By Gary Blick*

Summary

- Auckland has upcoming decisions that will affect how much capacity is available for new homes

- Auckland’s Unitary Plan shows how increases to capacity by allowing for density can affect the quantity and price of housing

- There is strong evidence that one-third of dwellings consented over 2016 to 2021 were a result of the upzoning of the Unitary Plan

- Rents and house prices in Auckland have been on a lower growth path than New Zealand as a whole

- Adding more capacity could improve housing affordability

Decisions on our capacity for housing

Auckland has some upcoming decisions that will affect the amount of capacity available for new homes. The decisions relate to the Auckland Unitary Plan which sets the rules for how we use our land.

- Auckland Council’s response to government directives to allow higher density around town centres and rapid transit stations and medium density elsewhere, known as Plan Change 78, is before a hearings panel. The incoming government intends to allow councils to opt out of the medium density component and so Auckland may have a choice – to proceed with the current plan to add more capacity, to opt out, or to do it differently.

- Unitary Plan rules in relation to natural hazard risk are being reviewed in the wake of the flooding and land slips in 2023. If there are good reasons to forgo some residential use in high-risk locations, that raises a question of whether to offset any reduction in capacity by adding more elsewhere.

- A full review of the Unitary Plan is required to begin by 2026. It will involve decisions about our capacity for new homes, through intensification in the existing urban area and in greenfield locations.

These decisions, to be taken by Elected Members, will determine how Auckland grows. A key consideration is whether changes to our capacity for new homes can affect the amount and affordability of housing overall.

Fortunately, we have insights into this from the effects of the Unitary Plan, which increased our capacity by ‘upzoning’ or permitting more density across much of Auckland’s residential land.

Record numbers of consents for new homes

Auckland has seen a surge in building consents for new dwellings since the Unitary Plan became live in late 2016. Annual numbers of consents had not previously peaked at much more than 12,000 in a year. Since then, new records have been set annually from nearly 13,000 in 2018 to 21,000 consents in 2022.

This increase has been driven by new townhouses in existing urban locations that were upzoned to allow for more density, as households trade-off space to locate closer to employment, transport and amenities.

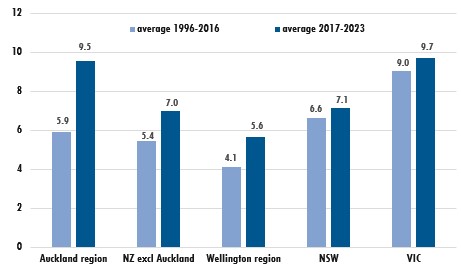

The uplift remains material after adjusting for growth in population over time. Consents for new dwellings in Auckland have risen from an average of 5.9 per 1,000 residents from 1996 to 2016, to 9.5 consents per 1,000 residents from 2017 to 2023. This suggests the housing supply has been able to respond to increased demand for housing from population growth and from the lower interest rates over 2020 to 2022.

Figure 1 shows the response from Auckland’s housing supply since the Unitary Plan has been stronger than the rest of the country, where the average rate of consents per 1,000 residents rose from 5.4 to 7.0. The equivalent rate for the Wellington region rose from 4.1 to 5.6. Placing this in a wider context, Auckland has surpassed New South Wales and matched Victoria.

Figure 1: Consents for new dwellings per 1,000 residents

Building consents per 1,000 residents per year

Sources: Stats NZ; Australian Bureau of Statistics

More new housing than otherwise

Importantly, there is strong evidence that the Unitary Plan has led to more new homes in Auckland than would otherwise have been the case.[1]

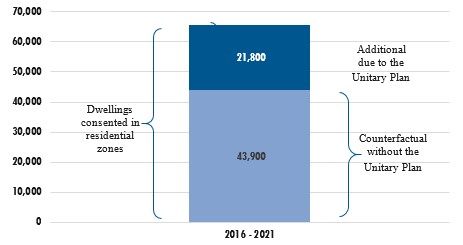

Research from the University of Auckland has found that 21,800 new dwellings consented between 2016 and 2021 were a direct result of the upzoning of the Unitary Plan and would not have occurred in its absence.[2]

That research, by Professors Ryan Greenaway-McGrevy and Peter Phillips, appears in a respected journal. It estimates a ‘counterfactual’ scenario by comparing consents in locations that were upzoned with those that were not, before and after the zoning change.

Put in context, the additional 21,800 dwellings equates to one-third of the 65,700 dwellings consented in residential zones over 2016 to 2021. That implies Auckland would have had 43,900 dwellings over that period without the upzoning. In other words, the 65,700 dwellings consented represent an increase of 50% over that counterfactual. This finding – similar to fingerprints on a smoking gun – points to the Unitary Plan as being significantly responsible for the surge in new homes.

Figure 2: New dwellings as a result of the Unitary Plan

Number of building consents for new dwellings

Sources: additionality from Greenaway-McGrevy & Phillips (2023); total consents calculated by the Chief Economist Unit

Reduced development cost per dwelling

More homes can be supplied because developers face a lower cost of development, enabling them to profitably meet more demand for housing. Costs fall in three ways.

- Less land per dwelling – an increase in potential density allows for multi-unit developments that use less land for each new home. Land is typically the costliest component of new dwellings.

- More competition – an increase in development opportunities adds to competition among land owners, reducing their market power, so that the land cost per new home is lower than otherwise.

- Economies of scale – the increase in potential density also enables cost efficiencies through all stages, e.g. design, consenting and construction.

