New data from the Reserve Bank (C33) reveals the average size of mortgages being granted and the level of switching that customers do between banks.

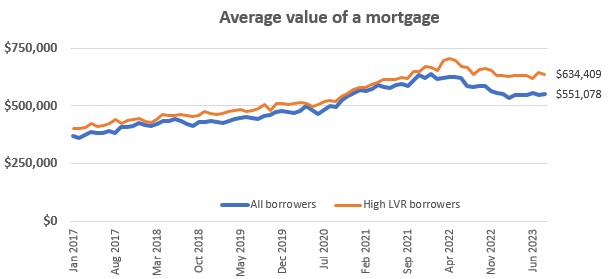

The release of the number of loans involved is the new bit, enabling us to track the average borrowing, not only for all borrowers, but for high LVR (loan to value ratio) borrowers as well.

And in turn that reveals borrowers have been reducing their obligations to banks. They topped out at an average of $637,300 per loan in January 2022. But in the 20 months since, this average has fallen to $551,100. That is more than a 13% fall in just 20 months.

After a long period of increases, since this data series began in 2017 but probably well before that, borrowers are restraining their appetite for taking on larger housing loan obligations. Perhaps they reached the limit of their financial capability, and were looking forward to much higher rates and therefore higher repayment obligations, with concern. They have certainly acted like that.

High LVR borrowers are more aggressive with how much they borrowed; presumably many of these are first home buyers who are stretching to get into home ownership. But they too have plateaued and also seem to have limits..

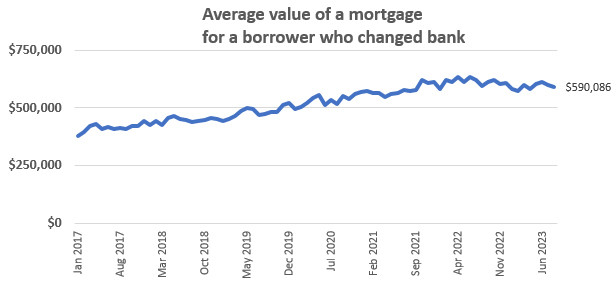

And the data allows us to look at another interesting group - those who changed banks. These people have higher loans ...

... but the much smaller group with high LVR loans that change banks do really have very much higher loans. At August, their loans averaged $750,000 each for the 20 borrowers involved.

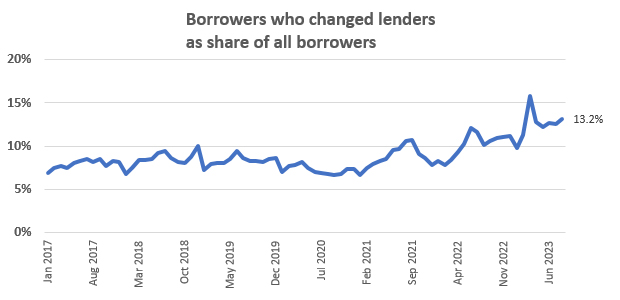

Switching banks is gradually becoming more popular

Among all borrowers, the frequency of changing banks is rising.

One in eight property purchase borrowers do so with a different bank than the last time. On average, every month 1830 of these borrowers have responded to the offer of a different bank. That is a lot of business chased to a successful switch; $3.8 billion per month.

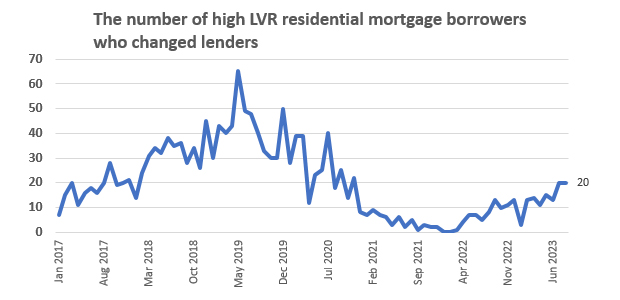

But banks have never really chased high LVR borrowers. Until the onset of the pandemic there was a minor amount of this activity - the most for any month was for just 65 loans nationwide. But the pandemic saw the end of that activity and there were two months where no bank took on a switching client who had a high LVR loan. Now the pandemic period has ended, and interest rates are rising, this corner of the mortgage market has hardly recovered. In August there were only 20 of these loans switching.

