Long end bond and wholesale rates are falling fast. The pace of the drop picked up today as markets absorbed what the tamer US inflation data will mean.

In the US, their ten year benchmark bond rate (UST 10yr) has now fallen to 3.45% and its lowest since September 2022. The UST 2yr equivalent is now at 4.14%. That is a negative rate curve larger than anything we have seen in more than 40 years, since 1981.

Persistent negative rate curves are often precursors to recessions. Most analysts, even central banks, do see recession conditions ahead as the battle for control over resurgent inflation goes on.

Locally, we have reached an historic point with our rate curves. Our NZGB 10 year rate fell sharply today, now down to 4.07%. That is a -51 bps retreat just since the start of 2023. Recall it rose very quickly in December, from a low on December 5 of just 4.00%. It has been yawing up and down in that range since September 2022.

But its variation from our two year rate has been growing and is now negative by almost -50 bps.

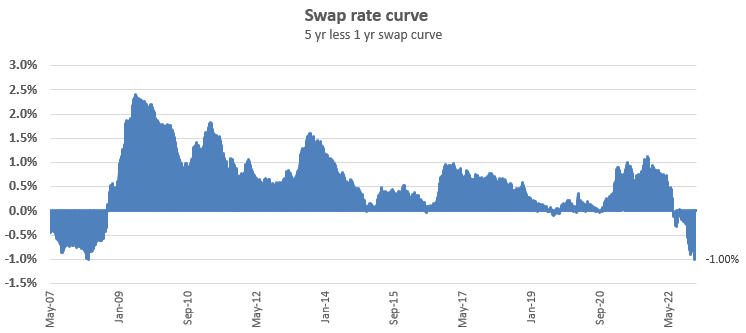

However, in wholesale swap markets, the inversion is now well above that, and very likely to exceed -75 bps today. Since we have been monitoring the 2-10 swap curve starting in 2007, it has never before blown out to more than a negative -100 bps before, but it did reach more than -90 bps in the middle of December 2022.

Wholesale interest rates are influential for mortgage pricing. Obviously we don't have 10 year mortgage rate offers in New Zealand, but we do have five year offers.

The 1-5 year inversion is now at its record low of -100 bps, and very likely to push through to new territory later today. Update: it ended today at -104 bps, a new all-time record low.

The last time we were in this position was in February 2008.

And the last time the RBNZ OCR was at about the current level was in January 2009.

This is how mortgage interest rates compared then.

| Bank averages | Floating | 1 yr | 2yr | 3yr | 4yr | 5yr |

| % | % | % | % | % | % | |

| February 2008 | 10.36 | 9.76 | 9.47 | 9.24 | 9.10 | 8.92 |

| January 2009 | 7.42 | 6.68 | 6.83 | 7.02 | 7.08 | 7.07 |

| January 2023 | 7.64 | 6.36 | 6.58 | 6.64 | 6.91 | 6.96 |

Current average bank mortgage rate levels are not too dissimilar to the 2009 levels when the OCR was at a similar level.

But the rate curve history suggests that there could be a shift down in fixed five year mortgage rates on the way if history is any guide. In 2008 when we had a similar inverted rate curve, five year rates were -50 bps lower than two year rates. Currently ours are +40 bps higher. That suggests there may be as much as 90 bps that could shift lower over the next few months if the inversion stays as it has suddenly become. That is a big 'if'. Clearly banks will wait for two things to play out - that the inversion stays, and that competitive pressures compel them to move.

Wholesale rates are not the only factor in where retail mortgage rates are pitched and wholesale rates are only influential for the main banks who source wholesale funds. Most of our smaller banks rely on retail funds for mortgage lending. If long term rates do move down (and it is no certainty), it will almost certainly drag longer term deposit rate offers lower with them.

The idea than this rate inversion will linger doesn't have a strong historical track record to back it up however. When we last hit the -100 bps inversion, it was unwound rather quickly. In that case, regulatory action kicked in to weigh against the 2008-2012 recession. The situation turned sharply the other way, as you can see from the chart above.

57 Comments

The Recession has arrived.

The bond market thinks the recession is coming. Not sure it's here just yet.

Actually the good times are almost here. Headline inflation numbers are set to tumble allowing central banks to cut rates sharply, in time for most consumers to avoid any sustained pain.

I think it will be the end of year at least before we see rates below where they are now. The 1y swap went up over Christmas and all the curves are peaking in July at the earliest.