More housing helps improve affordability

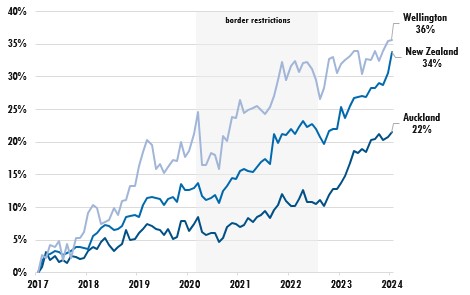

More new homes being supplied can be expected to help improve housing affordability. Consistent with this, rents and house prices in Auckland have been on a lower growth path than New Zealand as a whole.

Figure 3 shows that rents in Auckland increased by 22% between 2017 and 2024 compared with 34% nationally and 36% in the Wellington region. Moreover, research across urban areas concludes that upzoning improved affordability. It finds rents for three-bedroom homes in Auckland were 26% to 33% lower six years after the Unitary Plan than they otherwise would have been.[3]

Figure 3: Change in rental prices 2017-204

percent change from January 2017

Source: Stats NZ Rent Price Index series

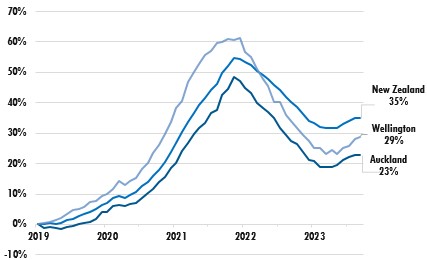

House prices are sensitive to changes in interest rates that affect how much households can afford to borrow. However, as Figure 4 shows, the rise in house prices in Auckland after March 2020 was lower than for New Zealand as a whole and that in the Wellington region.

This points to Auckland’s housing supply having been more responsive to demand, with more new dwellings consented since the Unitary Plan has been in place.

That picture fits with research that finds that upzoning can lead to house prices being lower than otherwise. Using a model fitted to Auckland, the research found the increased housing supply from the upzoning of the Unitary Plan would equate to a long-run reduction in house prices of 23% to 39%, relative to no upzoning.[4]

Figure 4: Change in house prices, 2019 to 2023

percent change from January 2019

Sources: REINZ house price index; RBNZ FSR Nov-2023

Implications for our housing capacity

Auckland’s experience shows how land use policy affects the quantity and price of housing. The key insight is that upzoning can lead to more homes and better affordability.

So, if increasing housing capacity has helped, would we benefit from adding more? Assessments have found that Auckland can physically accommodate demand for housing over 30 years. However, affordability remains challenging, despite recent gains, with the median price being 8 times the median household income. So rather than physical capacity, perhaps it is more a question of having enough capacity to really improve affordability.

More capacity could help reduce the cost of developing housing. Enabling more density increases competition among land owners by bringing many more opportunities into play and so lowering the land cost per dwelling.

Development in greenfield areas at the urban fringe is also part of the mix, as long as costly new infrastructure can be priced and charged to those that benefit. We also need to recognise that choice matters: while some households choose to locate further out, many more prefer to locate closer to jobs and amenities. In turn, that higher demand supports multi-unit housing types.

Auckland has a rich evidence base to inform decisions on our capacity for housing. If improving affordability is a goal, then we need to give serious consideration to increasing our capacity for new homes. In the next issue, we will look at the trade-offs involved and what a principled approach to weighing them could look like.

Footnotes:

[1] For a survey of the emerging literature on Auckland, see the accompanying Insights Paper

[2] Ryan Greenaway-McGrevy, Peter C.B. Phillips, “The impact of upzoning on housing construction in Auckland”, Journal of Urban Economics, Volume 136, 2023

[3] Ryan Greenaway-McGrevy, “Can Zoning Reform Reduce Housing Costs? Evidence from Rents in Auckland”, University of Auckland Economic Policy Centre working paper 16, 2023

[4] Ryan Greenaway-McGrevy, “Evaluating the Long-Run Effects of Zoning Reform on Urban Development”, University of Auckland Economic Policy Centre working paper 13, 2023

* Gary Blick is the Chief Economist at Auckland Council. This article is here with permission. The original is here. Other updates from the Auckland Council Chief Economist Unit are at Economic advice and publications (aucklandcouncil.govt.nz.

119 Comments

Once again, all talk of price and none of utilisation.

Just had it brought to my attention that in one of those other bastions of the never ending 'supply shortage' - otherwise known as Ireland - there were 230,000 vacant dwellings out of a total housing stock of 2,125,000 in 2022.

That's a vacancy rate of over 10% according to their census. And before anyone jumps on the 'away for the night' excuse, this doesn't include the 33,000 temporarily absent.

I guess they need to build more homes too? Or - god forbid - maybe they could look at why they have so many underutilised properties during an accommodation crisis?

FWIW I've always suspected a similar figure of around 10% for NZ.

Does anyone know the number of vacant KO houses, its often said its a high number through vacancies and protracted renos etc

5%. Although ironically much higher for newer KO homes.

Link please.

Closer to 6%.

Where did the figure that you concluded "ironically much higher for newer KO homes" come from?

https://www.beehive.govt.nz/release/unacceptable-number-empty-k%C4%81in…

786, almost 20 per cent, of the new public homes delivered by Kāinga Ora – Homes & Communities between June 2022 and October 2023 were vacant as of 31 October 2023

The full statement (of the party political broadcast) reads ...

“It’s simply not okay that 786, almost 20 per cent, of the new public homes delivered by Kāinga Ora – Homes & Communities between June 2022 and October 2023 were vacant as of 31 October 2023. Of these new homes, 287 were empty for more than four months despite thousands of families waiting for social homes such as these.

Shouldn't be surprising really that 287 were empty for so long. While a dwelling can be finished at any time, KO allows the recipient families time to get organised before they move in. E.g. let their kids finish their school term/year. Not much different to how settlement and possession dates get agreed.

