Our most-read Chart of the Week blogs last year show reader interest tracking the most pressing issues for the global economy. From inflation and economic growth to housing, food prices, globalization, and climate change, these visualisations encapsulate the biggest challenges policymakers faced — and may keep confronting in the year ahead. Follow the links below to read more:

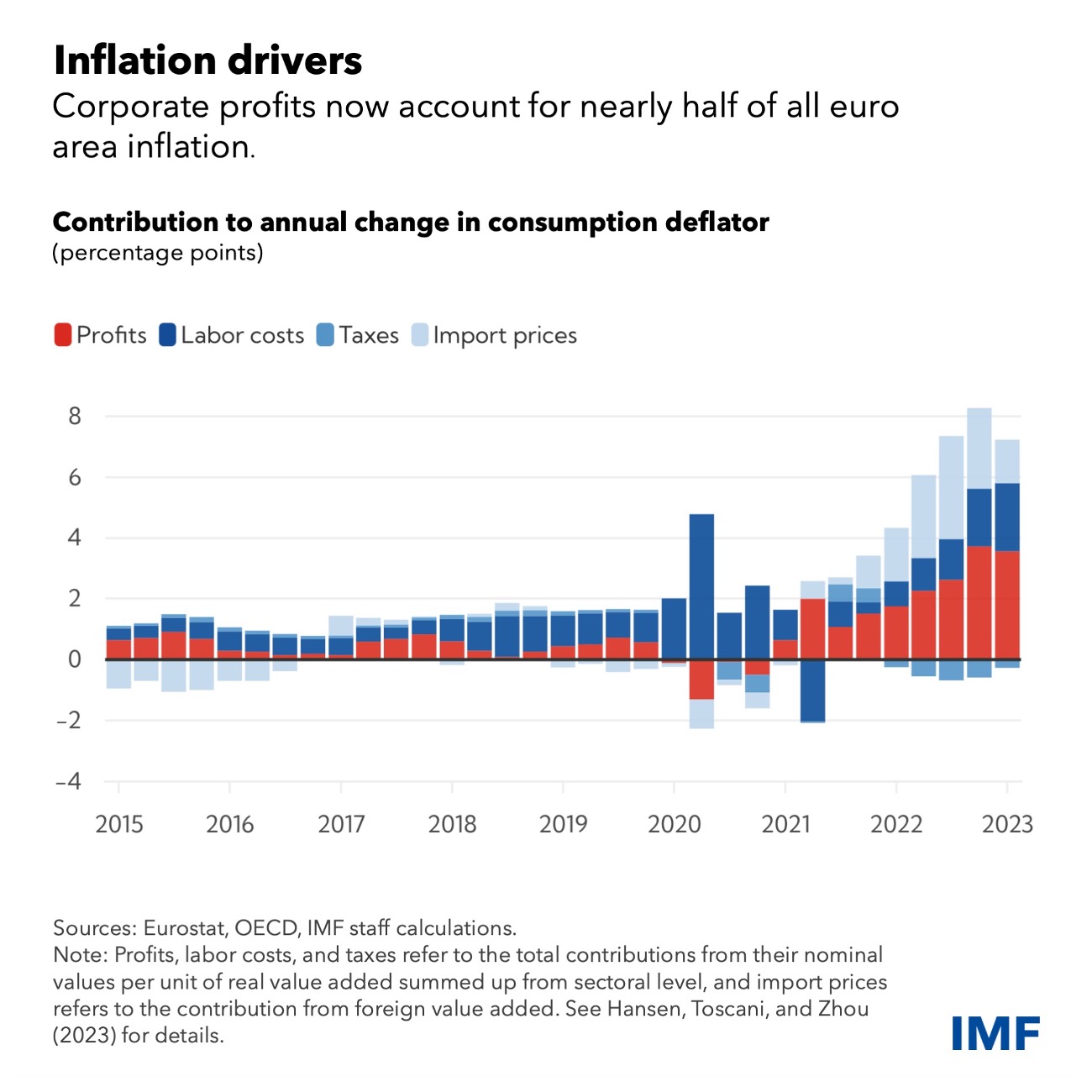

Europe’s Inflation Outlook Depends on How Corporate Profits Absorb Wage Gains

Higher prices so far mostly reflect increases in profits and import costs, but labor costs are picking up