I'm still seeing massive inflation at the supermarket (lack of specials especially) and in my monthly expenses.

Agree. Or maybe even first quarter next year

And even when it does it's only going expected to be a 1-2% reduction.

Some people out there might believe central banks can crash the economy and cycle back to ZIRP/NIRP but then we just end up back here and I don't think geopolitics will allow it next time.

Again, I agree. I think retail rates will be around 4.5% come late 2024, maybe down to 3.5-4% if the recession is a bad one and inflation nudges back under 3%. I think the new norm, or the neutral rate, will be an OCR of 2.5-3%.

What happened to May Day?

I never said interest rates would be cut in May.

May was my prediction for when the shit would have hit the fan for the economy, and when inflation is sub 4% (on an annual basis).

If inflation has dropped to 4% and the economy is in the shit, why would RBNZ wait an entire year before lowering OCR? Even just the probability of the OCR being lowered would drop market rates quite a lot, particularly the 2 and 3 year.

At some stage the RBNZ would have to consider it’s full employment mandate if inflation is mostly under control. That is the good thing about that mandate, without it the RBNZ could strangle the crap out of economy just to get inflation down from four to two percent.

Because 4% is still well above it’s inflation mandate and If it’s becoming evident around May that the shit is hitting the fan then I still think there will be a pause before they cut.

especially as I don’t think unemployment will skyrocket. Unemployment is a big part of their mandate and if it’s still low then I don’t think that gives them the mandate to cut the OCR if inflation is still 3.5-4%.

come late in the year unemployment might be climbing above 4.5% and inflation might be down around 3%, at that point they might feel they should cut.

There’s also an election too, and that might be another impetus to cut, as I don’t for a moment believe the RBNZ is truly independent…

The RBNZ needs to be proactive not reactive. If inflation is trending down fast from 7% to 4% and unemployment is trending up (or at least predicted to do so if economy in the shit), they probably wouldn’t wait. But even if they did wait, market interest rates are set by projections not the current OCR, particularly the 2 year and 3 year rates.

To be fair anything could happen though.

Actually the good times are almost here. Headline inflation numbers are set to tumble allowing central banks to cut rates sharply, in time for most consumers to avoid any sustained pain.

You think so? Is this a 'back to normal' prediction? While I agree that CPI inflation might subside and central banks may cut, not sure I buy into the 'she'll be right' narrative.

I wonder if he’s being Sarc? If he isn’t his views have changed massively in the space of 1-2 months!

Definitely no sarcasm. This is a very atypical economic phase, I've never seen anything like it. I predicted house prices 30 to 50% lower from peak, that is now likely to be 15 to 30%. Zero unemployment and above inflation pay rises no one here predicted, it is very unorthodox.

Maybe good times is a bit bullish, but we are going to weather this a lot better than the gloomsters would like. There will be very few distressed sales and the paper losses will be recouped over the next 3 2 to 3 years.

You have to admit that’s a massive change to your position within 1-2 months. But fair enough!

A very small minority of us commenting on this website have been bearish on interest rates. Will we be correct?

Oh yes. My decision to fix for 6 months 4 months ago is looking slightly less crazy.

As is my decision to fix for 18 months two months ago

I'm hoping that when my 5 year fix in December 2021 comes up for renewal, rates find themselves back to where they were (or lower). Insulated from the worst of it.

That was a great call to fix for 5 years in December ‘21.

Pushed my partner to go 5 in Nov 21 but she only went 3 but maybe just maybe that will see her past the peak, probably not.

I am just pleased my wife lets me sort all this stuff

Such a great call that you could call him Tony...

Hard to see them ever being lower than that. Literally once in a generation low in 20/21. Might take the property market a while to fully comprehend (and price) that

Don't think it'll trickle through to retail quite that quick, 6 months might have been a bit optimistic.

Yes, agreed. I will be tempted to let it float for a bit though. I'll dust down the spreadsheet.

No problem looking at the past to see what might eventuate, but when was the last time we were 'recovering' from global 0% interest rates? I think that answer is - never.