Look at the vacancy rate map on your link though - its weighted towards parts of Ireland with lower population density and housing demand.

I'd imagine a similar situation here, with higher vacancy rates in parts of the country people don't want to live permanently, and lower rates where the majority of people are wanting to live. But our overall vacancy rate appears to be lower:

Around 5% of New Zealand’s housing stock – 95,000 dwellings – were considered empty during the 2018 census.

According to the Empty Homes report, roughly 10% of the empty homes surveyed were intentionally being kept empty, while 35% were empty because they were holiday homes. A further 8% were kept empty for personal use (often as a second home), 23% were empty for renovations and repairs and about 17% were vacant rentals, sometimes due to non-compliance with Healthy Homes Standards. The remaining 6% were empty for “other reasons”, which often meant they were awaiting sale.

I believe Aucklands vacancy rate is around 3%.

Cheers. I'd missed that map. Thanks for pointing it out.

You are quite right about the weighting, though I'd still say vacancy rates of 6 and 7% for Dublin and Cork counties is not insubstantial. Also worth keeping in mind that these statistics don't seem to include occupied holiday/short term rentals, of which Dublin is infested.

Could you maybe provide a link to that Empty Homes report?

I believe Aucklands vacancy rate is around 3%

I imagine (though I could be wrong) you'll find this is the 'official' vacancy rate - i.e. the number of residences currently available on the long term rental market that are vacant. This is typically what is referred to as the 'vacancy rate' in the media. It's derived from Real Estate agencies so misses things like land banked properties for example.

https://www.emptyhomes.co.nz/Content/report/10161%20EH%20Report%20March…

It's a PDF. You want to look at around page 30.

Somewhere like Coromandel has a vacancy rate of 15%.

Auckland is 3% (the real estate "rental" vacancy rate you're alluding to in Auckland is something like 1.5%).

Hamilton 2.5%.

And the actual number of those empty homes which are sitting empty for no other reason than land banking, is likely fairly negligible in the context of the unfilled demand.

But we will tell ourselves we can resolve this by doing absolutely anything other than a concerted supply shock.

Something is off with the way that report is interpreting the 2018 census data.

In the report for Wellington City: 2202 unoccupied dwellings + 75,195 occupied dwellings = 77,397 total dwellings.

In the 2018 census data for Wellington City: 80,109 total dwellings.

I don't trust that the count of vacant properties they are working with is correct. What are the other 2712 dwellings being used for? If they are also not occupied as a home then we suddenly have a vacancy rate of over 6% - not dissimilar to the situation in Dublin.

Well, the data seems to be pointing towards not enough houses being built to satisfy our demographics, and there not being a substantive volume of under utilized homes. It does support prices and rents being highly correlated to the ease and volume of new supply.

If we were going to divest energy into resolving housing as a societal problem, the most obvious solution has some rather large illuminated arrows pointing at it.

We managed this 70 odd years ago, but seem to have largely forgotten how.

What are the other 2712 dwellings being used for? If they are also not occupied as a home then we suddenly have a vacancy rate of over 6% - not dissimilar to the situation in Dublin.

roughly 10% of the empty homes surveyed were intentionally being kept empty, while 35% were empty because they were holiday homes. A further 8% were kept empty for personal use (often as a second home), 23% were empty for renovations and repairs and about 17% were vacant rentals, sometimes due to non-compliance with Healthy Homes Standards. The remaining 6% were empty for “other reasons”, which often meant they were awaiting sale.

So of our small amount of empty homes, likely 10-20% of those could potentially be otherwise "available".

The 'empty homes' referred to in your quote from the report are the 2202 they identified, no? I am referring to the other 2712 dwellings unaccounted for.

As always, I suspect there are many more underutilised properties out there than most would believe.

What's your point?

Have you ever heard of private property rights?

Aha! Someone who gets it!

I do think that private property rights are important. I just happen to also believe that during an accommodation crisis the government shouldn't be providing incentives for people to purchase second homes, short term rentals, land banked properties, and so on. In fact, I think they should disincentive it as it seems pretty damned clear to me that it is contributing to our 'shortage' and by extension widespread poverty, crime, and a general sickness in our society.

Of course, I doubt the government will actually act in any meaningful way, but thankfully as we move into an era of higher rates the incentives drop away and the number of underutilised properties makes its way back on to the purchase and long term rental market.

If we look at data from interest costs, house value movements, and new supply, availability usually worsens on aggregate. And if someone is just land banking a house (I.e. it's sitting empty and not being rented or used), then interest is less likely a factor in their holding costs.

What you are focusing on is only an ancillary part of the equation. In the 2010s, it was foreign buyers.

What you are focusing on is only an ancillary part of the equation.

I really have to disagree.

Take total population divide by average household size and subtract from total dwellings then compare the result as a percentage of total dwellings for census data from 2001 and 2018.

2001: (1,515,639 - (3,737,346 / 2.7)) / 1,515,639 = 8.67% excess given population and average household size.

2018: (1,886,517 - (4,699,755 / 2.7)) / 1,886,517 = 7.73% excess given population and average household size.

The difference in those percentages doesn't indicate a massive growing shortage of dwellings to me. The only explanation that makes sense to explain a shortage in available dwellings is underutilisation and this speculative boom has encouraged a lot of that. Much more than people are aware of I would suggest.

Seems pretty damned clear to me that too many homes are being removed from our housing stock and made unavailable to use as a primary residence.

Edit to add:

Given those percentages above, obviously the astronomical increase in house prices can't simply be attributed to a supply shortage. So think about it... what else happened between 2001 and 2018? Exactly... the era of cheap money via steadily declining interest rates. That's the real culprit.

