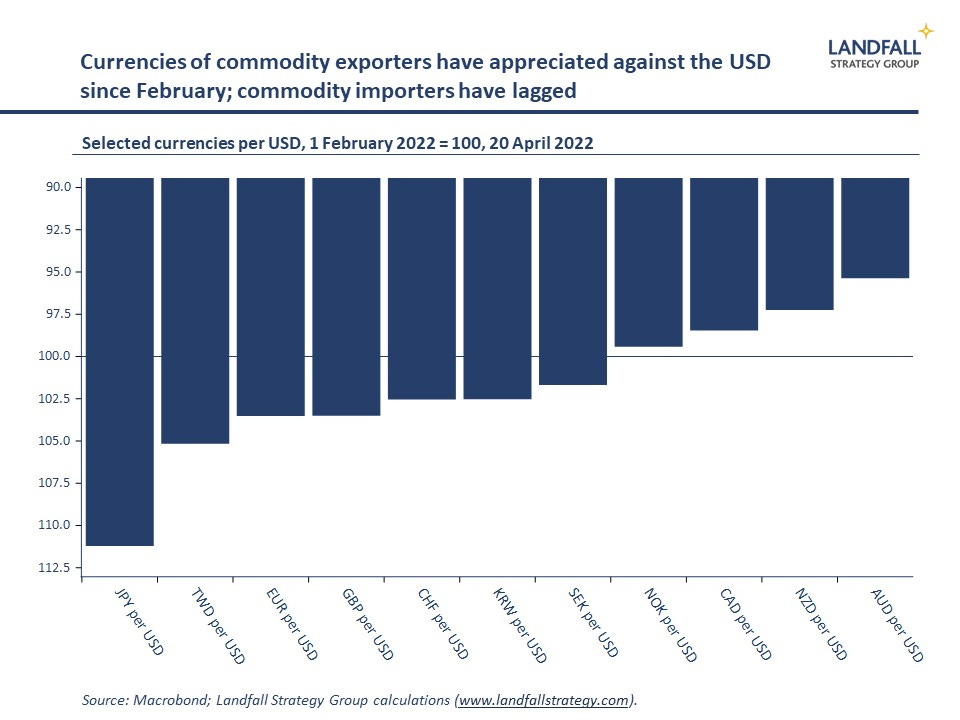

Indeed, being a commodity exporter is a good place to be at the moment. Commodity currencies (AUD, NZD, NOK, CAD) have out-performed this year against the flying USD; commodity importing currencies have lagged (JPY, KRW, TWD, euro). And from Norway to Australia (and unfortunately Russia), merchandise trade surpluses in commodity exporting countries have rocketed up over the past several months.

In an optimistic scenario, post-war Ukraine could leverage its dominant global position in a range of critical commodities, together with its technological capabilities, European integration, and strengthened institutions, to converge towards European per capita incomes.

But although commodities are not a sunset industry, countries and firms cannot rely on raw commodities alone. Massive disruption is occurring: renewable energy will displace oil and gas over time, and new technologies (vertical farming, plant-based foods, and precision fermentation) will disrupt food production. Innovation is also likely to alter demand for industrial metals (for example, around batteries). Commodity exporters should not be complacent. Firms and countries need to be active around the intersection of technology and commodities.

As is often the case, small advanced economies are leading on this because of their acute external exposures. Singapore, for example, is investing heavily in food innovation to bolster self-sufficiency (including regulatory approval for lab-grown foods), is exploring options for nuclear energy as well as importing solar energy from Australia, is a world leader in water (desalination, recycled water), and is working to strengthen its supply chains.

Countries have not paid full attention to their exposures to the physical world over the past few decades, partly because of the relatively benign global environment. But this is changing. Even leading advanced economies will need to ensure resilient supply chains, security of supply for key commodities, and invest in innovation around food, water, and energy, in order to secure a position on the commanding heights.

*David Skilling ((@dskilling) is director at economic advisory firm Landfall Strategy Group. You can subscribe to receive David Skilling’s notes by email here.

27 Comments

New Zealand should move to being self contained in energy. Probably that's electricity. So good local co-operatives for generation and sharing combined with a national grid that can cope with wider needs.

Unfortunately our civil servants and politicians can't think that long term or for the functional organisation.

we should move into wind and solar with traditional as an emergency standby.

I remember being taught in economics about the think big failure and the Clyde damn that we would never need. I wonder where we would be now without it?

KH,

Let me remind you of some possibly inconvenient facts. The transition from an energy supply dominated by fossil fuels to one based largely on renewables cannot be achieved except by using the same fossil fuels. Consider for a second the materials that go into wind turbines and solar arrays. You can look up these figures yourself, but right now and for the foreseeable future, these cannot be mined and manufactured without using fossil fuels. The second point to remember is that the EROI of these fuels has been declining for decades and will continue to do so. The EROI of wind and solar has improved substantially but is unlikely ever to meet that of fossil fuels.

The transition will be made, but what few are prepared to acknowledge are the effects on society. In short, it is likely that we will in time, have to accept that our current and extraordinarily wasteful standard of living must and will fall. The global economy must and will become more circular, but the transition will not be painless.

Strongly agree with your final point, but your EROI data is out of date (or is from one of the fossil fuel / nuclear sponsored studies). Hydro and wind basically kick ass now on EROI - PV solar is still lagging. A decent discussion of methodological issues at this link.

Mostly agee linklater. The point is we can act now to organise - or - - we can freeze like a possum in the headlights.

