Guest

Latest articles

More people describe their financial position as uncomfortable, and more are worried about their finances from pay to pay. It is increasing for those who have a mortgage, but remains the highest for renters, reports Patrick Nolan

Nouriel Roubini and Stephen Miran see a debt-issuance strategy at the US Treasury that is working at cross-purposes with the American central bank

Adam Posen worries that financial markets and some US Federal Reserve officials are misassessing the effects of policy-rate hikes

The IMF notes crypto mining and data centres now account for 2 per cent of global electricity use and nearly 1 per cent of global emissions, and their footprint is growing

It took a court case by the US Department of Justice to challenge Google’s monopoly, and we have yet to hear what might replace it, Katharina Pistor says

Disruption lies in empowering non-bank lenders to compete, not just making four major banks five, Lyn McMorran argues

Corpay's Peter Dragicevich explains why there are more headwinds than tailwinds ahead for the NZ dollar, suggesting the dwindling yield advantage will ultimately act as a handbrake

AI pioneers want bots to replace human teachers – here’s why that’s unlikely

NZ’s electricity market is a mess. Rolling out rooftop solar would change the game, Stephen Poletti, Bruce Mountain & Geoff Bertram say

Real-time crime centres are transforming policing – a criminologist explains how these advanced surveillance systems work

Diane Kraal argues Australia is missing the opportunity to fairly tax things that can only be extracted once, to the detriment of the community

Air New Zealand won’t be the last company to miss its climate goals – here’s why

Using AI technology to balance power usage can make mains grids more stable and reliable, Zoltan Nagy says

NZ is running out of gas, literally. That’s good for the climate, but bad news for the economy, David Dempsey, Jannik Haas & Rebecca Peer say

NikkoAM's Fergus McDonald says as interest rates start tracking lower, bond investor smiles will widen. But returns in other sectors should improve too

13th Aug 24, 10:09am

by Guest

NikkoAM's Fergus McDonald says as interest rates start tracking lower, bond investor smiles will widen. But returns in other sectors should improve too

David Cunningham calls for an end to a consensus-based approach in RBNZ Monetary Policy Committee decision making, and more independent committee members

Women are less interested in AI than men, but using it would help them advance at work

Hippolyte Fofack shows how interest rate differentials are stocking exchange rate volatility in rich countries

10th Aug 24, 10:18am

by Guest

Hippolyte Fofack shows how interest rate differentials are stocking exchange rate volatility in rich countries

Corpay's Peter Dragicevich explains why the recent enthusiastic firming of the NZD may not last, including because our links to Asian trade will be a constraining factor

New Zealand needs to be realistic about the clean energy potential of green hydrogen, Ian Mason and Robert McLachlan say

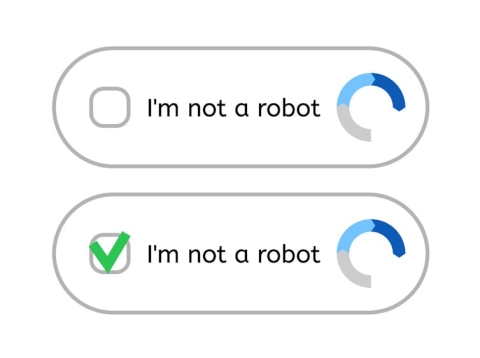

Traditional CAPTCHAs are becoming less effective in the AI era, Tam Nguyễn says

José Antonio Ocampo is cautiously optimistic about ongoing efforts to boost tax revenues from multinationals and the ultra-wealthy

Huang Yiping warns that Chinese local governments are now the greatest source of market distortion and financial risk in the country

Patrick Nolan says with the 'golden assumption' breaking down quickly now, policymakers will need to turn their attention to why it is so hard for many more people to retire without poverty. A social investment approach is one answer

Joseph Stiglitz highlights four inflation risks if there is another US Trump Administration, explains what US Republicans get wrong about freedom, identifies the principles that should guide a post-neoliberal agenda, & more