I know a lot of readers here are heavily invested in residential property. I really think you should pay more attention to the relative significance of interest rates over regulation, immigration, building costs, and the other usual bug bears. It's the fundamental that will have the biggest impact long term.

Nice drawing out that actual statistics.

Japan has had under zero percent interest rates for 30 years, but hasn't had the same level of house price appreciation as NZ, even in Tokyo which is still growing.

Part of this is down to treating houses like an appliance, which you can add relatively quickly at a nominal outlay.

We don't do that in NZ, and we don't do that in most other countries that are experiencing the same problems.

If we had a system that could supply a new dwelling 150m2, 3 bedroom for say, $400 grand, there's less of a reason to pay a million bucks for some rotten out 70 year old dog box.

Ideally as Jfoe has pointed out, you'd need low interest rates to help fund it.

Residential property investment isn't my sort of game. But I do see a lot of building, including much of the compliance and costs.

There are some properties that are empty, being held as a store of value. Proper unavailable. But usually owned outright. If someone's ticked up on them, they will want to derive some income from them to cover the holding costs.

Like, it's not good the system is so gamefied and weighted. It's pretty bad out there.

So basically there should be a political will to make some sort of pragmatic call about committing to consistent supply of affordable houses that satisfy the populations needs, rather than depending on a boom bust related house building cycle.

Japan is a really interesting and unique example. I still remember as a kid watching some reporter on a street corner in Tokyo in the 90's exclaiming that the square foot he was standing on was worth something like US10k. That didn't last...

With regard to their residential market, as you say, it's a very different culture. The 'second hand' house market is not such a thing - more of a land market really. The idea being that houses are easy to knock down and rebuild and that is expected to happen very frequently. Would be quite interesting to have that sort of expectation here (though laughably even without the expectation the leaky building syndrome debacle means we got it anyway!)

Big picture, it still astounds me that after how many thousands of years of doing this we don't have an acceptable, cheap, simple way of knocking up a dwelling in a couple of days for 10's of thousands. It should be a solved problem by now. I believe in the distant past it was...

Take away all the wokesters and then its very easy to "knock up a dwelling". The paper shuffling is where a lot of cost is hiding

'acceptable' is the operative word. I can assemble the trades and materials to knock you up a 3 bedroom house for around 200 grand. I'd expect it to last you 50+ years. It'd be functionally fine as a house, but legally unacceptable.

If you want a council to formalise the land parcel you want to put it on, you'll need at least another 100 grand.

If you want to satisfy the building requirements, add another 50-100 for the formation and approval of the plans, and to monitor and certify them.

Then maybe another 50 to have someone project manage it for you.

Greed and fear drive the cycles, so if houses dont have long-term appreciation then what drives demand. Can only be cost/benefit advantage, cheaper to buy than rent

Yep. These are the sort of questions we need to be asking ourselves if the Fed doesn't ride into town with a big healthy(?) dose of QE in their saddle bags.

Greed is fear - so what's everyone afraid of?

It wasn't that long ago that long-term appreciation (there's a misnomer if ever I saw one) wasn't a thing - demand was driven by the desire to create a home.

It's the baseline across the country. It's also likely not too dissimilar from the reasons houses are empty in Ireland (I.e., they're either mostly where people don't want to live, or most empty houses aren't "available").

Why not contact the firm and ask them to explain the Wellington disparity.

I believe if you were wanting to address housing, building more homes would be more effective than attempting to identify and fill empty homes.

It's not just a Wellington disparity. Porirua: 18,258 vs 18,765, Lower Hutt: 38,151 vs 39,456, etc...

But nah, I'm not going to get in touch with the authors. I'll stick to wasting people's time here.

"And the actual number of those empty homes which are sitting empty for no other reason than land banking, is likely fairly negligible in the context of the unfilled demand."

Very few land bankers own empty sections or have vacant houses. (Tax rules at play here. If the comments from many posters are read it is clear many don't know those tax rules - but land bankers do.) Developers may leave places vacant, but they are 'trading stock' on which the developer plans to build. (Different tax rules.)

For a land bwanker it is far better to own a large section with a single dwelling on which minimal maintenance is done while collecting rents to cover costs - while waiting for the land price to rise and then pocketing the untaxed capital gain. If the house is vacant for extended periods then tax may need to be paid as questions will be asked about what the taxable activity really was.

As evil as it sounds...it seems to me if someone wants to sit on an empty property then thats fine by me .... they pay rates and can do whatever they like in my book.

As I've mentioned before, I don't begrudge any particular individuals, just the system that pushes people in this direction. It's rentier capitalism at it's worst. Nothing against capitalism too by the way. When it promotes sustainable productivity.

I like your points (and your alias).

Define "earned" income

Not unearned.

Nobody pays me rent for a start.

But seriously, the vast majority of my income is earned through helping businesses to solve problems, reach more customers, and become more productive.

In other words my income comes from doing things, not owning things.

So if you owned plant and equipment, that would be doing stuff?

What about a warehouse?

Or a factory?

Hi Phalanax,

It’s nice, certainly, to see some vacant land / space among increasing density. Quality of life matters as well.

TTP

You've got to be careful with aggregated figures like the ones you use. They can lead to conclusions that don't stand up to scrutiny.

Ask yourself:

- Are the empty houses in places where people want to live?

- How affordable are they where people want to live?

- Do they meet the needs in terms of number or bedrooms, bathrooms, parking, etc.?

- What is the standard of vacant houses, and are they economical to bring up to standard?

- Are there geographical areas when vacancy rates are very low and others where they very high?

- Are non-obvious factors (e.g. tax) at play that would skew the figures?

- When times are tough, what is the cultural response? e.g. moving back in with parents, or immigrating, etc.