June 26, 2023

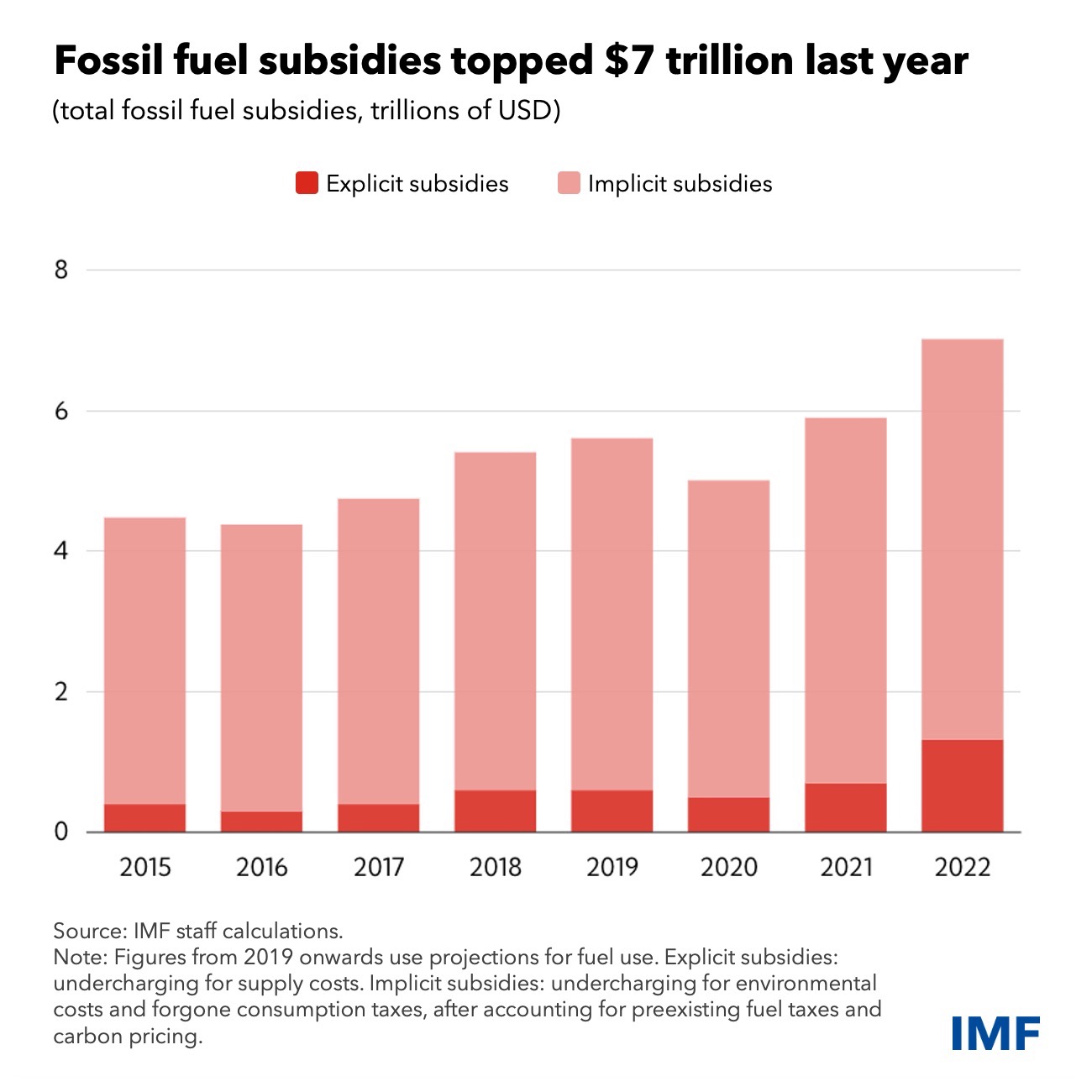

Fossil Fuel Subsidies Surged to Record $7 Trillion

Scaling back subsidies would reduce air pollution, generate revenue, and make a major contribution to slowing climate change

