Global inflation was generally moderating when the pandemic began, and the downward trend continued into the early months of the crisis. But surging prices since late 2020 have pushed inflation steadily higher. The average global cost of living has risen more in the 18 months since the start of 2021 than it did during the preceding five years combined.

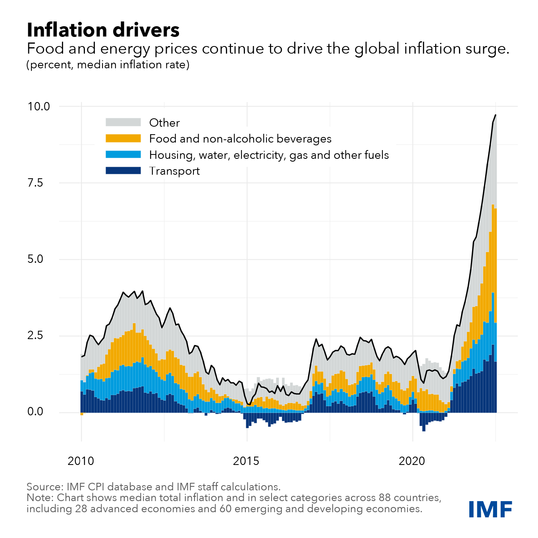

Food and energy are the main drivers of this inflation, as the chart below shows. Indeed, since the start of last year, the average contributions just from food exceed the overall average rate of inflation during 2016-2020. In other words, food inflation alone has eroded global living standards at the same rate as inflation of all consumption did in the five years immediately before the pandemic.

A similar story holds for energy costs, which show up both directly and indirectly, through higher transportation costs. This is not to say that prices of other items are not rising too. For example, services inflation has increased in the United States and the Euro Area. And the relative impact of food, energy, and other items in driving inflation varies considerably across countries.

Inflation continued to climb through July, albeit a little more slowly. Though circumstances vary by country, the latest observations show a slight change in the composition of inflation, with food’s share increasing further while energy-related categories eased slightly. This is consistent with the possibility that global energy prices have been passed on to consumers more quickly than higher wholesale food prices.

Our latest World Economic Outlook in July projected inflation to reach 6.6 percent this year in advanced economies and 9.5 percent in emerging market and developing economies—upward revisions of 0.9 and 0.8 percentage points respectively from three months earlier. Next year, interest-rate hikes are likely to bite, with the global economy growing by just 2.9 percent and in turn slowing price increases worldwide.

With rising prices continuing to squeeze living standards worldwide, taming inflation should be the priority for policymakers. Tighter monetary policy will inevitably have real economic costs, but these will only be exacerbated by delaying corrective action. As a recent Chart of the Week shows, central banks have dramatically pivoted this year toward tighter policy globally.

Targeted fiscal support can help cushion the impact on the most vulnerable. Policies to address specific impacts on energy and food prices should focus on those most affected without distorting prices. And with government budgets stretched by the pandemic such policies will need to be offset by increased taxes or lower government spending.

Philip Barrett is an economist in the IMF’s Research Department

17 Comments

With the global demand for food likely to be reasonably stable even with increasing interest rates the likelihood of foods contribution to inflation will stay high. Even if energy prices stabilize fertilizer is unlikely to following energies trends as the shortage associated with Russian Ukraine war will remain.

I'm sceptical of world eccominists optimistic forecast of growth and inflation to return to normal in 2024 and expect Central banks will be forced to increase rates further than forecast bring inflationunder control.

My dislike for Putin is stronger than ever but his quote this week

''The economy of imaginary wealth is being inevitably replaced by the economy of real and hard assets''.

Cuts at the heart of the issues with western capitalism.

Something has to change, repeating the past will only create bigger problems in the future for us and our children.

Yes I watched Putin’s speech and he oddly appears to be the only leader who has an understanding of macroeconomics.

Scary times.

We just have to hope that the current slapping around Putin is receiving, turns into a complete rout. If energy shortages over winter result in mass unrest and Putin retains his imperialistic urges, he may yet unfortunately emerge with a greater influence on the speed of civilisational demise. An interesting inflection point will be the end of SPR releases in the next few weeks. There is likely to be a surge in oil price at that point, unless demand can be killed beforehand. Either way, the result will be the same. demand destruction, surging inflation and unhappy voters.

Net zero and disastrous lockdown policies have driven food and energy inflation. Governents need to cease net zero policy and prohibit the use of lockdowns as a policy under any circumstances.