Until we have positive real interest rates again, then whatever we hope for or see might be in error.

https://www.visualcapitalist.com/the-history-of-interest-rates-over-670…

Bugger it. I have to sell and I have to buy something else to live in. I can't wait around longer than I already have. It goes against my better judgement but I can't put my life on hold waiting for the country to decide whether it's all in on property as our defacto retirement scheme, or it wants to intervene in a logcial way instead of just letting owner occupiers get decimated by negative equity. Some clocks tick their tock no matter what the prevailing economic situation is.

Well you could buy and rent somewhere to live in if you think you will be buying back in cheaper. Be aware that banks may have different ideas on your buying power in this "worse off" economic future scenario, i.e, you might get locked out, assuming you need a mortgage that is.

The main exercise is upgrading for school zones and a bigger family home to accommodate a possibly growing family at some point in the future - so it's a move I have to make, renting or otherwise. I'd rather not end up with kids bouncing around schools or driving across Auckland if rentals start selling from underneath should investors exit en masse - and as you say, there'd be no guarantee you could buy on the other side.

As far as I can see, the biggest and most immediate medium term risk is that values drop by enough from where they are now that 80% LVRs become an issue upon refinancing. For us to get in trouble, it would warrant the kind of drop that would trigger official intervention long before we got there, but given the chaotic energy of central banking these days, I can easily imagine a situation like the 1990s emerging for a number of reasons.

Ultimately I think the long-term nature of our purchase (e.g. a family home we'd be alright being stuck with) and the benefits that would flow from owning over renting (stability, schools, being able to plan around earnings to try and recover ground if things unwind) still means that it's not a financially suicidal move - but it does make me extremely apprehensive and cautious. But that's millennial life I guess.

Doesn't it even out? If your selling , you get less but you can also buy another for less? As far as i can see , the only people who really lose out are those selling and not buying another house.

well perhaps they are the winners .. sell now buy again in 5 yrs .. just saying

I know a couple of people that bought, bridged, and waiting to sell their original place (been on market 6 weeks). They could well loose.one asking dropped $40,000 so far. Plus the bridging cost.

As far as I can see, the biggest and most immediate medium term risk is that values drop by enough from where they are now that 80% LVRs become an issue upon refinancing. For us to get in trouble, it would warrant the kind of drop that would trigger official intervention long before we got there....

That was one deciding factor when we upgraded. We have a decent buffer and mortgage payments are comfortable, but we still have limits. Others will be in pain well before we are, and the Government may have to step in.

A bit like what they did with SCF's $1.7b bail out. $1.7b would reduce the mortgage balance of 17,000 households by $100k. Oh, wait, moral hazard only applies to grey haired investors.

Divorce?

The last significant inflation spike, starting in 1971 with an inflation over 10%, was tamed only after 20 years, in around 1990. (New Zealand Inflation Rate 1960-2023 | MacroTrends ).

It is a heroically optimistic assumption to hope that the current worldwide spike in inflation will be tamed by only a short-term increase in rates, and that everything is going to be OK (especially considering that the current spike is driven by many factors, including a general supply shock, de-globalization trends, excessive money printing, sustained excessively low monetary policy settings, demographic trends. wage-price feedback loops setting in, the maturing of the Chinese economy, the effects of the Ukraine war etc).

It would be really nice if inflation could be beaten so easily and quickly, but I stopped believing in Santa when I was 6 y.o. The era of ultra-low interest rates id gone for good, coming recession or not. Maybe there is going to be a small retrenchment from the OCR peak of 2023 (which might well get at or over the 6% threshold), but this is going to be a 2024 story at the earliest, and the decrease is going to be much smaller than many are hoping for.

What these brainless property parasite boomers miss (not all of you, but those blinded by their avarice), huffing copium about inflation falling, is that the disinflationary and deflationary pressures of globalisation, combined with gradually lowering interest rates since 1981 as well as the rise of finance in consumptive purchases enabled inflation to appear low.

The weightings for these consumer price index based inflation seem to be the key of the delusion. Very often these metrics exclude asset prices by attempting to focus on consumer goods. But the substitution bias (assuming people substitute for cheaper equivalents rather than lowering expectations), the overweighting of goods that are inherently improving their value proposition and cost (TVs, Computers under moore's law and computerisation), as well as the obvious price improvements of cheap imported goods from China vs domestically manufactured goods, created an enormous ILLUSION of low inflation.

The massaging of data is shown by the official inflation rate vs the chapwood index in the US, we don't seem to have an equivalent here but desperately need one. The world of GloboHomo was a one off of correlated historic events, where cheap labour from an opening China, cheap resources from post USSR Russia and a huge cohort of young boomers had increasingly cheap credit to financialise their lifestyles. These trends drove us through this period of globalisation.