August 24, 2023

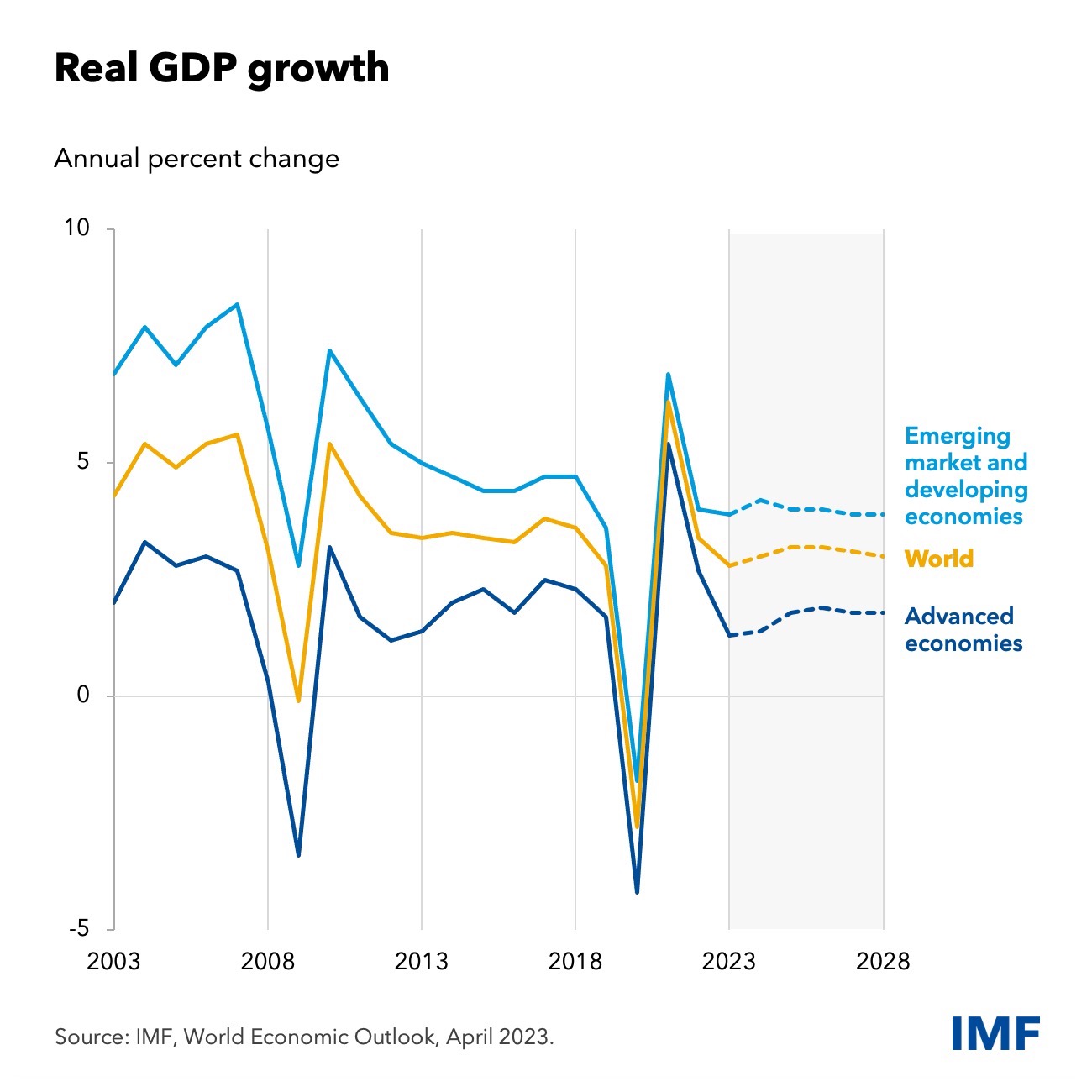

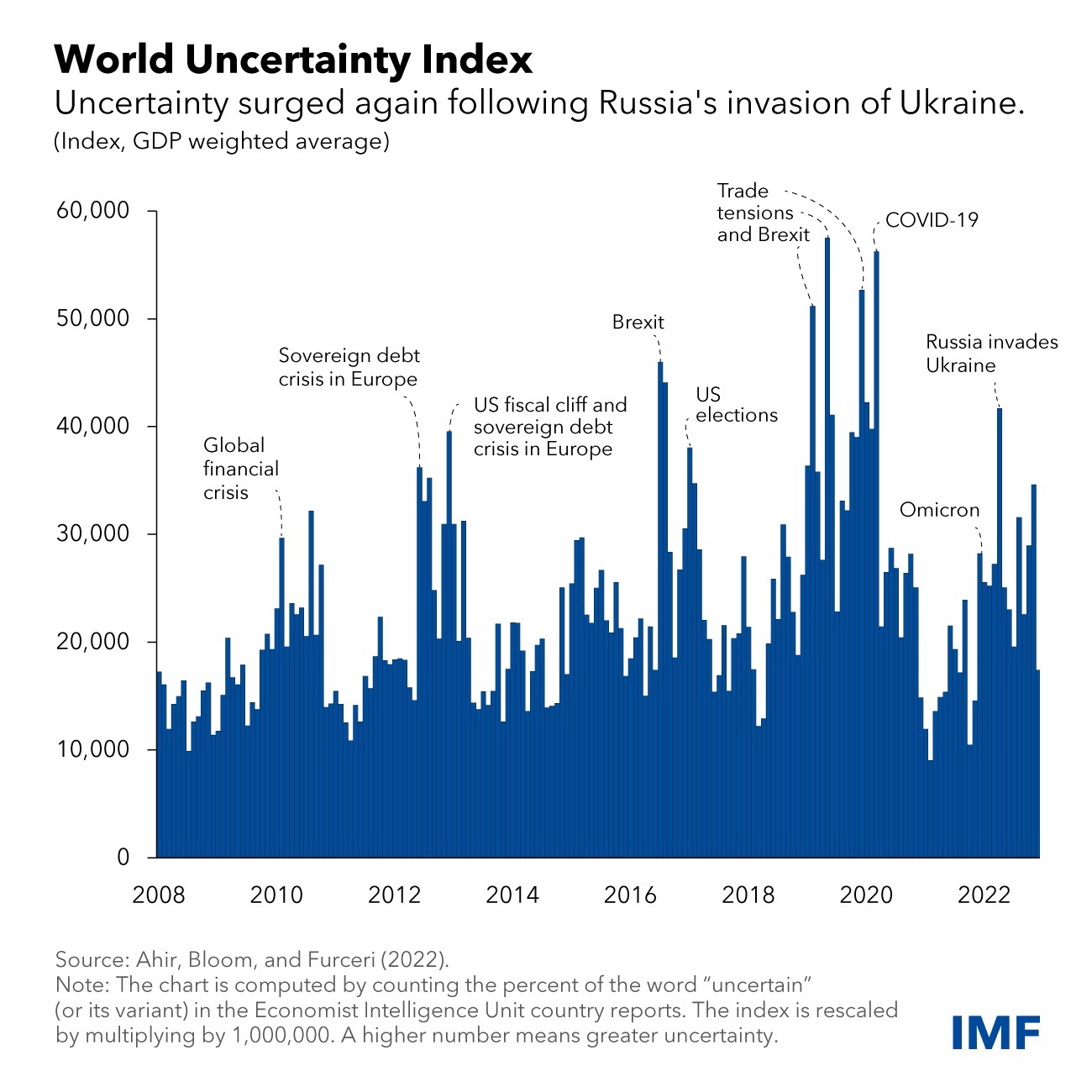

World Economic Outlook Shows Economies Facing High Uncertainty

The Chart of the Week brings together our economic forecasts, which reveal weaker growth amid an uncertain outlook with high downside risks

April 19, 2023

Asia Poised to Drive Global Economic Growth, Boosted by China’s Reopening

China and India together are forecast to generate about half of global growth this year