There is less pain in organising.

The West thought to exploit the softness and indecision of Gorbachev and alter and weaken Russia to its advantage. Many have tried, Napoleon & Hitler for instance violently, but it is surely quite clear from history that the only power that can change Russia, is that of Russians.

I recall the quote of an American statesman who said that Russia is not so much of a nation , as it is of a gigantic gas station , run by the Mafia ...

... similarly with China ... we need to wean our economies off these " countries " ... their leaders are corrupt despots ... and ought not be trusted ....

"Today’s plans to decarbonise global energy systems, which centre on a massive expansion in the use of solar, wind, and battery technologies, need to better account for the high environmental and economic costs of materials and minerals"

/issues.org/environmental-economic-costs-minerals-solar-wind-batteries-mills/

...investment in digital and other technologies has accelerated in many advanced economies. It is plausible that this stepped up investment will support a productivity renaissance.

I'll believe it when I see it. A lot of technology investment appears to be a dead-end. Per capita productivity growth within many economies has stalled.

I think we should still be searching for natural gas.... Cannot see any viable alternative here

have we ever considered geo thermal

... take it up with Jacinda ... she banned our offshore natgas exploration in 2017 , weeks after being installed as PM by Winsome Peters ..

No prior heads up , no negotiation : Gas bad .. other stuff good ...

I assume National can reverse it just as quickly.....

Good read. A strong energy, food, and water security plan would be such a vote winner in NZ. Imagine a politician standing up and saying: "We are going to invest in these things to make sure that our children and our childrens' children grow up in a country where they don't have to worry about whether the Saudis are hiking oil prices, or whether the Russians are invading their neighbours? And, as an outcome of this plan, we will get, within 10 years, clean low-cost power, rivers we can swim in, and dry, warm homes (and an end to involuntary employment obviously).

And not selling our land to global interests like Aust, UK, US and Singaporean proxied Chinese.

What jfoe ? Thinking ahead. We don't do such a thing in New Zealand.

With the change of chapter as described in the article, will need to come a change of thinking. We have heard endless anti-neo-liberal talk of recent times & probably some of it is fair. But we need food, water & energy today just like we did 1,000 years ago, albeit delivered on a smarter platform. New Zealand needs to become self-sufficient in all, or as many of the key life ingredients as it can. The woke world is coming apart as their theories are failing time & again & this has been shown to be obvious with Putin's check-mate on Germany in particular, but Europe & others as well. Chalk this one up to the Russian mafia as the woke west wonders what the hell to do next. The puppet Biden is out of his depth as are all of his feminist/BLM/corrupt university friends, as their narrative has been exposed for what it is. BS. In the end, if you can't eat, drink or shelter yourselves then all the technology wont help you much. We can post, watch, listen & comment as much as you want, but eventually you'll need to eat your dinner.

at the moment our system only measures dollars & gdp

so we get a growth oriented outcome

we actually need to use less electricity

im sure more products and services will start to be measured for the energy use and then we can see the costs from an environmental view

look at childcare as an example

each child gets twenty hours free care at the cost of the taxpayers...about twelve thousand each in subsidies

and the parents have to find the funds to live and pay the other hours in many cases....in many cases someone is working half the week to just pay the childcare.

now there are 190,000 kids registered for ECE....so how many car trips...pickup and drop-off...how much energy wasted when the alternative is home schooling and local co-op kindergartens.

what's the societal benefit of less stressed families

why do we fear the future...we shouldn't fear change & if it means using less energy so be it

Am I the only one that tunes out when someone mentions “woke”?

I tune out whenever I hear the words " framework " , or "protocol " .. or "package " ...

... Robbo cures my insomnia ... seconds into his spiel I'm ZZZZZZZZZZzzzzzzzz .... totally out to it ....

are you replying to my post Jimbo?

am i woke?....classic

Glass half full, there's always Nukularrgh.....

Very strange, we export Human Endeavor to Tonga via Air, but Store useless Workers by the thousand and give them a free for all Grant.

Personally I think our Illustrious Labour Miss-Leaders should allow Tongan Apple Pickers to remain in NZ and Pick the Fruit of Others Labours in all Orchards around New Zealand.

We need them Tongans, more so than Lay Abouts.

Seems a bit stupid to me to dispose of Real Workers, whilst Lazy People, can stay idle and us Tax Payers have to be rorted paying Labour Leaders to Jet around,making stupid decisions....far and wide.

Tongans have been here for Two Years, working up and down Ladders, hard at work. All they want is Work.....and a modicum of Pay. Long may they be sustained.

Work and Income is stupid in the extreme. Why send good workers back to Tonga, when we have a Labour Shortage here......DUH!.

i was speaking the other day to someone up in the northern territory

they were relying on tongans to go and pick the their mangoes

what's the energy cost of a mango including staff flights and transport costs by the way by the time its got to farro

anyway i raise it because i never hear about what the capacity of workers wanting to leave and pick is...i know the neo lib unplanned thing is suppose to work but the japanese and demming show other ways

Like the benefit of using wood in housing and furniture. All that carbon locked up.

But what is the carbon cost of cutting down the tree, trucking and shipping to the timber mill, to the retailer, to the building site? The carbon footprint of the builders etc?

Another article courtesy of Interest.co.nz highlighting the growing global food shortages and price increases and hardly a peep from commentators on this site.

Obviously food is not suppy/cost issue in this country yet ?

Farmers providing cheap food for too long ?

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.