There are lots of disadvantages for being a high LVR borrower, including suffering 'standard' interest rates, often enduring low equity premiums, not to mention extra scrutiny of your finances. Once you clear those hurdles, it seems either borrowers are too gun-shy to try and change banks, or alternative banks are wary about the real motivations you may have for wanting to switch at that point.

On the other hand, there are lots of very good financial reasons for wanting to pay down a home loan as quickly as you can afford. Just know it is rare and potentially rough waters if you are thinking of changing banks when you have a high loan to value ratio.

*This article was first published in our email for paying subscribers. See here for more details and how to subscribe.

14 Comments

As posted before, it's not that people don't want to buy houses, they cant meet the the financial reality. Inflation still pumping, rates HFL and Winston retaining FBB.

Speculative leverage, roll the dice....

It's not just the sheer size of the nominal loan. You also have to think about the psychological effects like loss aversion. The greater the amount owing, the more sensitive people will be to flat or falling prices. It's like a party of drunken sailors when a couple are arrested. The party carries on but the sailors start to get concerned that the booze is about to be cut off or something might happen and they won't make it back to the ship. That potentially represents a world of trouble.

It's all good ! ....it's got to the point that if prices really do fall further, it will be a sign that the economy is about to tank !....While with everything else going on OUTSIDE Aotearoa, let us all pray for a stabilised property market ....as that seems to be what keeps Auckland (at least) going.

Just listen to the sage advice from our beloved property expert, a Mr T. Alexander - nothing to see here, just relax and KEEP BORROWING (Key point - pardon the pun) and who cares about interest rates - just raise ya rents !! The taxpayer will chip with extra accommodation supplement - no worries mates !

Don't forget the Property Hour on Satdee arvo's on ZB - that will allay ALL your fears with comments from the above, Mr T.A. and other assorted property "experts"....you will all experience "warm fuzzies" after that show :) - absolutely compulsive listening !

C'mon us taxpayers are relying on you PI's to keep this circus going - get out there and buy, buy, buy !! You know in your heart of hearts, you have NOTHING to lose and everything to gain in the most "fair & balanced" property market in the world !

Everyone has got your back and is supporting you and the banks need the cash flow ! So extract as much as possible from your Ten-Ants ( as that is the number of them you will have)

I'll chip in my share of the accommodation supplement with my taxpayer $$$'s - while the banks will smugly sit back in their leather bound chairs and smirk, as they reach record profits - yet again !

We need sales, sales, sales !! ....you RE agents do you part and "MAX MARKET" properties with dreams of endless capital gains and ever increasing rents, due to the endless stream of immigrants to this great, "world class" cosmopolitan city - all equating to YOUR FINANCIAL FREEDOM for ever and eternity !!!

If I was a bit younger, I would be out there buying all I could see, and beyond - sight unseen even !! So don't make the mistake I made by missing this opportunity in this fantastic Auckland market, that represents so much value for your borrowed $$$'s and endless rental return's, topped up by the taxpayer :)

What are you waiting for ???

*** NOT FINANCIAL ADVICE *** *** DO YOUR OWN RESEARCH ***

Chief economists are all property spruikers?

“I say to people, ‘Buy anything and buy it early to get on the ladder’. Worst case, if you bought cheap in your 20s, by your 60s you’ll have paid it off; best case is you’ve leveraged and have traded up.”

https://www.oneroof.co.nz/news/do-australian-first-home-buyers-really-w…

https://www.thepost.co.nz/a/politics/350088591/more-20-mps-rent-back-th…

CAPITALS, bold and italic ! Wow it must be IMPORTANT ! (there's still an underline option for your next post)

interest rates start to squeeze both buyer and seller. yay! be quick, market crash!

Interest rates won't crash the market, but a GFC next year (if it happens) could do that. Ironically, interest rates would then come down.

Otherwise, we are looking at a flat market for the next 12 months or so.

In the words of Manuel, Que ? So low interest rates light a fire under the market but high interest rates flatten it... sounds reasonable

At the end of the day, those who can afford can afford regardless and those who can’t will be locked out of the market thanks to high interest rate.

Mr. Ice may differ to this article... as I stated, with the cost of borrowing going up, it'll put downward pressure on house prices

There would be multiple factors in housing market. Higher interest rate is a downward pressure when it's going up, but when interest rate becomes static, it's actually not a downward pressure anymore, as it's static.

the only moving bit in the housing market is migration increasing rapidly, and there'll be a new government and a new tax settings for housing market.

Is this the mean or the median average?

dp

Great article, very informative !

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.