May 1, 2023

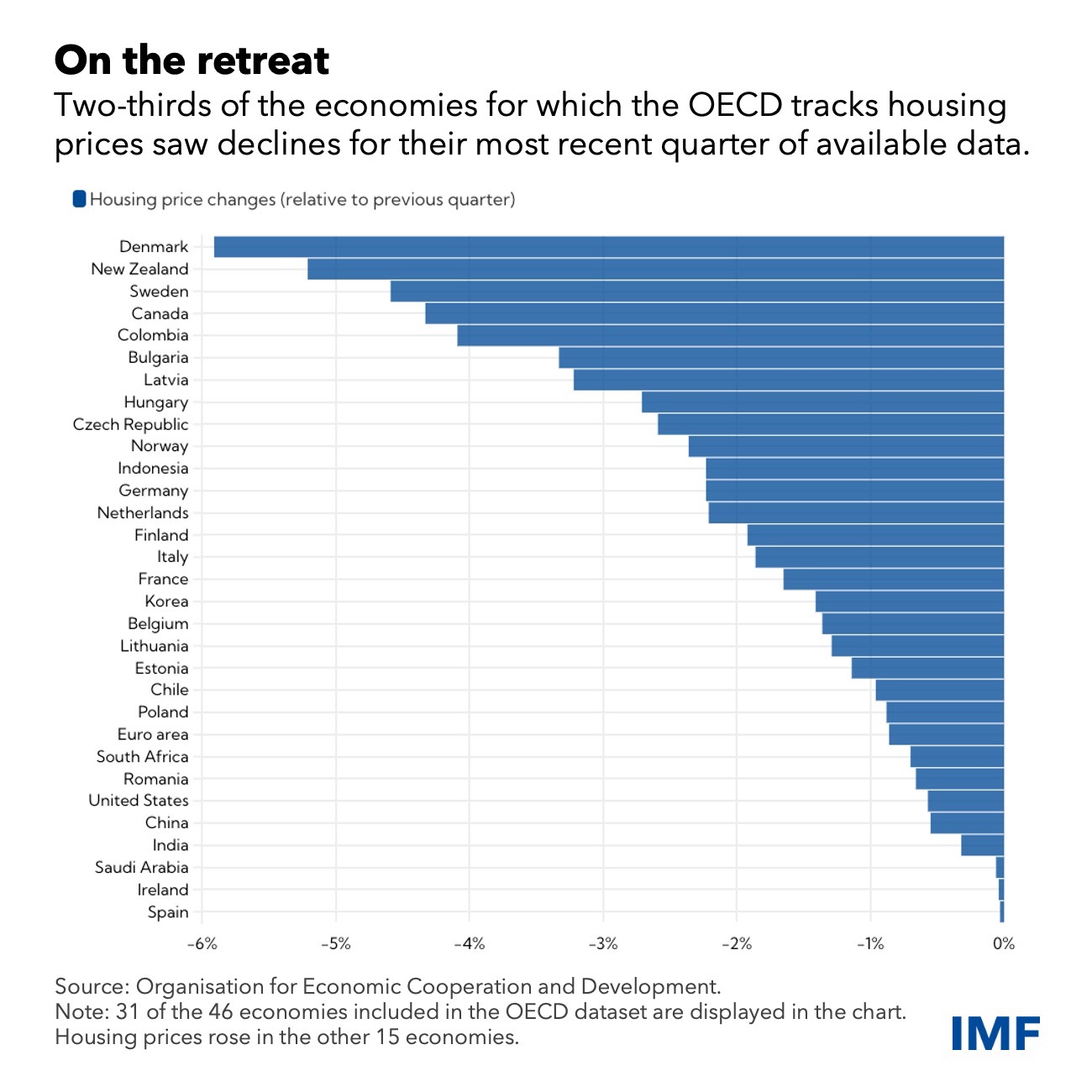

House Prices Continue to Fall as Borrowing Costs Rise

Property markets should enjoy greater stability when central banks slow or pause their campaign of raising interest rates to tame inflation