These conditions are not normal. Nor was the Great Prosperity of 1945 to 1975, when the United States was 75-80% of World GDP in 1945 after Firebombing their explicit enemies (Germans, Italians and Japanese) and bankrupting their nominal allies (The British and French) who found their industrial capital entirely destroyed. That prosperity came from a purposefully planned economic system which provided economic protections for the workers of these countries to placate them, explicitly because millions of veterans are extremely dangerous to a political system and they must be placated with generous deals and occupied with big families to be kept from political activism. Those veterans are not going to be afraid of the policeman's baton or the politician's threats after years of facing death, as the National Socialists, Italian Fascists and so on showed after WW1.

The current zeitgeist has a different set of paradigms. If I was to pick it out, it is the emerging world of resource scarcity and economic catabolysis. Malthus is still jogging right along behind us, after we got ahead for two centuries. The big three trends are:

- It is the need to rebuilt local manufacturing and production for a zero sum game of Great Power Struggle between the US and China. Economic polarisation and the end of cheap offshoring. Given the heightening prospect of war, Friendshoring is a bad idea given the likelihood that the ocean will be saturated with ship sinking Autonomous Underwater Vehicles.

- Demographics of zero growth -> Aging population, demand deflation + oversupply of goods + debt saturation amongst workers (maxxed out credit cards, 100k student loans, 19.95% APR car loans etc). Inviting the rest of the world is only of limited use to make GDP line go up given the infrastructure/social investment costs. This is very inflationary.

- Collapse of political trust, longer term effects of the Collapse of organised belief/religion, rapidly declining social trust, growth of alienation. All of the effects of this, the rise of cults and traditional forms of religiousity, the anti-natalism of many nihilistic/hedonistic people etc. Long term effects of the culture of Divorce etc.

It is an age of disintegration, not something within the memory of any of the people alive today.

Comes across as a bit of a rant VM, but largely agree with you. Especially paragraph four onwards.

Chat GPT got game!

Very thought-provoking comment. Thanks.

Interesting qualitative description of some current trends. Michael Burry and Jeremy Grantham would probably generally agree with you, but they have made some predictions about the current super-bubble bursting (like the S&P 500 heading south of 3,000 and the property market trending with it). Have you got anything quantitative, because qualitative ain't worth anything?

Nah, I just like ranting and raving on this site because the feedback is always good.

Legend rant. You could ask @ed to stretch that out.

Numbers aren’t informative by themselves… hence they’re narrative and ultimately can be manipulated - p.s. I’m an Accountant

How much does the Labour party pay you?

this is right up there with the "Do you still beat your wife?" question

Excellent analysis/comment. Thomas Malthus is one of my favourite and his observations have certainly played out. Even Syria with the drought pre 2000 and encouragement for larger families, influx of refugees then boom civil war. Recently, exploding cheap global travel and boom rapid transmission of disease. But more for NZ, an influx of free money, more handouts for the general population, far too much opinion based news flow of free-held assets to the few who knew/know what they are doing. Now we are left with a bulk population of poorly educated followers: tribal with low critical thinking. Fortunately the best NZers can do is camp out in central Wellington to protest, everything else takes too much energy - best to go to the food bank to get money for kai or steal someone else's.

With much higher levels of debt, and much higher levels of debt relative to income, all things being equal inflation should be more sensitive to the impact of rising interest rates than it was in the ‘70s and ‘80s.

Hang on... but a realtor is saying this:

A realtor says the next six weeks could be a "good time to pounce" on a new property ahead of another likely uptick in the Official Cash Rate (OCR). Further increases to the OCR will mean lenders will crank up mortgage rates, leading to Century 21 New Zealand owner Tim Kearins saying borrowers have a six-week window of "interest rate stability" before more changes.

https://www.google.com/amp/s/www.newshub.co.nz/home/money/2023/01/why-r…

Terrible journalism.

Ask any real estate agents, it's always a good time to buy

Code for "pay them commission"...

Looks like you are sold

Unrelated but related. US Monthly Budget Statement for December

USD -85.0B

Estimated at -65.0B; prev -21.3B

Yet none of the banks are offering a inverted 5 year rate , or a 5 year special.

Buy the dip /s

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.