The report you linked to provides answers, and/or insights to the answers, to many of these questions.

NZ is not Eire. Nor is Auckland like Dublin.

These are all good points and I apologise for not taking the time to address all of them.

Instead, I'll just reiterate the census data I posted in an earlier comment and ask you in return: given the small change in those statistics which indicate a relatively steady ratio of people to dwellings (keeping in mind that average household size remained the same), why do you think we have a shortage of available housing if not because of a change in the way we utilise dwellings? Household composition is one possibility, but unlikely given how much it would have to have changed.

Also, yes, I agree "NZ is not Eire. Nor is Auckland like Dublin", but likewise, I don't believe NZ is particularly exceptional when it comes to the fundamental underlying issues.

-----------

Take total population divide by average household size and subtract from total dwellings then compare the result as a percentage of total dwellings for census data from 2001 and 2018.

2001: (1,515,639 - (3,737,346 / 2.7)) / 1,515,639 = 8.67% excess given population and average household size.

2018: (1,886,517 - (4,699,755 / 2.7)) / 1,886,517 = 7.73% excess given population and average household size.

-----------

Edit to add the same for Wellington City (to partially address your concern about aggregated data):

2018: (80,109 - (209,172 / 2.83)) / 80109 = 7.73%

I'm surprised that it's bang on the national figure.

"Also, yes, I agree "NZ is not Eire. Nor is Auckland like Dublin", but likewise, I don't believe NZ is particularly exceptional when it comes to the fundamental underlying issues."

Are you familiar with the differences in the planning rules, and building rules, between Auckland and Dublin? Or Cork and Wellington?

The fundamentals in my view are interest rates and tax incentives (in that order), for both of which Ireland and NZ share similarities. Interest rates are obvious, but also no capital gains on property in many cases.

Again though, I'm interested to hear what you think the cause of our shortage of available homes is given the relatively steady population to dwelling ratio for the first couple of decades this century?

I think it's highly unlikely that so many places in the anglosphere are suffering from the exact same problem caused by planning and building rules. Occam's razor suggests something they all have in common. In my view that is most likely to be cheap credit causing a global asset price inflation problem. That translates into a shortage of available housing because all of the many ways people might underutilise properties (i.e. use them for anything other than a primary residence) become much more feasible when low holding costs and capital gains negate the need to generate much (if any) income from a property. More second homes, more holiday homes, short term rentals, etc.

Anecdotally, of ten uncles and aunts, five (soon to be six) own more than one property. Of those second properties four (soon to be five) are not used by anyone as a primary residence. This would have been unheard of 30 years ago for people in their position. It has only been possible due to low interest rates and rapid rises in price/equity.

Government planning changes - though welcome and necessary for many good reasons - won't solve this problem alone. Higher interest rates are the primary cause and the best solution. As much as I dislike it, government policy can't be relied on. The market will solve this in its usual inconsiderate fashion. That is, unless more QE is on the horizon...

Whilst interest rates and tax incentives are driving factors - they didn't used to be. I bought my first and only home in 2000 at 2x income, 100% financed (with guarantor) at 7.5%. It's the size of the debt that is the problem. I think the common problem in the anglosphere is the financialisation of homes - the predominant narrative for twenty plus years is that houses are for making money and profit, not for homes. It may be used as a home in the meantime. Negative gearing and residential property investment wasn't really a thing in the 90's but was highly marketed from 2000 onwards. Governments also don't have the awareness how unrelated policies may encourage people in this direction either and nor do they wield any hindsight and just compound the problem.

The driving factor though is ultimately the collective greed/fear. And it seems most predominant in the Anglosphere.

My anecdote - 11 aunties and uncles (in their 60's and upwards) and none of them own a second property. My parents did from 2000 - 2015 for their retirement plans. I know one cousin who has an additional 2 properties geared towards the AirBnB market. Growing up I had one aunty and uncle who had a beach holiday home and it was utilised by many of the family over the years. They only sold it due to their own retirement and cost of living and none of their children could afford to keep it in the family.

Maybe that generation were just programmed differently and of course that programming varies across the generation.

I don't think the market can solve it and thinking it will is part of the delusion. I'm sure we've all seen the image of the Monopoly board resting on the backs of the people suggesting that all they need to do is rise up to end the game. Unfortunately too many of the people are heavily vested in the game.

I think it's highly unlikely that so many places in the anglosphere are suffering from the exact same problem caused by planning and building rules

Where places are the least affordable, there's a significant legislative barrier to new dwelling generation. Go to California, Vancouver, London or Sydney, and you're looking at a 12-24 month journey to build your new house, and significant cost - assuming your plans meet approval.

The rules may not be identical, but the commonality is that new housing is very unaffordable and cumbersome to generate. A combination of nimbyism, fears of liability by the various stakeholders, and likely a degree of unnecessary grift.

Maybe it's just coincidence that the sorts of costs for a new house lay at the extremes of what cheap credit can afford that sets the price. But the costs aren't coming down, higher rates are strangling new supply, and when the dust settles from whatever is going on with the OCR, new house building will be behind, and take a few years to come back on stream.

Another mythical 'Affordability' tale .... Meantime all and sundry are working thru and paying the price for the last much touted 'Affordable' surge where historically low interest rates and thick as plank fanatical buyers have bought this country to its knees . 5% OCR default....5% Stamp duty ... Remove rental supplements/subsidies . Clear too see market is anticipating a return to Low rates and fantasy prices.... This country simply cannot sustain another surge.... Lets keep Cash King .... and make credit available at a cost that inflicts pain on the user ....not the entire country....

Wasn't the last affordability surge in Christchurch post EQC? When there was a protracted and multi-faceted response to severe housing shortage?