March 15, 2023

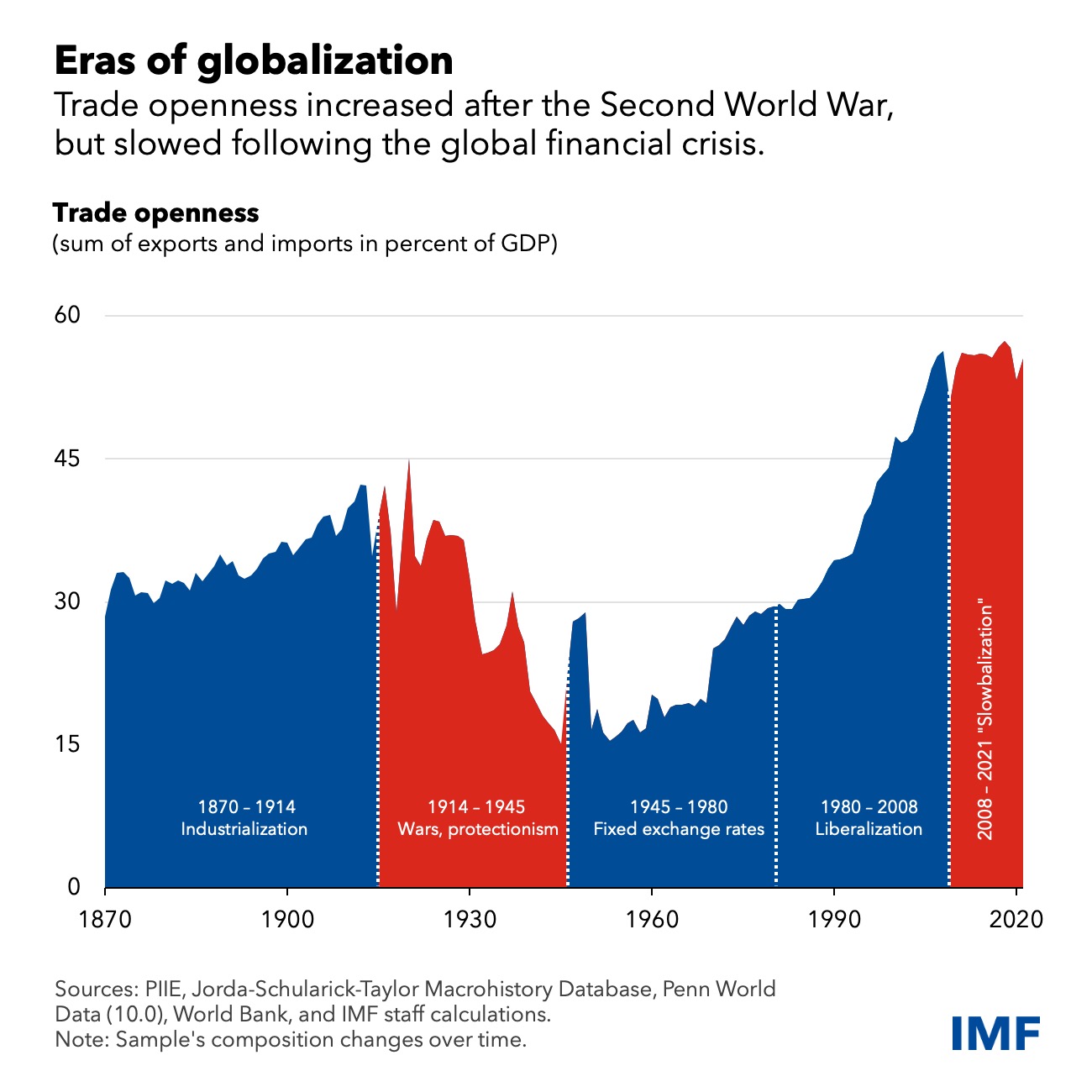

Charting Globalization’s Turn to Slowbalization After Global Financial Crisis

Trade openness increased after the Second World War, but has slowed following the global financial crisis

