Finance Minister Grant Robertson has announced the extension of fuel tax cuts and half price public transport fares until the end of January, 2023, saying the Government wanted to give consumers certainty at a time of elevated prices.

The extension from mid-August to the end of January would cost $652m, although Robertson said it would not represent a loosening of fiscal policy because it would be paid for by reallocating funding unused elsewhere in the Budget. He said Treasury had advised the policy had reduced headline inflation by 0.5 percentage points in the June quarter.

Robertson told a news conference after the announcement that the 25c/litre cut in fuel taxes could not go on forever and the Government was looking at options to phase it out gradually, rather than on a 'D-Day' that could cause disruptions with heavy queuing just before the 'D-Day'. He would not rule out or in whether it would still be in place at next year's election.

“There’s no easy fix for the cost of living, but we’re taking a range of actions to ease the pressure on families. In the case of today’s announcement we know that the rising price of fuel has a direct effect on inflation, and making these changes is a targeted approach to a root cause of the cost of living pressure being faced by Kiwi households," Robertson said.

Extending the fuel excise and RUC reductions until the end of January was estimated to cost $589m, while the cost of extending half price public transport was estimated to be $63.1m.

“In the end of financial year wash up we have identified funding that we can re-prioritise to meet these costs and top up the National Land Transport Fund, in particular from lower than forecast write-offs from the Small Business Cashflow Loan Scheme, and money remaining in the COVID Support Payment allocation,” Robertson said.

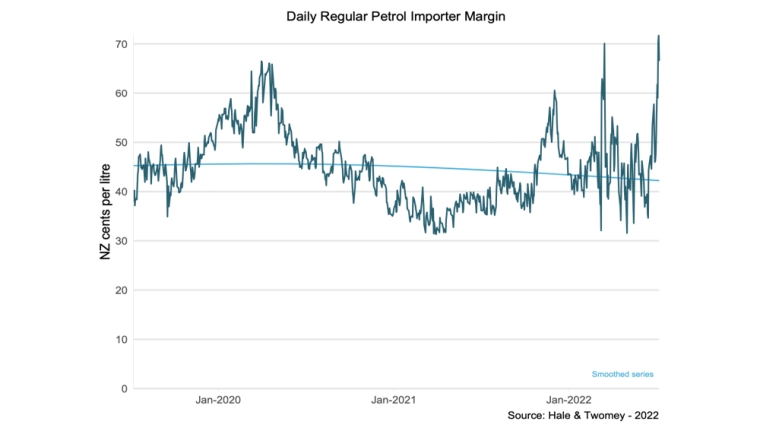

Meanwhile, Energy Minister Megan Woods told the Beehive Theatrette news conference that she had written to fuel companies last week for an explanation of a spike in fuel importing profit margins, as detailed here in an MBIE chart.

[chart:oil and petrol]

13 Comments

Pathetic - I thought we had a climate crisis.

Just another example, like Biden pleading for Saudi to pump more oil.

The human race will take no meaningfull action to reduce carbon emissions. Fossil fuels are just so damn vital to our way of life.

We have an energy crisis first and foremost.

And also a climate crisis.

Everthing is a crisis, just not the health system according to Little...

CPI tomorrow then. What a coincidence, not. Sounds like it might be higher than what Finance Minister Robertson bases his calculations on, that is according to, not him but “what most people think.”A decision out of stark political necessity because the higher inflation jumps out of the bag, the lower the government’s chances of re-election. Reinstating the tax level undoubtedly wouldn’t be good for that now would it. To hell with anything else much then, political expediency, nothing could be of greater priority. Can booted download the road consequently . Where exactly will oil prices be though, when it stops rolling?

the Government was looking at options to phase it out gradually, rather than on a 'D-Day' that could cause disruptions with heavy queuing just before the 'D-Day'

Funny how they only just managed to figure this out now.

It’s as unsubtle and laughable as the Christchurch City Council deferring implementation of its water usage rates because it wants its good people to have time to adjust to the reality of it. Truth is, in winter garden/outside watering reduces substantially and secondly, the generous council is having great difficulty in actually locating water inlets & meters and staff to do that and then attend to future recording & collating every quarter.

According to my mate that works for the City Care water unit, they're in the process of rolling out RF meters that send updates to a repeater on a lamppost. So the future recording and collating will not be an issue.

I will be surprised if this is ever reversed.

The Greens want the fuel tax reversed , but aren't making too much noise about it.

Its a blunt force instrument, the problem been there is no real alternative to help with inflation .It would be good to see a rebate on basic food items instead , but not sure how you implement that.

Pretty simple really, just 'temporarily' remove the GST off certain product categories.

That is not simple. Your Gst is a lump sum calculation , income minus expenses. there are no catergories.

I would think it could only be done at the importer/ producer level ,allowing every businees to exempt some goods but not others would be a nightmare.

I am loving the half priced fares, finally makes little jaunts around far more viable. Despite the unreliability

Wow. So extending the RUC and fuel excise discounts could have paid for 5 years of free public transport. Shows you where the government's priorities are.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.