Guest

Latest articles

How do the Australian and New Zealand retirement income systems compare? The NZIER takes a look

[sponsored]

With interest rates peaked and central banks easing, now is an optimal time to invest while it is still a buyers market

7th Nov 24, 10:43am

by Guest

With interest rates peaked and central banks easing, now is an optimal time to invest while it is still a buyers market

Angela Huyue Zhang warns that if the US doubles down on aggressive policies, it risks becoming defined by what it opposes

No, America’s battery plant boom isn’t going bust – construction is on track for the biggest factories, with over 23,000 jobs planned

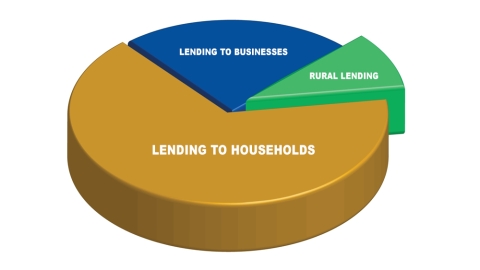

As MPs probe bank competition, Andrew Laming calls for an honest discussion on how capital allocation drivers are set

2023 election study: What voters really wanted, and why the coalition’s mandate could be fragile

The scale of fraud against seniors is huge, and still growing; Annie Lecompte explains why

Raghuram Rajan explains how the IMF as the world's financial backstop, must change if it is to remain effective

Increased investor risk-taking could fuel vulnerabilities, warns the IMF

The IMF says world growth is projected to hold steady, but amid weakening prospects and rising threats, the world needs a shift in policy gears

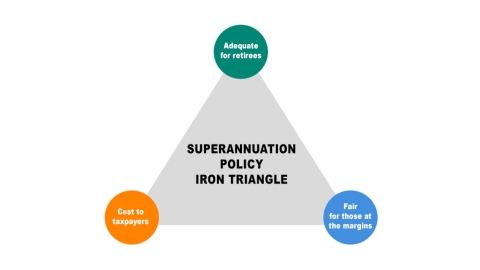

Patrick Nolan says that as we finally get serious about reforming our superannuations system (as the claimant level rises sharply), we will have to face up to some serious trade-offs, and make hard choices

The changing face of China’s animal protein market – four key trends set to shape future of consumption

Mona Krewel and Jack Vowles examine how New Zealanders feel about political party funding

Can NZ’s supply chain build enough resilience and sustainability to survive the next global crisis?

Preventing falls: Google Street View offers a quick way to assess risks for older New Zealanders

Jim O'Neill thinks the grouping continues to show that it serves no purpose beyond generating symbolic political gestures

Eswar Prasad looks beyond promising headline trends to identify deep-seated risks and barriers to growth

The IMF notes that the recent inflation surge followed a unique disruption to the global economy, but it still offers important lessons for central banks

The IMF says elevated risks to public debt call for enduring and carefully designed fiscal adjustments

AI-driven trading could lead to faster and more efficient markets, but also higher trading volumes and greater volatility in times of stress, says the IMF

19th Oct 24, 8:45am

by Guest

AI-driven trading could lead to faster and more efficient markets, but also higher trading volumes and greater volatility in times of stress, says the IMF

The World Gold Council explains why gold’s long-term return has been and will likely remain, well above inflation

Huang Yiping shows how Chinese industry and capital can accelerate the green transition in developing countries

Clues left by the Alpine Fault’s last big quake reveal its direction – this will help NZ prepare for the inevitable next rupture

Yi Fuxian argues China's efforts to mitigate the effects of rapid demographic ageing are too little, too late

Timothy Welch says Winston Peters’ $100 billion infrastructure fund is the right idea. Politics-as-usual is the problem