February 8, 2023

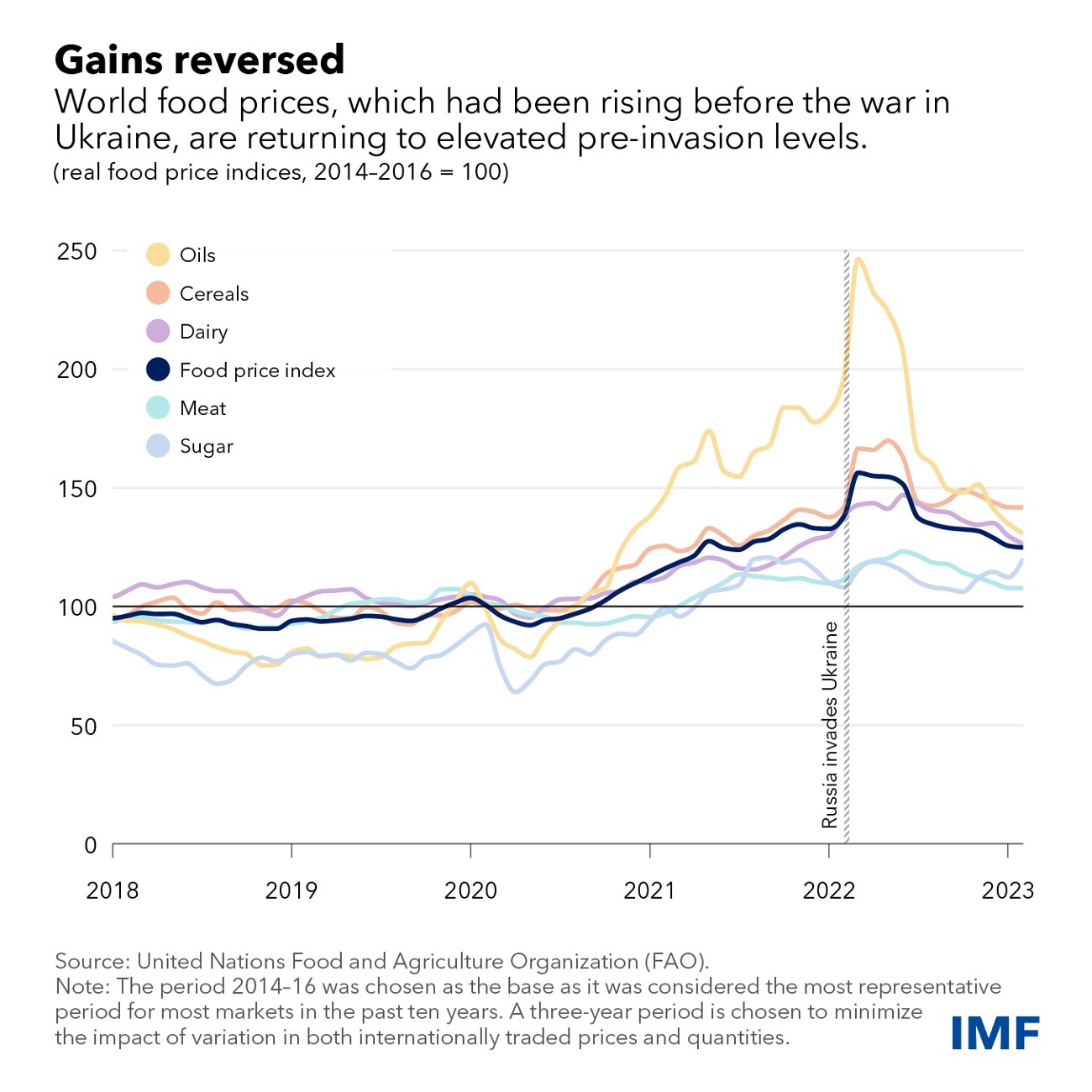

Global Food Crisis May Persist, With Prices Still Elevated After Year of War

International organizations repeat joint call for rapid action on food and nutrition security