That resulted in lower rent and price growth than the rest of the country, despite there being a large initial shock in demand.

More myth than fact....."Since the February 2011 earthquake, the greater Christchurch ... Housing costs, both house prices and rental costs, have increased in the greater Christchurch" ...MBIE "Housing pressure in Christchurch" a summary 2013

That's only 2 years after the quake that knocked out 10s of thousands of houses, and before widescale building.

Here's a 2023 report. In the late 2010s, Canterbury led the country in affordability.

https://www.google.com/url?sa=t&source=web&rct=j&opi=89978449&url=https…

Yes, but that affordability surge was preceded by a major drop as supply was lost. Rental affordability just settled back to where it was before the EQ - maybe a bit worse actually. You can see this clearly in the graph here. The rental affordability data on the HUD website is also worth a look.

Yeah, so you need to surge building, and not let up.

How about reducing demand by limiting the amount of people coming into the country. Could that work?

How about making it very cheap to subdivide any land, anywhere and sell it to whoever can meet the asking price... let the buyers choose the point in time they want to connect to services and pay for it when they choose to do so or when they can afford to. I would imagine theres plenty of folk presently in a bind that could do with some capital....but the subdivision costs make grabbing that capital very difficult. Its a survey and a few pegs they are after not a lifetime commitment...

Because the true cost of providing the true cost of the utilities falls on the ratepayers. It’s not just a bunch of pegs, that what caused the current problems.

Low density housing is not the solution.

What utilities would a bare patch of land need....? Let the costs come when the buyer makes a move on the land to develop not before. Feel free to send them a rates bill for their bare patch...they will pay their share.

Hi Hugh

Give an update on your new home build please?

It’s going well. Cladding is going on ant the mo. Anything specific you’d like to know?

Because the true cost of providing the true cost of the utilities falls on the ratepayers. It’s not just a bunch of pegs, that what caused the current problems.

Hard not to conclude though that councils are trying to cover their historic shortfalls by loading up the costs to alter land usage.

Thats funny , rural you put your own tanks in, sewage in, pay for power connection, ... then you pay rates to support councils providing these things in town

"How about reducing demand by limiting the amount of people coming into the country. Could that work?"

Yes it could. But the consequences in the shorter term are less than desirable. Consider the following:

Production = Land + Labor + Capital + Entrepreneurship.

If Labor is constrained, then for the same quantity of Production, one of the other factors needs to increase. NZ is recognized for having low productivity because we throw extra bodies at increasing production rather than increasing any of the other three - and most agree that the main one in which we're lacking is Capital. (Studies bear this out.)

Thus by constraining Labor - NZ businesses would need to invest (use Capital) to increase Production. (Note that it may not just be using money to buy new plant and machinery, it may also be paying for the training of workers.) NZ Inc's productivity would be forced to rise as it is measured on a per worker basis.

Alas - in the short term - almost all businesses in NZ would be forced (through a dearth of Entrepreneurship) to pay workers more and the wage / price spiral would result in inflation.

Gee, that labour's govt that achieved nothing, eh.

Nats played their part as well .... lol

Had me going for a minute there...

Happy April fools day everyone.

Especially if you are an EV owner.

How many of you have paid your RUC charges?

Very little in the media about this other than the Herald trying to convince us that they are all heavier than a double cab ute. I would say on average much lighter especially any that we eligible for the clean car rebate.

At a quick squizz the Model Y weights the same as a double cab Hilux.

I understand they wear out tyres at twice the rate of an ICE vehicle of a comparable size.

Depends how you drive. Where did you find this?

Not how you drive, but the weight of the vehicle. Also wearing out break pads faster. Both tyres and break pads creating more particle pollutants and emissions than a comparable ICE vehicle.

https://www.firstpost.com/tech/evs-more-polluting-worse-for-environment…

https://www.forbes.com/sites/jamesmorris/2023/06/24/more-efficient-less…

If you're using the mechanical brakes on an EV you're doing it wrong.

and they run over grannies who don't hear them coming , built by child labour using materials mined from endangered species by indigenous people who think they're making easter eggs, make people envious , and they not make cool vroom vroom sounds. also nearly impossible to lose traction for a sustained amount of time.

The brake pads last multiples longer because of the regenerative braking, 100,000 miles is often quoted.

As for the tyres the consensus among EV drivers is that how long they last depends on how heavy footed you are.

"Also wearing out break pads faster."

Look up how re-generative braking works.

And tires? Look up how much torque is instantly available with an EV/Hybrid in 'Sport' mode. It's staggering when compared to an ICE powered vehicle. If tires are an issue then slow down off the start line. (Me? I'm happy to pay for the tires just to feel the torque.)

You could just declare you get all your information from boomer book, then we'd what nonsense FUD you are about to regurgitate.

2 tyres after 58,000kms for me.

Disclaimer: N=1

42,000 for the rears, and about half through the fronts at that point. Not too bad really.

EV's eat tyres. There was a feed yesterday I read "Tyres are now the new oil change for EV's" A guy on there who drove it hard all the time went through his tires in 7500km. The potential acceleration and the weight of these EV's means they eat tires. I'm sure if you drive your Leaf like your nanna does then they will last just fine, but on a performance EV.....

And F1 tires don't even last an entire race. Sorry. What was your point again?

Oh. That if you use your street car like a racing car and treat the road like a racetrack (which are very smooth) you'll eat tires? Who'd have thought, ay? I hear drifting gets through tires fast too.

Leaf is 1500kg. Raptor 2500kg.

Leaf is 1500kg. Carolla 1000kg.

Comparing apples with apples.

And the most popular EVs in NZ are SUVs....

Are they? (LOL)

You know you could just Google the stuff instead of questioning me.

