Kiwibank is reporting a 16% rise in half year profits to $64 million compared with $55 million a year ago.

Chief executive Steve Jurkovich said the bank recorded improvements across all key internal financial metrics and outperformed the market in home loan and business banking growth, meaning it grew at a faster rate than the banking industry as a whole.

There's no reference in the result announcement to the possible looming ownership shake-up of Kiwibank's parent company Kiwi Group Holdings.

It gave these highlights:

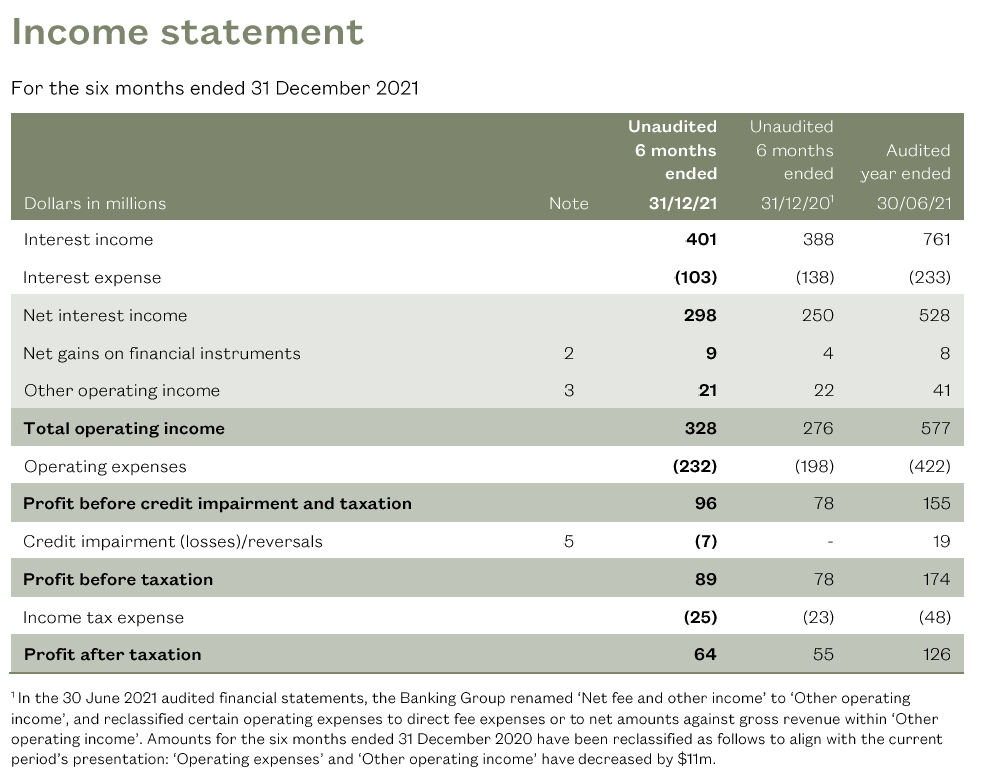

- NPAT $64m, up 16% from $55m in HY21

- NPBT $89m, up 14% from $78m in HY21

- Revenue $328m, up 19% from $276m in HY21

- Cost to income falls to 70.7%, from 71.7% in HY21

- Net interest margin 2.04%, from 1.94% in HY21

- Lending growth $1.9b, up 20% from $1.6b in HY21

- Net deposit growth $1.4b, up 10% from $1.3b HY21

- Investment in technology remains a strategic priority to improve scalability for future growth, with $50m spent during the period, broadly double the investment in the prior year

The bank's half-year disclosure statement is here.

"Total lending growth of $1.9b for the half (up 20% on the prior period) was driven by the strong housing market and solid demand, with above market growth from our continued focus on the expansion of adviser channels," Jurkovich said.

He said after a year of strong growth, the bank was forecasting a period of consolidation in the housing market and acknowledged the possibility of modest price falls.

"A number of factors are at play including expected increases to the Official Cash Rate, tighter lending restrictions (including LVRs, DTIs and CCCFA), and an increased supply of new homes.

"We remain committed to supporting Kiwi to get into homes while ensuring they have the means to meet their repayment obligations. We’ll be working with customers to understand what this looks like and the options available to them in this changing environment," he said.

"This strong result is due to our strategy which balances purpose and performance, and is driving more savers, homeowners and businesses to choose to bank with the largest New Zealand-owned bank," Jurkovich said.

He said business banking growth was "flat" on the prior half, "but well above the rest of the market". This was due to a refreshed strategy focused on key customer segments and high demand from the business sector to work with a trusted New Zealand brand.

“At the same time, we continued to make good progress on initiatives to improve customer experience, while doing everything we can to ensure we strengthen the fundamentals of our products and customer service with a determination to be safe, reliable, and available.”

You can compare Kiwibank's financial data with any other New Zealand retail bank here.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.