March 9, 2023

Global Economic Uncertainty Remains Elevated, Weighing on Growth

From Brexit and US-China trade tensions to the pandemic and war, successive shocks have combined to keep uncertainty elevated

January 26, 2023

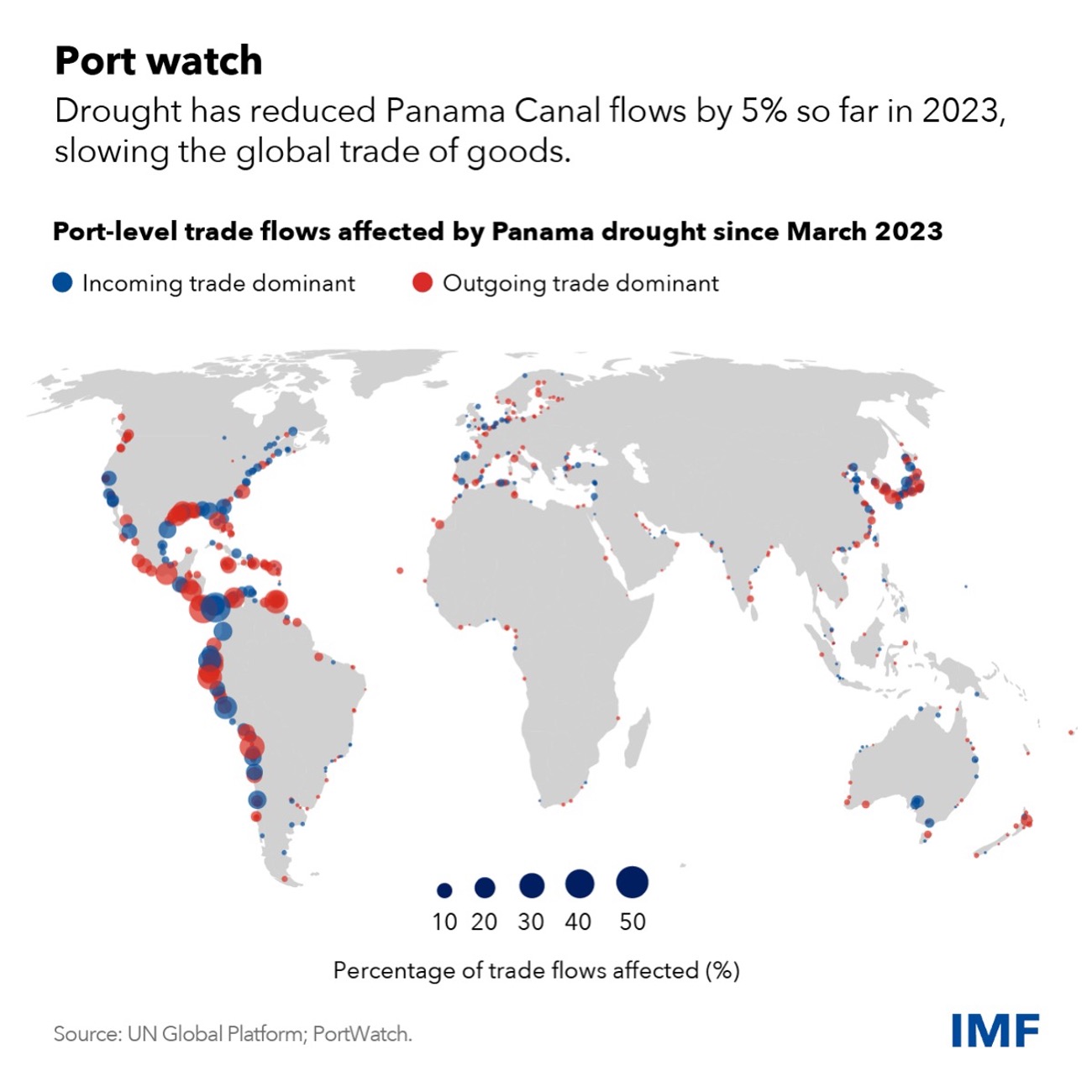

Climate Change is Disrupting Global Trade

Panama’s drought shows how trade disruptions from climate extremes can reverberate around the world