2024 YTD top 5 EVs

- Model Y

- BYD seal (admittedly a sedan, but definitely not a small car)

- Toyota BZ4x

- Ford Mustang Mach E

- BYD Atto 3

In 2023, the smallest, lightest electric car in the top 10 looks to be the MG4, 1750kgs.

The smartest use case for an electric passenger car would be a small, lightweight city car. The actual demand looks to be for larger heavier faux off-roaders.

Most are defined as "crossover" SUV. I.e. a passenger car chassis with a body pretending to be an SUV.

Wikipedia defines them thus:

A crossover, crossover SUV, or crossover utility vehicle (CUV) is a type of automobile with an increased ride height that is built on unibody chassis construction shared with passenger cars, as opposed to traditional sport utility vehicles (SUV), which are built on a body-on-frame chassis construction similar to pickup trucks.

https://en.wikipedia.org/wiki/Crossover_(automobile)

So is a "crossover SUV" an SUV? Not really. J

Ah, so a semantic debate over what constitutes an SUV. The string I was replying to was comparing conventional hatchbacks. These "whatever you want to define them" have up to a good half a ton weigh premium over something like a Leaf.

They're oversized, overweight fashion items rather than a genuine attempt at delivering some reasonable sort of efficiency. Something like a Kei car, for instance.

Corolla Hatch GX Hybrid which I think most new ones are.

Kerb weight total minimum 1370kg.

My 1959 VW weighs about 850 kgs and doesnt scream at me when I go gung ho without a seatbelt.

And a corolla is lighter than a leaf.

EVs are heavier than an equivalent ICE, it's not up for debate.

Wonder how many councils are demanding that all new builds be on poles in flood prone zones? Wonder how many councils are allowing swamps to be drained/ in filled but not requiring house lifts? We keep making the same mistakes with builds and there is no excuse for it .... Where is the buyer beware if folk can trot off to the council and seek reimbursement for later defects that builders/designers should be held accountable for ? Remove council liability ...it was fit and proper on the day it was completed ...the risk stays with the purchaser...builder...designer...

Umm errrr you seem to have totally missed infrastructure costs. They have sky rocketed. No just council but the monopolies are having a good time too.

A good idea if you got out and looked at it around all of the different areas where you take a lot of money.

Layers and layers of nonsense ... months to years of back and forth jabbering...just to buy Bobs front lawn....its tyranny....

The now dumped RMA changes (the Natural and Built Environments Act) made provision for that kind of single section subdivision (i.e., one lot to two) to be a permitted activity (under a new schedule in the Act) - hence no resource consent needed.

https://www.interest.co.nz/public-policy/118581/katharine-moody-casts-e…

AC loves to take credit for a unitary plan they tried their hardest to prevent. Their original plan had almost no density in the central suburbs, the government had to intervene. And even the final plan has all the density in the wrong places so the special / heritage / leafy / rich areas are immune.

In addition if the unitary plan has made such a difference to house prices, doesn’t that mean AC caused all this mess, all those years prior where they didn’t allow people to build anything?

Building cost

I'm currently in Oz & visited a street of show homes in a new subdivision yesterday

This 255m2 - 4brm, 2 bath, 3 living home was advertised house only price AUD256,100.

$1000/m2

https://coralhomes.com.au/house-and-land/highlands-255q-covella-lot-601…

So a section an hours drive from Brissie is 700 grand?

The average build cost in Queensland is north of 2 grand a square.

Looking around SE Queensland I'd estimate that average land costs are approximately double the house only build cost.

I'd also say that most new builds I saw would be between $300-400k - for a massive house. Also a lot more std inclusions eg landscaping solar. Well under half NZ build cost.

In the instance you showed, the land cost is triple the build, which seems a lot for a piece of dirt on the outskirts. Where I am, the build cost is double the land cost.

Potentially the "house only" cost is being heavily subsidized by a high land cost.

Cross subsidies may happen however we were told that the house only prices applied to our own section if we had one (within a certain km range)

Problem is in NZ its closer to $5k per sqm. At $2k per sqm we would be building a lot more houses...

It's currently around 3 grand a square for a housing company style house. In QE, the minimum is 2, but realistically today more than that, and Queensland doesn't have the same regulatory requirements.

Yes, let's free-up land, planning rules, and build absolutely loads more houses. Yes, we need to move away from dad and son outfits to serious-scale residential building companies. All good.

But, I get nervous about the results of that Auckland study - particularly in relation to the impact of upzoning on rental affordability. Auckland is a big, private-sector heavy metropolis, with a population and wages that boom and bust with economic cycles. This means that Auckland rents increase at a faster rate than other places during economic upturns, and moderate more quickly during downturns. The study did not really allow for this.

For example, compare Auckland and Wellington rents (over a longer period than the selective graph above). See how Auckland and Wellington rents drift apart during upturns, and converge back together during downturns (note Auckland lockdowns in 2021). Now, when did upzoning happen? Yep, 2016 - at what appears to be the peak of the economic cycle (between GFC and COVID). You can get the same miraculous result if you start your indexing at the peak of the pre-GFC economic cycle (2004).

Now, I am not saying that upzoning and building more houses won't make any difference to rents - just that the scale of building would have to be off the scale to stop rents rising to the most people can afford to pay. So, what to do? Govt need to support the development / construction sector directly / financially to build good quality, warm homes at an 'off the scale' pace for the next 20 years. Underwrite them, do the deals, let them take a decent margin. Buy Fletchers building materials out, take over some construction companies, nationalise property management companies - do everything! In the mean time, cap rent increases at 3% per annum and back Kainga Ora to buy landlords out if needed... because this is going to take many years.

It is definitely a process that'll be a decade in the making, assuming there's the political will.