I'd go more with the energy sanctions against Russia as the highest contributor to inflation. The sanctions have increased the price of gas horrendously and a direct flow on is fertiliser prices and electricity generation via gas as a fuel.

Net zero has a consequence from unreliables, wind and solar electricity generation. Net zero is more longer term contributor to inflation.

European fertiliser industry shutting down production to 35 % of capacity because gas prices are to high, there has to be an impact on food production some where in the system ?

The chart above doesn't match the Putin factor - the trajectory was set before the conflict took off. Putin is just a handy political excuse for disastrous lockdown policies which strangled supply. "Global inflation was generally moderating when the pandemic began, and the downward trend continued into the early months of the crisis. But surging prices since late 2020 have pushed inflation steadily higher."

Net zero policies strangled the supply of Europe's vast gas reserves - higher than US reserves. Instead they chose to pursue net zero policies and rely on Russian gas.

https://www.eia.gov/analysis/studies/worldshalegas/

Or, maybe there are more factors humans rely on for existence than economic ideology?

Green ideology bought us to this this point. Freezing to death because you can't afford to heat your flat is going to be the human factor this European winter. You think there is no human factor on the decimation of businesses or going to jail if you heat your flat above 19C? The Green killing people by cold/poverty today while trying to save them from warmth in 100 years.

“Swiss citizens found to be in violation of the country’s new heating rules, which prohibit warming homes above 19°C this winter, could face daily fines of up to 3,000 Swiss francs and up to three years in prison.”

No, blind faith in endless growth brought us here. In spite of overwhelming evidence the planet Earth is in fact finite, a certain powerful religious cult managed to convince humanity it was in their best interest to burn through the planet's resources as quickly as possible. Now here we are. The end of no strings attached profligacy.

Couldn't have put it better myself.

"Politicians are happy to blame Vladimir Putin and his Ukraine invasion for the current energy disaster. But what transformed that one-off shift in the relative price for energy into a global disaster was two decades of green-energy policy beforehand. In Europe, that includes a fixation on renewables incapable of powering industrial economies absent battery technologies that don’t exist, a refusal to tap domestic fossil-fuel reserves such as shale gas, and a deep and irrational hostility to nuclear power in many parts of the Continent.

...Well, if you seek “climate risk” to financial stability, look around you. It has arrived, although in exactly the opposite manner to what our current crop of eco-financiers predicted. Europe’s plight tells a tale that could become all too familiar in the U.S. soon.

...The U.K. may be facing a wave of business bankruptcies exceeding anything witnessed during the post-2008 panic and recession. Some 100,000 firms could be forced into insolvency in coming months, bankruptcy consultancy Red Flag Alert warned this week. These are otherwise healthy firms with at least £1 million in annual revenue. Business failures on this scale would dwarf the roughly 65,000 firms of any size that went under from 2008-10."

https://www.wsj.com/articles/the-coming-global-crisis-of-climate-policy…

Grant Robertson doesn't blame Putin .... apparently it's all the fault of the previous National Government , Tugger John & Wild Bill ...

The graph looks reasonably tame until you see the rises are rapid and range much higher than a few % from their onset. These are significant rises... and they will drag heavily on all . Risk is certainly up a notch. They wont be taming this in the blink of an eye.

IMF report states “And such policies will need to be offset by increased taxes or lower government spending”

The NZ government’s plan to tackle the “cost of living crisis” is to dramatically increase its spending on its pet projects like health restructuring, 3 waters, co-governance - this will cause excessive inflation to last much longer than necessary & much pain for Labour’s working class supporters - it is ironic that its supporters are hurt the most

... they say that we often hurt the ones who we love the most ...

Over the years , Labour has done that time & again ... yet , its loyal base of supporters remain steadfast followers .... kind of like diehard Auckland Warriors fans ... no amount of losing will sway their blind devotion ...

Here's one for their working class supporters - I'll let you know when I get my reply from the Committee! Each day I wonder what their excuse will be;

Targeted fiscal support can help cushion the impact on the most vulnerable. Policies to address specific impacts on energy and food prices should focus on those most affected without distorting prices. And with government budgets stretched by the pandemic such policies will need to be offset by increased taxes or lower government spending.

You've really got to hand it to these guys - they are sooooooo devoted to their neo-liberal prescriptions.

No mention whatsoever of governments exercising their power to regulate markets. Yet every time we get an update on bank profits, for example... And, what is the IMF suggesting? More handouts to keep a hungry poor from rioting, and more taxes from those just making ends meet. Sheeeesh.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.