November 15, 2023

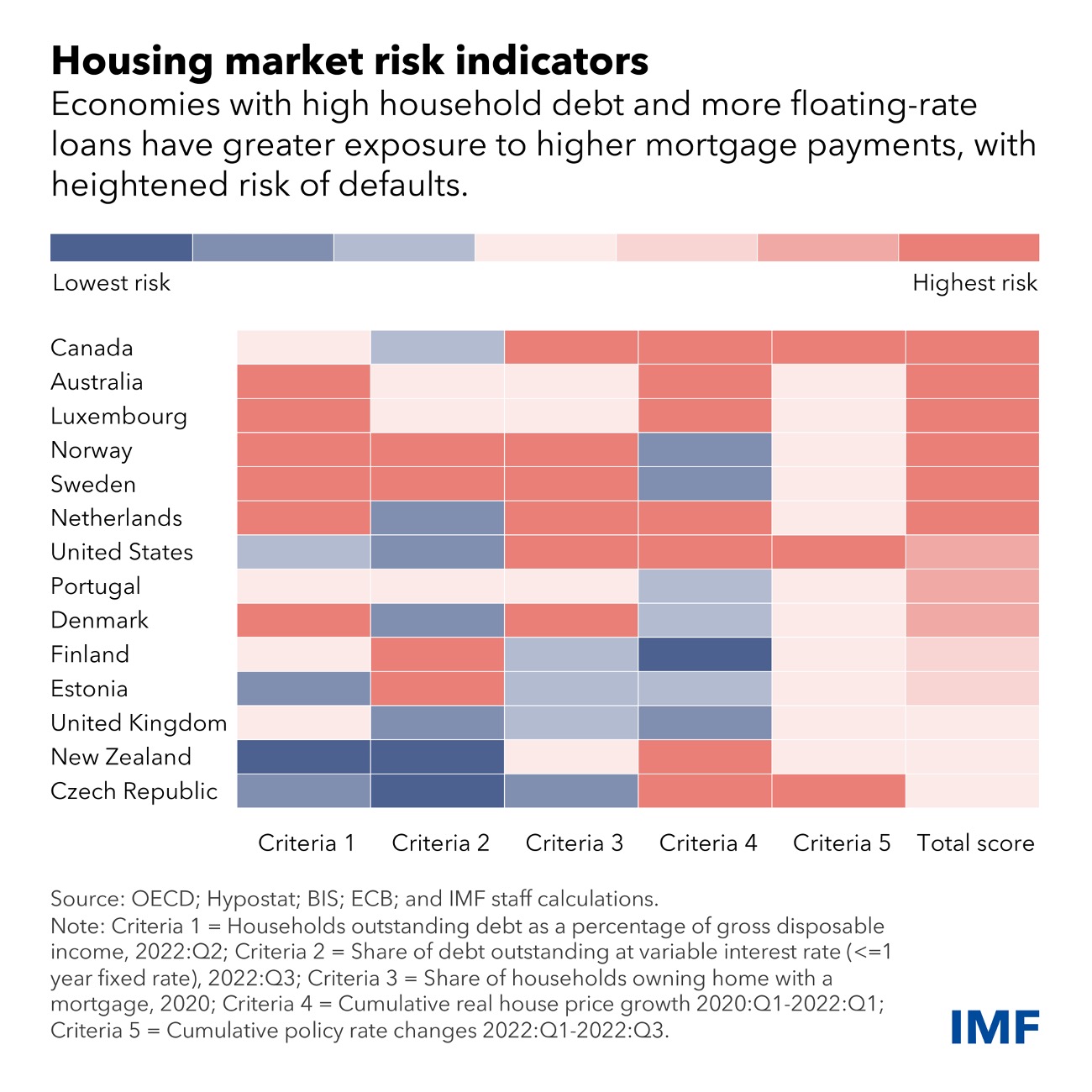

How Falling Home Prices Could Strain Financial Markets as Interest Rates Rise

Countries with elevated housing prices and high household debt issued at floating rates are particularly vulnerable to monetary policy tightening

May 31, 2023

This article was originally posted here.

3 Comments

So the last chart says NZ is not as bad as the others. Wow, that’s really saying something.

Needs a lot more data... are these the top fourteen countries at risk? It would be nicer to see where NZ stands in the total OECD or other representative grouping. There are a lot of OECD countries missing in that last chart, as well as some non OECD countries included in the chart.

I do struggle with the Category 1 and Category 2 weighting. As we all know, pricing is defined in the margins. Are the Category 1 and Category 2 evaluations done on median values? The long term owners are likely to not fall afoul of either category, unless they went silly with leverage. The challenge is in the edge quartile households. The margins tend to define the pricing.

Add: I *strongly* recommend looking at the dates for the respective charts. Most are rather dated.

NZ Housing = Low risk as an indicator the world knows our reliance on it and sees the lengths our government will go to prop the prices up to high heaven.

Food prices I'm assuming would be closely tied to oil prices however also the impact of weather across the recent couple of years also. Interested to hear discussion on this point.

Globally where we go from here is a tricky one to pick. While full-blown protectionism would cause more harm than good, and the WEF would like to see countries hone their georgraphical advantages and share the goods and services with the world, one can't help but think with the historical link between oil price shocks and inflationary pressures, surely more incentive to support and grow diversity in domestic production of goods and services is called for in the name of national resilience.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.