The government doesn't need to be the supplier or builder though. We did this in the 50s/60s, essentially what you need to do is:

- unified designs/materials

- a handful of nominated contractors and suppliers at a set rate

- as little impedance as possible to get it done (regulatory)

Instead currently much of our building is peacemeal, bespoke, and cumbersome. You should be able to want a house, order one, and move in within months.

Yes, the threat of Govt involvement might be enough, and public works dept for supporting infra might still be needed. Govt also provided a lot of cheap credit (effectively interest free) in the 50s and 60s of course.

The problem as I see it with a rent increase cap - is that we'd be capping them at an already unaffordable rate - over $2 billion+ per annum unaffordable if we simply look at the accommodation supplement costs as a metric.

If the government is serious about cost savings and at the same time bringing cost of living down - easy solution.

Do you not see the the contradiction in what you and others are saying?

You say free up things like land supply and yet go full commie on who gets to build them.

Yet, the most affordable housing jurisdictions free up the land AND also who can build.

Not what I said! Go full *everything* at building houses - public, private, upzoning, everything. We have done this before!

Or maybe the National Govt in the 1950s were communists?!?

You said 'get rid of Dad and son builders.'

Why would you need to artificially exclude them from the market, when if you allowed a more free market, it would be up to the market to chose who they built with, large or small?

In true free market jurisdictions, land developers are also the bulk builders and the Dad and Son operations do everything from reno's to bespoke.

That's not what was meant.

I read that to mean we need more building companies that can build more of what we need. I.e. with the capability and where-with-all to successfully build apartment buildings and non-terraced house multi-unit dwellings. Dad and son operations usually don't have this capability although they are often subbies on such developments.

Yes, that's right, thanks. The issue here as Aus, NZ, UK etc found throughout the late 40s and 50s is that getting house building really motoring requires a fundamental focus on the whole supply chain - skills development, flow of imported materials, domestic production, land, regulation, research etc. When NZ was building several times more houses per capita in the early 50s, the Govt was still holding crisis conferences with key industry players about the lack of progress!

"This means that Auckland rents increase at a faster rate than other places during economic upturns, and moderate more quickly during downturns."

Various recent studies have confirmed than rental price growth (and to lesser degree rental availability) are more aligned to wages / disposable incomes. So wouldn't Auckland wages - which in aggregate expand and contract more than Wellington - explain that same phenomena, or at least part of it?

If correct, that rental prices are more aligned to wage growth, then we have a different problem that a willy-nilly increase in supply may not necessarily fix - especially if the new building is at the edges. The problem could be defined as: Why are people prepared to pay so much of their disposable incomes on rents? (It seems a simple question but the demand and supply factors are far more complex than the simplicity of the question suggests.)

"... just that the scale of building would have to be off the scale to stop rents rising to the most people can afford to pay."

It would need to be "off the scale" - but in the right places, and of the right dwelling types. And I'd note that by that time, the dwellings that were not in the right place and of the right type would be either 'going for a song', empty, inhabited by squatters, or derelict. (USA, and to a lesser extent the UK, are awash with examples of this phenomena.)

Getting the right types of dwellings, in the right place, at the right time, to meet with the various incomes of people needing to rent (or buy) is extremely difficult when we've created a planning environment that is massively resistant to change.

Or put another way - we simply don't have a culture of constant urban renewal in this country. It is a massive problem.

On wages vs population vs economic cycle explanations. Yes, they're connected in my view. When Auckland economy picks up, jobs and wages go up, people move into the city for work (demand) and the *cohort of people* looking for a rental property within *a given time period* is willing to pay more. A group of 6 temp migrants working in tech and willing to use the lounge as a bedroom will outbid a local family etc.

So, if you plot changes in rental affordability against changes in population, wages, household income etc you get a nice match.

Need to add another 37,000+ residents of new arriving migrants to Auckland alone. Auckland Council relies on new ratepayers/renter every year.

For all the education that goes into 'crunching' the numbers it still promotes a system that gives us circa 8 to 10x median income multiples.

Yes upzoning helps supply but to say that it also makes housing more affordable when it is only making them smaller at almost twice the $m2 rate of a free standing buikd is a false equivalency.

Density is not a proxy for affordability anywhere in the world.

The solution is to remove restrictions in the system that cause monopolistic speculative behaviour starting with land use policies (up and out), immediately followed by council consenting, and other entity restrictions like worst case CC change modeling, and Infrastructure monopoly suppliers.

"Density is not a proxy for affordability anywhere in the world."

In the long term, you are completely correct. In the short and medium term it's not correct because adding dwellings in desirable locations, where none used to exists, changes the market dynamics substantially - not only in that location, but other locations as well.

Across any term - it is about where people want to live first - and what they can afford comes second. That sound odd but try this scenario: I can afford $1,000 per week, and I want to put down roots, and my choices are a house in South Auckland vs. a house on Auckland's North Shore.

They say there are three rules in property. They're not wrong.

But they are not being added in desirable locations anymore than any other location.

The more density is more a sign of trying to meet an affordability point as much as location.

Its time to start to put "Houses" into classifications before a caravan or an old bus on a section you are struggling to pay for becomes a "House" and I'm not joking I have actually seen a bus on blocks to try and get it level on a section out the back of Orewa years ago. This all ties in with the claimed "Affordability" because those sardine tins they are building now are hardly 4 bedroom houses on 500-600sqm of land are they ? All this "Low Cost" housing is stuffing up the figures used to do the affordability calculations.

Still common around Turangi

That's why the REINZ HPI is considered the 'gold standard' ... It adjusts to compare like with like.

That's quite an elaborate April fools day article.

Thanks Gary. Great stuff. Let's hope PC78 continues the momentum.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.